Decoding the ABC Trading Pattern: A Comprehensive Guide for Traders

In the dynamic world of financial markets, traders are constantly seeking reliable patterns and strategies to enhance their decision-making process. Among the various technical analysis tools available, the ABC trading pattern stands out as a versatile and widely recognized approach. This guide provides a comprehensive overview of the ABC trading pattern, exploring its formation, identification, application, and limitations.

Understanding the ABC Trading Pattern

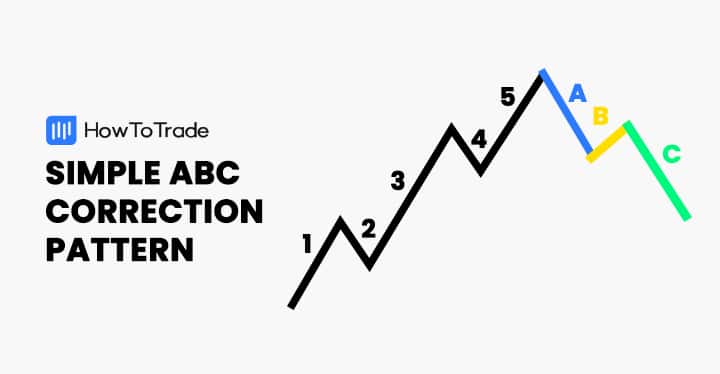

The ABC trading pattern is a three-wave price formation used in technical analysis to identify potential trading opportunities. It’s primarily based on the idea that price movements often occur in predictable patterns, and by recognizing these patterns, traders can anticipate future price behavior. The pattern consists of three points labeled A, B, and C, connected by two price swings.

Point A: Represents the beginning of the pattern, typically a significant high or low in the price chart.

Point B: Represents a retracement of the initial move from Point A. This retracement is usually a percentage of the distance between Point A and the start of the move. Fibonacci retracement levels are often used to identify potential locations for Point B.

Point C: Represents a continuation of the initial move in the same direction as the move from Point A. The target for Point C is often based on Fibonacci extensions or other technical analysis techniques.

Identifying the ABC Pattern

Identifying the ABC trading pattern requires careful observation of price action and the application of technical analysis tools. Here’s a step-by-step guide:

- Identify a Significant Trend: Look for a clear uptrend or downtrend in the market. The ABC trading pattern is most effective when it occurs within a defined trend.

- Locate Point A: Find a significant high (in a downtrend) or low (in an uptrend) that marks the beginning of the pattern.

- Identify Point B: Look for a retracement of the move from Point A. Use Fibonacci retracement levels to determine potential retracement areas. Common retracement levels include 38.2%, 50%, and 61.8%.

- Confirm Point C: Once the price retraces to a potential Point B, look for a continuation of the initial trend. This continuation should ideally break above the high (in an uptrend) or below the low (in a downtrend) established at Point A.

Types of ABC Patterns

The ABC trading pattern can manifest in various forms, each with its unique characteristics. Understanding these variations is crucial for effective pattern recognition and trading.

Bullish ABC Pattern

The bullish ABC trading pattern occurs in an uptrend. Point A is a low, Point B is a higher low (retracement), and Point C is a higher high that breaks above the high at Point A. This pattern suggests a continuation of the uptrend.

Bearish ABC Pattern

The bearish ABC trading pattern occurs in a downtrend. Point A is a high, Point B is a lower high (retracement), and Point C is a lower low that breaks below the low at Point A. This pattern suggests a continuation of the downtrend.

Expanded ABC Pattern

In an expanded ABC trading pattern, the price extends beyond the initial high or low at Point A before retracing. This variation can be more challenging to identify but can offer significant profit potential.

Trading Strategies Using the ABC Pattern

Once you’ve identified an ABC trading pattern, you can use various strategies to capitalize on the potential trading opportunity. Here are a few common approaches:

Entry Points

The most common entry point is when the price breaks above the high (in a bullish pattern) or below the low (in a bearish pattern) established at Point A. This confirms the continuation of the trend and provides a clear signal to enter the trade.

Stop-Loss Placement

Proper stop-loss placement is crucial for managing risk. A common strategy is to place the stop-loss order below Point B (in a bullish pattern) or above Point B (in a bearish pattern). This helps protect your capital if the pattern fails to materialize.

