Hedge Fund vs. Mutual Fund: Understanding the Key Differences

Navigating the world of investments can feel like deciphering a complex code. Two prominent players often discussed are hedge funds and mutual funds. While both are investment vehicles that pool money from multiple investors, they operate under vastly different structures, strategies, and regulatory frameworks. Understanding the nuances between a hedge fund and a mutual fund is crucial for any investor looking to diversify their portfolio or simply gain a clearer picture of the financial landscape. This article will delve into the key differences, providing a comprehensive comparison to help you make informed decisions.

What is a Mutual Fund?

A mutual fund is a type of investment vehicle that pools money from many investors to purchase a diversified portfolio of stocks, bonds, or other assets. These funds are typically managed by professional fund managers who make investment decisions on behalf of the investors. The primary goal of a mutual fund is to provide investors with access to a diversified portfolio that would be difficult or impossible to achieve on their own, especially for retail investors with limited capital.

Key Characteristics of Mutual Funds:

- Diversification: Mutual funds offer built-in diversification, reducing the risk associated with investing in individual securities.

- Liquidity: Investors can typically buy or sell shares of a mutual fund on any business day at the fund’s net asset value (NAV).

- Regulation: Mutual funds are heavily regulated by government agencies like the Securities and Exchange Commission (SEC) in the United States, providing a level of investor protection.

- Accessibility: Mutual funds are generally accessible to a wide range of investors, with relatively low minimum investment requirements.

- Transparency: Mutual funds are required to disclose their holdings and performance regularly, providing investors with transparency into the fund’s operations.

What is a Hedge Fund?

A hedge fund, on the other hand, is a private investment partnership that uses more aggressive and complex strategies to generate higher returns. Hedge funds are typically available only to accredited investors, such as high-net-worth individuals and institutional investors, due to their higher risk profile and less stringent regulatory oversight. Unlike mutual funds, hedge funds often employ strategies such as short selling, leverage, and derivatives trading to maximize returns.

Key Characteristics of Hedge Funds:

- Sophisticated Strategies: Hedge funds employ a wide range of investment strategies, including arbitrage, event-driven investing, and global macro strategies.

- Limited Liquidity: Hedge funds often have lock-up periods, restricting investors from withdrawing their funds for a specified period of time.

- Less Regulation: Hedge funds are subject to less regulatory oversight compared to mutual funds, giving them greater flexibility in their investment strategies.

- Accredited Investors Only: Hedge funds are generally only available to accredited investors who meet certain income or net worth requirements.

- Higher Fees: Hedge funds typically charge higher fees than mutual funds, including a management fee and a performance fee (often referred to as the “2 and 20” model).

