Hammer Stock: A Comprehensive Guide for Investors and Enthusiasts

The term “hammer stock” can refer to a few different things in the financial and tool industries. Understanding these different meanings is crucial for investors, tradespeople, and anyone interested in these areas. This article provides a comprehensive overview of what “hammer stock” can signify, exploring its various definitions and implications. From analyzing potential investment opportunities related to companies manufacturing hammers to understanding candlestick patterns in stock trading, we’ll delve into the nuances of this term. Whether you’re a seasoned investor looking for new insights or a DIY enthusiast keen to learn more about the tools you use, this guide aims to provide valuable information about the world of hammer stock.

Hammer Stock in the Context of Tool Manufacturing

One interpretation of “hammer stock” refers to the stock of companies that manufacture hammers. These companies produce a wide range of hammers, from basic claw hammers used in everyday construction to specialized hammers used in industries like metalworking and demolition. Investing in hammer stock within this context means purchasing shares in these manufacturing companies. Before investing, thorough due diligence is essential. This includes analyzing the company’s financial performance, market share, and competitive landscape. Factors such as material costs (steel, wood, fiberglass), production efficiency, and distribution networks significantly impact profitability. Market trends, such as the growth of the construction industry or the increasing demand for specialized tools, can also influence the performance of hammer stock.

Key Considerations for Investing in Tool Manufacturing Stocks

- Financial Health: Review the company’s balance sheet, income statement, and cash flow statement. Look for consistent revenue growth, healthy profit margins, and manageable debt levels.

- Market Position: Assess the company’s market share and competitive advantages. Does it have a strong brand reputation? Does it offer unique or innovative products?

- Industry Trends: Understand the trends affecting the tool manufacturing industry. Are there any emerging technologies or regulations that could impact the company’s performance?

- Management Team: Evaluate the experience and track record of the company’s management team. A strong management team is crucial for navigating challenges and capitalizing on opportunities.

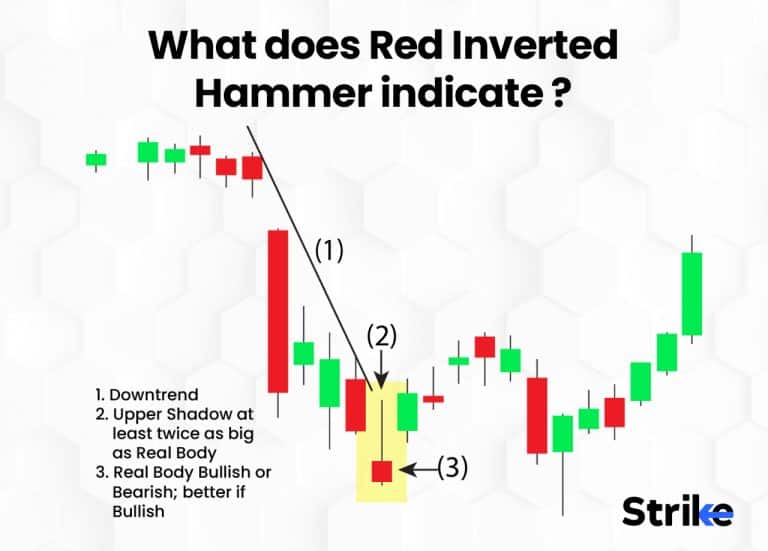

Hammer Stock in the Context of Candlestick Patterns

In the world of stock trading, “hammer” refers to a specific type of candlestick pattern. A hammer is a bullish reversal pattern that forms after a downtrend, signaling a potential bottom and a possible upward price movement. This pattern is characterized by a small body at the upper end of the trading range and a long lower shadow, which is at least twice the length of the body. The small body indicates that the opening and closing prices were relatively close, while the long lower shadow suggests that the price tested lower levels during the session but buyers stepped in to push the price back up. Identifying a hammer stock candlestick pattern requires careful analysis and confirmation from other technical indicators.

Understanding the Hammer Candlestick Pattern

The hammer candlestick pattern is a valuable tool for traders looking to identify potential buying opportunities after a period of price decline. The long lower shadow demonstrates that buyers are starting to gain control, which can lead to a reversal of the downtrend. However, it’s important to note that the hammer pattern is not a guaranteed signal of a reversal. Traders should look for confirmation from other technical indicators, such as volume and momentum oscillators, before making a trading decision. The color of the body (whether it’s bullish or bearish) is less important than the shape of the candlestick itself. A bullish hammer (where the closing price is higher than the opening price) is often considered a stronger signal, but a bearish hammer can still be valid if it’s followed by bullish confirmation.

