Decoding the World of the ‘Boss Trader’: Strategies, Risks, and the Path to Financial Independence

The allure of financial independence, achieved through the dynamic world of trading, is a powerful draw for many. At the heart of this ambition lies the aspiration to become a ‘boss trader‘ – someone who commands their financial destiny, navigates market complexities with skill, and generates consistent profits. But what exactly does it mean to be a boss trader, and what does it take to achieve this coveted status? This article delves into the strategies, risks, and realities of becoming a successful, self-directed trader.

What Defines a ‘Boss Trader’?

The term ‘boss trader‘ evokes images of autonomy and control. It signifies an individual who has mastered the art and science of trading, making independent decisions based on their own research, analysis, and risk management strategies. Unlike traders who rely on external signals or follow the herd, a boss trader is proactive, disciplined, and accountable for their results. They don’t just react to market movements; they anticipate them.

Key Characteristics of a ‘Boss Trader’

- Discipline: Sticking to a pre-defined trading plan, regardless of emotions or market noise.

- Knowledge: A deep understanding of market dynamics, technical analysis, fundamental analysis, and macroeconomic factors.

- Risk Management: Implementing robust strategies to protect capital and limit potential losses. This includes setting stop-loss orders and managing position sizes.

- Analytical Skills: The ability to interpret market data, identify trends, and make informed trading decisions.

- Emotional Control: Remaining calm and rational under pressure, avoiding impulsive decisions driven by fear or greed.

- Continuous Learning: Staying updated on market developments, new trading strategies, and technological advancements.

- Accountability: Taking responsibility for both winning and losing trades, learning from mistakes, and constantly refining their approach.

Essential Strategies for Aspiring ‘Boss Traders’

Becoming a boss trader requires a multifaceted approach that encompasses education, practice, and continuous improvement. Here are some essential strategies to consider:

Developing a Solid Trading Plan

A well-defined trading plan is the foundation of any successful trading career. This plan should outline your trading goals, risk tolerance, capital allocation, preferred markets, trading strategies, and entry/exit rules. Without a plan, you’re essentially gambling, not trading. A boss trader always has a plan.

