Decoding the Stock Candlestick Hammer: A Comprehensive Guide

The stock market is a complex landscape filled with various indicators and patterns that traders use to predict future price movements. Among these, candlestick patterns hold a significant place. One such pattern, the stock candlestick hammer, is a widely recognized signal that can indicate a potential bullish reversal. This guide provides a comprehensive overview of the stock candlestick hammer, its characteristics, how to identify it, and how to use it effectively in your trading strategy.

What is a Stock Candlestick Hammer?

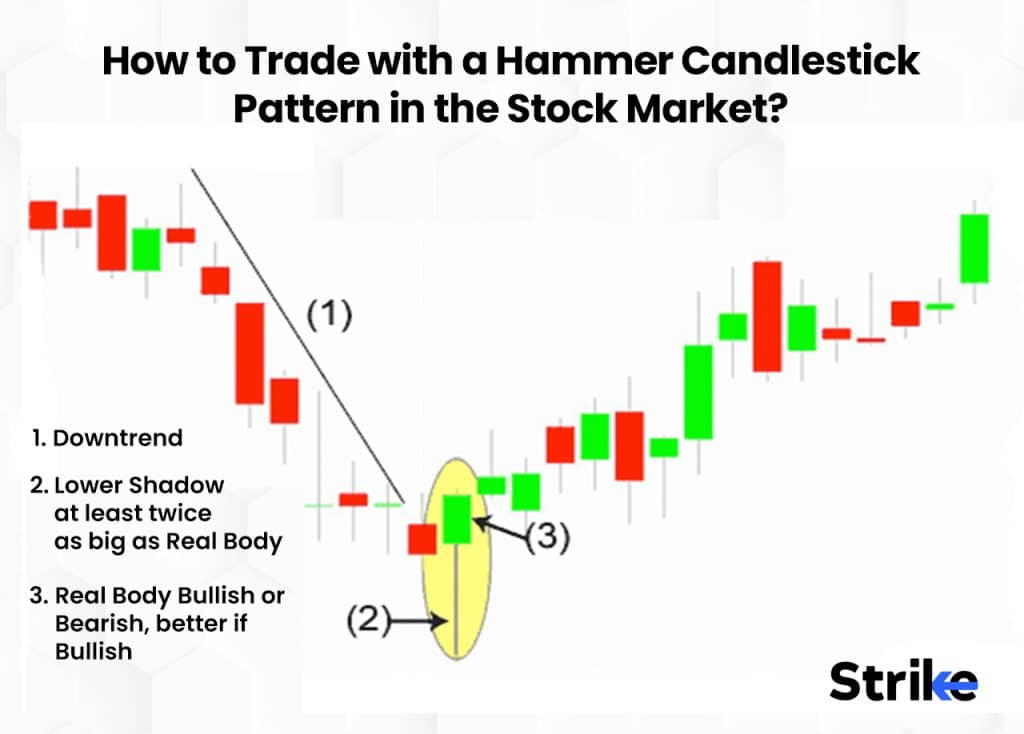

A stock candlestick hammer is a bullish reversal pattern that forms after a downtrend. It’s characterized by a small body at the upper end of the trading range and a long lower shadow, which should be at least twice the length of the body. The upper shadow, if any, should be very small or non-existent. The stock candlestick hammer suggests that although sellers initially pushed the price lower, buyers stepped in and drove the price back up, indicating a potential shift in momentum.

Key Characteristics of a Hammer Candlestick

- Downtrend Precedence: The pattern must occur after a noticeable downtrend for it to be valid.

- Small Body: The real body of the candlestick is small, representing a narrow range between the open and close prices. The color of the body (whether bullish or bearish) is less important, although a bullish (white or green) body can add confirmation.

- Long Lower Shadow: The lower shadow should be at least twice the length of the body. This indicates that the price fell significantly during the session but recovered to close near the opening price.

- Small or Non-Existent Upper Shadow: A small or non-existent upper shadow strengthens the validity of the pattern.

Identifying the Stock Candlestick Hammer Pattern

Identifying the stock candlestick hammer pattern requires careful observation of candlestick charts. Here’s a step-by-step guide:

- Look for a Downtrend: Ensure that the pattern is forming after a period of declining prices.

- Identify the Candlestick Shape: Look for a candlestick with a small body at the top of its range and a long lower shadow.

- Verify the Shadow Length: Confirm that the lower shadow is at least twice the length of the body.

