Decoding the Future: What is Stock Market Prediction and How Does it Work?

The stock market, a dynamic and often volatile arena, has always captivated investors and economists alike. The allure of predicting its future movements—what is stock market prediction—is a persistent and powerful one. But what exactly does stock market prediction entail, and how do analysts attempt to forecast the unpredictable? This article delves into the intricacies of stock market prediction, exploring its methodologies, challenges, and the role it plays in the financial world.

Understanding Stock Market Prediction

At its core, what is stock market prediction? It’s the attempt to forecast the future value of a company’s stock or other financial instrument traded on an exchange. These predictions can be short-term, focusing on daily or weekly fluctuations, or long-term, projecting performance over months or years. The goal is to identify opportunities for profit by anticipating market trends and making informed investment decisions.

Successful stock market prediction can yield significant financial gains. Imagine accurately forecasting a surge in a tech company’s stock before a major product launch. Such foresight allows investors to buy low and sell high, capitalizing on the anticipated price increase. Conversely, predicting a downturn can help investors mitigate losses by selling their holdings before prices plummet.

Methods Used in Stock Market Prediction

Various methods are employed in the quest for accurate stock market prediction. These approaches can be broadly categorized into two main types: fundamental analysis and technical analysis.

Fundamental Analysis

Fundamental analysis involves evaluating a company’s intrinsic value by examining its financial statements, industry trends, and macroeconomic factors. Analysts using this approach scrutinize balance sheets, income statements, and cash flow statements to assess a company’s profitability, solvency, and growth potential. They also consider factors such as management quality, competitive landscape, and regulatory environment. [See also: Understanding Financial Statements]

By understanding the underlying factors driving a company’s performance, fundamental analysts aim to determine whether its stock is undervalued or overvalued. If a stock is deemed undervalued, they may recommend buying it, anticipating that the market will eventually recognize its true worth. Conversely, if a stock is considered overvalued, they may suggest selling it.

Technical Analysis

Technical analysis, on the other hand, focuses on studying historical market data, such as price movements and trading volume, to identify patterns and trends. Technical analysts use charts and indicators to analyze these patterns and make predictions about future price movements. Common technical indicators include moving averages, relative strength index (RSI), and moving average convergence divergence (MACD). [See also: Introduction to Technical Indicators]

Technical analysts believe that market prices reflect all available information, including fundamental factors. They argue that by analyzing price charts and identifying patterns, they can gain insights into investor sentiment and predict future price movements, regardless of the underlying reasons for those movements. This method of stock market prediction relies heavily on statistical analysis and pattern recognition.

Quantitative Analysis

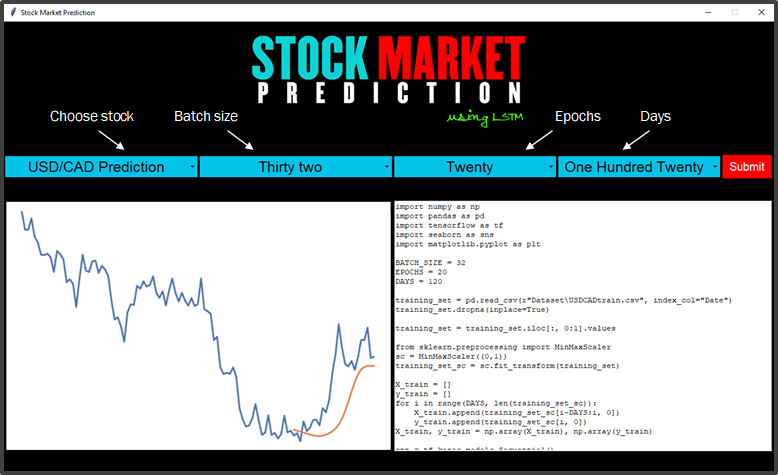

Quantitative analysis takes a mathematical and statistical approach to stock market prediction. It involves building models and algorithms to identify patterns and relationships in large datasets. Quantitative analysts use sophisticated techniques such as regression analysis, time series analysis, and machine learning to forecast stock prices and market trends. [See also: The Role of Data Science in Finance]

These models often incorporate a wide range of factors, including fundamental data, technical indicators, and macroeconomic variables. Quantitative analysts strive to develop models that can accurately predict market movements and generate profitable trading strategies. The rise of big data and advanced computing power has fueled the growth of quantitative analysis in recent years.

