Deflation of Economy: Understanding Its Causes, Consequences, and Potential Cures

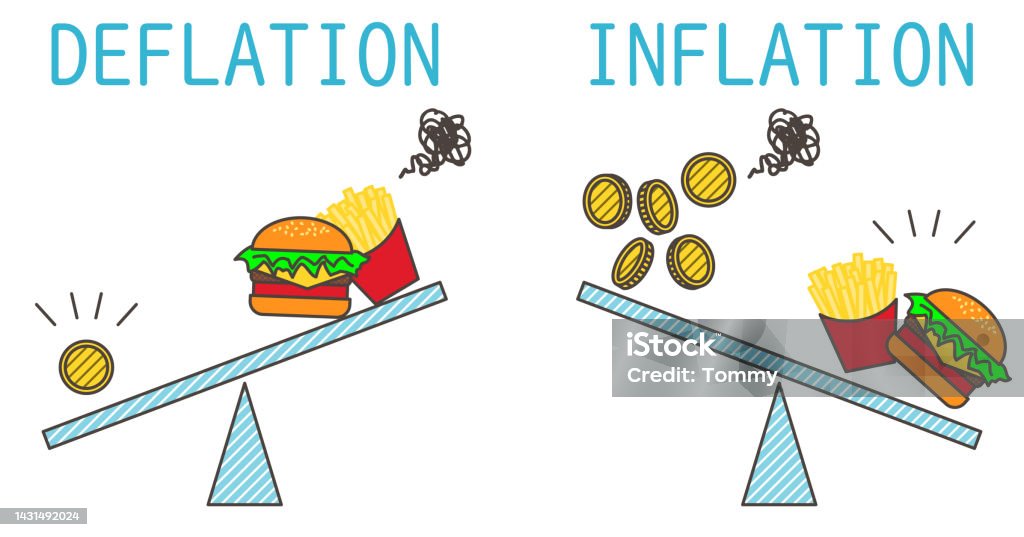

The deflation of economy, a sustained decrease in the general price level of goods and services, is a phenomenon that can have profound and often detrimental effects on an economy. Unlike inflation, which erodes purchasing power over time, deflation increases the real value of money, allowing consumers to buy more with the same amount of currency. While this might seem beneficial on the surface, the deflation of economy is generally viewed as a negative indicator, often associated with periods of economic stagnation and recession. This article delves into the causes, consequences, and potential cures for deflation of economy, offering a comprehensive understanding of this complex economic challenge.

What is Deflation?

Deflation is defined as the opposite of inflation. It occurs when the inflation rate falls below 0%, meaning that the purchasing power of money increases, and consumers can buy more goods and services with the same amount of money. This sounds appealing, but sustained deflation can signal deeper economic problems.

Causes of Deflation

Several factors can contribute to the deflation of economy. Understanding these causes is crucial for policymakers to implement effective countermeasures:

Decreased Aggregate Demand

A significant drop in aggregate demand, the total demand for goods and services in an economy, is a primary driver of deflation. This can stem from various sources, including:

- Recession: During economic downturns, businesses often reduce production, leading to job losses and lower consumer spending.

- Increased Savings: If consumers become pessimistic about the future, they may increase their savings and reduce spending, further dampening demand.

- Reduced Government Spending: Austerity measures and cuts in government spending can also contribute to a decrease in aggregate demand.

Increased Aggregate Supply

Conversely, a significant increase in aggregate supply without a corresponding increase in demand can also lead to deflation. This can occur due to:

- Technological Advancements: Technological breakthroughs can increase productivity and lower production costs, leading to an oversupply of goods and services.

- Increased Competition: Globalization and increased competition from foreign producers can drive down prices.

- Falling Input Costs: A decrease in the cost of raw materials or energy can also lead to lower prices.

Monetary Factors

Monetary policy also plays a crucial role. A contraction of the money supply or an increase in the real interest rate (nominal interest rate adjusted for inflation) can contribute to deflation of economy.

