How to Calculate Forex Profit: A Comprehensive Guide

Understanding how to calculate forex profit is crucial for any trader looking to succeed in the foreign exchange market. Whether you’re a beginner or an experienced trader, knowing exactly how your profits and losses are determined is essential for making informed decisions and managing your risk effectively. This guide will walk you through the various factors that influence your forex profit and provide you with the tools to accurately calculate forex profit.

Understanding the Basics of Forex Trading

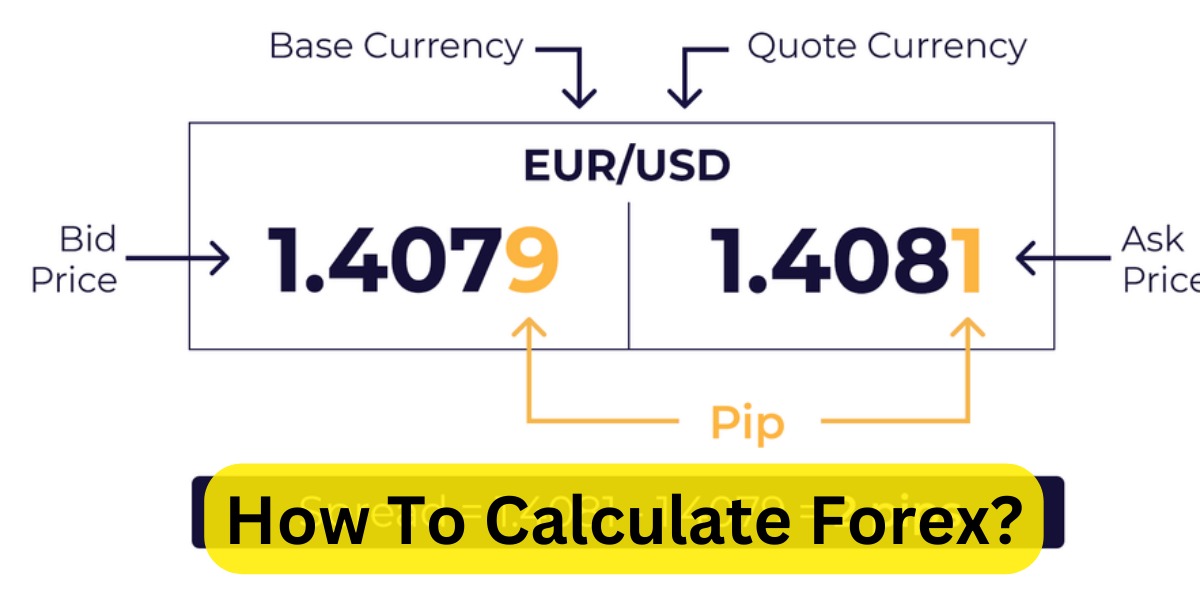

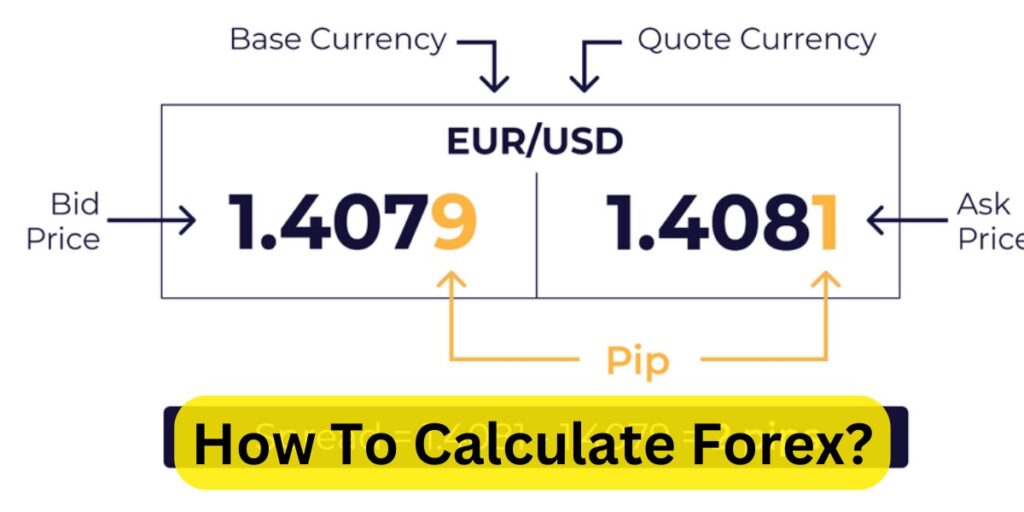

Before diving into the calculations, let’s recap the core concepts of forex trading. Forex trading involves buying and selling currencies in pairs. The value of a currency pair reflects the exchange rate between the two currencies. The first currency in the pair is called the base currency, and the second is the quote currency. For instance, in the EUR/USD pair, EUR is the base currency, and USD is the quote currency.

When you buy a currency pair, you are essentially buying the base currency and selling the quote currency. Conversely, when you sell a currency pair, you are selling the base currency and buying the quote currency. Your profit or loss is determined by the difference between the price at which you bought or sold the currency pair and the price at which you closed the position.

Key Factors Affecting Forex Profit

Several factors influence your forex profit. Understanding these factors is critical for accurate profit calculation and risk management:

- Pip Value: A pip (percentage in point) represents the smallest price movement that an exchange rate can make. Knowing the pip value for each currency pair you trade is essential for calculating potential profits and losses.

- Lot Size: Forex trades are conducted in lots. A standard lot is 100,000 units of the base currency, but smaller lot sizes like mini lots (10,000 units) and micro lots (1,000 units) are also available. The lot size directly impacts the potential profit or loss per pip movement.

- Leverage: Leverage allows you to control a larger position with a smaller amount of capital. While leverage can amplify your profits, it can also magnify your losses.

- Spread: The spread is the difference between the bid (selling) price and the ask (buying) price of a currency pair. It represents the broker’s commission and is an immediate cost to the trader.

