CFD vs. Spread Betting: Understanding the Key Differences

When it comes to trading the financial markets, individuals have a variety of options to choose from. Two popular methods are Contracts for Difference (CFDs) and spread betting. Both offer the potential for profit by speculating on the price movements of various assets, but they operate differently and have distinct advantages and disadvantages. Understanding the difference between CFD and spread betting is crucial for any trader looking to make informed decisions. This article will delve into the nuances of each, highlighting their key features, tax implications, and suitability for different trading styles.

What are CFDs?

CFDs, or Contracts for Difference, are derivative products that allow traders to speculate on the price movement of an asset without actually owning it. Instead, a trader enters into a contract with a broker to exchange the difference in the asset’s price between the time the contract is opened and when it is closed. CFDs cover a wide range of assets, including stocks, indices, commodities, and currencies.

Key Features of CFDs

- Leverage: CFDs offer high leverage, allowing traders to control a large position with a relatively small amount of capital. While this can amplify profits, it also magnifies losses.

- Wide Range of Markets: CFDs provide access to a diverse range of global markets, making it easy to diversify your portfolio.

- Short Selling: CFDs allow traders to easily profit from both rising and falling markets by going long (buying) or short (selling).

- No Stamp Duty: In many jurisdictions, CFDs are exempt from stamp duty, making them a cost-effective way to trade.

What is Spread Betting?

Spread betting is another form of derivative trading where traders speculate on the price movement of an asset. However, instead of buying or selling the asset itself, traders bet on whether the price will rise above or fall below a certain ‘spread’ offered by the broker. The spread is the difference between the buy and sell price of an asset.

Key Features of Spread Betting

- Tax-Free Profits: In some countries, like the UK and Ireland, profits from spread betting are often tax-free, making it an attractive option for many traders.

- Fixed Odds: Spread betting offers fixed odds, meaning that the potential profit or loss is known in advance based on the size of the bet and the movement of the asset price.

- Leverage: Like CFDs, spread betting also offers high leverage, increasing both potential gains and risks.

- Simplicity: Spread betting can be simpler to understand than CFDs for novice traders, as it involves betting on the direction of price movement rather than dealing with complex contract specifications.

The Core Differences Between CFD and Spread Betting

While both CFDs and spread betting allow traders to speculate on price movements, several key differences set them apart. These include tax implications, market availability, and the mechanics of trading.

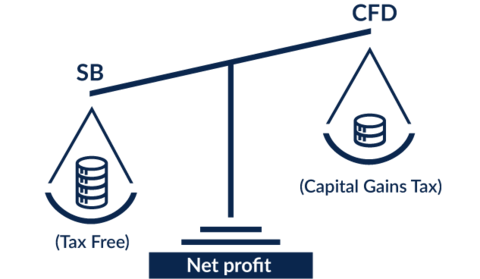

Tax Implications

One of the most significant differences between CFDs and spread betting lies in their tax treatment. In the UK and Ireland, profits from spread betting are generally tax-free, while profits from CFDs are subject to capital gains tax. This can be a major consideration for traders, especially those who are actively trading and generating significant profits. However, tax laws vary by jurisdiction, so it’s essential to consult with a tax advisor to understand the specific rules in your country.

Market Availability

Both CFDs and spread betting offer access to a wide range of markets, but there may be some differences in the specific assets available. CFDs generally offer a broader selection of assets, including stocks from various global exchanges, while spread betting may focus more on major indices, currencies, and commodities. The availability can vary between brokers, so it’s crucial to check what markets are offered before choosing a trading platform.

Trading Mechanics

The mechanics of trading CFDs and spread betting also differ. With CFDs, you are essentially buying or selling a contract that reflects the price movement of the underlying asset. The profit or loss is the difference between the opening and closing price, multiplied by the number of contracts. With spread betting, you are betting on whether the price will move above or below the spread offered by the broker. The profit or loss depends on how much the price moves relative to the spread and the stake per point.

Advantages and Disadvantages

Both CFDs and spread betting have their own set of advantages and disadvantages. Understanding these can help traders decide which option is best suited to their individual needs and trading style.

CFD Advantages

- Wider Market Access: CFDs typically offer a broader range of markets compared to spread betting.

- Suitable for Hedging: CFDs can be used effectively for hedging existing investments.