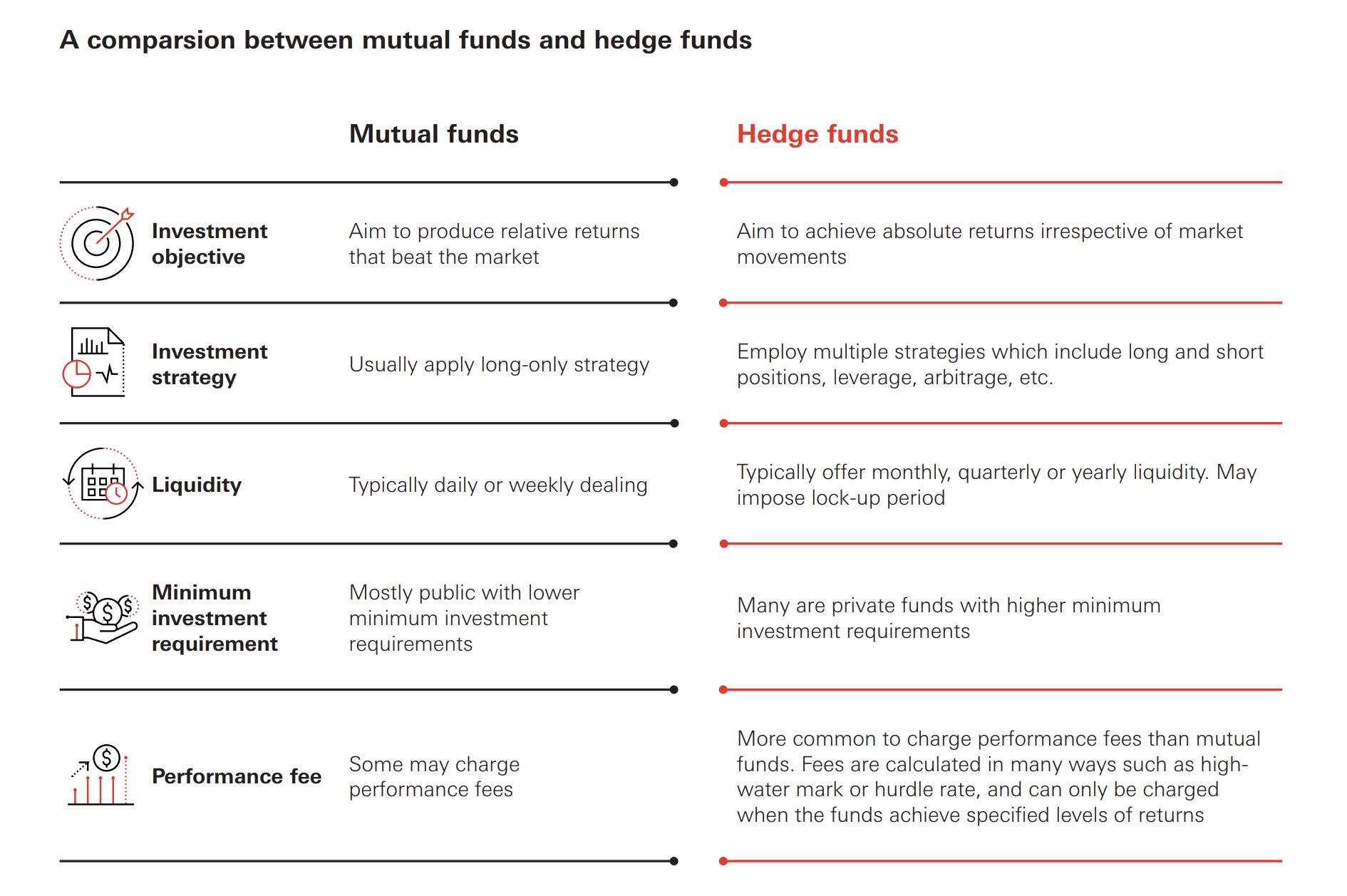

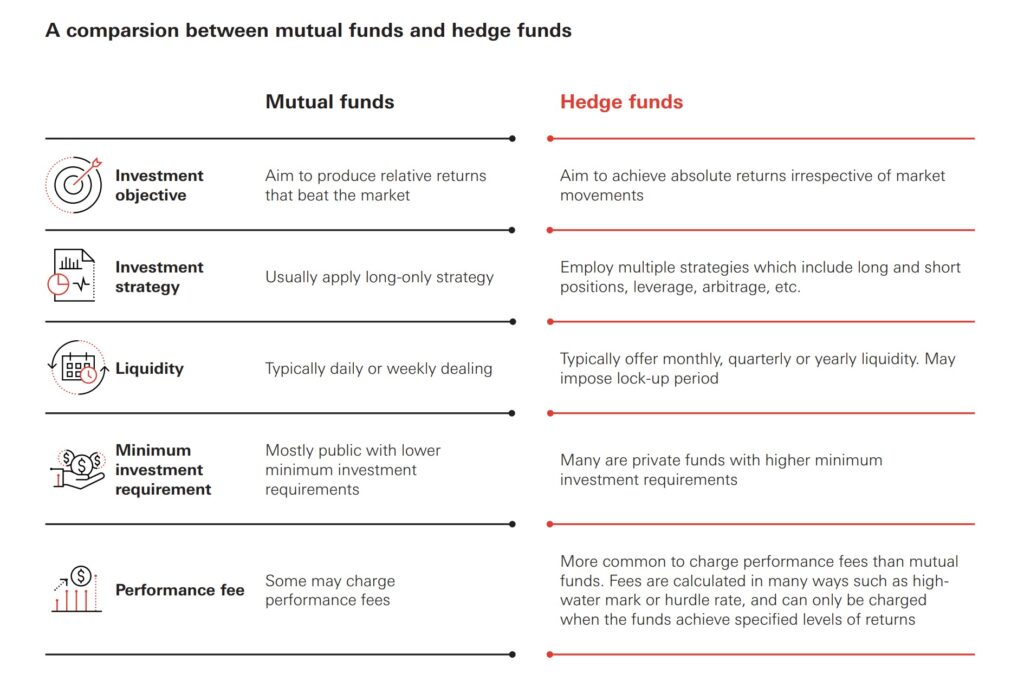

Hedge Fund vs Mutual Fund: A Detailed Comparison

Let’s delve deeper into the specific differences between hedge funds and mutual funds across several key areas:

Investment Strategies

Mutual funds generally follow more traditional investment strategies, focusing on long-term growth and diversification. They typically invest in a mix of stocks, bonds, and other securities, aiming to generate returns that match or exceed a specific benchmark. Hedge funds, in contrast, employ a wider range of strategies, including short selling, leverage, and derivatives trading, to generate higher returns regardless of market conditions. These strategies often involve higher risk and require a more sophisticated understanding of financial markets. A key difference is that hedge funds can often bet against assets, attempting to profit from a decline in value, which is rarely, if ever, done in standard mutual funds.

