Decoding the Stock Candlestick Hammer: A Comprehensive Guide

The stock market is filled with patterns and indicators that traders use to predict future price movements. Among these, the stock candlestick hammer is a significant single-candle pattern that can signal a potential bullish reversal. Understanding what a stock candlestick hammer looks like, how it forms, and how to interpret its signals is crucial for making informed trading decisions. This guide will provide a comprehensive overview of the stock candlestick hammer, its variations, confirmation signals, and strategies for incorporating it into your trading plan.

What is a Stock Candlestick Hammer?

A stock candlestick hammer is a bullish reversal pattern that forms after a downtrend. It is characterized by a small body located at the upper end of the trading range, a long lower shadow (or wick) that is at least twice the length of the body, and little to no upper shadow. The shape of the stock candlestick hammer resembles a hammer, hence the name.

The color of the body (whether it is bullish or bearish) is not as important as the shape. However, a bullish (white or green) stock candlestick hammer may provide a slightly stronger signal than a bearish (black or red) one.

Key Characteristics of a Stock Candlestick Hammer

- Small Body: The body of the candle is relatively small compared to the lower shadow.

- Long Lower Shadow: The lower shadow is at least twice the length of the body, indicating that sellers initially drove the price down, but buyers stepped in to push the price back up.

- Little or No Upper Shadow: Ideally, there should be little or no upper shadow. A small upper shadow is acceptable, but a long one can weaken the signal.

- Downtrend Precedence: The stock candlestick hammer must occur after a significant downtrend to be valid.

How the Stock Candlestick Hammer Forms

The formation of a stock candlestick hammer reflects a specific sequence of events during a trading session. Initially, sellers dominate, pushing the price significantly lower. This creates the long lower shadow, signaling strong selling pressure. However, as the session progresses, buyers enter the market and drive the price back up, close to the opening price (or even higher). This buying pressure results in the small body at the top of the candle.

The long lower shadow indicates that even though sellers were initially in control, buyers ultimately gained the upper hand, suggesting a potential shift in market sentiment. This shift is what makes the stock candlestick hammer a bullish reversal signal.

Variations of the Hammer Pattern

While the basic stock candlestick hammer pattern is straightforward, there are some variations to be aware of:

Inverted Hammer

The inverted hammer is another bullish reversal pattern that looks like an upside-down hammer. It has a small body at the lower end of the trading range and a long upper shadow. The inverted hammer suggests that buyers initially pushed the price higher, but sellers then brought it back down. Like the stock candlestick hammer, it requires confirmation from subsequent price action.

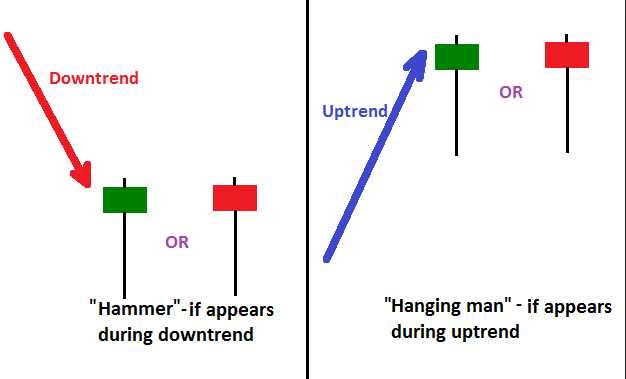

Hanging Man

The hanging man looks identical to the stock candlestick hammer but appears after an uptrend. It is a bearish reversal pattern, indicating that selling pressure is increasing and a potential downtrend may be on the horizon. Distinguishing between a stock candlestick hammer and a hanging man depends on the preceding trend.

Interpreting the Stock Candlestick Hammer Signal

The stock candlestick hammer is a visual signal that suggests a potential change in market direction. However, it is crucial to understand that the stock candlestick hammer is not a foolproof predictor of future price movements. It is best used in conjunction with other technical indicators and analysis tools.

Confirmation is Key

Confirmation is a critical aspect of trading the stock candlestick hammer pattern. Confirmation occurs when the next candle after the stock candlestick hammer closes above the high of the stock candlestick hammer. This provides further evidence that buyers are indeed in control and that the bullish reversal is likely to continue.

Without confirmation, the stock candlestick hammer may be a false signal, and the price may continue to decline. Therefore, it is generally advisable to wait for confirmation before entering a long position.

