Decoding the Hammer Pattern: A Comprehensive Guide for Traders

The hammer pattern is a candlestick formation in technical analysis that signals a potential bullish reversal in a downtrend. Recognizing this pattern can provide traders with valuable insights into market sentiment and potential buying opportunities. This guide will delve into the intricacies of the hammer pattern, exploring its characteristics, interpretation, and limitations.

Understanding Candlestick Patterns

Before diving into the specifics of the hammer pattern, it’s crucial to understand the basics of candlestick charts. Candlesticks represent price movements over a specific period, typically a day. Each candlestick consists of a body, which shows the opening and closing prices, and wicks (or shadows), which represent the high and low prices for that period. The color of the body indicates whether the price closed higher (usually green or white) or lower (usually red or black) than it opened.

What is the Hammer Pattern?

The hammer pattern is characterized by a small body located at the upper end of the trading range and a long lower wick that is at least twice the length of the body. The upper wick, if any, is very small or nonexistent. This pattern typically appears at the end of a downtrend and suggests that selling pressure is weakening, and buyers are starting to gain control.

Key Characteristics of a Hammer Pattern:

- Small Body: The real body (the difference between the open and close) is relatively small.

- Long Lower Wick: The lower shadow is significantly longer than the body, ideally at least twice the size.

- Little or No Upper Wick: A small or nonexistent upper shadow is preferable.

- Appears in a Downtrend: The hammer pattern is only valid if it forms after a period of declining prices.

The Psychology Behind the Hammer Pattern

The formation of the hammer pattern reflects a specific sequence of events during the trading period. Initially, sellers dominate, pushing the price significantly lower. However, buyers then step in, driving the price back up to close near the opening price. This suggests that the downtrend may be losing momentum and that buyers are starting to exert their influence. The long lower wick represents the extent of the selling pressure that was ultimately overcome by the buyers. [See also: Understanding Market Sentiment]

How to Identify a Valid Hammer Pattern

Identifying a valid hammer pattern requires careful observation and consideration of the surrounding market context. Here’s a step-by-step guide:

- Confirm a Downtrend: Ensure that the pattern appears after a clear downtrend.

- Look for a Small Body: The body should be small relative to the overall range.

- Verify the Long Lower Wick: The lower wick should be at least twice the length of the body.

- Check for Minimal Upper Wick: The upper wick should be minimal or absent.

- Confirmation: Wait for confirmation in the subsequent trading period. This could be a bullish candlestick that closes above the high of the hammer.

Trading Strategies Using the Hammer Pattern

The hammer pattern can be used in various trading strategies. However, it’s crucial to remember that no pattern is foolproof, and risk management is essential.

Entry Points:

A common strategy is to enter a long position after the confirmation candle closes above the high of the hammer pattern. This confirms that the bullish reversal is gaining momentum.

Stop-Loss Orders:

Place a stop-loss order below the low of the hammer pattern to limit potential losses if the reversal fails.

Target Prices:

Determine target prices based on previous resistance levels or other technical indicators such as Fibonacci retracements. [See also: Fibonacci Trading Strategies]

The Inverted Hammer Pattern

The inverted hammer pattern is the opposite of the hammer pattern and is also a bullish reversal pattern. It has a small body at the lower end of the trading range and a long upper wick. The lower wick is either very small or nonexistent. The inverted hammer suggests that buyers attempted to push the price higher, but sellers eventually brought it back down. However, the fact that buyers were able to push the price up at all indicates potential buying pressure.

Hammer vs. Hanging Man

It’s important not to confuse the hammer pattern with the hanging man pattern. While they look similar, their significance is different. The hammer pattern appears in a downtrend and signals a potential bullish reversal, while the hanging man appears in an uptrend and signals a potential bearish reversal. The context in which the pattern appears is crucial for proper interpretation.

Limitations of the Hammer Pattern

While the hammer pattern can be a valuable tool, it’s essential to be aware of its limitations:

- False Signals: Like all technical indicators, the hammer pattern can generate false signals.

- Confirmation Required: It’s crucial to wait for confirmation before entering a trade based on the hammer pattern.

- Market Context: The effectiveness of the pattern depends on the overall market context.

- Not a Standalone Indicator: The hammer pattern should not be used in isolation. Combine it with other technical indicators and analysis techniques for better results.

