Deflation Explained: Understanding Its Causes, Effects, and Risks

Deflation, the opposite of inflation, represents a sustained decrease in the general price level of goods and services in an economy. While seemingly beneficial at first glance – who wouldn’t want things to get cheaper? – prolonged periods of deflation can signal deeper economic problems and potentially trigger a downward spiral. This article aims to explain deflation in detail, exploring its causes, effects, associated risks, and potential policy responses. Understanding deflation is crucial for businesses, policymakers, and individuals alike, as its impact can be far-reaching and significantly affect economic stability.

What is Deflation? A Closer Look

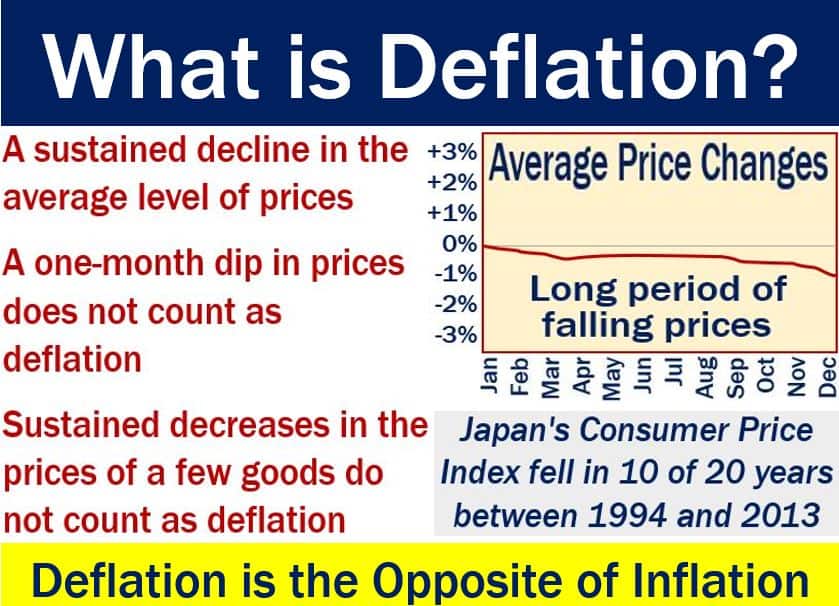

Deflation occurs when the inflation rate falls below 0%, indicating that the prices of goods and services are decreasing over time. This is different from disinflation, which is a slowdown in the rate of inflation. Deflation is not just a short-term dip in prices; it’s a persistent and widespread decline. It is typically measured using the Consumer Price Index (CPI) or the GDP deflator. A sustained period of deflation can be particularly damaging to an economy. [See also: Understanding Inflation and Its Impact]

Causes of Deflation

Several factors can contribute to deflation. Understanding these causes is essential for anticipating and mitigating its potential negative consequences.

Decreased Aggregate Demand

A significant drop in overall demand for goods and services is a primary driver of deflation. This can stem from various sources, including:

- Recession: During economic downturns, consumers and businesses reduce spending due to job losses, decreased income, and uncertainty about the future.

- Increased Savings: If people become more risk-averse and choose to save more rather than spend, demand will fall.

- Government Austerity: Government spending cuts can reduce aggregate demand, especially if they are implemented rapidly.

Increased Aggregate Supply

A surge in the supply of goods and services without a corresponding increase in demand can also lead to deflation. This can be caused by:

- Technological Advancements: New technologies can increase production efficiency, leading to a greater supply of goods and services.

- Increased Competition: Intense competition between businesses can force them to lower prices to attract customers.

- Globalization: Access to cheaper labor and resources in other countries can lower production costs and increase supply.

Monetary Factors

Monetary policy plays a crucial role in managing inflation and deflation. Factors related to the money supply can contribute to deflation:

- Contractionary Monetary Policy: If a central bank tightens monetary policy by raising interest rates or reducing the money supply, it can curb spending and investment, leading to deflation.