The Challenges of Stock Market Prediction

Despite the advancements in analytical techniques, stock market prediction remains a challenging endeavor. The stock market is influenced by a multitude of factors, many of which are unpredictable. Economic events, political developments, and even investor sentiment can have a significant impact on stock prices. Here are some of the key challenges:

- Market Volatility: The stock market is inherently volatile, with prices fluctuating rapidly and unpredictably. This volatility makes it difficult to predict future price movements with certainty.

- Information Asymmetry: Not all investors have access to the same information. Insiders with privileged knowledge can exploit this information asymmetry to their advantage, making it difficult for others to accurately predict market movements.

- Behavioral Factors: Investor behavior is often driven by emotions such as fear and greed, which can lead to irrational decision-making. These behavioral biases can disrupt market patterns and make it difficult to predict future price movements.

- Black Swan Events: Unexpected and unpredictable events, such as financial crises or natural disasters, can have a significant impact on the stock market. These “black swan” events are difficult to anticipate and can invalidate even the most sophisticated prediction models.

The Role of Technology in Stock Market Prediction

Technology plays an increasingly important role in stock market prediction. The availability of vast amounts of data and the development of powerful computing tools have enabled analysts to build more sophisticated prediction models. Machine learning algorithms, in particular, have shown promise in identifying patterns and predicting market movements. [See also: Artificial Intelligence in Trading]

High-frequency trading (HFT), which uses algorithms to execute trades at lightning speed, has also become a significant force in the stock market. HFT firms use sophisticated models to identify arbitrage opportunities and profit from small price discrepancies. While HFT can improve market efficiency, it can also contribute to market volatility and instability.

Is Accurate Stock Market Prediction Possible?

The question of whether accurate stock market prediction is possible remains a subject of debate. While some analysts claim to have developed successful prediction models, the reality is that no one can consistently and accurately predict the stock market. The market is simply too complex and unpredictable to be fully understood and modeled.

However, this does not mean that stock market prediction is a futile exercise. By using sound analytical techniques, understanding market trends, and managing risk effectively, investors can improve their chances of success. It’s important to remember that investing in the stock market always involves risk, and there are no guarantees of profit. Successful stock market prediction, therefore, is less about certainty and more about probability and risk management.

Furthermore, the definition of “accurate” needs to be considered. Predicting the exact price of a stock at a specific point in time is highly unlikely. However, identifying trends and making informed judgments about potential growth or decline can be valuable for long-term investment strategies. Understanding what is stock market prediction in this context becomes more about informed analysis and strategic decision-making rather than clairvoyance.

The Future of Stock Market Prediction

The future of stock market prediction is likely to be shaped by further advancements in technology and data analysis. Machine learning algorithms will continue to improve, allowing analysts to identify more subtle patterns and relationships in market data. The use of alternative data sources, such as social media sentiment and satellite imagery, may also provide valuable insights into market trends. [See also: The Impact of Alternative Data on Investing]

However, it’s important to remember that technology is just a tool. The human element will always be crucial in stock market prediction. Analysts must be able to interpret data, understand market dynamics, and exercise sound judgment. The best approach is likely to be a combination of technology and human expertise. By continuously learning and adapting, investors can navigate the complexities of the stock market and improve their chances of achieving their financial goals.

In conclusion, what is stock market prediction? It’s a complex and challenging field that attempts to forecast future market movements. While perfect accuracy remains elusive, employing sound analytical techniques, understanding market dynamics, and leveraging technology can significantly improve investment outcomes. The pursuit of stock market prediction, therefore, remains a worthwhile endeavor for those seeking to navigate the ever-evolving world of finance.