Hammer Stock: A Comprehensive Guide to Understanding and Investing

Understanding the dynamics of the stock market requires a deep dive into various investment strategies and financial instruments. Among these, the concept of hammer stock stands out as a critical aspect for both novice and seasoned investors. This article aims to provide a comprehensive overview of what hammer stock represents, its implications for investment portfolios, and strategies for navigating the complexities associated with it. We will explore the characteristics of hammer stock, analyze its risks and rewards, and offer actionable insights for making informed investment decisions. The goal is to equip you with the knowledge to confidently engage with hammer stock and integrate it effectively into your broader financial strategy.

What is Hammer Stock?

The term “hammer stock” typically refers to a stock that has experienced a significant decline in value but shows potential for recovery. This potential is often signaled by specific candlestick patterns in technical analysis, where the “hammer” pattern indicates a possible reversal of the downward trend. The “hammer” pattern is characterized by a small body at the top of the trading range and a long lower shadow, suggesting that although selling pressure was strong during the trading period, buyers eventually stepped in to push the price back up. [See also: Understanding Candlestick Patterns in Stock Analysis]

In a broader sense, hammer stock can also describe any stock that is undervalued or oversold and presents a buying opportunity. These stocks may be associated with companies facing temporary challenges, industry downturns, or market corrections, leading to a depressed stock price that doesn’t accurately reflect the company’s intrinsic value. Identifying hammer stock requires careful analysis of financial statements, industry trends, and overall market conditions.

Identifying Potential Hammer Stock

Identifying potential hammer stock involves a multi-faceted approach that combines technical and fundamental analysis. Here are some key indicators and strategies to consider:

