How to Invest $100k to Make $1 Million: A Strategic Guide

The allure of turning $100,000 into $1 million is a common aspiration, but it requires a well-thought-out strategy, discipline, and a realistic understanding of risk and time. This isn’t about getting rich quick; it’s about making informed investment decisions that can compound over time. This article provides a roadmap for how to invest $100k to make $1 million, covering various investment options, risk management, and the importance of financial planning.

Understanding the Landscape: Risk, Time, and Returns

Before diving into specific investment strategies, it’s crucial to understand the interplay between risk, time, and potential returns. Generally, higher returns come with higher risk. To turn $100,000 into $1 million, you’ll likely need to target investments that offer above-average returns, which inherently involve greater risk. The timeframe you’re working with also significantly impacts your strategy. A longer timeframe allows for more aggressive investments, while a shorter timeframe may necessitate more conservative approaches.

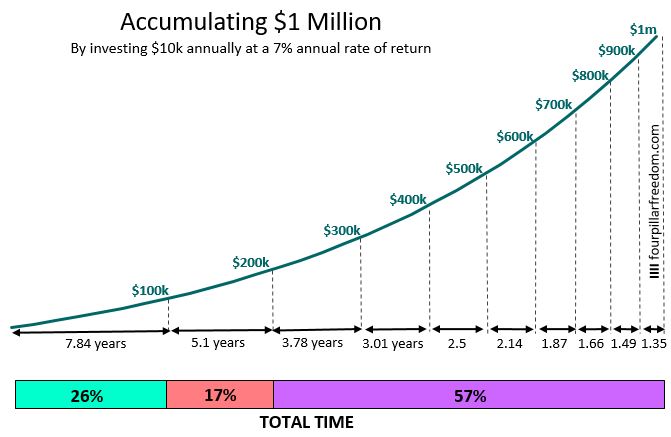

The Power of Compounding

Albert Einstein famously called compound interest the “eighth wonder of the world.” Compounding is the process of earning returns on your initial investment and then earning returns on those returns. Over time, this exponential growth can significantly increase your wealth. The longer your investment horizon, the more powerful compounding becomes. For example, if you consistently achieve an average annual return of 10%, your initial $100,000 will grow significantly over a period of 20-30 years due to compounding.

Investment Options to Consider

Several investment options can potentially help you reach your goal of turning $100k into $1 million. Each option has its own risk profile and potential return, so it’s important to diversify your portfolio and choose investments that align with your risk tolerance and time horizon.

Stocks

Investing in the stock market offers the potential for high returns. However, it also comes with significant risk. Individual stocks can be volatile, and market downturns can impact your portfolio. Consider investing in a diversified portfolio of stocks through index funds or exchange-traded funds (ETFs). These funds track a specific market index, such as the S&P 500, providing broad market exposure and reducing the risk associated with individual stock picking. For example, an S&P 500 ETF will give you exposure to 500 of the largest publicly traded companies in the United States. Furthermore, consider dividend-paying stocks. Dividends provide a steady stream of income and can be reinvested to further accelerate compounding. [See also: Dividend Investing Strategies for Beginners]

Real Estate

Real estate can be a lucrative investment, offering both rental income and potential appreciation in value. Investing in rental properties can provide a steady stream of cash flow, while also building equity over time. However, real estate investing requires significant capital, and managing properties can be time-consuming. Consider investing in real estate investment trusts (REITs) as an alternative. REITs are companies that own or finance income-producing real estate across a range of property sectors. They offer diversification and liquidity, making them an attractive option for investors looking to gain exposure to the real estate market without directly owning properties. REITs can be publicly traded, providing easy access for investors.

Bonds

Bonds are generally considered less risky than stocks, but they also offer lower potential returns. Bonds can provide stability to your portfolio and generate income through interest payments. Consider investing in a mix of government bonds and corporate bonds. Government bonds are backed by the full faith and credit of the issuing government and are generally considered very safe. Corporate bonds are issued by companies and offer higher yields than government bonds, but they also carry more risk. The risk associated with corporate bonds varies based on the creditworthiness of the issuing company. Diversifying your bond portfolio can help mitigate risk. [See also: Understanding Bond Yields and Interest Rates]

Alternative Investments

Alternative investments, such as private equity, venture capital, and hedge funds, can offer the potential for high returns, but they also come with significant risk and illiquidity. These investments are typically only available to accredited investors, who meet certain income or net worth requirements. Private equity involves investing in private companies, while venture capital focuses on early-stage startups. Hedge funds employ a variety of investment strategies to generate returns, including short selling, leverage, and derivatives. Due to their complexity and risk, alternative investments should only be considered by sophisticated investors with a high risk tolerance and a long-term investment horizon.

