How to Cash In Bearer Bonds: A Comprehensive Guide

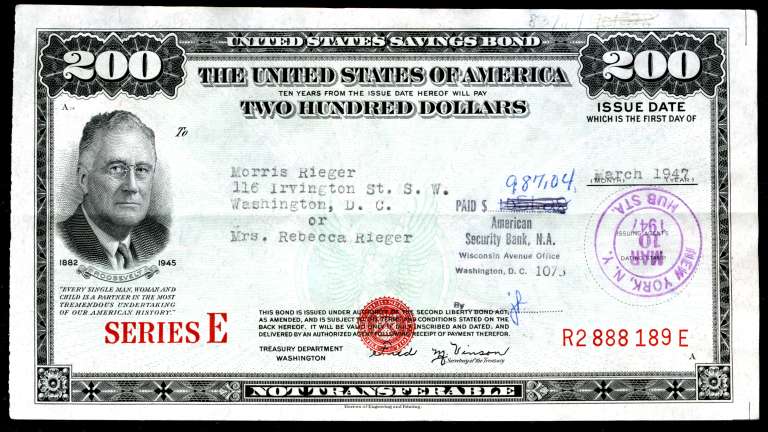

Bearer bonds, once a popular investment vehicle, represent a unique piece of financial history. Unlike registered bonds, bearer bonds are not recorded in the owner’s name. Ownership is determined solely by possession of the physical certificate. This characteristic, while offering anonymity, also presents challenges when it comes to cashing them in. This guide provides a comprehensive overview of how to cash in bearer bonds, covering everything from identifying valid bonds to navigating the redemption process.

Understanding Bearer Bonds

Before diving into the process of cashing in, it’s crucial to understand what bearer bonds are and why they are relatively rare today. These bonds were issued with attached coupons that the holder would detach and redeem for interest payments. The principal amount was paid out upon maturity when the bond itself was presented. The anonymity offered by bearer bonds made them attractive to some, but also susceptible to misuse, leading to their decline in popularity and eventual discontinuation in many jurisdictions.

Key Characteristics of Bearer Bonds

- Anonymity: Ownership is determined by possession.

- Physical Certificates: Exist as physical documents.

- Coupon Payments: Interest is paid via detachable coupons.

- Maturity Date: Principal is paid upon presenting the bond at maturity.

Identifying Valid Bearer Bonds

The first step in how to cash in bearer bonds is verifying its validity. This involves several steps to ensure the bond is genuine and still redeemable. Many bearer bonds have matured, rendering them worthless. Others may have been called (redeemed early) or lost their value for other reasons.

Steps to Verify a Bearer Bond

- Examine the Certificate: Check for the issuing entity (government or corporation), face value, interest rate, and maturity date.

- Check for Call Provisions: Some bonds may have been called before maturity. Contact the issuer or a financial professional to determine if this occurred.

- Research the Issuer: Determine if the issuing entity still exists and is solvent. If the issuer no longer exists, the bond may be worthless.

- Consult a Financial Advisor: A financial advisor with experience in fixed-income securities can provide valuable assistance in verifying the bond’s authenticity and value.

Locating the Issuer or Paying Agent

Once you’ve confirmed the bond’s validity, the next step in how to cash in bearer bonds is to locate the issuer or paying agent. This can be challenging, especially for older bonds. The issuer is the entity that originally issued the bond (e.g., a corporation or government). The paying agent is the entity designated to make payments on behalf of the issuer.

Methods to Find the Issuer or Paying Agent

- Examine the Bond Certificate: The certificate may contain contact information for the issuer or paying agent.

- Research Online: Search online for the issuer’s name and the terms “investor relations” or “bondholder information.”

- Contact a Brokerage Firm: A brokerage firm may be able to assist in locating the issuer or paying agent.

- Use Bond Databases: Some financial databases contain information on historical bond issues, including issuer details.

