Decoding the Adam and Eve Pattern: A Comprehensive Guide for Traders

The Adam and Eve pattern is a popular chart pattern used in technical analysis to identify potential trend reversals. Understanding and recognizing this pattern can provide traders with valuable insights into market sentiment and potential trading opportunities. This guide will delve into the intricacies of the Adam and Eve pattern, its characteristics, how to identify it, and strategies for trading it effectively. Mastering the **Adam and Eve pattern** can significantly enhance a trader’s ability to predict market movements and improve their overall trading performance.

Understanding the Adam and Eve Pattern

The Adam and Eve pattern is a double bottom or double top pattern that signifies a potential reversal in the prevailing trend. It consists of two distinct bottoms (in the case of a double bottom) or two distinct tops (in the case of a double top), each with its unique characteristics. Recognizing the **Adam and Eve pattern** requires a keen eye for detail and an understanding of market dynamics.

Key Characteristics of the Adam and Eve Pattern

Several key characteristics define the Adam and Eve pattern:

- Adam Bottom/Top: This is characterized by a sharp, narrow, and often V-shaped bottom or top. The price decline or rise is typically rapid and decisive.

- Eve Bottom/Top: This is characterized by a broader, rounder, and more gradual bottom or top. The price movement is less volatile and more sustained.

- Volume: Volume typically decreases during the formation of the pattern and increases on the breakout.

- Neckline: The neckline is the resistance level (for double bottoms) or support level (for double tops) that must be broken for the pattern to be confirmed.

Identifying the Adam and Eve Pattern

Identifying the **Adam and Eve pattern** requires careful observation and analysis of price charts. Here’s a step-by-step guide:

Steps to Identify the Pattern

- Identify a Trend: Determine the prevailing trend. The Adam and Eve pattern is a reversal pattern, so it typically forms at the end of an uptrend (for double tops) or a downtrend (for double bottoms).

- Look for the Adam Formation: Identify the first bottom or top, characterized by its sharp, narrow, and V-shaped appearance.

- Look for the Eve Formation: Identify the second bottom or top, characterized by its broader, rounder, and more gradual appearance.

- Draw the Neckline: Draw a horizontal line connecting the highest point between the two bottoms (for double bottoms) or the lowest point between the two tops (for double tops).

- Confirm the Breakout: Wait for the price to break above the neckline (for double bottoms) or below the neckline (for double tops) on significant volume. This confirms the pattern.

Trading Strategies for the Adam and Eve Pattern

Once the **Adam and Eve pattern** is identified and confirmed, traders can employ various strategies to capitalize on the potential trend reversal.

Entry Points

The most common entry point is after the price breaks above the neckline (for double bottoms) or below the neckline (for double tops). Some traders may choose to enter on a retest of the neckline after the breakout.

Stop-Loss Orders

A stop-loss order should be placed below the second bottom (for double bottoms) or above the second top (for double tops) to limit potential losses if the pattern fails.

Profit Targets

The profit target is typically calculated by measuring the distance between the neckline and the bottom of the pattern (for double bottoms) or the top of the pattern (for double tops) and projecting that distance upward (for double bottoms) or downward (for double tops) from the breakout point. Another approach is to use Fibonacci extensions to identify potential resistance or support levels as profit targets. Understanding the **Adam and Eve pattern** is crucial for setting realistic profit targets.

