Economic Deflation Definition: Understanding the Causes and Consequences

Economic deflation, a phenomenon characterized by a sustained decrease in the general price level of goods and services, presents a complex challenge for economies worldwide. Unlike inflation, where prices rise, deflation sees prices falling, which might seem beneficial at first glance. However, persistent deflation can lead to a cascade of negative economic effects. This article delves into the economic deflation definition, exploring its causes, consequences, and potential remedies.

What is Economic Deflation?

The economic deflation definition can be simply stated as a persistent decline in the general price level of goods and services in an economy. It’s the opposite of inflation. When deflation occurs, the purchasing power of money increases – meaning you can buy more goods and services with the same amount of money. While this sounds advantageous, prolonged deflation can be detrimental to economic health. Understanding the economic deflation definition is crucial for policymakers and individuals alike to navigate the complexities of economic cycles.

Causes of Economic Deflation

Several factors can trigger economic deflation. Here are some of the most common:

- Decreased Aggregate Demand: A significant drop in overall demand for goods and services can lead to deflation. This can be caused by factors like recession, increased savings rates, or decreased consumer confidence.

- Increased Productivity: If productivity increases significantly without a corresponding increase in demand, companies may lower prices to sell their products. This is a less harmful form of deflation, sometimes called “benign deflation.”

- Contraction of the Money Supply: A decrease in the amount of money circulating in the economy can also lead to deflation. This can happen when central banks tighten monetary policy or when banks become more reluctant to lend.

- Debt: High levels of debt can contribute to deflation. When people are heavily indebted, they may cut back on spending to repay their debts, leading to decreased demand and falling prices.

- Globalization: Increased competition from foreign producers can drive down prices, contributing to deflationary pressures.

Consequences of Economic Deflation

While lower prices might seem appealing, economic deflation can have serious negative consequences:

- Delayed Consumption: Consumers may postpone purchases if they expect prices to fall further, leading to decreased demand and economic stagnation. This is known as the “deflationary spiral.”

- Increased Debt Burden: Deflation increases the real value of debt, making it more difficult for borrowers to repay their loans. This can lead to defaults and financial instability.

- Reduced Investment: Businesses may delay investments if they expect prices to fall, as this reduces their profit margins.

- Wage Cuts: Companies facing falling prices may reduce wages to maintain profitability, leading to lower incomes and decreased consumer spending.

- Increased Real Interest Rates: Even if nominal interest rates are low, deflation increases the real interest rate (nominal interest rate minus inflation rate), making borrowing more expensive and discouraging investment.

- Bankruptcies: Falling prices can make it difficult for businesses to generate enough revenue to cover their costs, leading to bankruptcies and job losses.

Examples of Economic Deflation

Throughout history, several countries have experienced periods of economic deflation. One notable example is the Great Depression of the 1930s. During this period, the United States experienced severe deflation, with prices falling by approximately 25% between 1929 and 1933. This deflation exacerbated the economic downturn, leading to widespread unemployment and bank failures. [See also: The Great Depression: Causes and Consequences]

Another example is Japan in the late 1990s and early 2000s. After the collapse of its asset bubble in the early 1990s, Japan experienced a prolonged period of deflation known as the “Lost Decade.” This deflation contributed to economic stagnation and hindered Japan’s recovery.

How to Combat Economic Deflation

Combating economic deflation requires a multi-pronged approach. Central banks and governments can use various tools to stimulate demand and increase prices:

- Monetary Policy: Central banks can lower interest rates to encourage borrowing and spending. They can also use quantitative easing (QE) to increase the money supply.

- Fiscal Policy: Governments can increase spending or cut taxes to stimulate demand. Infrastructure projects, tax rebates, and unemployment benefits can all help to boost the economy.

- Direct Intervention: In some cases, governments may intervene directly in the market to support prices. This could involve buying up excess supply or providing subsidies to businesses.

- Inflation Targeting: Central banks can adopt an inflation target to guide monetary policy. By committing to maintaining a certain level of inflation, they can help to anchor expectations and prevent deflation from taking hold.

