CFD vs. Spread Betting: A Comprehensive Comparison for Traders

For traders looking to leverage market movements, Contracts for Difference (CFDs) and spread betting are two popular options. Both allow you to speculate on the price of an asset without owning it, but they differ significantly in their structure, taxation, and the markets they access. This article provides a comprehensive comparison of CFD vs. spread betting to help you determine which is best suited to your trading style and financial goals. Understanding the nuances between CFD vs. spread betting is crucial for making informed decisions and maximizing your potential returns.

What are CFDs?

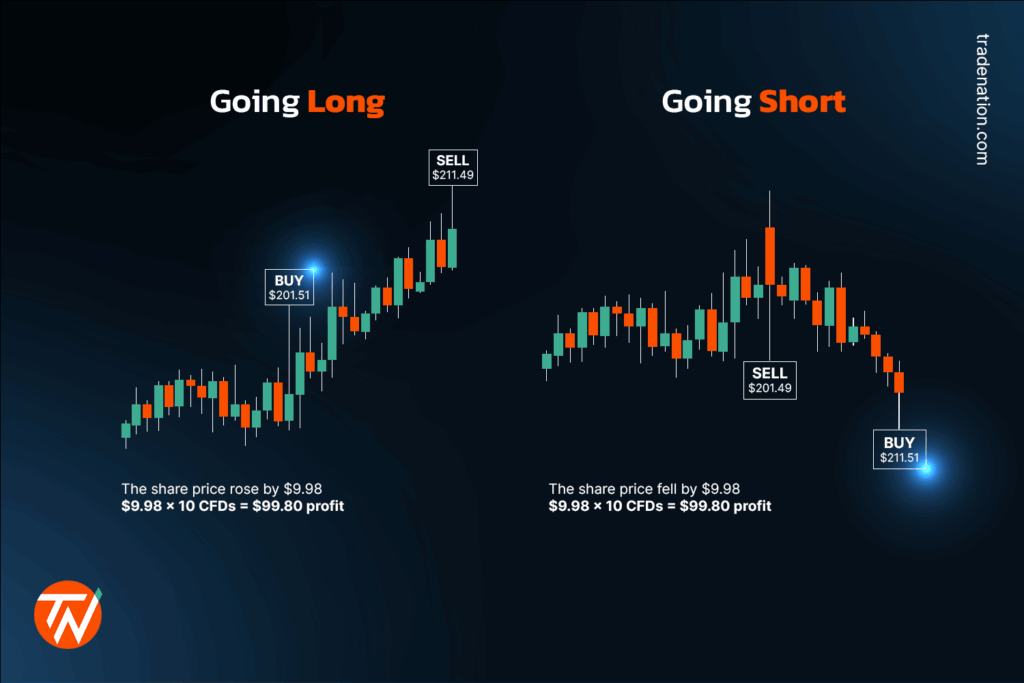

A Contract for Difference (CFD) is an agreement between two parties to exchange the difference in the value of an asset between the time the contract is opened and closed. You’re essentially speculating on whether the price of an asset will rise (going long) or fall (going short). CFDs cover a wide range of markets, including stocks, indices, commodities, and currencies.

Key Features of CFDs

- Leverage: CFDs offer high leverage, allowing you to control a large position with a relatively small amount of capital. This can amplify both profits and losses.

- Market Access: Access to a wide range of global markets, including stocks, indices, commodities, and currencies.

- No Stamp Duty: In the UK, CFDs are subject to Capital Gains Tax (CGT) and are not subject to Stamp Duty.

- Direct Market Access (DMA): Some brokers offer DMA, allowing you to trade directly on the order book of an exchange.

- Commissions: Typically, brokers charge a commission on each trade, although some may offer commission-free trading with wider spreads.

What is Spread Betting?

Spread betting involves speculating on the price movement of a financial instrument. Instead of buying or selling the asset, you’re betting on whether the price will go up or down from the current “spread” offered by the broker. The spread is the difference between the buying and selling price.

Key Features of Spread Betting

- Leverage: Like CFDs, spread betting offers high leverage.

- Tax Advantages: In the UK, profits from spread betting are generally exempt from Capital Gains Tax (CGT) due to being classified as gambling. This is a significant advantage for many traders.

- Fixed Spreads: Brokers typically offer fixed spreads, making it easier to calculate potential profits and losses.

- Market Access: Similar to CFDs, spread betting provides access to various markets.

- No Commissions: Spread betting brokers typically do not charge commissions, but instead make their profit from the spread.

CFD vs. Spread Betting: A Detailed Comparison

Let’s delve deeper into the key differences between CFD vs. spread betting:

Taxation

This is perhaps the most significant difference. In the UK, profits from spread betting are generally tax-free, while profits from CFDs are subject to Capital Gains Tax (CGT). This tax advantage can make spread betting more attractive to UK residents. However, tax laws can change, so it’s always best to consult with a tax advisor.

Market Access

Both CFD vs. spread betting offer access to a wide range of markets, including stocks, indices, commodities, and currencies. However, the specific instruments available may vary depending on the broker.