- Debt Deflation: A decrease in the money supply can increase the real value of debt, making it more difficult for borrowers to repay their loans and leading to reduced spending.

The Effects of Deflation

While lower prices might seem appealing, deflation can have several adverse effects on the economy:

Decreased Spending and Investment

When prices are falling, consumers and businesses may postpone purchases, anticipating further price declines. This can lead to a decrease in aggregate demand, further exacerbating deflation.

Increased Real Debt Burden

Deflation increases the real value of debt, making it more difficult for borrowers to repay their loans. This can lead to defaults and financial instability. A significant debt burden can stifle economic growth and contribute to further deflation.

Wage Cuts and Unemployment

Businesses facing declining revenues may be forced to cut wages or lay off employees. This can lead to a decrease in consumer spending and a further decline in aggregate demand.

Reduced Corporate Profits

Falling prices can squeeze corporate profits, leading to reduced investment and innovation. This can hinder long-term economic growth.

Deflationary Spiral

The most concerning consequence of deflation is the risk of a deflationary spiral. This occurs when falling prices lead to decreased spending, which further reduces prices, creating a vicious cycle of economic decline. This spiral can be difficult to break and can lead to prolonged periods of economic stagnation.

Examples of Deflationary Periods

Several historical periods have experienced significant deflation. Understanding these episodes can provide valuable insights into the causes and consequences of deflation.

The Great Depression (1930s)

The Great Depression was a period of severe economic contraction characterized by widespread deflation. Falling prices, coupled with high unemployment and bank failures, led to a significant decline in economic activity. The combination of decreased demand and a contraction of the money supply created a powerful deflationary force. [See also: Economic Indicators and Their Significance]

Japan in the 1990s and 2000s

Japan experienced a prolonged period of deflation in the 1990s and 2000s, often referred to as the “Lost Decade.” This period was characterized by stagnant economic growth, falling prices, and high levels of debt. Despite various policy interventions, Japan struggled to escape the deflationary trap.

Policy Responses to Deflation

Policymakers have several tools at their disposal to combat deflation. The effectiveness of these policies can vary depending on the specific circumstances of the economy.

Monetary Policy

Central banks can use monetary policy to stimulate demand and combat deflation:

- Lowering Interest Rates: Reducing interest rates can encourage borrowing and investment, increasing aggregate demand.

- Quantitative Easing (QE): QE involves a central bank purchasing assets to increase the money supply and lower long-term interest rates.

- Negative Interest Rates: In some cases, central banks have experimented with negative interest rates to encourage banks to lend more money.

Fiscal Policy

Governments can use fiscal policy to increase aggregate demand:

- Increased Government Spending: Government spending on infrastructure projects or other initiatives can boost demand and create jobs.

- Tax Cuts: Tax cuts can increase disposable income, encouraging consumers to spend more.

Structural Reforms

Structural reforms can address underlying economic problems that contribute to deflation:

- Deregulation: Reducing regulations can promote competition and innovation, leading to increased productivity and economic growth.

- Labor Market Reforms: Reforms to improve labor market flexibility can help reduce unemployment and increase wages.

The Debate Surrounding Deflation

While the potential negative consequences of deflation are widely recognized, some economists argue that mild deflation can be beneficial in certain circumstances. They contend that it can increase purchasing power and encourage efficiency. However, the consensus among economists is that prolonged periods of deflation pose a significant risk to economic stability.

Conclusion

Deflation, characterized by a sustained decrease in the general price level, can have detrimental effects on an economy. Its causes range from decreased aggregate demand and increased supply to contractionary monetary policies. The consequences include decreased spending, increased real debt burden, wage cuts, and the risk of a deflationary spiral. While policymakers have tools to combat deflation, such as monetary and fiscal policies, effective management requires a comprehensive understanding of the underlying economic conditions. Recognizing the potential risks and implementing appropriate policy responses are crucial for maintaining economic stability and preventing the damaging effects of prolonged deflation.