Investor Eligibility

Mutual funds are accessible to a broad range of investors, including retail investors with relatively small amounts of capital. The minimum investment requirements for mutual funds are typically low, making them an attractive option for individuals who are just starting to invest. Hedge funds, on the other hand, are generally only available to accredited investors who meet certain income or net worth requirements. This restriction is in place because hedge funds are considered to be higher-risk investments, and regulators want to ensure that investors have the financial sophistication and resources to understand and withstand potential losses.

Fees and Expenses

Mutual funds typically charge lower fees than hedge funds. The fees associated with mutual funds usually include a management fee, which is a percentage of the fund’s assets under management (AUM), and other expenses, such as administrative costs and marketing expenses. Hedge funds, on the other hand, often charge a combination of a management fee and a performance fee. The most common fee structure for hedge funds is the “2 and 20” model, which means that the fund charges a 2% management fee and a 20% performance fee on any profits generated. This higher fee structure reflects the more complex and active management required by hedge fund strategies.

Regulation and Transparency

Mutual funds are heavily regulated by government agencies like the SEC. This regulation is designed to protect investors by ensuring that mutual funds operate in a transparent and accountable manner. Mutual funds are required to disclose their holdings and performance regularly, providing investors with insight into the fund’s operations. Hedge funds are subject to less regulatory oversight compared to mutual funds. This reduced regulation allows hedge funds greater flexibility in their investment strategies, but it also means that investors have less transparency into the fund’s operations. The lack of transparency is one of the key reasons why hedge funds are generally only available to accredited investors who are presumed to have the financial sophistication to assess the risks involved.

Liquidity

Mutual funds offer high liquidity, allowing investors to buy or sell shares on any business day at the fund’s NAV. This liquidity makes mutual funds an attractive option for investors who may need to access their funds quickly. Hedge funds often have lock-up periods, restricting investors from withdrawing their funds for a specified period of time. These lock-up periods can range from a few months to several years, depending on the hedge fund’s strategy. The illiquidity of hedge funds is another reason why they are generally only available to accredited investors who are willing to commit their capital for a longer period of time.

Examples of Hedge Fund and Mutual Fund Strategies

To further illustrate the differences, let’s look at examples of strategies employed by each fund type.

Mutual Fund Strategies:

- Index Funds: These funds aim to replicate the performance of a specific market index, such as the S&P 500. They are passively managed and typically have low fees.

- Growth Funds: These funds invest in companies with high growth potential, aiming to generate capital appreciation.

- Value Funds: These funds invest in undervalued companies, aiming to profit from a future increase in their stock prices.

- Bond Funds: These funds invest in bonds, aiming to generate income through interest payments.

Hedge Fund Strategies:

- Long/Short Equity: This strategy involves taking long positions in stocks that are expected to increase in value and short positions in stocks that are expected to decrease in value.

- Event-Driven Investing: This strategy involves investing in companies that are undergoing significant corporate events, such as mergers, acquisitions, or bankruptcies.

- Global Macro: This strategy involves investing based on macroeconomic trends, such as interest rate changes, currency fluctuations, and commodity prices.

- Arbitrage: This strategy involves exploiting price discrepancies in different markets to generate risk-free profits.

Which is Right for You?

The choice between a hedge fund and a mutual fund depends on your individual investment goals, risk tolerance, and financial situation. If you are a retail investor with limited capital and a desire for diversification and liquidity, a mutual fund may be a more suitable option. Mutual funds offer a relatively low-cost and accessible way to invest in a diversified portfolio of securities. [See also: Investing for Beginners].

If you are an accredited investor with a high-risk tolerance and a desire for potentially higher returns, a hedge fund may be worth considering. Hedge funds offer the potential for higher returns, but they also come with higher risks and less liquidity. It’s crucial to conduct thorough due diligence and understand the specific strategies and risks associated with any hedge fund before investing. Consulting with a financial advisor is always recommended before making investment decisions, especially when considering complex investment vehicles like hedge funds. The key is understanding the differences between a hedge fund and a mutual fund, and aligning your investment choices with your overall financial goals.

Conclusion

In conclusion, while both hedge funds and mutual funds serve as investment vehicles, they cater to different investor profiles and employ vastly different strategies. Mutual funds offer broad accessibility, diversification, and regulatory oversight, making them a popular choice for retail investors. Hedge funds, on the other hand, target accredited investors with sophisticated strategies, higher fees, and less regulation. Understanding these key differences is paramount for making informed investment decisions and navigating the complexities of the financial market. Whether you opt for the accessibility of a mutual fund or the potential returns of a hedge fund, thorough research and professional advice are essential for achieving your financial goals. Remember to always consider your risk tolerance, investment timeline, and financial situation before making any investment decisions.