Leverage

Both CFDs and spread betting offer high leverage, allowing traders to control large positions with relatively small amounts of capital. Leverage can amplify both profits and losses, so it’s crucial to use it responsibly. Regulatory changes in recent years have limited the leverage available to retail traders.

Spreads and Commissions

CFD brokers typically charge a commission on each trade, although some offer commission-free trading with wider spreads. Spread betting brokers, on the other hand, typically do not charge commissions but instead make their profit from the spread. The spread is the difference between the buying and selling price.

Regulation

Both CFDs and spread betting are regulated by financial authorities. In the UK, both are regulated by the Financial Conduct Authority (FCA). This regulation provides a level of protection for traders.

Complexity

Both CFD vs. spread betting can be complex instruments, especially for beginners. It’s essential to understand the risks involved before trading. Many brokers offer educational resources and demo accounts to help traders learn the ropes.

Pros and Cons of CFDs

Pros

- Access to a wide range of markets.

- Potential for high leverage.

- Hedging opportunities.

- DMA (Direct Market Access) options available with some brokers.

Cons

- Profits are subject to Capital Gains Tax (CGT) in the UK.

- Leverage can amplify losses.

- Can be complex for beginners.

- Commissions may apply.

Pros and Cons of Spread Betting

Pros

- Profits are generally tax-free in the UK.

- Fixed spreads can make it easier to calculate potential profits and losses.

- Access to a wide range of markets.

- No commissions are typically charged.

Cons

- Leverage can amplify losses.

- Can be complex for beginners.

- Spreads may be wider than those offered by CFD brokers.

- Tax laws can change.

Choosing Between CFD vs. Spread Betting

The best choice between CFD vs. spread betting depends on your individual circumstances and trading goals. Consider the following factors:

- Tax situation: If you’re a UK resident, the tax-free status of spread betting can be a significant advantage.

- Trading style: If you prefer fixed spreads and no commissions, spread betting may be a better option. If you prefer lower spreads and are willing to pay commissions, CFDs may be more suitable.

- Risk tolerance: Both CFDs and spread betting involve high leverage, so it’s crucial to understand the risks involved and use leverage responsibly.

- Market access: Ensure that the broker offers access to the markets you want to trade.

Before making a decision, it’s essential to do your research and compare different brokers. Look for brokers that are regulated by reputable authorities, offer competitive spreads and commissions, and provide good customer support. [See also: Choosing the Right Broker for CFD Trading]

Risk Management in CFD and Spread Betting

Regardless of whether you choose CFD vs. spread betting, risk management is crucial. Here are some tips for managing risk:

- Use stop-loss orders: Stop-loss orders automatically close your position when the price reaches a certain level, limiting your potential losses.

- Use take-profit orders: Take-profit orders automatically close your position when the price reaches a certain level, locking in your profits.

- Manage your leverage: Don’t use excessive leverage, as it can amplify your losses.

- Diversify your portfolio: Don’t put all your eggs in one basket. Diversify your portfolio across different markets and asset classes.

- Stay informed: Keep up-to-date with market news and events that could affect your trades.

The Future of CFD and Spread Betting

The landscape of CFD vs. spread betting is constantly evolving. Regulatory changes, technological advancements, and changing market conditions are all shaping the future of these instruments. It’s important to stay informed about these developments and adapt your trading strategies accordingly.

One key trend is the increasing focus on regulation. Financial authorities around the world are tightening regulations on CFDs and spread betting to protect retail traders. This includes limiting leverage, requiring brokers to provide more transparent pricing, and implementing stricter marketing rules. [See also: Regulatory Changes Affecting CFD Trading]

Another trend is the increasing use of technology. Brokers are using technology to provide better trading platforms, more sophisticated charting tools, and faster execution speeds. Artificial intelligence (AI) is also being used to develop automated trading systems and provide personalized trading recommendations.

Conclusion

CFD vs. spread betting both offer opportunities for traders to profit from market movements. The choice between them depends on your individual circumstances and trading goals. Consider the tax implications, trading style, risk tolerance, and market access before making a decision. Remember that both instruments involve high leverage, so it’s crucial to use them responsibly and manage your risk effectively. By understanding the differences and risks involved, you can make informed trading decisions and increase your chances of success in the financial markets. Whether you opt for CFD vs. spread betting, remember that continuous learning and adaptation are key to long-term success. Always stay updated on market trends and regulatory changes to refine your strategies and navigate the complexities of these trading instruments. Understanding the nuances of CFD vs. spread betting empowers you to make choices aligned with your financial objectives. Careful consideration of your risk appetite and financial goals will guide you to the most suitable option. Ultimately, the informed trader is the successful trader in the world of CFD vs. spread betting. Before you engage in CFD vs. spread betting, ensure you have a solid understanding of the fundamentals. The more you know, the better equipped you are to make sound decisions in the dynamic world of trading. The advantages of CFD vs. spread betting can be significant if approached with knowledge and caution.