The Redemption Process

After locating the issuer or paying agent, you can begin the redemption process. This typically involves submitting the physical bond certificate and any remaining coupons to the designated entity. It’s crucial to follow their specific instructions carefully to ensure a smooth redemption process. Understanding how to cash in bearer bonds also involves being prepared for potential delays or complications.

Steps in the Redemption Process

- Contact the Issuer/Paying Agent: Inquire about their specific redemption procedures and required documentation.

- Prepare the Bond Certificate: Ensure the certificate is in good condition and that all remaining coupons are attached.

- Submit the Bond: Send the bond certificate and required documentation to the issuer or paying agent via registered mail or another secure method. Keep a copy for your records.

- Wait for Payment: The issuer or paying agent will process the redemption and issue payment, typically via check or electronic transfer.

Tax Implications

Cashing in bearer bonds can have tax implications. The interest earned over the years and the redemption proceeds are generally taxable as income. It’s essential to consult with a tax professional to understand the specific tax rules that apply to your situation and ensure you comply with all applicable tax laws. Knowing how to cash in bearer bonds also means understanding the tax consequences.

Key Tax Considerations

- Interest Income: Interest earned on the bond is taxable as ordinary income.

- Capital Gains: If you sell the bond for more than you paid for it, the difference is a capital gain, which may be subject to capital gains tax.

- Reporting Requirements: You must report the interest income and any capital gains on your tax return.

Potential Challenges and Solutions

How to cash in bearer bonds isn’t always straightforward. Several challenges can arise during the redemption process. These challenges can range from difficulty locating the issuer to dealing with lost or damaged bond certificates.

Common Challenges

- Issuer No Longer Exists: If the issuer has gone out of business, it may be difficult to redeem the bond.

- Lost or Damaged Certificate: Replacing a lost or damaged bearer bond certificate can be a complex and time-consuming process.

- Difficulty Locating the Issuer: Finding the current contact information for the issuer or paying agent can be challenging, especially for older bonds.

- Redemption Delays: The redemption process can sometimes take longer than expected.

Potential Solutions

- Consult a Financial Advisor: A financial advisor can help you navigate the challenges of cashing in bearer bonds.

- Contact a Lost Securities Service: These services specialize in helping individuals recover lost or stolen securities, including bearer bonds.

- Persistence: Be persistent in your efforts to locate the issuer and follow up on your redemption request.

The Future of Bearer Bonds

Bearer bonds are largely a relic of the past. Due to concerns about money laundering and tax evasion, many countries have phased out or severely restricted their use. While some bearer bonds may still exist, they are becoming increasingly rare. Understanding how to cash in bearer bonds is more about dealing with historical assets than planning for future investments.

Alternatives to Bearer Bonds

For investors seeking fixed-income investments, there are many alternatives to bearer bonds that offer greater security and transparency. These include registered bonds, Treasury securities, and certificates of deposit (CDs). These options provide a clear record of ownership and are subject to greater regulatory oversight.

- Registered Bonds: Bonds registered in the owner’s name, providing a clear record of ownership.

- Treasury Securities: Bonds issued by the U.S. government, considered to be very safe investments.

- Certificates of Deposit (CDs): Savings accounts that offer a fixed interest rate for a specified period.

Conclusion

Cashing in bearer bonds can be a complex process, requiring careful research, patience, and persistence. By following the steps outlined in this guide, you can increase your chances of successfully redeeming your bearer bonds. Remember to consult with a financial advisor and tax professional to ensure you are making informed decisions and complying with all applicable laws. Understanding how to cash in bearer bonds is essential for anyone holding these historical financial instruments. Successfully navigating the process allows you to reclaim the value of your investment and close a chapter on a bygone era of finance. While bearer bonds themselves may be fading into history, the principles of responsible investing and due diligence remain as relevant as ever. [See also: Understanding Different Types of Bonds] [See also: How to Find Lost Savings Bonds] [See also: Tax Implications of Bond Investments]