How to Trade the Hammer Pattern

When trading the hammer pattern, it’s crucial to wait for confirmation before entering a long position. This confirmation typically comes in the form of a higher close on the next trading day. A conservative approach would be to wait for the price to close above the high of the hammer candlestick. This confirms that buyers have indeed taken control and are willing to push the price higher. Stop-loss orders should be placed below the low of the hammer candlestick to limit potential losses if the pattern fails. The profit target can be determined based on various factors, such as previous resistance levels or Fibonacci retracement levels. Remember, no trading strategy is foolproof, and it’s essential to manage risk effectively by using appropriate position sizing and stop-loss orders. Identifying a hammer stock candlestick pattern can be a good starting point, but it should always be part of a broader trading strategy.

Analyzing Companies in the Hammer Tool Industry

Investing in companies that manufacture hammer stock requires a careful evaluation of their financial performance, market position, and growth prospects. Here are some key factors to consider:

- Product Portfolio: Does the company offer a diverse range of hammers to cater to different industries and applications? A diversified product portfolio can help mitigate risk and ensure a steady stream of revenue.

- Innovation: Is the company investing in research and development to create new and improved hammers? Innovation can lead to a competitive advantage and higher profit margins.

- Distribution Channels: Does the company have a strong distribution network to reach its target customers? Effective distribution is crucial for ensuring that the company’s products are readily available to end-users.

- Supply Chain Management: How efficiently does the company manage its supply chain? Efficient supply chain management can help reduce costs and improve profitability.

- Sustainability: Is the company committed to sustainable manufacturing practices? Increasingly, investors are looking for companies that are environmentally responsible and socially conscious.

The Impact of Economic Factors on Hammer Stock

The performance of hammer stock, whether in the context of tool manufacturing or candlestick patterns, can be influenced by various economic factors. Economic growth, interest rates, and inflation can all play a role in shaping the demand for hammers and the overall stock market sentiment. For example, during periods of economic expansion, construction activity typically increases, leading to higher demand for hammers and other tools. Conversely, during economic downturns, construction activity may decline, which can negatively impact the sales of hammer manufacturers. Interest rates can also affect the demand for hammers, as higher interest rates can make it more expensive for businesses and consumers to borrow money, which can reduce investment in construction projects. Inflation can affect the profitability of hammer manufacturers by increasing the cost of raw materials and labor. Therefore, investors should carefully consider these economic factors when evaluating the potential of hammer stock.

Case Studies of Companies Involved in Hammer Manufacturing

Examining real-world examples of companies involved in hammer manufacturing can provide valuable insights into the dynamics of the industry. These case studies can highlight the challenges and opportunities that these companies face and the strategies they employ to succeed. For instance, a case study of a company that has successfully innovated its hammer designs and expanded its market share can offer valuable lessons for other companies in the industry. Similarly, a case study of a company that has struggled with supply chain issues or changing consumer preferences can provide cautionary tales and highlight the importance of adaptability. By studying these real-world examples, investors can gain a deeper understanding of the factors that drive success in the hammer stock market.

The Future of Hammer Stock

The future of hammer stock, both in terms of tool manufacturing and candlestick patterns, is likely to be shaped by a number of factors. Technological advancements, changing consumer preferences, and evolving economic conditions will all play a role in determining the outlook for this area. In the tool manufacturing industry, we can expect to see continued innovation in hammer designs and materials, as well as increased automation in manufacturing processes. In the stock market, the use of candlestick patterns, including the hammer pattern, is likely to become more sophisticated as traders and investors seek to gain an edge in the competitive world of trading. By staying informed about these trends and developments, investors and enthusiasts can position themselves to capitalize on the opportunities that the future of hammer stock may hold. Analyzing hammer stock should always involve a comprehensive strategy. This includes, but is not limited to, reviewing the company’s financials, understanding market trends, and staying up-to-date with the latest industry news. A well-informed approach is key to making sound investment decisions.

In conclusion, the term “hammer stock” encompasses both the stock of companies manufacturing hammers and a specific candlestick pattern used in stock trading. Understanding both contexts is crucial for anyone interested in investing or trading in these areas. By carefully analyzing the financial performance of hammer manufacturers, understanding the nuances of the hammer candlestick pattern, and staying informed about the latest industry trends, investors and traders can make informed decisions and potentially profit from the opportunities that hammer stock presents. Remember to always conduct thorough research and consult with a financial advisor before making any investment decisions. The landscape of hammer stock is constantly evolving, and staying informed is the best way to navigate its complexities.

[See also: Investing in Construction Equipment Companies]

[See also: Understanding Candlestick Patterns for Day Trading]

[See also: The Impact of Inflation on Manufacturing Stocks]