Decoding the Adam and Eve Pattern: A Comprehensive Guide for Traders

In the realm of technical analysis, traders are constantly seeking reliable patterns to predict future price movements. Among these patterns, the Adam and Eve pattern stands out as a significant indicator of potential trend reversals. This article provides a comprehensive guide to understanding, identifying, and trading the Adam and Eve pattern, ensuring traders can effectively incorporate it into their strategies. The Adam and Eve pattern is a powerful tool that can enhance a trader’s ability to anticipate market shifts and capitalize on emerging opportunities. Knowing how to recognize and interpret the Adam and Eve pattern is crucial for any serious trader.

Understanding the Adam and Eve Pattern

The Adam and Eve pattern is a type of double bottom or double top formation, characterized by distinct differences in the shape and volatility of its two peaks or troughs. These differences provide valuable insights into the underlying market dynamics and potential future price action. The Adam and Eve pattern often signals a significant shift in market sentiment.

Key Characteristics

- Adam Formation: The ‘Adam’ part of the pattern is typically characterized by a sharp, narrow price peak or trough. This formation often results from a sudden spike in buying or selling pressure, creating a V-shaped recovery or decline.

- Eve Formation: In contrast, the ‘Eve’ formation is broader and more rounded. This occurs as the market gradually tests support or resistance levels, resulting in a more prolonged and less volatile price movement.

- Volume: Volume patterns also play a crucial role. The ‘Adam’ formation often sees higher volume during its initial spike, while the ‘Eve’ formation tends to have lower, more consistent volume.

Identifying the Adam and Eve Pattern

Recognizing the Adam and Eve pattern requires careful observation and analysis of price charts. Traders must be able to distinguish between the ‘Adam’ and ‘Eve’ formations based on their shape, volatility, and volume characteristics. Misidentification can lead to incorrect trading decisions, so precision is paramount. The Adam and Eve pattern can be found in various markets and timeframes.

Steps to Identify the Pattern

- Locate a Potential Double Bottom or Double Top: Begin by identifying a chart pattern that resembles a double bottom (potential bullish reversal) or a double top (potential bearish reversal).

- Analyze the First Peak or Trough (Adam): Determine if the first peak or trough is sharp and narrow, resembling a V-shape. Check for a corresponding spike in volume.

- Analyze the Second Peak or Trough (Eve): Assess whether the second peak or trough is broader and more rounded, indicating a gradual test of support or resistance. Look for lower, more consistent volume.

