How to Cash In Bearer Bonds: A Comprehensive Guide

Bearer bonds, once a common financial instrument, represent a debt security owned by whoever holds the physical bond certificate. Unlike registered bonds, the owner’s name isn’t recorded with the issuer. This anonymity made them popular in the past, but also led to their decline due to concerns about money laundering and tax evasion. If you’ve come into possession of a bearer bond, understanding how to cash in bearer bonds is crucial. This guide provides a comprehensive overview of the process, potential challenges, and important considerations.

What are Bearer Bonds?

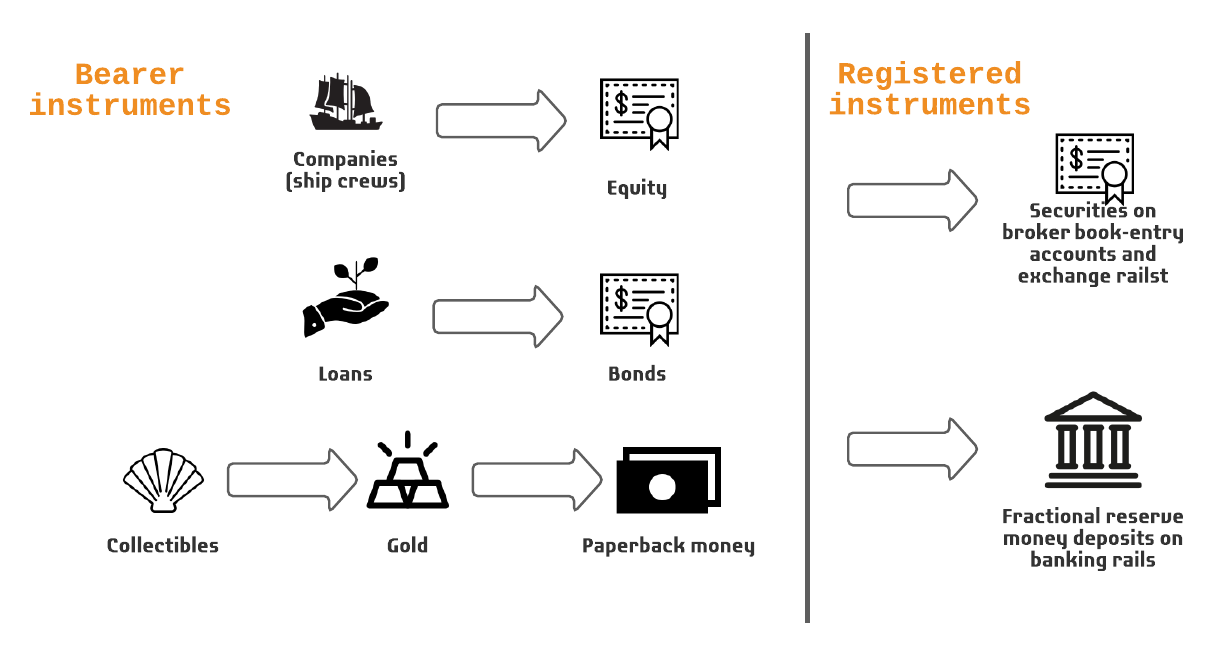

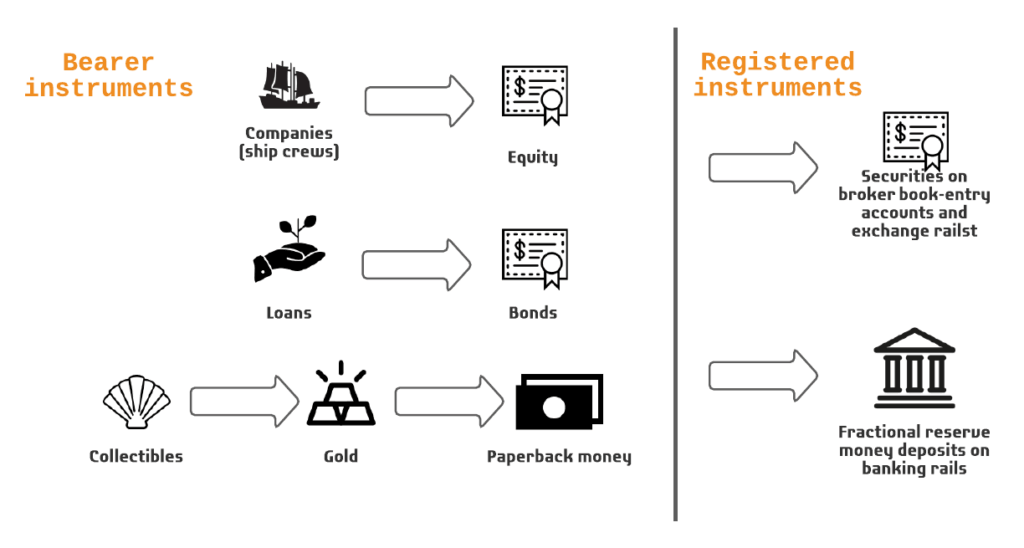

Bearer bonds are debt instruments that are not registered in the name of an owner. Ownership is determined solely by possession of the physical bond. The issuer promises to pay the bond’s face value at maturity and periodic interest payments (coupon payments) to whoever presents the coupons attached to the bond. This lack of registration provides anonymity, which was once seen as an advantage. However, this anonymity also made them attractive for illicit activities, leading to increased scrutiny and their eventual phasing out in many jurisdictions.

Key Characteristics of Bearer Bonds

- Anonymity: No record of ownership is kept by the issuer.

- Physical Certificate: Ownership is proven by possession of the physical bond certificate.