Volume Analysis

Analyzing trading volume can provide additional insights into the strength of the stock candlestick hammer signal. Ideally, the volume on the stock candlestick hammer day should be higher than the average volume. This indicates strong buying pressure that supports the potential reversal.

If the volume is low, the stock candlestick hammer signal may be weaker, and the likelihood of a successful reversal may be lower.

Strategies for Trading the Stock Candlestick Hammer

There are several strategies that traders can use to incorporate the stock candlestick hammer pattern into their trading plans:

Entry Points

The most common entry point is after the confirmation candle closes above the high of the stock candlestick hammer. This provides a higher probability of success, as it confirms the bullish reversal.

Aggressive traders may choose to enter a long position at the close of the stock candlestick hammer day, anticipating the confirmation. However, this approach carries a higher risk of a false signal.

Stop-Loss Placement

Proper stop-loss placement is essential for managing risk when trading the stock candlestick hammer pattern. A common strategy is to place the stop-loss order just below the low of the stock candlestick hammer. This limits the potential loss if the price continues to decline.

Another approach is to use a percentage-based stop-loss, which sets the stop-loss order at a fixed percentage below the entry price. This allows for some flexibility in the stop-loss placement and can help to avoid being stopped out prematurely.

Profit Targets

Determining appropriate profit targets is crucial for maximizing gains when trading the stock candlestick hammer pattern. One common strategy is to use Fibonacci retracement levels to identify potential resistance levels. These levels can serve as profit targets.

Another approach is to use a fixed risk-reward ratio. For example, if the risk is $1 per share, the profit target could be set at $2 or $3 per share, depending on the trader’s risk tolerance.

Examples of Stock Candlestick Hammer in Action

To illustrate the practical application of the stock candlestick hammer pattern, let’s consider a few hypothetical examples:

Example 1: Successful Reversal

Imagine a stock has been in a downtrend for several weeks. One day, a stock candlestick hammer forms with a small body and a long lower shadow. The next day, the price closes above the high of the stock candlestick hammer, confirming the bullish reversal. A trader enters a long position and places a stop-loss order below the low of the stock candlestick hammer. The price then rises to the predetermined profit target, resulting in a successful trade.

Example 2: False Signal

In another scenario, a stock candlestick hammer forms after a downtrend. However, the next day, the price fails to close above the high of the stock candlestick hammer. Instead, it continues to decline. A trader who entered a long position at the close of the stock candlestick hammer day would be stopped out, resulting in a small loss. This illustrates the importance of waiting for confirmation before entering a trade.

Limitations of the Stock Candlestick Hammer

While the stock candlestick hammer can be a valuable tool for identifying potential bullish reversals, it is important to be aware of its limitations:

- False Signals: The stock candlestick hammer can produce false signals, especially in volatile markets.

- Subjectivity: Identifying a stock candlestick hammer can be subjective, as different traders may interpret the same pattern differently.

- Lack of Context: The stock candlestick hammer should not be used in isolation. It is important to consider the overall market context and other technical indicators.

Combining the Stock Candlestick Hammer with Other Indicators

To improve the accuracy of the stock candlestick hammer signal, it is often beneficial to combine it with other technical indicators. Some popular indicators that can be used in conjunction with the stock candlestick hammer include:

- Moving Averages: Using moving averages can help to identify the overall trend and potential support and resistance levels.

- Relative Strength Index (RSI): The RSI can help to identify overbought and oversold conditions, which can provide additional confirmation of the stock candlestick hammer signal.

- MACD: The MACD can help to identify changes in momentum, which can also provide confirmation of the stock candlestick hammer signal.

[See also: Understanding Candlestick Patterns for Day Trading]

[See also: Advanced Technical Analysis Techniques for Stock Trading]

Conclusion

The stock candlestick hammer is a powerful tool for identifying potential bullish reversals in the stock market. By understanding its characteristics, how it forms, and how to interpret its signals, traders can make more informed trading decisions. However, it is important to remember that the stock candlestick hammer is not a foolproof predictor of future price movements and should be used in conjunction with other technical indicators and analysis tools. Always wait for confirmation and manage risk effectively to maximize the chances of success. Understanding the stock candlestick hammer can significantly enhance your trading strategy and potentially improve your investment outcomes.