Hedge Fund vs. Mutual Fund: Understanding the Key Differences

Navigating the complex world of investment can feel like deciphering a foreign language. Two common investment vehicles often compared are hedge funds and mutual funds. While both pool money from investors with the goal of generating returns, their strategies, accessibility, and associated risks differ significantly. This article aims to provide a clear and concise comparison of hedge fund vs mutual fund, helping you understand which might be a better fit for your investment goals and risk tolerance. Before making any investment decisions, it is crucial to conduct thorough research and consult with a qualified financial advisor.

What is a Mutual Fund?

A mutual fund is a type of investment vehicle that pools money from many investors to purchase a diversified portfolio of stocks, bonds, or other assets. The fund is managed by a professional fund manager who makes investment decisions based on the fund’s stated objectives. Mutual funds are regulated by the Securities and Exchange Commission (SEC) and are required to adhere to strict transparency rules. This means investors have access to regular reports detailing the fund’s holdings and performance. The price of a mutual fund share, known as the Net Asset Value (NAV), is calculated daily based on the total value of the fund’s assets divided by the number of outstanding shares.

Key Characteristics of Mutual Funds:

- Accessibility: Generally accessible to a wide range of investors, including retail investors.

- Regulation: Heavily regulated by the SEC, ensuring transparency and investor protection.

- Liquidity: Shares can typically be bought and sold daily at the NAV.

- Diversification: Offer diversification across a variety of asset classes, reducing risk.

- Transparency: Provide regular reports on fund holdings and performance.

- Investment Strategies: Typically employ more traditional investment strategies, such as buying and holding stocks and bonds.

What is a Hedge Fund?

A hedge fund is a privately managed investment fund that employs more complex and often riskier investment strategies than mutual funds. They aim to generate high returns, often using leverage, short selling, and derivatives. Hedge funds are typically only available to accredited investors, meaning individuals or institutions with a high net worth or income. Due to their private nature, hedge funds are subject to less regulatory oversight than mutual funds, which allows them greater flexibility in their investment strategies but also increases the risk for investors. The minimum investment required for hedge funds is often substantial, typically starting in the hundreds of thousands or even millions of dollars.

Key Characteristics of Hedge Funds:

- Accessibility: Primarily accessible to accredited investors with high net worth or income.

- Regulation: Less regulated than mutual funds, allowing for greater investment flexibility but also higher risk.

- Liquidity: Typically have lock-up periods, meaning investors cannot withdraw their funds for a specified period.

- Investment Strategies: Employ complex and often aggressive investment strategies, including leverage, short selling, and derivatives.

- Transparency: Offer less transparency than mutual funds, with less frequent and detailed reporting.

- Fees: Charge higher fees than mutual funds, often including a management fee and a performance fee (incentive fee).

Hedge Fund vs. Mutual Fund: A Detailed Comparison

To better understand the differences between hedge fund vs mutual fund, let’s examine several key aspects:

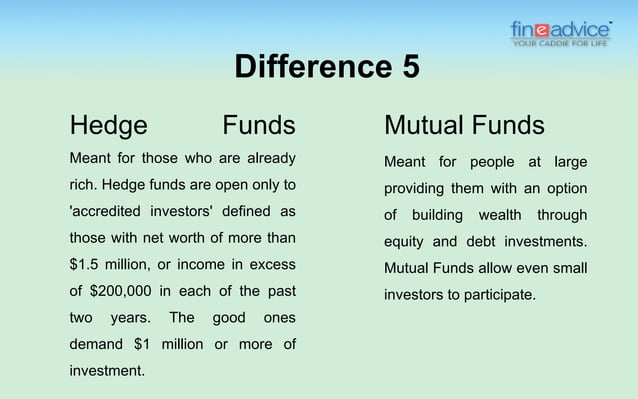

Investor Eligibility

This is perhaps the most significant difference. Mutual funds are open to virtually any investor, regardless of their net worth or income. Hedge funds, on the other hand, are generally restricted to accredited investors. The SEC defines accredited investors as individuals with a net worth of at least $1 million (excluding their primary residence) or an annual income of at least $200,000 (or $300,000 jointly with their spouse) for the past two years, with a reasonable expectation of the same income level in the current year.

