Decoding the Information Ratio: A Comprehensive Guide

In the complex world of investment management, evaluating performance is paramount. Investors constantly seek metrics that can effectively gauge the risk-adjusted return of a portfolio. One such critical metric is the information ratio. This article provides a comprehensive guide to understanding and applying the information ratio, exploring its significance, calculation, interpretation, and limitations. Whether you’re a seasoned financial professional or a novice investor, grasping the nuances of the information ratio is essential for making informed investment decisions.

What is the Information Ratio?

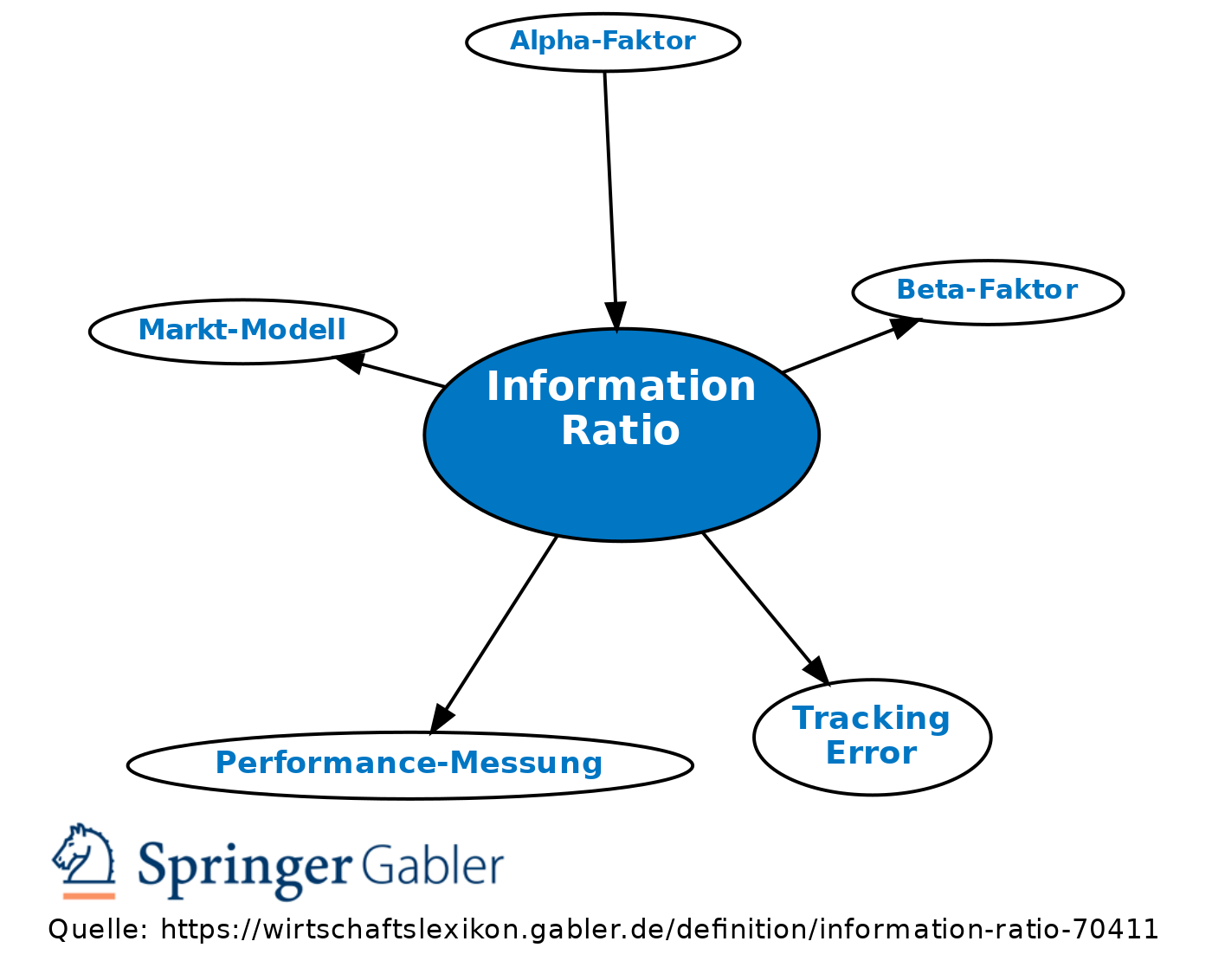

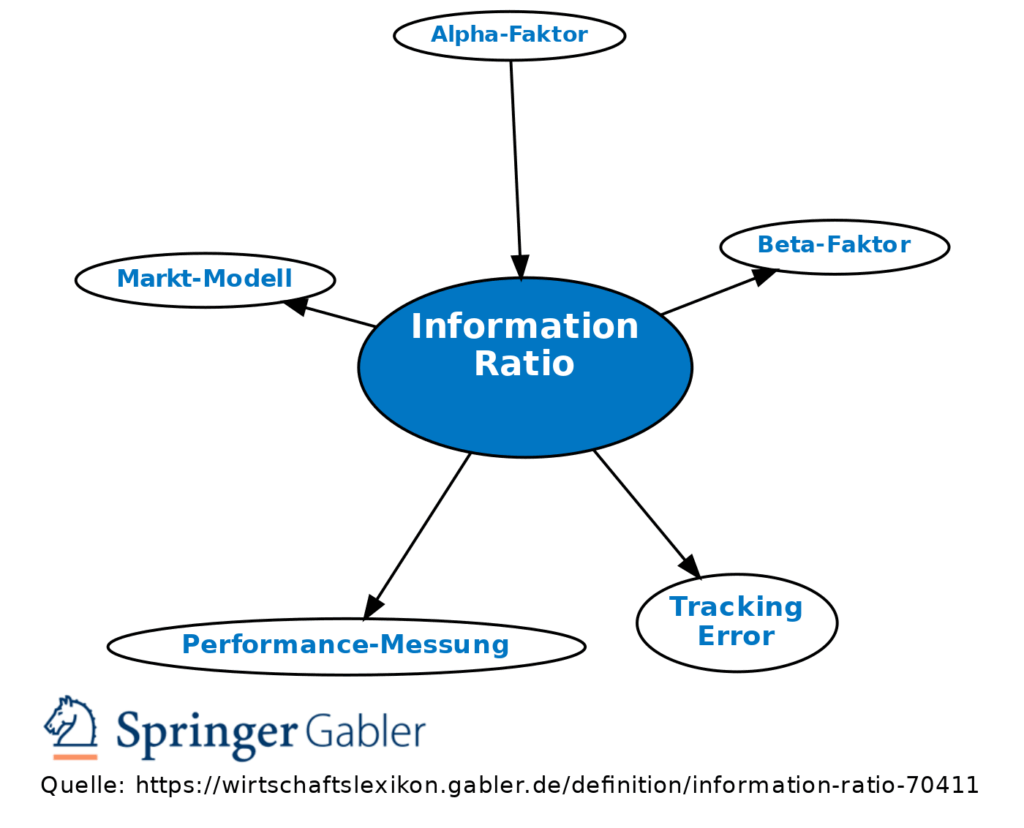

The information ratio (IR) is a measurement of portfolio returns beyond the returns of a benchmark, usually an index, compared to the volatility of those excess returns. In simpler terms, it quantifies how much “bang for your buck” an investment manager is generating relative to a benchmark. It essentially measures the consistency of the manager’s performance. A higher information ratio suggests that the manager is generating significant excess returns without taking on excessive risk.

Unlike the Sharpe ratio, which compares returns to the risk-free rate, the information ratio focuses on the excess returns relative to a benchmark, making it particularly useful for evaluating active investment strategies. The information ratio is a valuable tool for assessing the skill of an investment manager in generating returns above a specific benchmark.

How to Calculate the Information Ratio

The formula for calculating the information ratio is straightforward:

Information Ratio (IR) = (Portfolio Return – Benchmark Return) / Tracking Error

Where:

- Portfolio Return: The total return of the investment portfolio over a given period.

- Benchmark Return: The total return of the chosen benchmark index over the same period.

