Decoding the Hammer Pattern in Stocks: A Comprehensive Guide

The stock market, a complex arena of fluctuating prices and investor sentiment, often presents patterns that seasoned traders use to predict future movements. Among these patterns, the hammer candlestick pattern stands out as a potentially bullish signal. This guide will delve into the intricacies of the hammer pattern stocks, exploring its formation, interpretation, and limitations, providing you with a comprehensive understanding of this valuable technical analysis tool.

Understanding Candlestick Patterns

Before diving into the hammer pattern stocks, it’s crucial to understand the basics of candlestick charts. Candlestick charts are a visual representation of price movements for a specific period. Each candlestick represents a single period (e.g., a day, a week, or an hour) and displays four key pieces of information:

- Open: The price at which the period began.

- High: The highest price reached during the period.

- Low: The lowest price reached during the period.

- Close: The price at which the period ended.

The body of the candlestick represents the difference between the open and close prices. If the close price is higher than the open price, the body is typically colored green or white, indicating a bullish (positive) movement. Conversely, if the close price is lower than the open price, the body is colored red or black, indicating a bearish (negative) movement. The lines extending above and below the body are called “wicks” or “shadows” and represent the high and low prices for the period.

What is the Hammer Pattern?

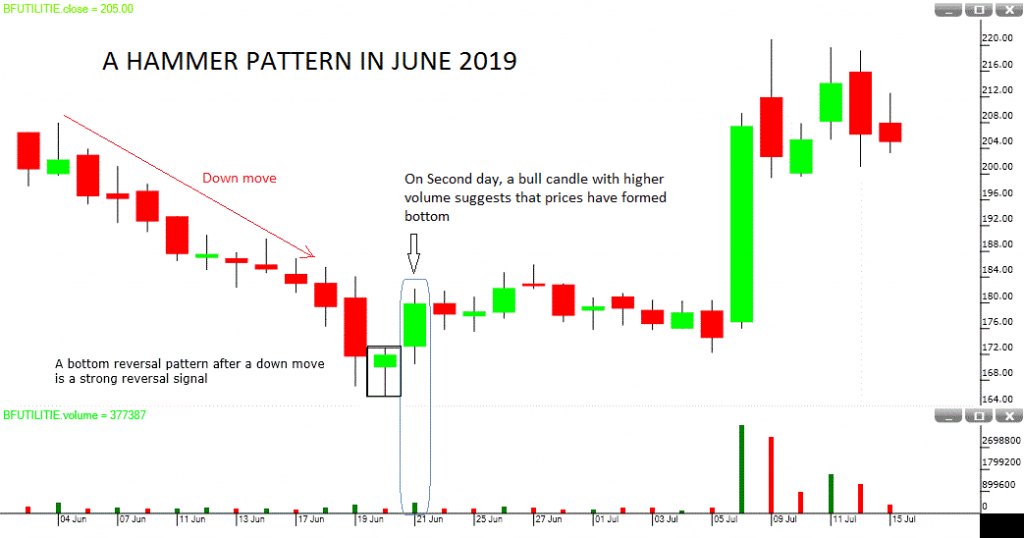

The hammer pattern is a single candlestick pattern that appears at the bottom of a downtrend, suggesting a potential reversal of the downward movement. It is characterized by a small body (either bullish or bearish) located at the upper end of the trading range and a long lower shadow that is at least twice the length of the body. The upper shadow, if any, is very small or nonexistent. The essence of the hammer pattern lies in its depiction of a market that tested lower prices but ultimately saw buyers step in to push the price back up towards the open.

Key Characteristics of the Hammer Pattern:

- Long Lower Shadow: This indicates that sellers initially pushed the price down significantly, but buyers then entered the market and drove the price back up.

- Small Body: The small body suggests that the opening and closing prices were relatively close, indicating a period of consolidation after the initial selling pressure.

- Location: The hammer pattern is most significant when it appears after a sustained downtrend.

- Color of the Body: While the color of the body is not as crucial as the other characteristics, a bullish (green or white) body can provide additional confirmation of the potential reversal.

Identifying Hammer Pattern Stocks

Identifying hammer pattern stocks requires careful observation of candlestick charts. Here’s a step-by-step guide:

- Identify a Downtrend: Look for stocks that have been consistently declining in price over a period of time.

- Scan Candlestick Charts: Review the candlestick charts of these stocks, paying close attention to the formation of individual candlesticks.