- Check for a Small Upper Shadow: Ensure that the upper shadow is minimal or absent.

Consider using technical analysis software or charting platforms that can automatically identify candlestick patterns to streamline the process. However, always verify the identified patterns manually to ensure accuracy.

The Psychology Behind the Hammer

The stock candlestick hammer reflects a battle between buyers and sellers. During the trading session, sellers initially dominate, driving the price down significantly. However, buyers then enter the market, absorbing the selling pressure and pushing the price back up towards the opening price. This demonstrates a significant shift in sentiment from bearish to potentially bullish, suggesting that the downtrend may be losing steam.

The long lower shadow represents the extent of the selling pressure that was ultimately overcome by the buyers. The small body indicates that the closing price was near the opening price, further highlighting the buyers’ strength. Traders interpret this pattern as a sign that the market may be ready for a reversal.

Trading Strategies Using the Stock Candlestick Hammer

The stock candlestick hammer is not a foolproof signal, and it should be used in conjunction with other technical indicators and analysis techniques. Here are some strategies for incorporating the stock candlestick hammer into your trading plan:

Confirmation is Key

Never rely solely on the stock candlestick hammer pattern to make trading decisions. Always wait for confirmation from other indicators or price action. Confirmation can come in the form of a bullish candlestick on the following day, a break above a resistance level, or a signal from an oscillator like the Relative Strength Index (RSI).

Combining with Other Indicators

Use the stock candlestick hammer pattern in combination with other technical indicators to increase the probability of a successful trade. For example:

- Moving Averages: Look for a stock candlestick hammer that forms near a key moving average. This can act as a support level and increase the likelihood of a bounce.

- Fibonacci Retracement Levels: Identify stock candlestick hammer patterns that occur at Fibonacci retracement levels. These levels often act as areas of support or resistance.

- Volume Analysis: Check the volume during the formation of the stock candlestick hammer. Higher volume can indicate stronger buying pressure and increase the reliability of the pattern.

Setting Stop-Loss Orders

Protect your capital by setting stop-loss orders when trading based on the stock candlestick hammer pattern. A common strategy is to place the stop-loss order just below the low of the hammer candlestick. This helps to limit your potential losses if the pattern fails and the price continues to decline.

Setting Profit Targets

Determine your profit target before entering a trade based on the stock candlestick hammer pattern. Consider using technical analysis techniques, such as identifying resistance levels or projecting price targets based on the height of the pattern, to set realistic profit targets.

Examples of Stock Candlestick Hammer in Action

Let’s look at a few hypothetical examples to illustrate how the stock candlestick hammer pattern can be used in trading:

Example 1: A stock has been in a downtrend for several weeks. A stock candlestick hammer forms near a 50-day moving average. Traders wait for confirmation in the form of a bullish candlestick on the following day before entering a long position. They set a stop-loss order just below the low of the hammer and a profit target near the next resistance level.

Example 2: A stock is retracing after a strong uptrend. A stock candlestick hammer appears at the 61.8% Fibonacci retracement level. Traders see this as a potential buying opportunity and enter a long position with a stop-loss order below the low of the hammer and a profit target based on the previous high.

Limitations of the Stock Candlestick Hammer Pattern

While the stock candlestick hammer can be a valuable tool for traders, it’s essential to be aware of its limitations:

- False Signals: The pattern can sometimes generate false signals, leading to incorrect trading decisions. This is why confirmation is crucial.

- Market Context: The effectiveness of the pattern can vary depending on the overall market context. In highly volatile or uncertain markets, the pattern may be less reliable.

- Subjectivity: Identifying candlestick patterns can be subjective, and different traders may interpret the same pattern differently.

The Inverted Hammer

It’s crucial to distinguish the stock candlestick hammer from its counterpart, the inverted hammer. While both appear at the end of downtrends, their structures differ slightly. The inverted hammer features a long upper shadow and a small body at the lower end, suggesting that buyers attempted to push prices higher but were ultimately rejected. It also signals a potential bullish reversal but requires the same confirmation as the regular hammer.

Conclusion

The stock candlestick hammer is a valuable tool for traders looking to identify potential bullish reversals. By understanding its characteristics, learning how to identify it, and using it in conjunction with other technical indicators and analysis techniques, you can improve your trading accuracy and profitability. Remember to always wait for confirmation and manage your risk effectively. Happy trading! [See also: Understanding Candlestick Patterns for Stock Trading] [See also: Technical Analysis for Beginners]