- Tracking Error: The standard deviation of the difference between the portfolio’s return and the benchmark’s return. It measures how consistently the portfolio deviates from the benchmark.

Let’s illustrate with an example. Suppose a portfolio returned 12% over a year, while its benchmark returned 8%. The tracking error between the portfolio and the benchmark was 4%. The information ratio would be calculated as follows:

IR = (12% – 8%) / 4% = 1

This indicates that the portfolio generated one unit of excess return for each unit of tracking error.

Interpreting the Information Ratio

The information ratio provides a clear indicator of an investment manager’s ability to generate excess returns relative to the risk taken. Here’s a general guide to interpreting the information ratio:

- High Information Ratio: An information ratio above 0.5 is generally considered good. An information ratio of 1 or higher is excellent, suggesting that the manager is consistently generating significant excess returns relative to their tracking error.

- Moderate Information Ratio: An information ratio between 0 and 0.5 indicates that the manager is generating some excess returns, but the returns may not be consistently high relative to the risk taken.

- Low or Negative Information Ratio: An information ratio of 0 or below suggests that the manager is not generating excess returns or is taking on too much risk relative to the returns generated. This may indicate poor investment decisions or an ineffective strategy.

It’s crucial to remember that the information ratio should be considered alongside other performance metrics and qualitative factors when evaluating an investment manager. [See also: Sharpe Ratio vs. Information Ratio]

Advantages of Using the Information Ratio

The information ratio offers several advantages as a performance evaluation tool:

- Benchmark-Specific: It focuses on excess returns relative to a benchmark, making it highly relevant for evaluating active management strategies.