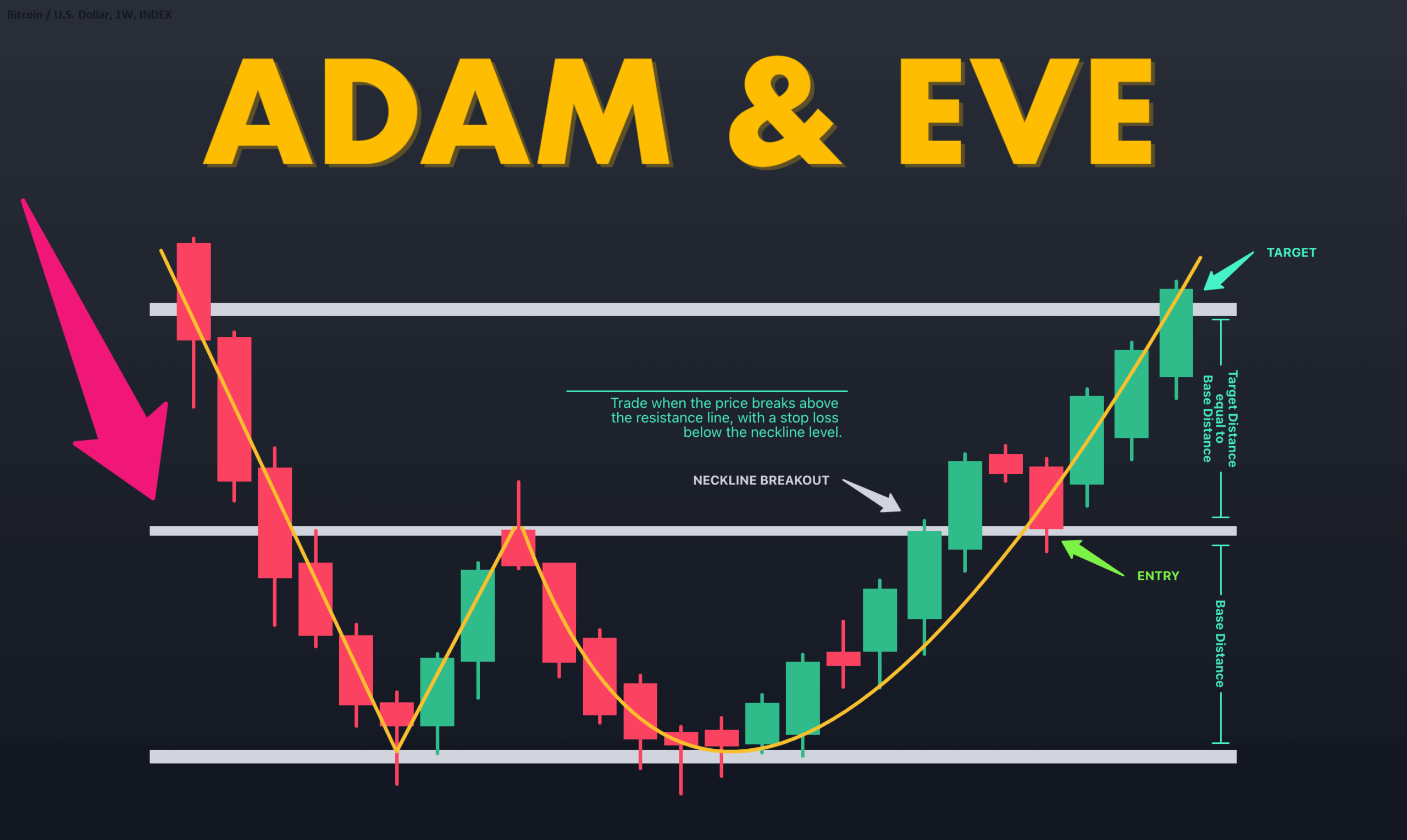

- Confirm the Pattern: Ensure that the price breaks above the neckline (for a double bottom) or below the neckline (for a double top) after the ‘Eve’ formation. This breakout confirms the pattern and provides a potential entry point.

Trading Strategies for the Adam and Eve Pattern

Once the Adam and Eve pattern has been identified and confirmed, traders can implement various strategies to capitalize on the anticipated price movement. These strategies typically involve entering a trade after the price breaks out of the pattern, setting appropriate stop-loss orders to manage risk, and establishing profit targets based on the pattern’s potential. Successfully trading the Adam and Eve pattern requires discipline and a well-defined trading plan. [See also: Double Bottom Chart Pattern]

Entry Points

- Double Bottom (Bullish Reversal): Enter a long position after the price breaks above the neckline, which is the resistance level connecting the peaks of the ‘Adam’ and ‘Eve’ formations.

- Double Top (Bearish Reversal): Enter a short position after the price breaks below the neckline, which is the support level connecting the troughs of the ‘Adam’ and ‘Eve’ formations.

Stop-Loss Orders

Placing stop-loss orders is crucial for managing risk and protecting capital. The placement of stop-loss orders depends on the trader’s risk tolerance and the specific characteristics of the pattern.

- Double Bottom: Place the stop-loss order below the lowest point of the ‘Eve’ formation.

- Double Top: Place the stop-loss order above the highest point of the ‘Eve’ formation.

Profit Targets

Setting profit targets involves estimating the potential price movement based on the pattern’s height. A common approach is to measure the distance between the neckline and the lowest point (for a double bottom) or the highest point (for a double top), and then project that distance from the breakout point.

Examples of the Adam and Eve Pattern

To illustrate the Adam and Eve pattern, consider a hypothetical scenario in the stock market. Imagine a stock that experiences a sharp decline (Adam) followed by a gradual recovery (Eve), forming a double bottom. The price then breaks above the neckline, signaling a bullish reversal. Conversely, a stock might experience a sharp rise (Adam) followed by a gradual decline (Eve), forming a double top. The price then breaks below the neckline, indicating a bearish reversal. Real-world examples can be found across various asset classes, including stocks, forex, and commodities.

Advantages and Limitations

Like any technical analysis tool, the Adam and Eve pattern has its advantages and limitations. Understanding these aspects is essential for using the pattern effectively and avoiding potential pitfalls. The Adam and Eve pattern offers valuable insights, but it should not be used in isolation.

Advantages

- Clear Identification: The distinct shapes of the ‘Adam’ and ‘Eve’ formations make the pattern relatively easy to identify compared to other chart patterns.

- Potential for High-Probability Trades: When confirmed by a breakout, the Adam and Eve pattern can offer high-probability trading opportunities.

- Versatility: The pattern can be observed across various markets and timeframes, making it a versatile tool for traders.

Limitations

- Subjectivity: Identifying the pattern can be subjective, as the shapes of the ‘Adam’ and ‘Eve’ formations can vary.

- False Signals: Like all chart patterns, the Adam and Eve pattern can generate false signals, leading to unprofitable trades.

- Confirmation Required: The pattern must be confirmed by a breakout to increase the probability of a successful trade.

Tips for Trading the Adam and Eve Pattern

To enhance the effectiveness of trading the Adam and Eve pattern, consider the following tips:

- Combine with Other Indicators: Use the pattern in conjunction with other technical indicators, such as moving averages, RSI, and MACD, to confirm the signal.

- Analyze Volume: Pay close attention to volume patterns during the formation of the ‘Adam’ and ‘Eve’ peaks or troughs.

- Practice Risk Management: Always use stop-loss orders to manage risk and protect capital.

- Backtest the Strategy: Before implementing the strategy in live trading, backtest it on historical data to assess its performance.

Conclusion

The Adam and Eve pattern is a valuable tool for traders seeking to identify potential trend reversals. By understanding its key characteristics, identifying the pattern accurately, and implementing appropriate trading strategies, traders can enhance their ability to capitalize on market opportunities. However, it’s crucial to remember that the Adam and Eve pattern, like all technical analysis tools, should be used in conjunction with other indicators and risk management techniques. Mastering the Adam and Eve pattern can significantly improve a trader’s analytical skills and trading outcomes. Consistent practice and a disciplined approach are essential for success. [See also: Chart Pattern Trading Strategies] Remember that the Adam and Eve pattern provides insight into potential trend reversals, but thorough analysis is always recommended. Using the Adam and Eve pattern effectively requires a combination of knowledge and experience.