Investment Strategies

Mutual funds typically employ more conservative and traditional investment strategies. They often focus on long-term growth and diversification, investing in a broad range of stocks, bonds, and other assets. Hedge funds, in contrast, are known for their aggressive and sophisticated strategies. They may use leverage to amplify returns, engage in short selling to profit from declining prices, and invest in derivatives such as options and futures. These strategies can potentially generate higher returns but also carry significantly higher risks.

Regulation and Transparency

Mutual funds are subject to strict regulatory oversight by the SEC. This includes requirements for regular reporting of fund holdings, performance data, and fees. This high level of transparency is designed to protect investors and ensure they have access to the information they need to make informed decisions. Hedge funds operate with less regulatory scrutiny. They are not required to disclose their investment strategies or holdings to the same extent as mutual funds, which makes it more difficult for investors to assess the risks involved.

Fees and Expenses

Mutual funds typically charge lower fees than hedge funds. Mutual fund fees usually consist of an expense ratio, which covers the fund’s operating expenses. Hedge funds, on the other hand, often charge a “2 and 20” fee structure. This means they charge a 2% management fee on the total assets under management and a 20% performance fee on any profits generated. This fee structure can significantly reduce the returns for investors, especially if the hedge fund does not perform well. [See also: Understanding Investment Fees]

Liquidity

Mutual funds offer high liquidity. Investors can typically buy or sell shares daily at the NAV. Hedge funds often have lock-up periods, meaning investors cannot withdraw their funds for a specified period, such as one or two years. This lack of liquidity can be a disadvantage for investors who may need access to their funds in the short term. Understanding the liquidity constraints is critical when considering a hedge fund investment.

Risk Profile

Due to their more conservative investment strategies, mutual funds generally have a lower risk profile than hedge funds. However, the risk level of a mutual fund can vary depending on the specific fund’s investment objectives and holdings. Hedge funds are inherently riskier due to their use of leverage, short selling, and derivatives. These strategies can lead to substantial losses if not managed effectively. Investors considering hedge fund investments should have a high tolerance for risk and be prepared to potentially lose a significant portion of their investment. [See also: Assessing Your Risk Tolerance]

Who Should Invest in Hedge Funds vs. Mutual Funds?

The choice between hedge fund vs mutual fund depends largely on an investor’s financial situation, risk tolerance, and investment goals. Mutual funds are generally suitable for a wide range of investors, including those who are just starting out or who prefer a more conservative investment approach. They offer diversification, transparency, and liquidity, making them a good option for long-term investing. Hedge funds are typically only appropriate for sophisticated investors with a high net worth, a strong understanding of complex investment strategies, and a high tolerance for risk. They may offer the potential for higher returns, but they also come with significantly higher risks and fees. The decision to invest in a hedge fund should not be taken lightly and should be based on a thorough assessment of the investor’s financial situation and investment objectives.

The Future of Hedge Funds and Mutual Funds

Both hedge funds and mutual funds continue to evolve in response to changing market conditions and investor demands. Mutual funds are increasingly offering more specialized investment strategies, such as socially responsible investing and thematic investing. Hedge funds are facing pressure to lower fees and increase transparency. The rise of alternative investment strategies and the increasing availability of information are blurring the lines between hedge fund vs mutual fund. Investors need to stay informed about the latest developments in the investment industry and carefully consider their options before making any investment decisions. [See also: Trends in Alternative Investments]

Conclusion

Understanding the differences between hedge fund vs mutual fund is crucial for making informed investment decisions. Mutual funds offer accessibility, diversification, and transparency, making them suitable for a wide range of investors. Hedge funds offer the potential for higher returns but come with higher risks, fees, and less transparency, making them appropriate only for sophisticated investors with a high net worth and risk tolerance. Before investing in either type of fund, carefully consider your financial situation, investment goals, and risk tolerance, and consult with a qualified financial advisor. The key takeaway is that there is no one-size-fits-all answer when it comes to choosing between a hedge fund and a mutual fund. It’s about finding the investment vehicle that best aligns with your individual circumstances and objectives. The world of finance is complex, but with careful research and planning, you can navigate it successfully.