Decoding the Deception: Understanding Fake Stock Market Screens and Their Impact

In the fast-paced world of finance, where fortunes can be made and lost in the blink of an eye, the integrity of information is paramount. The ubiquitous stock market screen, displaying real-time data and intricate charts, serves as a crucial tool for investors, traders, and analysts alike. However, the rise of sophisticated technology has also given rise to a darker side: the proliferation of fake stock market screens. These deceptive displays can mislead investors, manipulate market sentiment, and ultimately, cause significant financial harm.

This article delves into the multifaceted world of fake stock market screens, exploring their various forms, the motivations behind their creation, the potential consequences for unsuspecting individuals and the broader market, and the measures that can be taken to protect against such deceptive practices. Understanding the nuances of these fraudulent displays is crucial for navigating the complexities of the modern financial landscape.

What Exactly is a Fake Stock Market Screen?

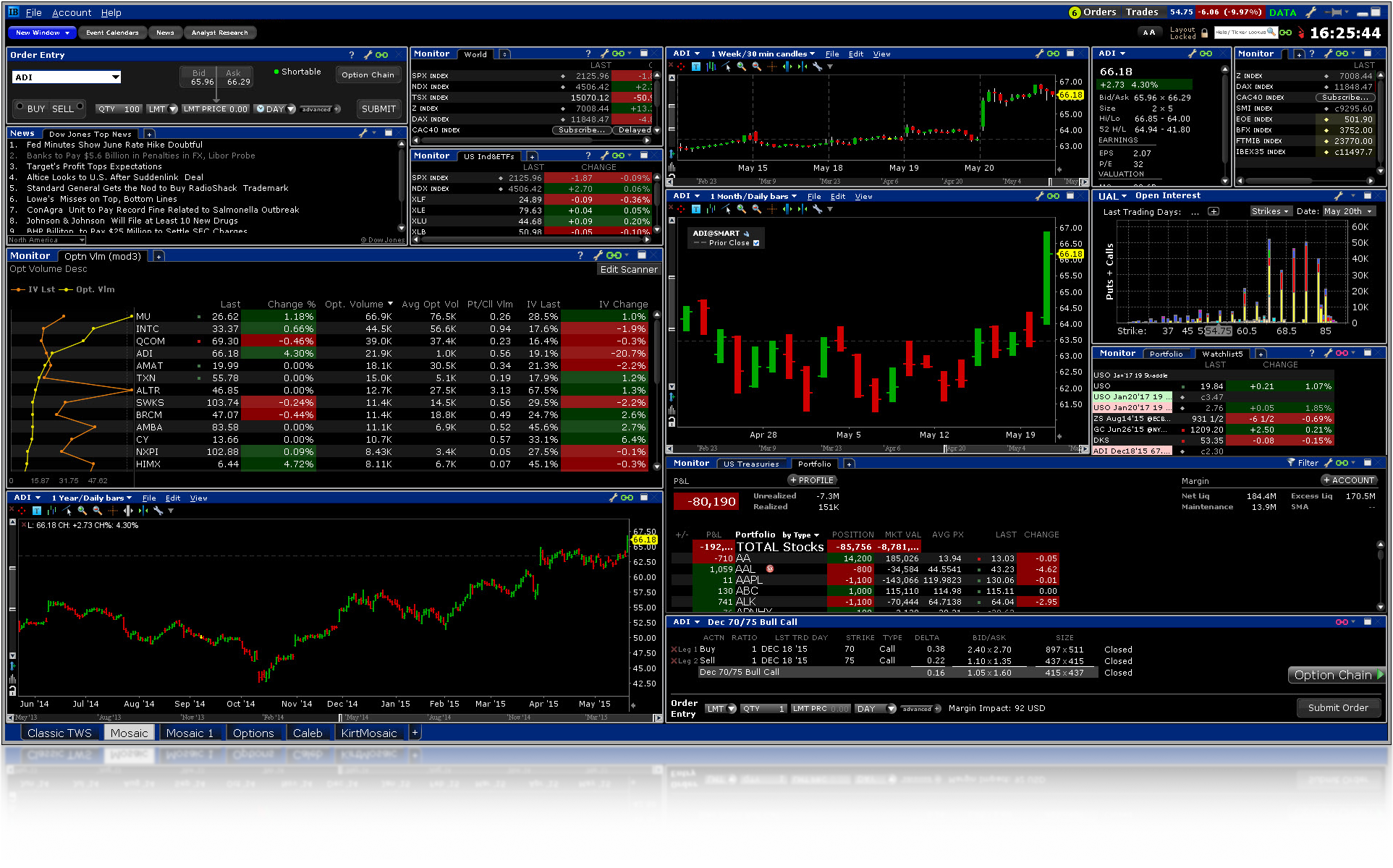

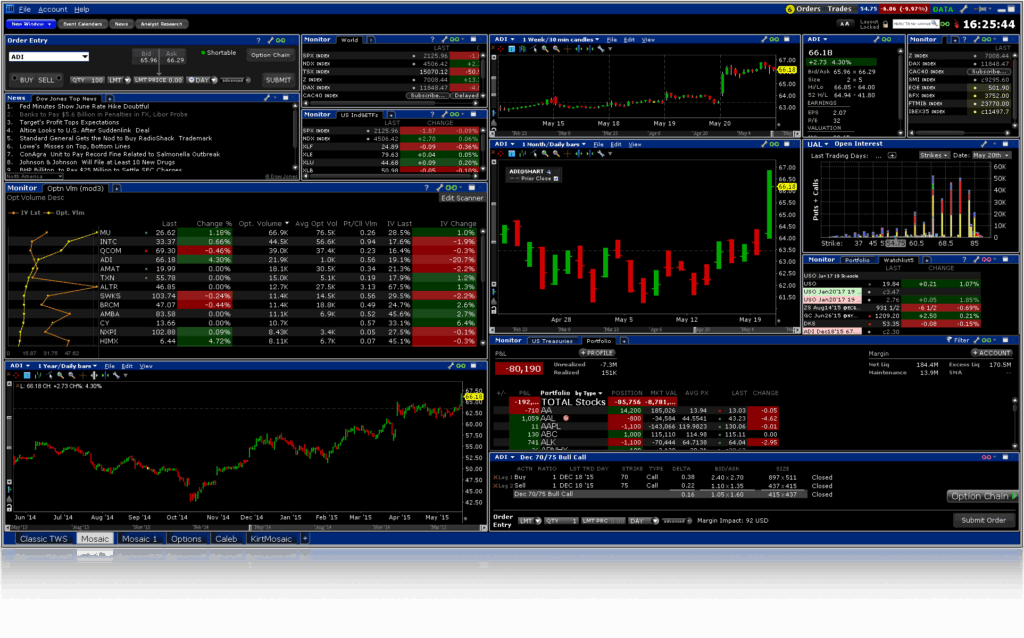

A fake stock market screen is a deceptive visual representation of stock market data designed to mimic the appearance of legitimate trading platforms or financial news outlets. These screens can range from simple, static images to complex, interactive simulations that closely resemble the real thing. The key difference lies in the data being presented: it’s either entirely fabricated, manipulated, or significantly delayed, rendering it unreliable for making informed investment decisions.