Technical Analysis

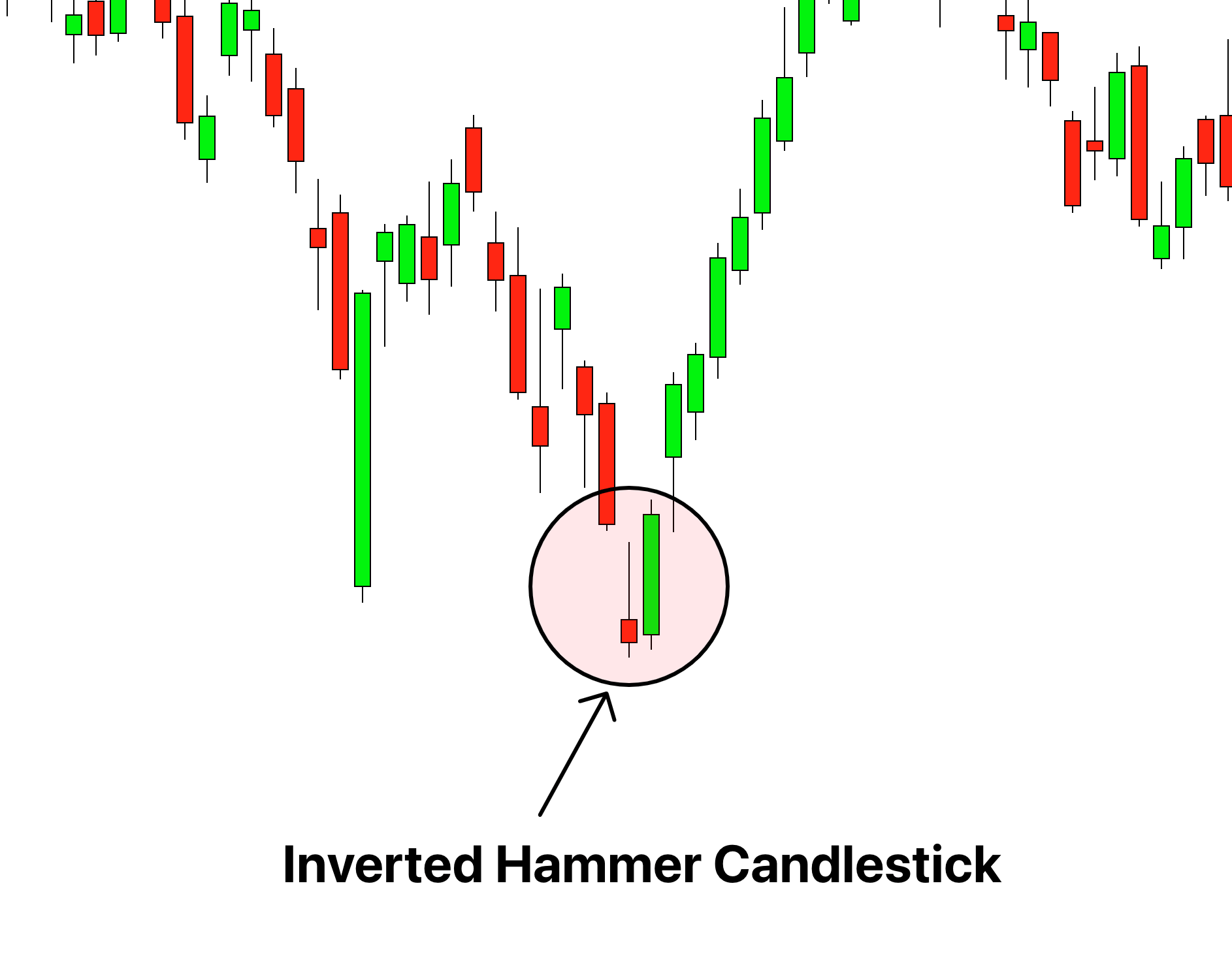

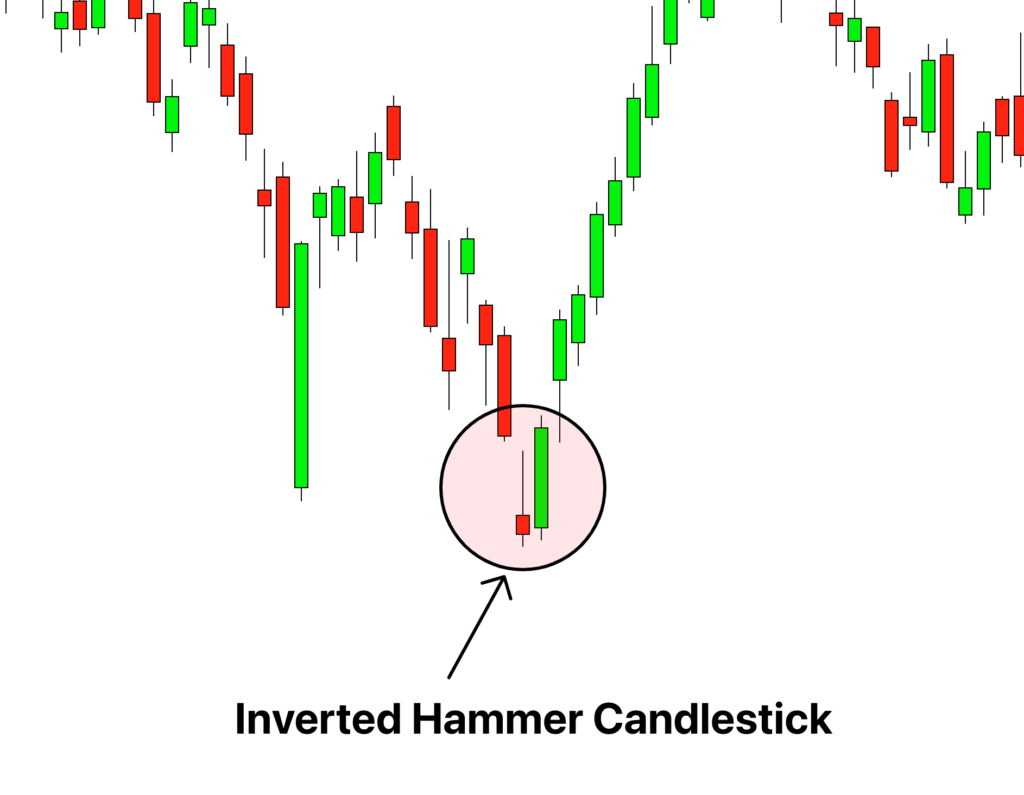

- Candlestick Patterns: Look for the “hammer” or “inverted hammer” patterns on stock charts. These patterns suggest a potential reversal of a downtrend.

- Relative Strength Index (RSI): An RSI below 30 often indicates that a stock is oversold and may be poised for a rebound. Hammer stock often exhibits this characteristic.

- Moving Averages: Monitor moving averages to identify potential support levels. If a stock bounces off a key moving average, it could signal a buying opportunity.