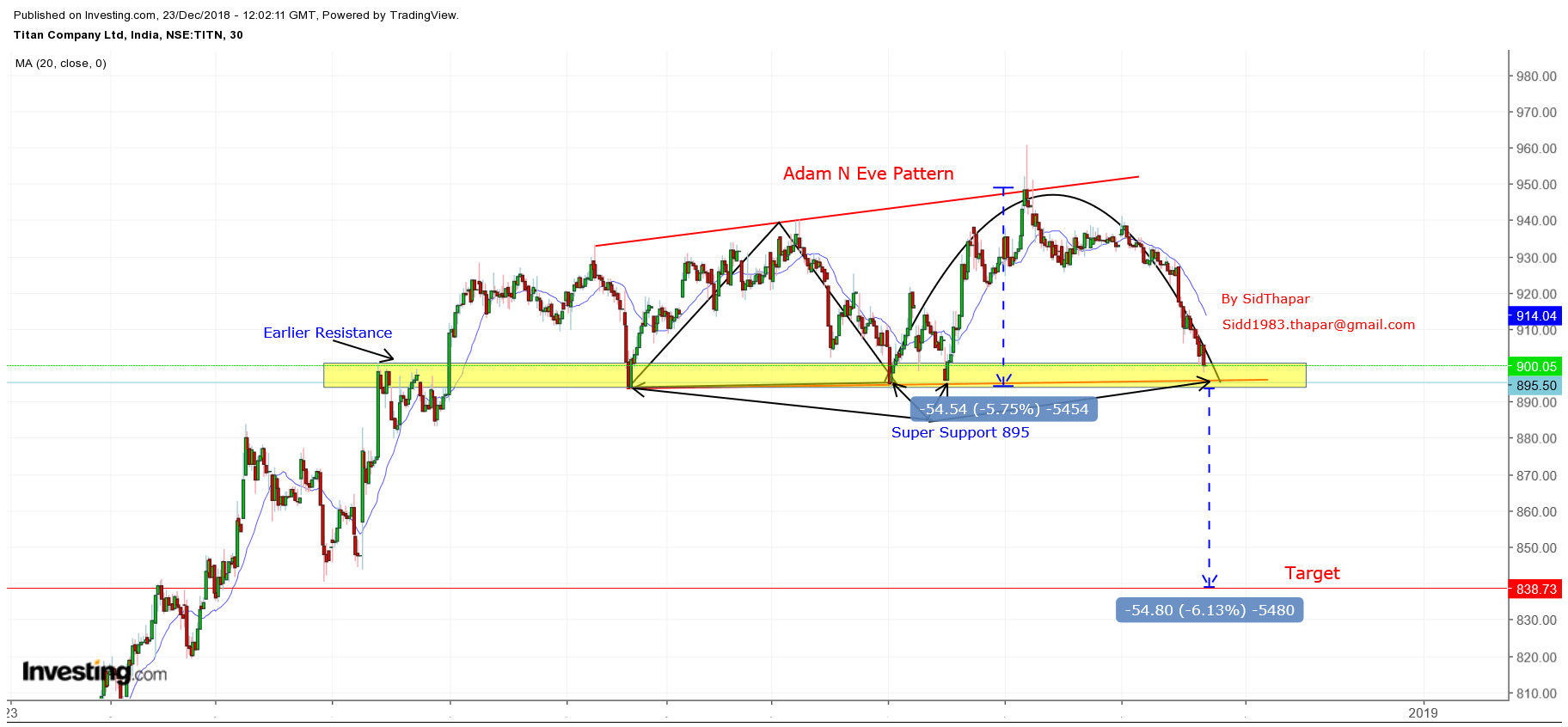

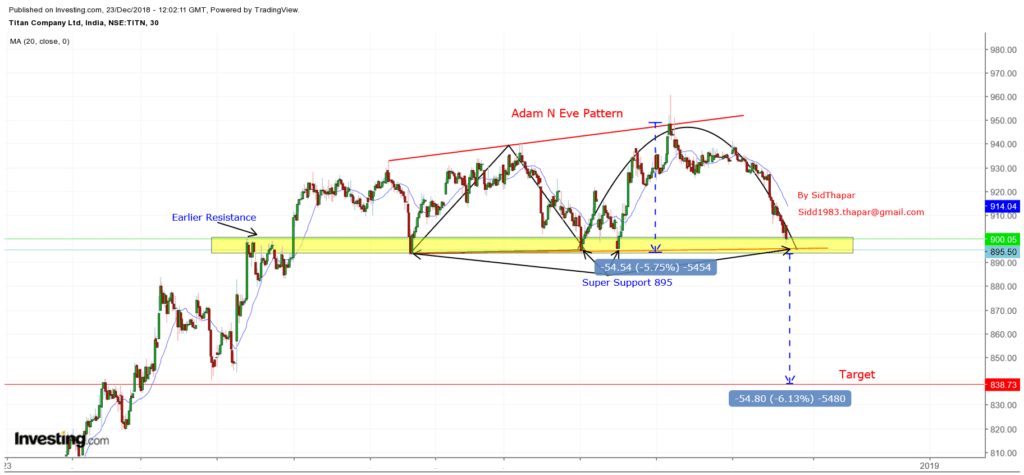

Examples of the Adam and Eve Pattern in Real Markets

The **Adam and Eve pattern** can be observed in various markets, including stocks, forex, and commodities. Let’s look at a few hypothetical examples:

Example Stock Chart

Imagine a stock that has been in a downtrend for several months. The price forms a sharp V-shaped bottom (the Adam formation), followed by a broader, rounder bottom (the Eve formation). The price then breaks above the neckline on increased volume, signaling a potential trend reversal. A trader could enter a long position after the breakout, placing a stop-loss order below the Eve bottom and setting a profit target based on the height of the pattern.

Example Forex Chart

Consider a forex pair that has been in an uptrend. The price forms a sharp V-shaped top (the Adam formation), followed by a broader, rounder top (the Eve formation). The price then breaks below the neckline on increased volume, signaling a potential trend reversal. A trader could enter a short position after the breakout, placing a stop-loss order above the Eve top and setting a profit target based on the height of the pattern. Recognizing the **Adam and Eve pattern** in forex trading can offer significant advantages.