These screens are often used to create a false sense of market activity or to artificially inflate or deflate the perceived value of a particular stock. They can be deployed in various contexts, from online scams targeting individual investors to elaborate schemes aimed at manipulating broader market trends.

Common Types of Fake Stock Market Screens

The sophistication of fake stock market screens varies greatly. Here are some common types:

- Static Images: The simplest form involves displaying a pre-designed image of a stock market screen with fabricated data. These are often used in phishing scams or to promote dubious investment opportunities.

- Simulated Trading Platforms: These are more complex, mimicking the look and feel of real trading platforms. However, the data displayed is often manipulated or delayed, giving users a false impression of market conditions. [See also: Understanding Stock Trading Platforms]

- Pump-and-Dump Schemes: In these schemes, fraudsters use fake stock market screens to artificially inflate the price of a stock (often a penny stock) by creating a false sense of demand. Once the price reaches a certain level, they sell their shares for a profit, leaving other investors with worthless stock.

- Fake News Websites: Some websites masquerade as legitimate financial news outlets, using fake stock market screens to support false or misleading articles designed to influence investor sentiment.

Motivations Behind Creating Fake Stock Market Screens

The primary motivation behind creating fake stock market screens is financial gain. Fraudsters use these deceptive displays to:

- Defraud Investors: By presenting false or misleading information, they can lure unsuspecting investors into buying or selling stocks at artificially inflated or deflated prices.

- Manipulate Market Sentiment: By creating a false sense of market activity or momentum, they can influence the overall direction of the market.