Real-World Examples of Hammer Patterns

Let’s consider a hypothetical example. Suppose a stock has been in a downtrend for several weeks. On a particular day, the stock opens at $50, falls to $45, but then rallies to close at $49. The resulting candlestick has a small body near the top and a long lower wick. This could be a hammer pattern. If the next day the stock opens higher and continues to rise, this would confirm the bullish reversal.

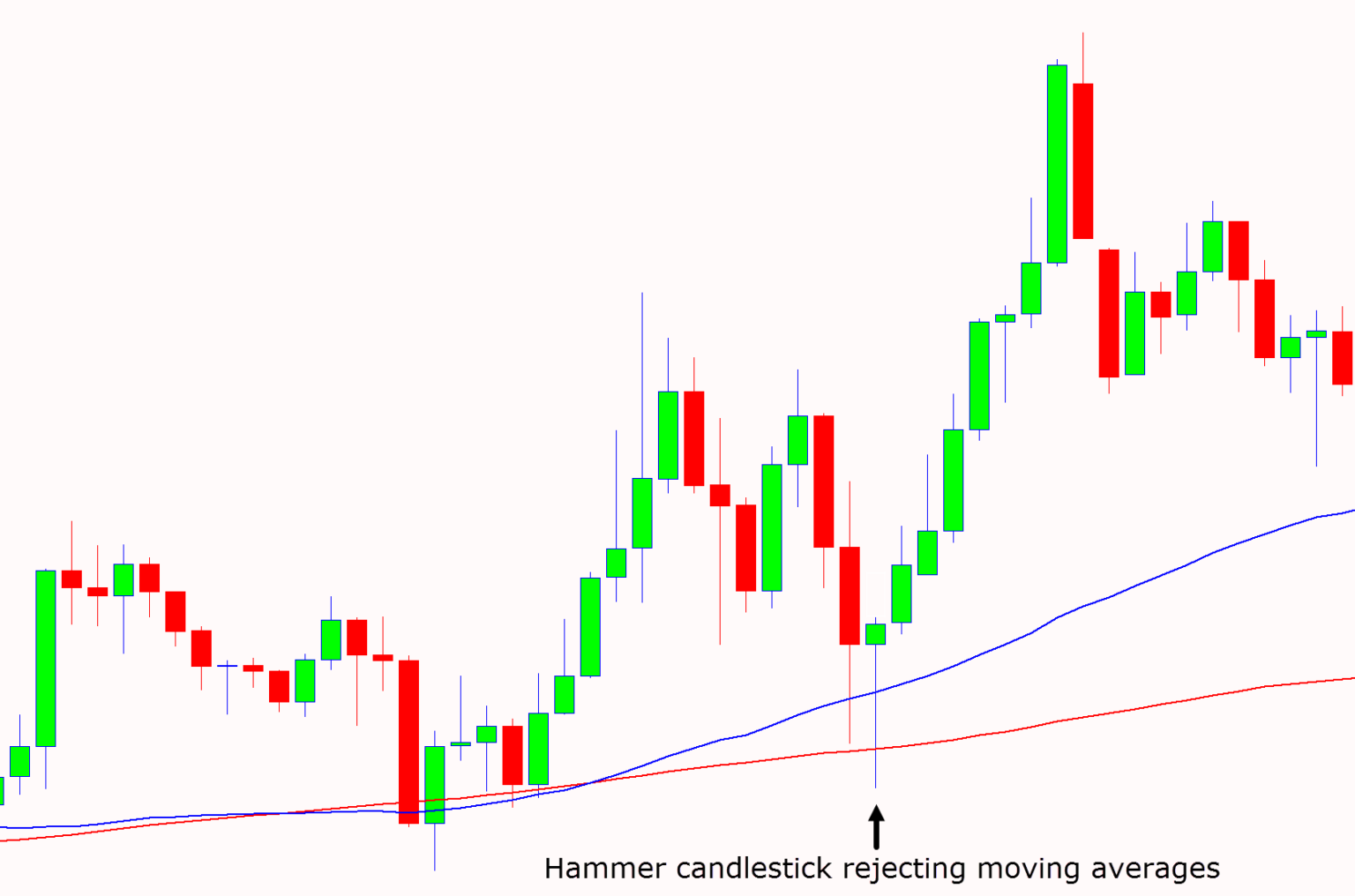

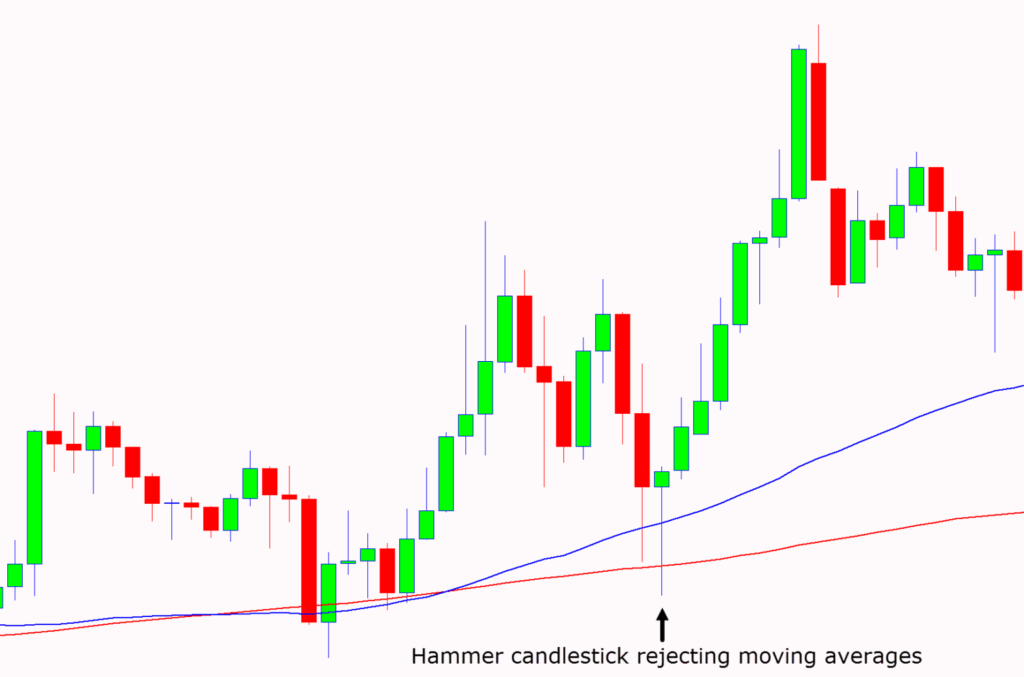

Combining the Hammer Pattern with Other Indicators

To increase the reliability of the hammer pattern, it’s advisable to combine it with other technical indicators. Some popular combinations include:

- Moving Averages: Using moving averages to identify the overall trend and potential support levels.

- Relative Strength Index (RSI): Using RSI to confirm oversold conditions, which can increase the likelihood of a bullish reversal.

- Volume Analysis: Analyzing trading volume to confirm the strength of the reversal.

Hammer Pattern in Different Timeframes

The hammer pattern can be observed on various timeframes, from intraday charts to weekly or monthly charts. Longer timeframes generally provide more reliable signals, as they represent more significant price movements and are less prone to noise. However, shorter timeframes can also be useful for identifying potential entry points within a larger trend.

Advanced Considerations

Experienced traders may also consider the following advanced factors when analyzing hammer pattern:

- Gap Fills: The presence of a gap before the hammer can strengthen the signal.

- Support and Resistance: The pattern’s proximity to key support and resistance levels.

- Candlestick Volume: The volume during the hammer’s formation can provide additional insights into the strength of the potential reversal.

Conclusion

The hammer pattern is a powerful candlestick formation that can provide valuable insights into potential bullish reversals. By understanding its characteristics, interpretation, and limitations, traders can use this pattern to enhance their trading strategies. Remember to always confirm the pattern with other technical indicators and to practice proper risk management. The hammer pattern, when correctly identified and acted upon, can be a valuable addition to any trader’s toolkit. Keep practicing identifying these patterns and refining your strategy for consistent and informed trading decisions. Always remember that the hammer pattern is just one piece of the puzzle, and successful trading requires a comprehensive understanding of market dynamics and risk management principles. Recognizing the hammer pattern can significantly improve your ability to identify potential buying opportunities, ultimately contributing to more profitable trading outcomes. Don’t underestimate the power of the hammer pattern in your trading arsenal. The hammer pattern, in essence, is a signal that the market *might* be changing direction, and that’s valuable information for any trader to have. Remember to use the hammer pattern responsibly and in conjunction with other analysis techniques for best results.