Consequences of Deflation

While lower prices might seem appealing, the deflation of economy can have severe consequences:

Debt Burden

Deflation increases the real value of debt. Borrowers must repay their debts with money that is worth more than when they borrowed it, making it more difficult to service their debts. This can lead to defaults, bankruptcies, and financial instability. This is especially problematic for governments with large national debts.

Decreased Investment

Businesses may postpone investments if they expect prices to fall further in the future. This decrease in investment can lead to lower economic growth and job creation.

Reduced Consumer Spending

Consumers may delay purchases in anticipation of lower prices, leading to a further decrease in demand and exacerbating the deflationary spiral. This “wait-and-see” attitude can paralyze economic activity.

Wage Stagnation

Deflation can put downward pressure on wages. Employers may resist wage increases or even cut wages to maintain profitability, leading to lower incomes and reduced consumer spending.

Increased Real Interest Rates

Even if nominal interest rates are low, the real interest rate (nominal interest rate minus inflation rate) can be high during a period of deflation, discouraging borrowing and investment.

Examples of Deflation

Historically, there have been several instances of prolonged deflation of economy:

The Great Depression (1930s)

The Great Depression was characterized by severe deflation, high unemployment, and widespread economic hardship. A sharp contraction in the money supply and a collapse in aggregate demand contributed to the downward spiral.

Japan in the 1990s and 2000s

Japan experienced a prolonged period of deflation following the collapse of its asset bubble in the early 1990s. This period, often referred to as the “Lost Decade,” saw stagnant economic growth and persistent price declines. [See also: Japan’s Economic Recovery]

Cures for Deflation

Addressing deflation of economy requires a multi-pronged approach involving both monetary and fiscal policy measures:

Monetary Policy

- Lowering Interest Rates: Central banks can lower interest rates to encourage borrowing and spending. However, this may be ineffective if interest rates are already near zero (the “zero lower bound”).

- Quantitative Easing (QE): QE involves a central bank injecting liquidity into the economy by purchasing assets, such as government bonds, to lower long-term interest rates and stimulate lending.

- Negative Interest Rates: Some central banks have experimented with negative interest rates on commercial banks’ reserves held at the central bank to encourage lending.

Fiscal Policy

- Increased Government Spending: Government spending on infrastructure projects, education, and other public goods can boost aggregate demand and create jobs.

- Tax Cuts: Tax cuts can increase disposable income and encourage consumer spending.

- Direct Cash Transfers: Direct payments to individuals can provide immediate relief and stimulate demand.

Other Measures

- Wage and Price Controls: While controversial, some economists advocate for temporary wage and price controls to break the deflationary spiral.

- Devaluation of Currency: A weaker currency can make exports more competitive and increase domestic demand.

The Importance of Expectations

Managing expectations is crucial in combating deflation. If consumers and businesses expect prices to continue falling, they may delay spending and investment, exacerbating the problem. Central banks need to communicate their commitment to price stability and implement policies that convince the public that deflation will not persist. Credible and transparent communication is key to influencing expectations and restoring confidence in the economy.

Conclusion

The deflation of economy is a serious economic challenge that can have far-reaching consequences. Understanding its causes, consequences, and potential cures is essential for policymakers to implement effective measures to restore price stability and promote sustainable economic growth. While lower prices may seem appealing in the short term, the long-term effects of sustained deflation can be devastating. A proactive and comprehensive approach involving both monetary and fiscal policy is necessary to address this complex issue and prevent a deflationary spiral. Ignoring the risks of deflation can lead to prolonged economic stagnation and hardship. Successfully navigating the challenges of deflation requires a deep understanding of economic principles and a commitment to implementing bold and innovative solutions. The key to preventing and combating deflation lies in proactive policy measures, effective communication, and a commitment to maintaining price stability. The complexities surrounding deflation of economy require continuous monitoring and adaptation of strategies to ensure long-term economic health. By understanding and addressing the factors contributing to deflation, policymakers can create a more stable and prosperous economic future. Preventing deflation is always preferable to curing it, and early intervention is crucial. The economic consequences of deflation can be severe and long-lasting, necessitating careful attention and decisive action. Ultimately, a healthy economy requires stable prices and a balanced approach to managing both inflation and deflation.