Advantages and Limitations of the Adam and Eve Pattern

Like any trading pattern, the **Adam and Eve pattern** has its advantages and limitations.

Advantages

- Clear Identification: The distinct shapes of the Adam and Eve formations make the pattern relatively easy to identify.

- High Probability: When confirmed by a breakout on significant volume, the pattern has a high probability of success.

- Defined Entry and Exit Points: The neckline and the height of the pattern provide clear entry and exit points, making it easier to manage risk.

Limitations

- Subjectivity: Identifying the pattern can be subjective, as the shapes of the Adam and Eve formations may vary.

- False Breakouts: The price may break above or below the neckline but fail to continue in the expected direction, resulting in a false breakout.

- Time-Consuming: The pattern can take a significant amount of time to form, requiring patience and discipline from the trader.

Tips for Trading the Adam and Eve Pattern

To increase the chances of success when trading the **Adam and Eve pattern**, consider the following tips:

Confirm the Breakout

Always wait for a confirmed breakout above or below the neckline on significant volume before entering a trade. Avoid entering prematurely based on anticipation of a breakout.

Use Stop-Loss Orders

Always use stop-loss orders to limit potential losses if the pattern fails. Place the stop-loss order below the Eve bottom (for double bottoms) or above the Eve top (for double tops).

Consider Market Context

Consider the overall market context when trading the Adam and Eve pattern. Look for confluence with other technical indicators and fundamental factors to increase the probability of success. For example, if a company announces positive earnings, it could strengthen a bullish **Adam and Eve pattern**.

Practice Patience

The Adam and Eve pattern can take a significant amount of time to form. Be patient and wait for the pattern to fully develop and confirm before entering a trade. Avoid chasing the market or forcing a trade.

The Psychology Behind the Adam and Eve Pattern

Understanding the psychology behind the **Adam and Eve pattern** can provide valuable insights into market sentiment and potential trading opportunities. The Adam formation represents a sharp, decisive move driven by strong buying or selling pressure. This often indicates a sudden shift in market sentiment. The Eve formation, on the other hand, represents a more gradual and uncertain move, reflecting a period of consolidation and indecision. The breakout from the neckline signifies a renewed conviction in the new trend, as buyers (for double bottoms) or sellers (for double tops) overwhelm the opposing forces.

Combining the Adam and Eve Pattern with Other Technical Indicators

To further enhance the reliability of the **Adam and Eve pattern**, traders often combine it with other technical indicators. Here are a few examples:

Moving Averages

Using moving averages can help confirm the trend reversal signaled by the Adam and Eve pattern. For example, if the price breaks above the neckline of a double bottom and also crosses above a key moving average, it provides additional confirmation of a bullish trend reversal.

Relative Strength Index (RSI)

The RSI can help identify overbought or oversold conditions, which can further validate the Adam and Eve pattern. For example, if the RSI is oversold during the formation of a double bottom, it suggests that the market is ripe for a reversal.

MACD

The MACD can help confirm the momentum behind the breakout from the neckline. A bullish MACD crossover after the breakout from a double bottom provides additional confirmation of a bullish trend reversal.

Advanced Techniques for Trading the Adam and Eve Pattern

Experienced traders may use advanced techniques to further refine their trading strategies based on the **Adam and Eve pattern**.

Volume Analysis

Analyzing volume patterns can provide valuable insights into the strength of the trend reversal. Look for increasing volume during the breakout from the neckline, as this indicates strong buying or selling pressure.

Fibonacci Retracements

Using Fibonacci retracements can help identify potential support and resistance levels, which can be used to set profit targets and stop-loss orders. For example, if the price retraces to the 38.2% or 50% Fibonacci level after the breakout, it could present a buying opportunity.

Pattern Failure Recognition

Recognizing when the **Adam and Eve pattern** is likely to fail is crucial for managing risk. If the price fails to break above or below the neckline after multiple attempts, it could indicate that the pattern is invalid and that the trend is likely to continue in its original direction.

Conclusion

The **Adam and Eve pattern** is a valuable tool for traders looking to identify potential trend reversals. By understanding its characteristics, how to identify it, and strategies for trading it effectively, traders can significantly enhance their ability to predict market movements and improve their overall trading performance. Remember to always confirm the breakout, use stop-loss orders, consider the market context, and practice patience. By mastering the Adam and Eve pattern, traders can gain a competitive edge in the market and increase their chances of success. Further research into chart patterns such as [See also: Head and Shoulders Pattern] and [See also: Double Top and Double Bottom Patterns] can also be beneficial. Always remember to practice risk management when utilizing the **Adam and Eve pattern** or any other trading strategy.