Deflation of Economy: Understanding the Causes, Consequences, and Potential Solutions

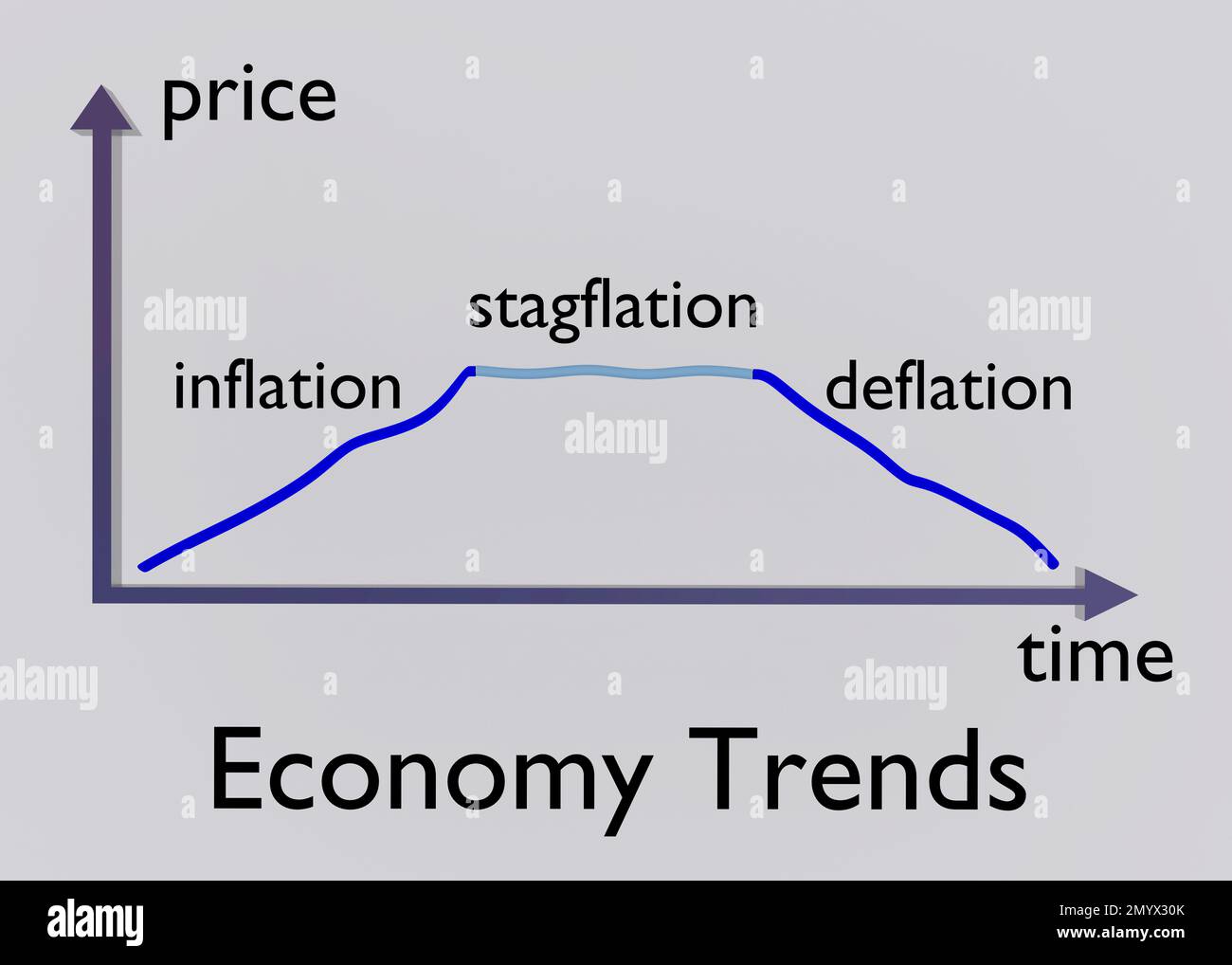

Deflation of economy, the opposite of inflation, is a sustained decrease in the general price level of goods and services in an economy. While on the surface, lower prices might seem beneficial, persistent deflation of economy can signal deeper economic problems. This article aims to provide a comprehensive understanding of the causes, consequences, and potential solutions associated with deflation of economy.

What is Deflation?

Deflation of economy occurs when the inflation rate falls below 0%, indicating that the purchasing power of money is increasing over time. In simpler terms, you can buy more goods and services with the same amount of money. This might sound appealing, but the reality is often more complex.

Unlike disinflation, which is a slowing down in the rate of inflation, deflation of economy represents an actual decline in prices. Understanding this distinction is crucial for comprehending the potential economic impact.