- Commissions and Fees: Some brokers charge commissions or other fees in addition to the spread. These costs should be factored into your profit calculations.

Step-by-Step Guide to Calculate Forex Profit

Here’s a step-by-step guide on how to calculate forex profit:

Step 1: Determine the Pip Value

The pip value depends on the currency pair, the lot size, and the exchange rate. For most currency pairs where the quote currency is USD, the pip value for a standard lot (100,000 units) is $10. For other currency pairs, the pip value can be calculated using the following formula:

Pip Value = (Pip Size / Exchange Rate) x Lot Size

For example, if you are trading EUR/JPY with a standard lot and the exchange rate is 130.00, and the pip size is 0.01, the pip value would be:

Pip Value = (0.01 / 130.00) x 100,000 = ¥7.69 (approximately)

To convert this to your account currency (e.g., USD), you would need to divide the pip value by the current exchange rate between JPY and USD.

Step 2: Calculate the Profit in Pips

The profit in pips is the difference between the opening price and the closing price of your trade. If you bought a currency pair and the price increased, you made a profit. If the price decreased, you incurred a loss. Conversely, if you sold a currency pair and the price decreased, you made a profit, and if the price increased, you incurred a loss.

For example, if you bought EUR/USD at 1.1000 and sold it at 1.1050, your profit is 50 pips.

Step 3: Calculate the Total Profit

To calculate the total profit, multiply the profit in pips by the pip value:

Total Profit = Profit in Pips x Pip Value

Using the previous example, if you made 50 pips trading EUR/USD with a standard lot (where the pip value is $10), your total profit would be:

Total Profit = 50 pips x $10/pip = $500

Step 4: Account for the Spread and Commissions

Remember to subtract the spread and any commissions or fees from your gross profit to determine your net profit. The spread is typically measured in pips, so you can convert it to a monetary value using the pip value.

For instance, if the spread for EUR/USD is 2 pips, the cost of the spread for a standard lot would be:

Spread Cost = 2 pips x $10/pip = $20

If your broker charges a commission of $5 per standard lot, your total costs would be:

Total Costs = Spread Cost + Commission = $20 + $5 = $25

Therefore, your net profit would be:

Net Profit = Gross Profit – Total Costs = $500 – $25 = $475

Examples of Forex Profit Calculations

Let’s look at a few more examples to illustrate how to calculate forex profit in different scenarios.