- Risk-Adjusted: It considers the tracking error, providing a risk-adjusted measure of performance.

- Comparative Analysis: It allows for the comparison of different investment managers or strategies against the same benchmark.

- Performance Consistency: It highlights the consistency of a manager’s ability to generate excess returns.

Limitations of the Information Ratio

Despite its usefulness, the information ratio has certain limitations:

- Benchmark Dependency: The information ratio is only as good as the chosen benchmark. If the benchmark is not representative of the investment strategy, the information ratio can be misleading.

- Historical Data: It relies on historical data, which may not be indicative of future performance.

- Tracking Error Calculation: The accuracy of the information ratio depends on the accuracy of the tracking error calculation. Different methods of calculating tracking error can lead to different results.

- Manipulation Potential: Managers may be tempted to manipulate their portfolios to artificially inflate the information ratio, such as by reducing tracking error.

- Doesn’t Capture All Risks: The tracking error only captures the volatility relative to the benchmark and may not capture other types of risks, such as liquidity risk or credit risk.

The Information Ratio vs. The Sharpe Ratio

While both the information ratio and the Sharpe ratio are used to evaluate risk-adjusted returns, they differ in their focus. The Sharpe ratio measures excess returns relative to the risk-free rate, whereas the information ratio measures excess returns relative to a benchmark. The Sharpe ratio is more appropriate for evaluating absolute performance, while the information ratio is more suitable for evaluating active management relative to a specific market benchmark. [See also: Understanding Risk-Adjusted Return]

The Sharpe Ratio uses the standard deviation of returns, while the information ratio uses tracking error. The Sharpe Ratio is: (Portfolio Return – Risk-Free Rate) / Standard Deviation, while the information ratio is (Portfolio Return – Benchmark Return) / Tracking Error.

Practical Applications of the Information Ratio

The information ratio can be used in various practical applications:

- Manager Selection: Investors can use the information ratio to compare the performance of different investment managers and select those who consistently generate high excess returns relative to their benchmarks.

- Portfolio Construction: Portfolio managers can use the information ratio to optimize portfolio allocations by identifying assets or strategies that offer the highest risk-adjusted excess returns.

- Performance Monitoring: The information ratio can be used to monitor the performance of existing investments and identify any deterioration in a manager’s ability to generate excess returns.

- Strategy Evaluation: The information ratio helps in evaluating the effectiveness of different investment strategies by comparing their risk-adjusted excess returns.

Real-World Examples of Information Ratio Analysis

Consider two hedge fund managers, Manager A and Manager B, both benchmarked against the S&P 500. Over the past five years, Manager A has an average annual return of 15% with a tracking error of 6%, while Manager B has an average annual return of 12% with a tracking error of 3%.

For Manager A: IR = (15% – 10%) / 6% = 0.83 (assuming the S&P 500 returned 10%)

For Manager B: IR = (12% – 10%) / 3% = 0.67

Although Manager A has a higher return, their information ratio is also higher, indicating they are generating better risk-adjusted excess returns compared to Manager B. This demonstrates the importance of considering the information ratio alongside absolute returns.

Improving Your Information Ratio

For investment managers, improving the information ratio involves several key strategies:

- Refine Investment Strategy: Continuously evaluate and refine the investment strategy to identify and exploit market inefficiencies.

- Enhance Risk Management: Implement robust risk management practices to control tracking error and minimize unnecessary volatility.

- Improve Portfolio Construction: Optimize portfolio allocations to maximize excess returns while managing risk effectively.

- Reduce Costs: Minimize transaction costs and management fees to enhance net returns.

- Accurate Benchmarking: Ensure the benchmark accurately reflects the investment strategy to provide a meaningful comparison.

The Future of the Information Ratio

As investment strategies evolve and markets become more complex, the information ratio will continue to be a valuable tool for evaluating performance. However, it’s essential to adapt its application to reflect changing market dynamics. With the rise of alternative investments and more sophisticated benchmarking techniques, the information ratio may need to be refined to account for different risk factors and investment styles.

Conclusion

The information ratio is a powerful metric for evaluating the risk-adjusted performance of investment managers and strategies. By understanding its calculation, interpretation, advantages, and limitations, investors can make more informed decisions and select managers who consistently deliver high excess returns relative to their benchmarks. While it’s not a perfect measure, the information ratio remains an essential tool in the arsenal of any serious investor or financial professional. Remember to consider the information ratio alongside other performance metrics and qualitative factors to gain a comprehensive understanding of an investment manager’s capabilities. A high information ratio generally indicates a skilled manager adept at generating excess returns without undue risk. Understanding and utilizing the information ratio is key to navigating the complexities of the investment world and achieving superior performance.