Grid Trading: A Comprehensive Guide to Automated Trading Strategies

In the dynamic world of financial markets, traders are constantly seeking innovative strategies to capitalize on price fluctuations. Among these, grid trading stands out as a systematic and automated approach designed to profit from both sideways and trending markets. This article delves into the intricacies of grid trading, exploring its mechanics, advantages, disadvantages, and practical applications for modern traders. We’ll examine how this strategy works, the tools and platforms used, and the risk management techniques essential for success. Whether you’re a seasoned trader or just starting, understanding grid trading can offer valuable insights into optimizing your trading performance.

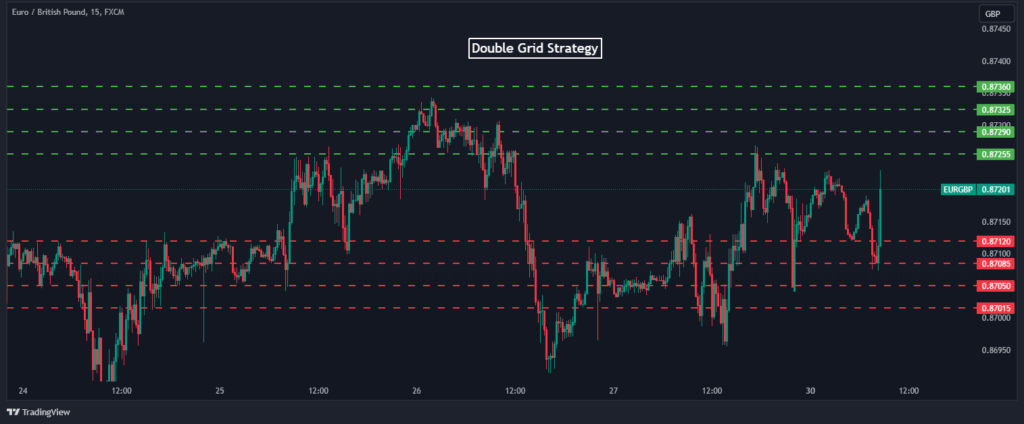

Understanding Grid Trading

Grid trading is a trading strategy that involves placing a series of buy and sell orders at predetermined intervals above and below a current price. These orders create a “grid” of potential entry and exit points. The core idea behind grid trading is to capture small profits from frequent price movements within a defined range. Unlike directional strategies that rely on predicting market direction, grid trading aims to profit from volatility and price oscillations. This makes it particularly suitable for markets that are range-bound or experiencing choppy conditions.

The strategy is based on the assumption that prices will fluctuate within a specific range. By setting up a grid of orders, traders can automatically execute trades as prices move up and down. When the price moves up and triggers a sell order, the trader profits from that transaction. Conversely, when the price moves down and triggers a buy order, the trader profits from that transaction. The key is to set the grid intervals and trade sizes appropriately to manage risk and maximize potential gains.

How Grid Trading Works

The mechanics of grid trading can be broken down into several key steps:

- Define the Price Range: The first step is to identify the potential high and low points within which the price is expected to fluctuate. This range forms the boundaries of the grid.

- Set Grid Intervals: Determine the spacing between each buy and sell order within the grid. This interval should be based on factors such as market volatility, average price movements, and risk tolerance.

- Place Buy and Sell Orders: Place a series of buy orders below the current price and sell orders above the current price, according to the defined grid intervals.

- Automate Execution: Use a trading platform or bot to automatically execute the orders as prices reach the predefined levels. This automation is crucial for efficiently managing the grid and capturing profits.

- Manage Risk: Implement risk management techniques, such as stop-loss orders and position sizing, to protect against adverse price movements.

For example, consider a scenario where a trader believes that a currency pair will trade between 1.1000 and 1.1100. They might set up a grid with buy orders every 10 pips below the current price (e.g., 1.0990, 1.0980, 1.0970) and sell orders every 10 pips above the current price (e.g., 1.1010, 1.1020, 1.1030). As the price oscillates within this range, the grid automatically executes trades, generating profits from each transaction.

Advantages of Grid Trading

Grid trading offers several advantages that make it an attractive strategy for certain traders:

- Profits in Sideways Markets: One of the primary benefits of grid trading is its ability to generate profits in range-bound or sideways markets. Unlike trend-following strategies that require directional price movements, grid trading thrives on volatility and price oscillations within a defined range.

- Automated Execution: The automated nature of grid trading allows traders to execute trades efficiently without constantly monitoring the market. This can be particularly beneficial for those who have limited time or prefer a hands-off approach.