- Look for the Hammer: Identify candlesticks with the key characteristics of a hammer pattern: a small body at the upper end of the trading range and a long lower shadow at least twice the length of the body.

- Confirm the Pattern: The hammer pattern is more reliable when followed by bullish confirmation. This typically involves the next candlestick closing above the close of the hammer.

Interpreting the Hammer Pattern

The hammer pattern signals a potential shift in market sentiment from bearish to bullish. The long lower shadow indicates that sellers initially dominated the trading session, driving the price down. However, the subsequent rally and closing near the high of the session suggest that buyers stepped in and absorbed the selling pressure. This suggests that the downtrend may be losing momentum and that a reversal to the upside is possible. When identifying potential hammer pattern stocks, remember this pattern can be a powerful indicator.

Confirmation is Key

While the hammer pattern can be a valuable signal, it’s crucial to seek confirmation before making any trading decisions. Confirmation typically involves the next candlestick closing above the close of the hammer. This confirms that the bullish momentum is continuing and that the potential reversal is likely to materialize. Without confirmation, the hammer pattern could be a false signal, leading to potential losses.

The Inverted Hammer Pattern

It’s important to distinguish the hammer pattern from the inverted hammer pattern. While both patterns suggest potential bullish reversals, their formations differ slightly. The inverted hammer has a long upper shadow and a small body at the lower end of the trading range. This pattern indicates that buyers initially pushed the price up, but sellers then brought the price back down towards the open. Like the hammer pattern, the inverted hammer requires confirmation before it can be considered a reliable signal.

Examples of Hammer Pattern Stocks

Let’s consider a hypothetical example. Imagine a stock, XYZ Corp., has been in a downtrend for several weeks, falling from $50 to $40. One day, a candlestick forms with a small body near $40 and a long lower shadow extending down to $38. This could be a hammer pattern. If the next day, XYZ Corp. closes above $40, this confirms the hammer pattern and suggests a potential rally. Investors might consider entering a long position, anticipating a further increase in price. Identifying these patterns can be crucial in finding hammer pattern stocks.

Another example could be a tech company, ABC Tech, that experiences a dip in its stock price after an earnings report. If a hammer pattern forms at the bottom of this dip, it could signal that investors see the dip as a buying opportunity and are stepping in to support the stock. This could lead to a rebound in the stock price.

Limitations of the Hammer Pattern

While the hammer pattern can be a useful tool, it’s important to be aware of its limitations:

- False Signals: The hammer pattern is not always accurate and can sometimes generate false signals. It’s crucial to seek confirmation before making any trading decisions.

- Context Matters: The significance of the hammer pattern depends on the overall market context. It’s more reliable when it appears after a sustained downtrend and is supported by other technical indicators.

- Subjectivity: Identifying the hammer pattern can be subjective, as there is no precise definition of what constitutes a “small body” or a “long lower shadow.”

- Doesn’t Predict Magnitude: While it can suggest a reversal, the hammer pattern doesn’t predict how far the price will rise. Other analysis is needed to estimate potential profit targets.

Combining Hammer Pattern with Other Technical Indicators

To increase the reliability of the hammer pattern, it’s often beneficial to combine it with other technical indicators, such as:

- Moving Averages: Using moving averages can help identify the overall trend and confirm the potential reversal suggested by the hammer pattern.

- Relative Strength Index (RSI): The RSI can indicate whether a stock is oversold, which can increase the likelihood of a bullish reversal.

- Volume Analysis: Increased trading volume during the formation of the hammer pattern can provide additional confirmation of the potential reversal.

- Fibonacci Retracement Levels: Identifying hammer pattern stocks near Fibonacci retracement levels can provide confluence and strengthen the signal.

Risk Management

As with any trading strategy, it’s crucial to implement proper risk management techniques when trading hammer pattern stocks. This includes setting stop-loss orders to limit potential losses and managing position sizes to avoid overexposure. Never risk more than you can afford to lose, and always do your own research before making any investment decisions.

Conclusion

The hammer pattern is a valuable tool for technical analysts, providing insights into potential bullish reversals in the stock market. By understanding its formation, interpretation, and limitations, traders can use the hammer pattern to identify potential buying opportunities. However, it’s crucial to remember that the hammer pattern is not a foolproof signal and should always be used in conjunction with other technical indicators and risk management techniques. Always confirm the pattern before making any trading decisions. Identifying hammer pattern stocks requires diligence and a comprehensive approach to technical analysis. [See also: Understanding Candlestick Charts] [See also: Technical Analysis for Beginners]