- No Expiry Dates: Many CFDs do not have expiry dates, allowing traders to hold positions for longer periods.

CFD Disadvantages

- Taxable Profits: Profits from CFDs are subject to capital gains tax in many jurisdictions.

- Complexity: CFDs can be more complex to understand than spread betting, especially for novice traders.

- Overnight Funding Charges: Holding CFD positions overnight can incur funding charges.

Spread Betting Advantages

- Tax-Free Profits: In the UK and Ireland, profits from spread betting are generally tax-free.

- Simplicity: Spread betting can be easier to understand than CFDs, making it suitable for beginners.

- Fixed Odds: The potential profit or loss is known in advance, providing greater transparency.

Spread Betting Disadvantages

- Limited Market Access: Spread betting may offer a more limited range of markets compared to CFDs.

- Potential for Large Losses: High leverage can lead to significant losses if the market moves against your position.

- Availability: Spread betting is not available in all countries.

Who Should Use CFDs?

CFDs may be a suitable option for traders who:

- Want access to a wider range of global markets.

- Are comfortable with the complexity of CFD trading.

- Are looking to hedge existing investments.

- Are not concerned about paying capital gains tax on profits (or are in a jurisdiction where CFDs are tax-advantaged).

Who Should Use Spread Betting?

Spread betting may be a suitable option for traders who:

- Are based in the UK or Ireland and want to take advantage of tax-free profits.

- Prefer a simpler trading mechanism.

- Are comfortable with the higher leverage offered by spread betting.

- Focus on trading major indices, currencies, and commodities.

Leverage and Risk Management

Both CFDs and spread betting offer high leverage, which can amplify both profits and losses. It’s crucial to understand the risks associated with leverage and to implement effective risk management strategies. Always use stop-loss orders to limit potential losses, and never risk more than you can afford to lose. [See also: Risk Management Strategies for Traders]

The difference between CFD and spread betting regarding leverage is minimal, as both typically offer similar levels. However, the impact of leverage on your trading account remains the same regardless of the product you choose. Proper risk management is paramount.

Choosing a Broker

Selecting a reputable broker is essential for both CFD and spread betting. Look for a broker that is regulated by a reputable financial authority, offers a wide range of markets, provides competitive spreads and commissions, and has a user-friendly trading platform. [See also: How to Choose a Reliable Trading Broker]

When evaluating brokers, consider the difference in the platforms they offer for CFDs and spread betting. Some brokers may specialize in one over the other, providing better tools and resources for that particular product.

Regulation

The regulation of CFDs and spread betting varies by jurisdiction. In many countries, CFDs are regulated by financial authorities such as the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC) in Australia. Spread betting is also regulated in the UK by the FCA. Regulation provides a level of protection for traders, ensuring that brokers adhere to certain standards of conduct and financial stability. Always trade with a regulated broker to minimize the risk of fraud or insolvency.

Examples of CFD and Spread Betting Trades

To illustrate the difference between CFD and spread betting, let’s consider a few examples:

CFD Example

Suppose you believe that the price of a stock currently trading at $100 will increase. You decide to buy 100 CFD contracts on the stock. The margin requirement is 10%, so you need to deposit $1,000 (10% of $10,000). If the price of the stock increases to $105, your profit is $500 (100 contracts x $5 increase). However, if the price falls to $95, your loss is $500 (100 contracts x $5 decrease).

Spread Betting Example

Suppose a broker is offering a spread of 100-101 on a particular index. You believe the index will rise, so you decide to ‘buy’ at 101, betting $10 per point. If the index rises to 105, your profit is $40 (4 points x $10 per point). However, if the index falls to 97, your loss is $40 (4 points x $10 per point).

Conclusion

The difference between CFD and spread betting lies primarily in their tax treatment and the mechanics of trading. CFDs offer access to a wider range of markets and are suitable for hedging, but profits are generally taxable. Spread betting, on the other hand, offers tax-free profits in some jurisdictions and is simpler to understand, but may have a more limited market range. Ultimately, the choice between CFDs and spread betting depends on your individual circumstances, trading style, and tax considerations. Carefully consider your options and choose the one that best aligns with your goals and risk tolerance. Regardless of which you choose, remember that both involve significant risk and require a solid understanding of the markets and effective risk management strategies.