- Structural Reforms: Implementing structural reforms to improve productivity and competitiveness can also help to combat deflation. This could involve deregulation, investment in education and training, and measures to promote innovation.

The Role of Central Banks in Managing Deflation

Central banks play a crucial role in managing economic deflation. They are responsible for setting monetary policy and can use various tools to influence the money supply and interest rates. During periods of deflation, central banks typically lower interest rates to encourage borrowing and spending. However, when interest rates are already near zero, this tool becomes less effective. In such cases, central banks may resort to unconventional measures such as quantitative easing.

Quantitative easing involves the central bank purchasing assets, such as government bonds, to increase the money supply and lower long-term interest rates. This can help to stimulate demand and prevent deflation from taking hold. However, QE can also have unintended consequences, such as asset bubbles and inflation. [See also: Understanding Quantitative Easing]

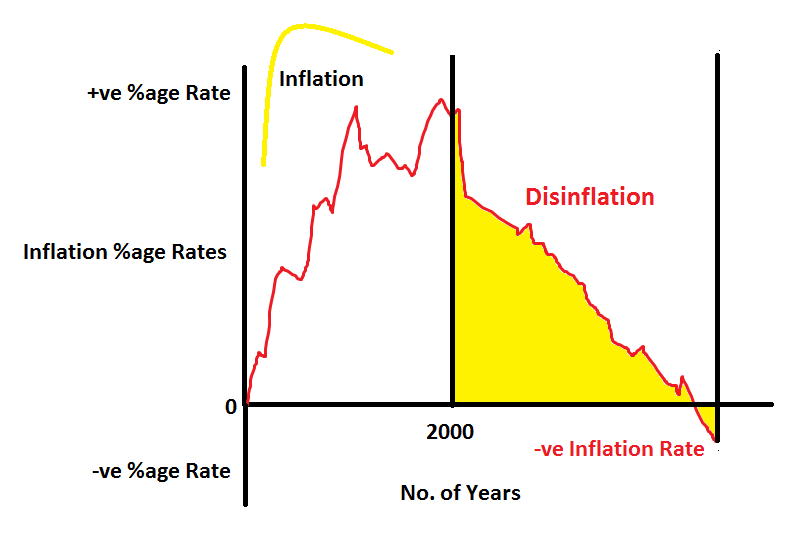

Deflation vs. Disinflation

It’s important to distinguish between economic deflation and disinflation. Deflation is a sustained decrease in the general price level, while disinflation is a slowdown in the rate of inflation. In other words, disinflation occurs when prices are still rising, but at a slower pace. While disinflation can be a precursor to deflation, it is not necessarily a cause for concern. In fact, disinflation can be a sign that monetary policy is working to control inflation.

Is Deflation Always Bad?

While economic deflation is generally considered to be harmful, there are some circumstances in which it can be beneficial. For example, if deflation is caused by increased productivity, it can lead to lower prices without necessarily causing economic hardship. This is sometimes referred to as “benign deflation.” However, even in these cases, deflation can still pose challenges, such as increasing the real value of debt.

The Future of Economic Deflation

The risk of economic deflation remains a concern for many countries around the world. Factors such as aging populations, high levels of debt, and increased global competition could all contribute to deflationary pressures. However, central banks and governments have learned from past experiences and are better equipped to combat deflation than they were in the past. By using a combination of monetary and fiscal policies, they can help to stimulate demand and prevent deflation from taking hold.

Conclusion

Economic deflation, defined as a sustained decrease in the general price level, can have significant negative consequences for economies. While lower prices might seem appealing, deflation can lead to delayed consumption, increased debt burdens, reduced investment, and wage cuts. Understanding the causes and consequences of deflation is crucial for policymakers and individuals alike. By implementing appropriate monetary and fiscal policies, central banks and governments can help to prevent deflation from taking hold and promote sustainable economic growth. The economic deflation definition is more than just a textbook term; it’s a real-world phenomenon with tangible effects.