Causes of Deflation

Several factors can trigger deflation of economy. These causes often interact and reinforce each other, making the situation even more challenging to manage.

Decreased Aggregate Demand

A significant drop in aggregate demand, the total demand for goods and services in an economy, is a primary driver of deflation of economy. This can be caused by various factors, including:

- Recessions: Economic downturns often lead to reduced consumer spending and business investment.

- High Unemployment: Job losses reduce disposable income, leading to lower demand.

- Decreased Consumer Confidence: Uncertainty about the future can make people hesitant to spend.

Increased Aggregate Supply

Conversely, a surge in aggregate supply, without a corresponding increase in demand, can also lead to deflation of economy. This can happen due to:

- Technological Advancements: Improved productivity can increase the supply of goods and services.

- Lower Production Costs: Reduced input costs, such as raw materials or energy, can lower prices.

- Increased Competition: More companies entering the market can drive down prices.

Debt and Credit Contraction

A decrease in the availability of credit or a deleveraging process (reducing debt) can also contribute to deflation of economy. When people and businesses are burdened by debt, they tend to save more and spend less, further dampening demand. [See also: Understanding Debt Cycles]

Monetary Policy

Inadequate monetary policy can exacerbate deflation of economy. If the central bank fails to inject enough liquidity into the economy or raise interest rates appropriately, it can worsen the deflationary spiral.

Consequences of Deflation

While lower prices might seem beneficial at first glance, persistent deflation of economy can have severe consequences for the economy.

Delayed Spending

One of the most significant dangers of deflation of economy is that it encourages consumers and businesses to delay spending. If prices are expected to fall further, people will postpone purchases, hoping to buy goods and services at a lower price in the future. This reduced spending further weakens demand, creating a vicious cycle.

Increased Real Debt Burden

Deflation of economy increases the real value of debt. While nominal debt remains the same, the value of money increases, making it more difficult for borrowers to repay their loans. This can lead to defaults and bankruptcies, further destabilizing the financial system.

Decreased Corporate Profits

Falling prices can squeeze corporate profits, as businesses struggle to maintain margins. This can lead to reduced investment, hiring freezes, and even layoffs, further contributing to economic stagnation.

Higher Real Interest Rates

Even if nominal interest rates are low or even zero, deflation of economy can lead to high real interest rates (nominal interest rates minus the inflation rate). This makes borrowing more expensive, discouraging investment and further suppressing demand.

Wage Cuts

In a deflationary environment, companies may try to reduce costs by cutting wages. However, wage cuts can further depress demand, as workers have less disposable income to spend.

Examples of Deflationary Periods

Several historical examples illustrate the potential dangers of deflation of economy.

The Great Depression (1930s)

The Great Depression was characterized by severe deflation of economy, which exacerbated the economic downturn. Falling prices led to decreased spending, increased debt burdens, and widespread bankruptcies.

Japan in the 1990s

Japan experienced a prolonged period of deflation of economy in the 1990s, often referred to as the “Lost Decade.” This deflationary period was caused by a combination of factors, including a burst asset bubble and a decline in aggregate demand. [See also: Analysis of Japanese Economic History]

Potential Solutions to Deflation

Addressing deflation of economy requires a multi-pronged approach, involving both monetary and fiscal policies.

Monetary Policy

Central banks can use various tools to combat deflation of economy:

- Lowering Interest Rates: Reducing interest rates can encourage borrowing and spending.

- Quantitative Easing (QE): QE involves the central bank purchasing assets to inject liquidity into the financial system.

- Forward Guidance: Communicating the central bank’s intentions can help manage expectations and influence economic behavior.

Fiscal Policy

Governments can also use fiscal policy to stimulate demand and combat deflation of economy:

- Increased Government Spending: Investing in infrastructure projects or providing direct payments to individuals can boost demand.

- Tax Cuts: Reducing taxes can increase disposable income and encourage spending.

Structural Reforms

In addition to monetary and fiscal policies, structural reforms can also help address the underlying causes of deflation of economy. These reforms can include:

- Deregulation: Reducing regulations can encourage investment and innovation.

- Labor Market Reforms: Making labor markets more flexible can improve employment rates.

- Debt Restructuring: Helping borrowers manage their debt burdens can reduce the risk of defaults.

Conclusion

Deflation of economy, while seemingly beneficial due to lower prices, poses significant risks to economic stability. Understanding the causes and consequences of deflation of economy is crucial for policymakers and individuals alike. By implementing appropriate monetary and fiscal policies, along with structural reforms, it is possible to mitigate the negative effects of deflation of economy and promote sustainable economic growth. The key is proactive intervention and a comprehensive understanding of the complex dynamics at play when dealing with deflation of economy.