- Promote Scams: Fake stock market screens are often used to promote fraudulent investment schemes, such as pyramid schemes or Ponzi schemes.

- Damage Competitors: In some cases, they may be used to spread false information about competitors, damaging their reputation and stock price.

The Consequences of Fake Stock Market Screens

The consequences of fake stock market screens can be devastating, both for individual investors and the broader market:

- Financial Losses: Investors who rely on fake stock market screens to make investment decisions can suffer significant financial losses.

- Erosion of Trust: The proliferation of fake stock market screens can erode trust in the financial markets, making investors more hesitant to participate.

- Market Instability: Large-scale manipulation using fake stock market screens can destabilize the market, leading to unpredictable price swings and increased volatility.

- Legal Repercussions: Individuals and organizations involved in creating and distributing fake stock market screens can face serious legal consequences, including fines, imprisonment, and civil lawsuits.

How to Spot a Fake Stock Market Screen

Protecting yourself from fake stock market screens requires vigilance and a healthy dose of skepticism. Here are some red flags to watch out for:

- Unrealistic Promises: Be wary of any investment opportunity that promises guaranteed returns or unusually high profits.

- Pressure Tactics: Fraudsters often use pressure tactics to rush investors into making decisions before they have time to do their research.

- Unsolicited Offers: Be skeptical of unsolicited investment offers, especially those received via email or social media.

- Lack of Transparency: If you can’t verify the legitimacy of a company or investment opportunity, it’s best to avoid it.

- Suspicious Websites: Pay attention to the website’s design, grammar, and spelling. Fake stock market screens are often found on poorly designed websites with grammatical errors.

- Data Discrepancies: Compare the data displayed on the screen with other reputable sources, such as major financial news outlets or official exchange websites. Any significant discrepancies should raise a red flag.

- No Real-Time Updates: Ensure the screen is providing real-time or near real-time data. Significant delays are a sign that the information may not be accurate.

Protecting Yourself from Deceptive Practices

Beyond identifying red flags, proactive measures can significantly reduce your risk of falling victim to fake stock market screens:

- Do Your Research: Before investing in any stock, thoroughly research the company, its financials, and its management team.

- Use Reputable Sources: Rely on reputable financial news outlets and data providers for your market information.

- Consult a Financial Advisor: A qualified financial advisor can help you assess your risk tolerance and develop a sound investment strategy.

- Be Skeptical: Always approach investment opportunities with a healthy dose of skepticism, especially if they seem too good to be true.

- Report Suspicious Activity: If you suspect that you have encountered a fake stock market screen or other fraudulent activity, report it to the appropriate authorities, such as the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA).

- Verify Information: Cross-reference data from multiple sources. Don’t rely solely on one fake stock market screen for your investment decisions. [See also: How to Verify Stock Market Data]

The Role of Regulation and Technology

Combating the spread of fake stock market screens requires a multi-pronged approach, involving both regulation and technological innovation.

Regulatory bodies like the SEC play a crucial role in investigating and prosecuting individuals and organizations involved in creating and distributing fake stock market screens. They also work to educate investors about the risks of fraud and provide resources for reporting suspicious activity.

Technological advancements can also help to detect and prevent the creation and distribution of fake stock market screens. For example, artificial intelligence (AI) can be used to identify patterns of fraudulent activity and flag suspicious websites or data sources. Blockchain technology can also be used to create more secure and transparent financial systems, making it more difficult for fraudsters to manipulate market data.

The Future of Fake Stock Market Screens

As technology continues to evolve, so too will the sophistication of fake stock market screens. It’s likely that we will see even more realistic and convincing simulations of real trading platforms and financial news outlets in the future. This makes it all the more important for investors to be vigilant and to stay informed about the latest scams and fraudulent practices. Furthermore, the rise of deepfakes and AI-generated content poses a new threat, potentially enabling the creation of even more convincing and deceptive fake stock market screens.

Conclusion

Fake stock market screens pose a significant threat to investors and the integrity of the financial markets. By understanding the various forms of these deceptive displays, the motivations behind their creation, and the potential consequences, investors can take steps to protect themselves from fraud. Vigilance, skepticism, and a reliance on reputable sources of information are essential for navigating the complexities of the modern financial landscape. The fight against fake stock market screens is an ongoing one, requiring a collaborative effort from regulators, technology companies, and individual investors alike.