- Consistent Income: By capturing small profits from frequent price movements, grid trading can provide a consistent stream of income over time. This can be appealing to traders seeking a more predictable return on investment.

- Flexibility: Grid trading can be applied to a wide range of financial instruments, including currencies, stocks, commodities, and cryptocurrencies. This flexibility allows traders to diversify their portfolios and capitalize on opportunities in different markets.

Disadvantages of Grid Trading

Despite its advantages, grid trading also has several potential drawbacks that traders should be aware of:

- Risk of Large Losses: If the price breaks out of the defined range, the grid can accumulate significant losses. This is particularly true if the trader does not implement adequate risk management measures, such as stop-loss orders.

- Capital Intensive: Grid trading typically requires a substantial amount of capital to set up a grid with sufficient depth and spacing. This can be a barrier to entry for traders with limited funds.

- Complexity: Setting up and managing a grid trading strategy can be complex, requiring a thorough understanding of market dynamics, risk management, and trading platforms.

- Potential for Over-Trading: The automated nature of grid trading can lead to over-trading, resulting in increased transaction costs and potentially reduced profitability.

Tools and Platforms for Grid Trading

Several tools and platforms are available to help traders implement grid trading strategies. These include:

- MetaTrader 4/5 (MT4/MT5): These popular trading platforms offer a wide range of features and tools for automated trading, including the ability to create and execute grid trading strategies using Expert Advisors (EAs).

- TradingView: TradingView is a web-based platform that provides advanced charting tools, technical analysis indicators, and a social networking community for traders. While it doesn’t natively support grid trading, users can develop custom scripts and alerts to implement the strategy.

- специализированные торговые боты: Several specialized trading bots are designed specifically for grid trading. These bots typically offer advanced features such as automated grid creation, risk management tools, and backtesting capabilities. Examples include Pionex and KuCoin trading bot.

- Custom Programming: For advanced traders, custom programming offers the flexibility to create a grid trading strategy tailored to their specific needs. This can involve using programming languages such as Python or MQL4/MQL5 to develop custom trading algorithms.

Risk Management in Grid Trading

Effective risk management is crucial for success in grid trading. Here are some key risk management techniques to consider:

- Stop-Loss Orders: Implement stop-loss orders to limit potential losses if the price breaks out of the defined range. Place stop-loss orders at levels that are acceptable based on your risk tolerance and capital allocation.

- Position Sizing: Determine the appropriate position size for each trade based on your capital and risk tolerance. Avoid over-leveraging your account, as this can amplify potential losses.

- Grid Spacing: Adjust the spacing between grid levels based on market volatility. In highly volatile markets, wider spacing may be necessary to avoid being whipsawed by rapid price movements.

- Range Adjustment: Continuously monitor the market and adjust the grid range as needed. If the price shows signs of breaking out of the range, consider widening the grid or closing the positions to avoid further losses.

- Backtesting: Before implementing a grid trading strategy in a live account, backtest it using historical data to assess its performance and identify potential weaknesses.

Practical Applications of Grid Trading

Grid trading can be applied to a wide range of financial instruments and market conditions. Here are some practical applications:

- Currency Trading (Forex): Grid trading is commonly used in forex markets, where currency pairs often exhibit range-bound behavior. Traders can set up grids to profit from the frequent price fluctuations in major currency pairs.

- Stock Trading: Grid trading can also be applied to stocks that are trading within a defined range. This can be particularly effective for stocks that are relatively stable and less prone to volatile price swings.

- Commodity Trading: Grid trading can be used to trade commodities such as gold, silver, and oil. These markets often exhibit periods of range-bound behavior, making them suitable for grid trading strategies.

- Cryptocurrency Trading: With the high volatility of cryptocurrencies, grid trading can be a useful strategy. However, it’s important to manage risk carefully due to the potential for large price swings. [See also: Cryptocurrency Trading Strategies]

Conclusion

Grid trading is a sophisticated trading strategy that can be highly profitable when implemented correctly. By understanding its mechanics, advantages, disadvantages, and risk management techniques, traders can effectively utilize grid trading to capitalize on market volatility and generate consistent income. However, it’s essential to approach grid trading with caution and implement robust risk management measures to protect against potential losses. Whether you’re trading currencies, stocks, commodities, or cryptocurrencies, grid trading can be a valuable tool in your trading arsenal. Always remember to backtest your strategies and continuously monitor the market to adapt to changing conditions. The world of automated trading is constantly evolving, and staying informed is key to long-term success. [See also: Algorithmic Trading Basics]