CFD vs. Spread Betting: Understanding the Key Differences

For individuals looking to participate in the financial markets, Contracts for Difference (CFDs) and spread betting are two popular methods. Both offer a way to speculate on price movements without owning the underlying asset. However, there are fundamental difference between CFD and spread betting that traders should understand before choosing which one suits their trading style and financial goals. This article will delve into the nuances of each, highlighting their key distinctions, advantages, and disadvantages.

What are CFDs?

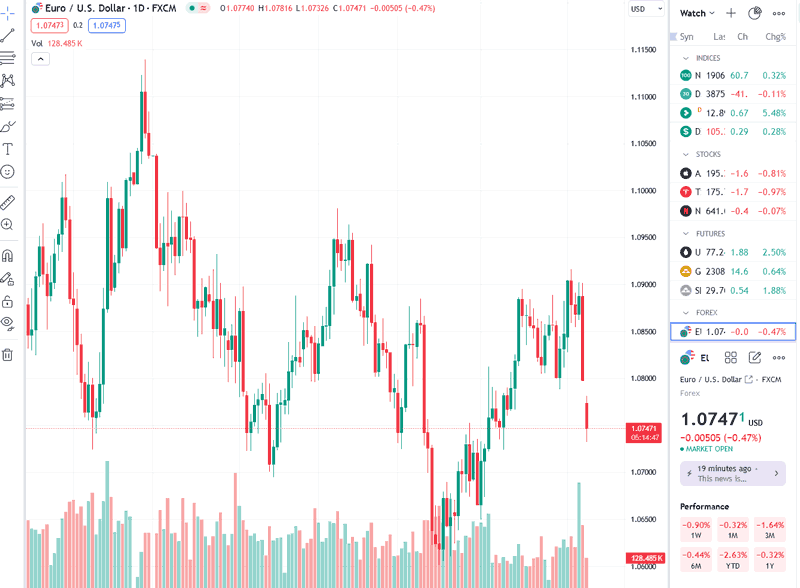

A Contract for Difference (CFD) is an agreement between two parties to exchange the difference in the value of an asset between the time the contract is opened and when it is closed. CFDs allow traders to speculate on the price movement of various assets, including stocks, indices, commodities, and currencies. When trading CFDs, you don’t actually own the underlying asset; instead, you’re entering into a contract based on its price movement.

CFDs are leveraged products, meaning you only need to deposit a percentage of the total trade value (known as margin) to open a position. This leverage can amplify both profits and losses. For example, with a 10% margin, you can control a position worth $10,000 with only $1,000. This allows for greater potential returns, but also greater risk.

What is Spread Betting?

Spread betting is a form of speculation on the movement of financial markets where you bet on whether the price of an asset will rise or fall. Like CFDs, spread betting is a leveraged product, allowing traders to control larger positions with a smaller initial deposit. The key difference lies in how profits and losses are calculated.

With spread betting, the broker offers a ‘spread’ – a difference between the buying and selling price of an asset. You bet on whether the price will rise above the buying price (going long) or fall below the selling price (going short). Your profit or loss is determined by the amount the price moves in your favor or against you, multiplied by your stake per point. For example, if you bet £10 per point that a stock will rise, and it rises by 50 points, you would make a profit of £500.

Key Differences Between CFD and Spread Betting

While both CFDs and spread betting allow you to speculate on price movements, several key differences impact how they are traded and taxed:

Taxation

One of the most significant difference between CFD and spread betting is their tax treatment. In the UK and Ireland, spread betting profits are typically exempt from Capital Gains Tax (CGT). This is because spread betting is classified as gambling rather than investing. Conversely, CFD profits are generally subject to CGT. This can be a significant advantage for spread betting, especially for frequent traders who generate substantial profits. However, tax laws can change, so it’s essential to consult with a tax advisor for up-to-date information.

Commission and Spreads

The cost structure also presents a notable difference between CFD and spread betting. CFD providers often charge a commission on each trade, in addition to the spread (the difference between the buying and selling price). Spread betting firms, on the other hand, typically do not charge commission but instead widen the spread to incorporate their fees. This means the spread is often wider in spread betting than in CFD trading. Traders should consider their trading frequency and volume when evaluating these cost structures. High-frequency traders may find CFDs more cost-effective due to tighter spreads, while less frequent traders may prefer the simplicity of spread betting with no commission.