Mastering Technical and Fundamental Analysis

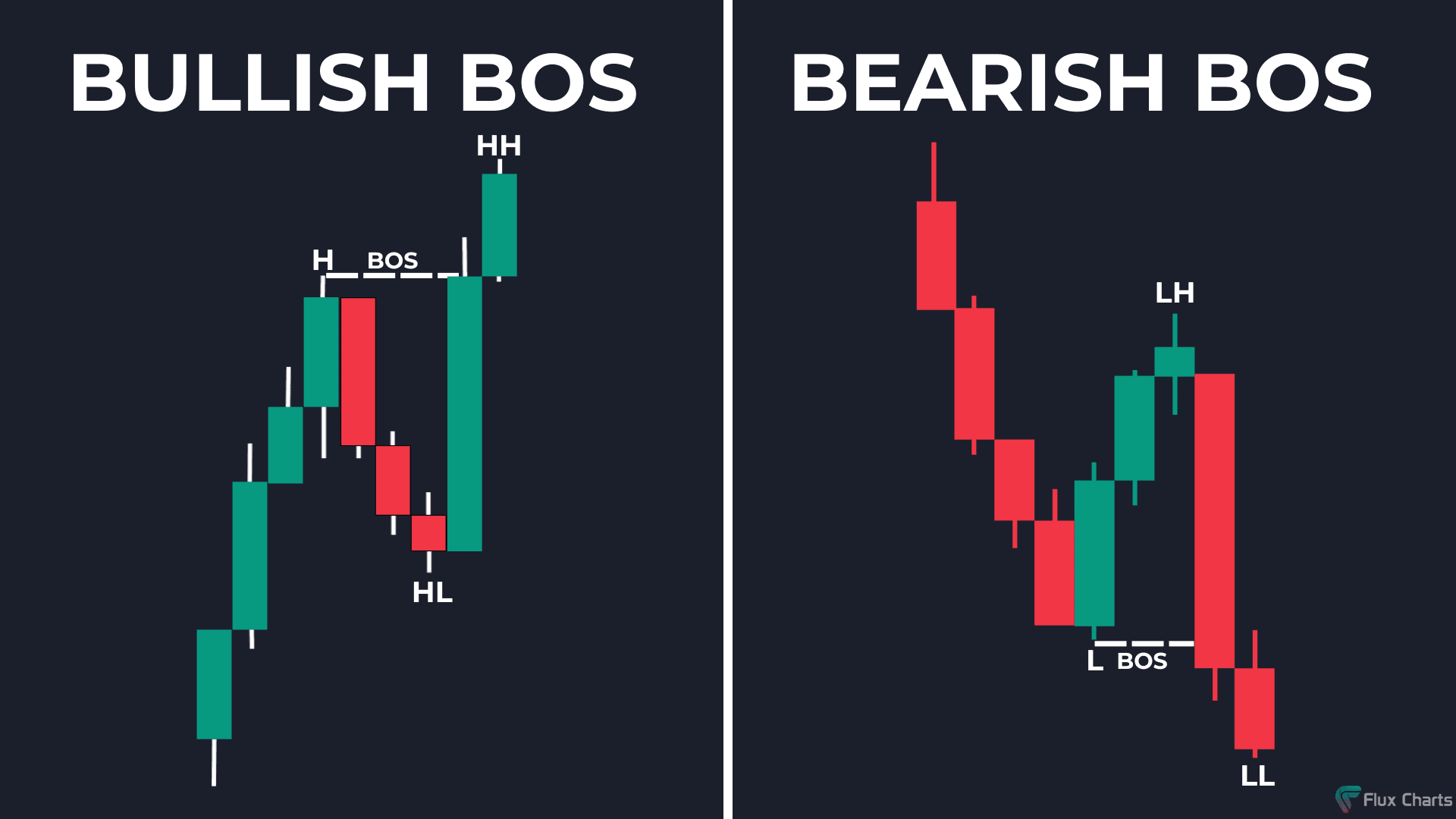

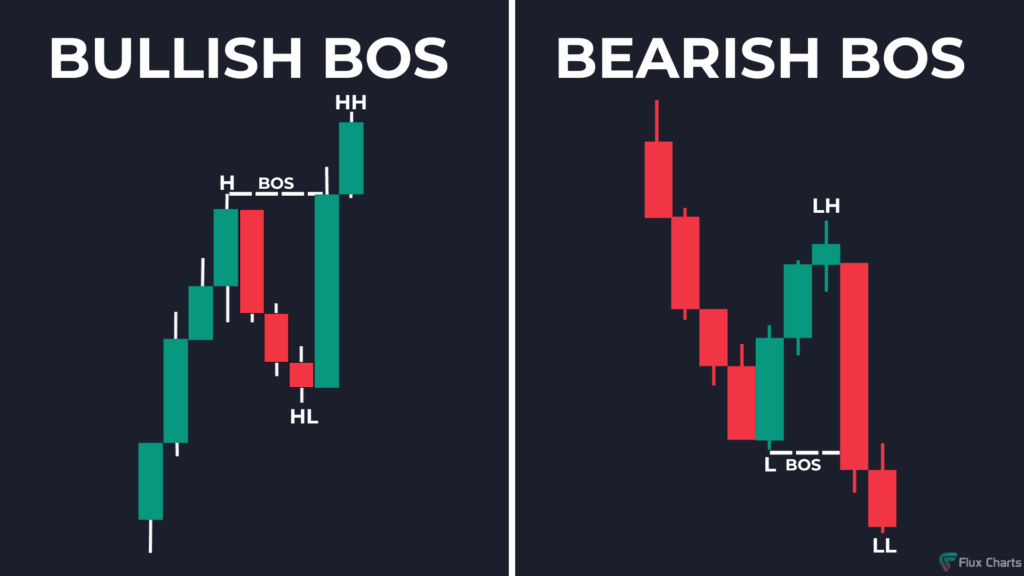

Technical analysis involves studying price charts and using indicators to identify patterns and predict future price movements. Fundamental analysis, on the other hand, focuses on evaluating the underlying value of an asset by analyzing economic data, financial statements, and industry trends. A boss trader is proficient in both and uses them in conjunction to make well-informed decisions. [See also: Day Trading Strategies for Beginners]

Implementing Robust Risk Management

Risk management is paramount to long-term success in trading. It involves setting stop-loss orders to limit potential losses, managing position sizes to control exposure, and diversifying your portfolio to reduce overall risk. A boss trader understands that preserving capital is just as important as generating profits. They never risk more than they can afford to lose on any single trade. Proper risk management is key for any successful boss trader.