Example 1: Trading GBP/USD

Suppose you buy GBP/USD at 1.3000 with a mini lot (10,000 units). The pip value for a mini lot is typically $1. You close the position at 1.3050.

- Profit in Pips: 1.3050 – 1.3000 = 50 pips

- Pip Value: $1/pip

- Gross Profit: 50 pips x $1/pip = $50

- Spread (2 pips): 2 pips x $1/pip = $2

- Commission: $0 (assuming no commission)

- Net Profit: $50 – $2 = $48

Example 2: Trading USD/JPY

You sell USD/JPY at 110.00 with a standard lot (100,000 units). The exchange rate moves to 109.50, and you close the position.

- Profit in Pips: 110.00 – 109.50 = 50 pips

- Pip Value (approximately): ¥7.69/pip (as calculated earlier)

- To convert the pip value to USD, assume the USD/JPY rate is 110.00: ¥7.69 / 110.00 = $0.07/pip (approximately)

- Gross Profit: 50 pips x $9.09/pip (after conversion from JPY) = $454.50 (approximately)

- Spread (3 pips): 3 pips x $9.09/pip = $27.27 (approximately)

- Commission: $5

- Net Profit: $454.50 – $27.27 – $5 = $422.23 (approximately)

Tools for Calculating Forex Profit

Several tools can help you calculate forex profit quickly and accurately:

- Forex Calculators: Many online forex calculators can automatically calculate pip values, profit, and loss based on your trade parameters.

- Trading Platforms: Most trading platforms, such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), provide real-time profit and loss calculations for your open positions.

- Spreadsheet Software: You can create your own spreadsheet to track your trades and calculate profits and losses. This allows for greater customization and control over your calculations.

Common Mistakes to Avoid When Calculating Forex Profit

Here are some common mistakes to avoid when calculating forex profit:

- Ignoring the Spread: Failing to account for the spread can lead to an overestimation of your net profit.

- Miscalculating Pip Value: Using the wrong pip value can significantly skew your profit and loss calculations. Always double-check the pip value for the specific currency pair and lot size you are trading.

- Forgetting Commissions and Fees: Neglecting to factor in commissions, swap fees, or other charges can result in inaccurate profit calculations.

- Not Converting Currency: When trading currency pairs where the quote currency is not your account currency, remember to convert the pip value to your account currency for accurate profit calculations.

The Importance of Accurate Profit Calculation

Accurate profit calculation is essential for several reasons:

- Performance Tracking: Knowing your actual profits and losses allows you to track your trading performance and identify areas for improvement.

- Risk Management: Accurate profit calculations help you assess your risk exposure and adjust your trading strategy accordingly.

- Tax Reporting: Accurate records of your profits and losses are necessary for tax reporting purposes.

- Financial Planning: Understanding your trading profitability enables you to make informed financial decisions and plan for the future.

Advanced Strategies for Forex Profit Maximization

Once you have a solid understanding of how to calculate forex profit, you can explore advanced strategies to maximize your profitability:

- Scalping: This strategy involves making many small profits by exploiting minor price movements. Accurate profit calculation is crucial for scalpers, as even small errors can significantly impact their overall profitability.

- Day Trading: Day traders open and close positions within the same trading day to avoid overnight fees. They need to closely monitor their profits and losses to make timely decisions.

- Swing Trading: Swing traders hold positions for several days or weeks, aiming to capture larger price swings. They need to factor in swap fees and other costs when calculating their potential profits.

- Position Trading: Position traders hold positions for several weeks or months, focusing on long-term trends. They need to consider fundamental factors and economic indicators when assessing their potential profits.

Conclusion

Mastering how to calculate forex profit is a fundamental skill for any forex trader. By understanding the key factors that influence your profits and losses, using the right tools, and avoiding common mistakes, you can accurately track your performance, manage your risk, and make informed trading decisions. Whether you’re a beginner or an experienced trader, taking the time to understand and implement these principles will significantly improve your chances of success in the forex market. [See also: Forex Trading Strategies for Beginners] Remember to always stay informed, adapt to market conditions, and continuously refine your trading strategy based on your profit calculations.