Market Access

Both CFDs and spread betting offer access to a wide range of markets, including stocks, indices, commodities, and currencies. However, the specific instruments available may vary depending on the broker. Generally, CFDs offer a slightly wider range of markets, including more exotic assets and niche markets. This can be an important consideration for traders looking to diversify their portfolio and access specific investment opportunities. [See also: Diversifying Your Investment Portfolio]

Regulation

Both CFDs and spread betting are regulated by financial authorities, but the level of regulation and investor protection can vary. In the UK, both are regulated by the Financial Conduct Authority (FCA). However, the FCA’s rules and regulations may differ slightly for each product. It’s crucial to choose a regulated broker to ensure your funds are protected and the broker adheres to strict conduct standards. Regulation provides a level of security and transparency, reducing the risk of fraud and malpractice.

Leverage

Both CFDs and spread betting offer leverage, allowing traders to control larger positions with a smaller initial deposit. However, the level of leverage offered can vary depending on the broker and the asset being traded. High leverage can amplify both profits and losses, so it’s crucial to understand the risks involved and use leverage responsibly. [See also: Understanding and Managing Leverage in Trading]

Contract Size

Another difference between CFD and spread betting lies in the contract size. CFDs typically have a contract size that represents one unit of the underlying asset (e.g., one share of a stock). Spread betting, on the other hand, involves betting a certain amount per point movement in the asset’s price. This difference can impact the minimum trade size and the granularity of positions. CFDs offer more flexibility in terms of trade size, allowing traders to fine-tune their positions to specific risk tolerance levels.

Advantages and Disadvantages of CFDs

Advantages:

- Wider range of markets available.

- Tighter spreads, potentially lower costs for high-frequency traders.

- More flexibility in trade size.

- Potential for hedging existing investments.

Disadvantages:

- Profits subject to Capital Gains Tax (CGT).

- Commission charged on each trade.

- Can be more complex to understand than spread betting.

Advantages and Disadvantages of Spread Betting

Advantages:

- Profits typically exempt from Capital Gains Tax (CGT) in the UK and Ireland.

- No commission charged on trades.

- Simpler to understand than CFDs.

Disadvantages:

- Wider spreads, potentially higher costs for low-frequency traders.

- Limited flexibility in trade size.

- Tax benefits may be subject to change.

Choosing Between CFD and Spread Betting

The choice between CFD and spread betting depends on individual circumstances, trading style, and financial goals. Consider the following factors:

- Tax situation: If you are based in the UK or Ireland and want to avoid Capital Gains Tax, spread betting may be more suitable.

- Trading frequency: If you are a high-frequency trader, CFDs may be more cost-effective due to tighter spreads.

- Market access: If you need access to a wider range of markets, CFDs may offer more options.

- Complexity: If you prefer a simpler trading product, spread betting may be easier to understand.

- Risk tolerance: Both CFDs and spread betting are leveraged products, so it’s crucial to understand the risks involved and use leverage responsibly.

Ultimately, the best way to decide is to research both options thoroughly, consider your individual needs and circumstances, and potentially try both with small amounts to see which one suits you best. Both CFD and spread betting are risky and complicated products. [See also: Risk Management Strategies for Traders]

Conclusion

Understanding the difference between CFD and spread betting is crucial for anyone looking to trade financial markets. While both offer leveraged exposure to various assets, their tax treatment, cost structures, and other features differ significantly. By carefully considering these differences and evaluating your own trading style and financial goals, you can make an informed decision about which product is right for you. Remember to always trade responsibly and understand the risks involved. Both CFD and spread betting require a high degree of understanding and should be approached with caution. Make sure to do your own research and consult with a financial advisor if needed. The difference between CFD and spread betting is significant enough to warrant careful consideration. Always prioritize education and responsible trading practices when engaging with these financial instruments. The key difference between CFD and spread betting often comes down to tax implications and trading style. The nuanced difference between CFD and spread betting should be thoroughly investigated before making any investment decisions. The profit potential and associated risks highlight the critical difference between CFD and spread betting. The structural difference between CFD and spread betting impacts the overall trading experience. Recognizing the regulatory difference between CFD and spread betting is crucial for investor protection. The financial difference between CFD and spread betting can greatly impact profitability. Careful analysis of the operational difference between CFD and spread betting is essential for informed trading. The strategic difference between CFD and spread betting can influence long-term investment goals.