Profit Targets

Profit targets can be determined using various techniques, such as Fibonacci extensions, previous support and resistance levels, or risk-reward ratios. A common approach is to project the distance between Point A and Point B and extend it from Point C to determine a potential profit target.

Tools for Identifying ABC Patterns

Several tools can assist traders in identifying ABC trading patterns:

- Fibonacci Retracement and Extension Tools: These tools are essential for identifying potential retracement levels (Point B) and profit targets (Point C).

- Trendlines: Trendlines can help confirm the overall trend and identify potential support and resistance levels.

- Moving Averages: Moving averages can provide a smoothed view of price action and help identify the prevailing trend.

- Pattern Recognition Software: Some trading platforms offer automated pattern recognition software that can identify potential ABC trading patterns.

Advantages of Using the ABC Pattern

The ABC trading pattern offers several advantages to traders:

- Clear Entry and Exit Points: The pattern provides clear signals for entering and exiting trades.

- Defined Risk Management: Stop-loss orders can be placed based on the pattern’s structure, allowing for effective risk management.

- Versatility: The pattern can be applied to various markets and timeframes.

- Confirmation of Trend: The pattern confirms the continuation of an existing trend.

Limitations of the ABC Pattern

Despite its advantages, the ABC trading pattern also has limitations:

- Subjectivity: Identifying the pattern can be subjective, and different traders may interpret it differently.

- False Signals: The pattern can generate false signals, leading to losing trades.

- Time-Consuming: Identifying and confirming the pattern requires time and patience.

- Not Always Present: The pattern does not occur frequently in all markets or timeframes.

Tips for Trading the ABC Pattern Effectively

To improve your success rate when trading the ABC trading pattern, consider the following tips:

- Confirm with Other Indicators: Use other technical indicators to confirm the pattern’s validity.

- Trade with the Trend: Focus on trading the pattern in the direction of the prevailing trend.

- Manage Risk: Always use stop-loss orders to protect your capital.

- Practice Patience: Wait for the pattern to fully develop before entering a trade.

- Backtest Your Strategy: Test your strategy on historical data to assess its effectiveness.

Real-World Examples of the ABC Trading Pattern

Analyzing real-world examples can provide valuable insights into how the ABC trading pattern works in practice. Look for charts where the pattern clearly formed and resulted in a profitable trade. Pay attention to the specific market conditions and the indicators that confirmed the pattern.

Combining the ABC Pattern with Other Technical Analysis Techniques

The ABC trading pattern can be effectively combined with other technical analysis techniques to enhance its accuracy and reliability. For instance, using candlestick patterns to confirm the breakout at Point C or combining the pattern with volume analysis can provide additional confirmation signals.

The Psychology Behind the ABC Pattern

Understanding the psychology behind the ABC trading pattern can provide a deeper understanding of why it works. The pattern reflects the ebb and flow of market sentiment, with periods of buying pressure (or selling pressure) followed by retracements and then a continuation of the initial trend. By understanding the psychological drivers behind these price movements, traders can gain a competitive edge.

Advanced ABC Pattern Strategies

For experienced traders, there are several advanced strategies that can be used to enhance the profitability of the ABC trading pattern. These strategies may involve using more complex Fibonacci techniques, incorporating time-based analysis, or using advanced order types.

Conclusion

The ABC trading pattern is a valuable tool for traders seeking to identify potential trading opportunities. By understanding its formation, identification, application, and limitations, traders can effectively incorporate it into their trading strategies. Remember to always manage risk and confirm the pattern with other technical indicators to improve your success rate. The ABC trading pattern can be a powerful addition to any trader’s arsenal, providing clear entry and exit points and defined risk management parameters. Keep practicing and refining your approach to master this pattern and enhance your trading performance. The ABC trading pattern is a classic, and with proper application, it can unlock profitable opportunities. The ABC trading pattern offers a structured approach to market analysis. Don’t underestimate the power of the ABC trading pattern. Recognizing the ABC trading pattern is a skill that improves with practice. Always remember to factor in market context when analyzing the ABC trading pattern.

[See also: Fibonacci Retracement Explained] [See also: Trend Trading Strategies] [See also: Risk Management in Trading]