Fundamental Analysis

- Financial Statements: Analyze the company’s balance sheet, income statement, and cash flow statement to assess its financial health. Look for companies with strong fundamentals that are temporarily undervalued.

- Industry Analysis: Understand the industry dynamics and competitive landscape. Identify companies that are well-positioned to weather industry downturns and emerge stronger.

- Valuation Metrics: Use valuation metrics such as price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and price-to-sales (P/S) ratio to determine if a stock is undervalued compared to its peers.

Risks and Rewards of Investing in Hammer Stock

Investing in hammer stock can be a high-risk, high-reward strategy. While the potential for significant gains exists, it’s crucial to understand the associated risks.

Potential Rewards

- High Returns: If a hammer stock successfully rebounds, investors can realize substantial returns.

- Undervalued Assets: Investing in undervalued assets allows investors to buy quality companies at a discount.

- Market Correction Opportunities: Market corrections often create opportunities to buy hammer stock at attractive prices.

Potential Risks

- Further Decline: There is always a risk that a hammer stock may continue to decline if the underlying issues are not resolved.

- Financial Distress: Some companies may be facing severe financial difficulties, making a rebound unlikely.

- Market Volatility: Hammer stock can be highly volatile, leading to significant price swings.

Strategies for Investing in Hammer Stock

To mitigate the risks associated with investing in hammer stock, consider the following strategies:

Diversification

Diversify your portfolio to spread risk across multiple stocks and asset classes. Avoid putting all your eggs in one basket.

Due Diligence

Conduct thorough research and analysis before investing in any hammer stock. Understand the company’s business model, financial health, and industry dynamics.

Stop-Loss Orders

Use stop-loss orders to limit potential losses. A stop-loss order automatically sells a stock if it falls below a certain price level.

Long-Term Perspective

Take a long-term perspective when investing in hammer stock. Be patient and allow the company time to turn around. The identification of hammer stock is not a guarantee of immediate returns, but rather an indicator of potential long-term growth.

Stay Informed

Stay informed about market trends, industry news, and company developments. Monitor your investments regularly and adjust your strategy as needed.

Examples of Hammer Stock

To illustrate the concept of hammer stock, let’s consider a hypothetical example. Suppose a technology company experiences a temporary setback due to a product recall, causing its stock price to plummet. However, the company has a strong track record, a solid balance sheet, and a loyal customer base. In this scenario, the stock may be considered a hammer stock, presenting a buying opportunity for investors who believe in the company’s long-term potential.

Another example could be a retail company that suffers a temporary decline in sales due to economic conditions. If the company has a strong brand, efficient operations, and a history of profitability, its stock may be considered a hammer stock. Investors who believe that the economy will recover and that the company will regain its sales momentum may see this as an attractive investment opportunity.

The Role of Market Sentiment

Market sentiment plays a crucial role in the performance of hammer stock. Positive market sentiment can drive up the price of undervalued stocks, while negative sentiment can exacerbate the downward trend. Investors should pay attention to market news, economic indicators, and investor psychology to gauge the prevailing sentiment. [See also: Analyzing Market Sentiment for Investment Decisions]

Understanding market sentiment can help investors make more informed decisions about when to buy or sell hammer stock. For example, if the market is oversold and sentiment is extremely negative, it may be a good time to buy hammer stock. Conversely, if the market is overbought and sentiment is excessively bullish, it may be a good time to take profits.

Hammer Stock and the Importance of Patience

Investing in hammer stock requires patience and discipline. It may take time for a company to turn around and for its stock price to recover. Investors should be prepared to hold their investments for the long term and to weather short-term volatility. It’s important to remember that the identification of a hammer stock is based on analysis and potential, not a guarantee of immediate profit.

Patience is particularly important when investing in companies that are undergoing restructuring or facing significant challenges. These companies may require several years to implement their turnaround plans and to restore profitability. Investors who are willing to wait and to remain patient can potentially reap significant rewards.

Conclusion

Hammer stock represents a unique investment opportunity for those willing to conduct thorough research, understand the associated risks, and exercise patience. By combining technical and fundamental analysis, investors can identify undervalued stocks with the potential for significant gains. However, it’s crucial to diversify your portfolio, use stop-loss orders, and stay informed about market trends and company developments. Investing in hammer stock is not a get-rich-quick scheme, but rather a long-term strategy that requires discipline and a deep understanding of the market. With careful planning and execution, hammer stock can be a valuable addition to any investment portfolio.