Starting a Business

Investing in your own business can provide the greatest potential return, but it also carries the highest risk. Starting a successful business requires significant time, effort, and capital. However, if you have a strong business idea and the entrepreneurial skills to execute it, starting a business can be a highly rewarding investment. Consider bootstrapping your business initially to minimize risk and retain more control. Bootstrapping involves using your own savings and cash flow to fund your business, rather than relying on external investors. This allows you to maintain ownership and avoid diluting your equity. [See also: How to Write a Business Plan]

Crafting Your Investment Strategy

Turning $100k into $1 million requires a strategic approach that considers your risk tolerance, time horizon, and financial goals. Here’s a framework for developing your investment strategy:

Assess Your Risk Tolerance

Before making any investment decisions, it’s crucial to assess your risk tolerance. Are you comfortable with the possibility of losing some or all of your investment in exchange for the potential for higher returns? Or do you prefer a more conservative approach that prioritizes capital preservation? Your risk tolerance will influence the types of investments you choose and the allocation of your portfolio. A risk-averse investor may prefer a portfolio heavily weighted towards bonds, while a risk-tolerant investor may allocate a larger portion of their portfolio to stocks or alternative investments.

Define Your Time Horizon

Your time horizon is the length of time you plan to invest your money. A longer time horizon allows for more aggressive investments, as you have more time to recover from any potential losses. A shorter time horizon may necessitate a more conservative approach, as you have less time to recover from market downturns. If you have a long time horizon (e.g., 20-30 years), you can afford to take on more risk in the pursuit of higher returns. If you have a shorter time horizon (e.g., 5-10 years), you may need to prioritize capital preservation and focus on lower-risk investments.

Diversify Your Portfolio

Diversification is the key to managing risk in your investment portfolio. By diversifying across different asset classes, industries, and geographic regions, you can reduce the impact of any single investment on your overall portfolio. A well-diversified portfolio should include a mix of stocks, bonds, real estate, and potentially alternative investments. The specific allocation of your portfolio will depend on your risk tolerance and time horizon. For example, you might consider allocating 60% of your portfolio to stocks, 30% to bonds, and 10% to real estate.

Rebalance Your Portfolio Regularly

Over time, the allocation of your portfolio may drift away from your target allocation due to market fluctuations. For example, if stocks perform well, they may become a larger portion of your portfolio than you initially intended. Rebalancing involves selling some of your winning investments and buying more of your losing investments to bring your portfolio back to its target allocation. Rebalancing helps you maintain your desired risk level and can also improve your long-term returns. It’s generally recommended to rebalance your portfolio at least annually.

The Role of Professional Advice

Investing can be complex, and it’s often beneficial to seek professional advice from a financial advisor. A financial advisor can help you assess your risk tolerance, define your financial goals, and develop a personalized investment strategy. They can also provide ongoing guidance and support as your financial situation changes. When choosing a financial advisor, it’s important to find someone who is qualified, experienced, and trustworthy. Look for advisors who are certified financial planners (CFPs) or chartered financial analysts (CFAs). Also, be sure to understand their fees and compensation structure. Some advisors charge a percentage of assets under management, while others charge an hourly fee or a flat fee.

Staying the Course: Discipline and Patience

Turning $100k into $1 million is a long-term endeavor that requires discipline and patience. It’s important to stay focused on your long-term goals and avoid making impulsive decisions based on short-term market fluctuations. Market downturns are inevitable, and it’s important to remain calm and avoid selling your investments out of fear. Instead, view market downturns as opportunities to buy more of your favorite investments at lower prices. Remember that compounding takes time, and the longer you stay invested, the more powerful it becomes.

Tracking Your Progress

Regularly tracking your progress is essential to staying motivated and on track towards your goal. Monitor your portfolio’s performance and compare it to your benchmark. Are you achieving your target returns? Are you on track to reach your goal of $1 million? If not, you may need to adjust your investment strategy. Consider using financial planning software or working with a financial advisor to track your progress and stay on track. Regular progress reports can provide valuable insights and help you make informed decisions.

Conclusion: A Journey of Strategic Investing

Turning $100k into $1 million is an ambitious but achievable goal. It requires a well-defined investment strategy, a disciplined approach, and a long-term perspective. By understanding the interplay between risk, time, and returns, diversifying your portfolio, and seeking professional advice when needed, you can increase your chances of success. Remember that investing is a journey, not a destination. Stay focused on your goals, stay disciplined, and be patient, and you can achieve your financial dreams. Investing $100k to make $1 million is achievable with careful planning and execution.