Practicing with a Demo Account

Before risking real money, it’s crucial to practice your trading strategies with a demo account. This allows you to familiarize yourself with the trading platform, test your strategies, and refine your risk management techniques without any financial consequences. Think of it as a simulator for becoming a boss trader.

Staying Informed and Adaptable

The financial markets are constantly evolving, so it’s essential to stay informed about market developments, economic news, and geopolitical events. A boss trader is a continuous learner, always seeking new knowledge and adapting their strategies to changing market conditions. They subscribe to reputable financial news sources, attend webinars, and participate in trading communities.

Navigating the Risks and Challenges

The path to becoming a boss trader is not without its challenges. The financial markets are inherently volatile and unpredictable, and even the most skilled traders can experience losses. It’s crucial to be aware of the risks and challenges involved and to develop strategies to mitigate them.

Emotional Trading

One of the biggest challenges for traders is emotional trading. Fear, greed, and anxiety can cloud judgment and lead to impulsive decisions. A boss trader understands the importance of emotional control and has strategies in place to manage their emotions, such as taking breaks, meditating, or seeking support from other traders.

Overtrading

Overtrading is another common mistake that can lead to losses. This involves trading too frequently, often driven by a desire to make quick profits or to recover losses. A boss trader is patient and disciplined, waiting for high-probability trading opportunities and avoiding the temptation to overtrade. They know that quality is more important than quantity.

Lack of Discipline

Discipline is essential for success in trading. Without discipline, it’s easy to deviate from your trading plan, make impulsive decisions, and take unnecessary risks. A boss trader is disciplined and adheres to their trading plan, even when faced with temptation or pressure. They treat trading like a business, not a hobby.

Information Overload

In today’s information age, it’s easy to get overwhelmed by the sheer volume of market data and news. A boss trader is able to filter out the noise and focus on the information that is most relevant to their trading strategies. They develop a system for processing information efficiently and avoid getting bogged down in irrelevant details.

The Path to Financial Independence

Becoming a boss trader is not just about generating profits; it’s about achieving financial independence and taking control of your financial destiny. It’s about having the freedom to work from anywhere in the world, set your own hours, and pursue your passions. However, it’s important to remember that financial independence is a journey, not a destination. It requires dedication, hard work, and a commitment to continuous learning.

Setting Realistic Goals

It’s important to set realistic goals for your trading career. Don’t expect to become a millionaire overnight. Start small, focus on mastering the basics, and gradually increase your trading size as you gain experience and confidence. A boss trader sets achievable goals and celebrates their progress along the way. They understand that success is a marathon, not a sprint.

Building a Community

Trading can be a lonely endeavor, so it’s important to build a community of like-minded individuals. Connect with other traders online or in person, share ideas, and support each other. A boss trader understands the value of collaboration and networking. They learn from others, share their knowledge, and contribute to the trading community. [See also: Online Trading Communities: A Guide for Beginners]

Staying Persistent

The path to becoming a boss trader is not always easy. There will be setbacks and challenges along the way. It’s important to stay persistent, learn from your mistakes, and never give up on your goals. A boss trader is resilient and determined. They view setbacks as learning opportunities and use them to become a better trader. They embody the spirit of never giving up.

Conclusion: Embracing the ‘Boss Trader’ Mindset

The journey to becoming a ‘boss trader‘ is a challenging but rewarding one. It requires a combination of knowledge, skill, discipline, and emotional control. By developing a solid trading plan, mastering technical and fundamental analysis, implementing robust risk management, and staying persistent, you can increase your chances of success and achieve your financial goals. Embrace the ‘boss trader‘ mindset, take control of your financial destiny, and embark on the path to financial independence. Remember, the market rewards those who are prepared, disciplined, and resilient. The ultimate goal is to become a self-sufficient and consistently profitable boss trader.