- Coupon Payments: Interest is paid via coupons attached to the bond, which are detached and presented for payment.

- Maturity Date: The date on which the principal amount is repaid to the bearer.

The Decline of Bearer Bonds

The use of bearer bonds has significantly declined due to international efforts to combat money laundering, tax evasion, and other financial crimes. Many countries have either outlawed their issuance or have imposed strict regulations on their use. This makes cashing in bearer bonds a more complex process than it once was. The increased regulatory scrutiny makes it harder to find institutions willing to handle them, and the process may require extensive documentation and due diligence.

Steps to Cash In Bearer Bonds

If you have a bearer bond, here’s a step-by-step guide on how to cash in bearer bonds:

Verify the Bond’s Authenticity

Before attempting to cash in a bearer bond, it’s essential to verify its authenticity. Counterfeit bonds are not uncommon, and attempting to cash one could lead to legal problems. Contact the issuer directly, if possible, or consult with a financial professional who specializes in bond verification. They can examine the bond’s security features, check its serial number against records, and confirm its validity. [See also: Understanding Bond Authentication Procedures]

Determine the Bond’s Value

The value of a bearer bond depends on several factors, including its face value, maturity date, interest rate, and the issuer’s creditworthiness. Even if the bond is authentic, its value may have changed over time. Obtain a professional appraisal to determine the bond’s current market value. This will help you understand what to expect when you attempt to cash it in and ensure you receive a fair price. A financial advisor or broker specializing in fixed-income securities can assist with this process. Knowing the bond’s accurate value is a critical part of understanding how to cash in bearer bonds.

Locate a Financial Institution Willing to Handle Bearer Bonds

Finding a financial institution willing to cash in a bearer bond can be challenging due to the regulatory scrutiny surrounding them. Many banks and brokerage firms no longer handle these types of securities. Research institutions that specialize in handling older or less common financial instruments. Be prepared to provide extensive documentation and undergo thorough due diligence checks. Contact several institutions to inquire about their policies and procedures regarding bearer bonds. The key is to be persistent and patient, as the process may take time. This is a crucial step in learning how to cash in bearer bonds.

Gather Required Documentation

When attempting to cash in a bearer bond, you’ll need to provide extensive documentation to satisfy anti-money laundering (AML) and know-your-customer (KYC) regulations. This may include:

- Proof of Identity: Government-issued identification, such as a passport or driver’s license.

- Proof of Ownership: Documentation demonstrating how you came into possession of the bond (e.g., inheritance documents, gift records).

- Source of Funds: Information about the origin of the funds used to purchase the bond, if known.

- Tax Identification Number (TIN): Your Social Security number or other relevant tax identification number.

The financial institution may also require additional documentation depending on the circumstances. Be prepared to provide as much information as possible to facilitate the process. A lack of documentation can significantly delay or even prevent you from cashing in bearer bonds.

Comply with Due Diligence Requirements

Financial institutions are required to conduct thorough due diligence on individuals attempting to cash in bearer bonds. This may involve background checks, verification of the information provided, and scrutiny of the bond’s history. Cooperate fully with the institution’s requests and provide accurate and complete information. Any inconsistencies or red flags could raise suspicion and lead to further investigation. Understanding how to cash in bearer bonds includes understanding the rigorous compliance requirements.

Consider Tax Implications

Cashing in bearer bonds can have significant tax implications. The interest earned on the bond and any capital gains realized upon redemption are subject to taxation. Consult with a tax advisor to understand your tax obligations and ensure you comply with all applicable laws. Failure to properly report income from bearer bonds can result in penalties and legal consequences. It’s essential to plan your financial strategy accordingly to minimize your tax burden. [See also: Tax Implications of Bond Investments]

Be Aware of Potential Scams

The market for bearer bonds can attract scammers and fraudsters. Be wary of individuals or organizations offering to cash in your bond for a fee or promising unrealistically high returns. Always conduct thorough research and verify the legitimacy of any entity you deal with. Never provide sensitive personal or financial information to unknown parties. If something seems too good to be true, it probably is. Protect yourself from becoming a victim of fraud when cashing in bearer bonds.

Alternatives to Cashing In Bearer Bonds

If you’re unable to find a financial institution willing to cash in your bearer bond, or if the process is too cumbersome, you may consider alternative options:

- Private Sale: Attempt to sell the bond to a private investor or collector. However, this may be difficult due to the limited market for bearer bonds.

- Donation: Donate the bond to a charitable organization. You may be able to claim a tax deduction for the donation, but consult with a tax advisor to determine the eligibility and value of the deduction.

- Hold Until Maturity: If the bond is close to maturity, you may choose to hold it until the maturity date and then attempt to redeem it. However, this may still be challenging due to the regulatory issues discussed earlier.

The Future of Bearer Bonds

The future of bearer bonds is uncertain. While they were once a popular investment vehicle, their use has been significantly curtailed due to regulatory concerns. It is unlikely that they will regain their former prominence in the financial markets. As governments continue to crack down on financial crime, the regulations surrounding bearer bonds are likely to become even stricter. Understanding how to cash in bearer bonds is increasingly important for those who still possess them.

Conclusion

Cashing in bearer bonds can be a complex and challenging process. It requires patience, persistence, and a thorough understanding of the regulatory landscape. By following the steps outlined in this guide and seeking professional advice, you can increase your chances of successfully redeeming your bond and navigating the associated legal and financial complexities. Remember to verify the bond’s authenticity, determine its value, gather the required documentation, and comply with due diligence requirements. Be aware of potential scams and consult with a tax advisor to understand the tax implications. While the process may be difficult, with careful planning and execution, you can successfully cash in bearer bonds.