Investing in the S&P 500 with Vanguard: A Comprehensive Guide

The S&P 500 is a stock market index that tracks the performance of 500 of the largest publicly traded companies in the United States. It’s widely regarded as one of the best single gauges of large-cap U.S. equities. For investors looking to gain broad market exposure, investing in the S&P 500 through Vanguard offers a convenient and cost-effective solution. This article provides a comprehensive guide to understanding the S&P 500 and how to invest in it using Vanguard’s various investment vehicles.

Understanding the S&P 500 Index

The Standard & Poor’s 500 (S&P 500) is a market-capitalization-weighted index, meaning companies with larger market caps have a greater influence on the index’s performance. The index includes leading companies across various sectors, providing a diversified representation of the U.S. economy. Investing in the S&P 500 Vanguard ETFs or mutual funds allows you to own a small piece of each of these companies, effectively diversifying your investment portfolio.

The S&P 500 is not static; its composition changes periodically as companies are added and removed based on factors such as market capitalization, liquidity, and sector representation. This dynamic nature ensures that the index remains a relevant benchmark for the U.S. stock market.

Why Invest in the S&P 500?

Investing in the S&P 500 offers several potential benefits:

- Diversification: Gain exposure to a broad range of companies and sectors, reducing the risk associated with investing in individual stocks.

- Low Cost: Vanguard S&P 500 funds typically have very low expense ratios, minimizing investment costs.

- Long-Term Growth Potential: Historically, the S&P 500 has delivered strong long-term returns, making it a suitable investment for retirement planning and other long-term goals.

- Simplicity: Investing in an S&P 500 index fund is a simple and straightforward way to participate in the stock market without the need for extensive research or stock picking.

- Transparency: The composition of the S&P 500 is publicly available, allowing investors to understand what they are investing in.

Vanguard: A Leader in Low-Cost Investing

Vanguard is a well-respected investment management company known for its low-cost index funds and ETFs. Founded by John C. Bogle, Vanguard revolutionized the investment industry by offering index funds that track market indexes like the S&P 500 at significantly lower costs than actively managed funds. Vanguard’s ownership structure, where the funds are owned by their investors, allows them to prioritize investor interests and maintain low expense ratios.

Vanguard’s S&P 500 Investment Options

Vanguard offers several ways to invest in the S&P 500, including:

Vanguard S&P 500 ETF (VOO)

The Vanguard S&P 500 ETF (VOO) is an exchange-traded fund that seeks to track the performance of the S&P 500 index. ETFs trade like stocks on exchanges, offering intraday liquidity and flexibility. VOO is one of the most popular and liquid S&P 500 ETFs, making it easy to buy and sell shares.

Vanguard S&P 500 Index Fund Admiral Shares (VFIAX)

The Vanguard S&P 500 Index Fund Admiral Shares (VFIAX) is a mutual fund that also tracks the S&P 500. Mutual funds are priced once per day after the market closes. Admiral Shares typically have lower expense ratios than Investor Shares, but they often require a higher minimum investment.

Vanguard S&P 500 Index Fund Investor Shares (VFINX)

The Vanguard S&P 500 Index Fund Investor Shares (VFINX) is another mutual fund option. While it tracks the same index as VFIAX, VFINX usually has a slightly higher expense ratio and a lower minimum investment requirement, making it accessible to a wider range of investors.

How to Invest in Vanguard S&P 500 Funds

Investing in Vanguard S&P 500 funds is a straightforward process:

- Open a Vanguard Account: You can open an account directly with Vanguard through their website. You’ll need to provide personal information and choose the type of account you want to open (e.g., taxable brokerage account, IRA, Roth IRA).

- Fund Your Account: Once your account is open, you’ll need to fund it with cash. You can transfer funds electronically from your bank account or mail a check.

- Choose Your Investment: Decide whether you want to invest in the Vanguard S&P 500 ETF (VOO) or one of the Vanguard S&P 500 index funds (VFIAX or VFINX). Consider factors such as your investment horizon, minimum investment requirements, and preferred trading style.

- Place Your Order: If you choose VOO, you can place a buy order through your brokerage account like you would for any other stock. If you choose VFIAX or VFINX, you can purchase shares directly through Vanguard’s website.

- Reinvest Dividends (Optional): Consider reinvesting any dividends you receive back into the fund to take advantage of compounding growth.

Factors to Consider Before Investing

Before investing in the S&P 500 Vanguard or any other investment, it’s essential to consider your individual circumstances and investment goals:

- Risk Tolerance: Understand your risk tolerance and investment horizon. The S&P 500 is generally considered a moderate-risk investment, but it’s important to be comfortable with the potential for market fluctuations.

- Investment Goals: Determine your investment goals and how the S&P 500 fits into your overall financial plan.

- Time Horizon: Consider your time horizon. The S&P 500 is typically a long-term investment, and you should be prepared to hold it for several years to realize its full potential.

- Expense Ratio: Pay attention to the expense ratio of the fund you choose. Lower expense ratios mean more of your investment returns go to you. Vanguard S&P 500 funds are known for their low expense ratios.

- Tax Implications: Understand the tax implications of investing in the S&P 500, particularly if you are investing in a taxable brokerage account.

The Importance of Dollar-Cost Averaging

Dollar-cost averaging is a strategy where you invest a fixed amount of money at regular intervals, regardless of the market price. This can help reduce the risk of investing a large sum of money at the wrong time and can potentially lead to better long-term returns. Consider using dollar-cost averaging when investing in the S&P 500 Vanguard.

Potential Risks of Investing in the S&P 500

While investing in the S&P 500 offers numerous benefits, it’s important to be aware of the potential risks:

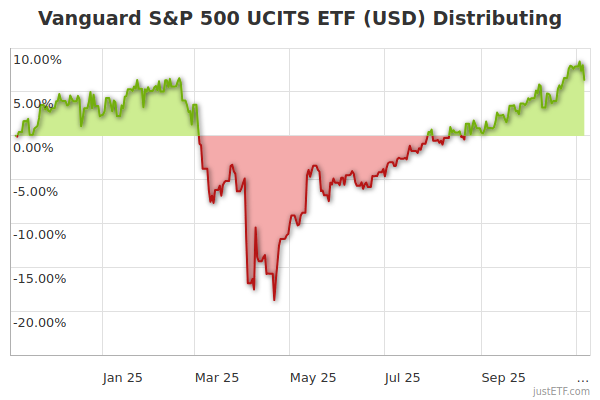

- Market Risk: The S&P 500 is subject to market risk, meaning its value can fluctuate based on economic conditions, investor sentiment, and other factors.

- Economic Downturns: During economic downturns, the S&P 500 can experience significant declines.

- Inflation Risk: Inflation can erode the purchasing power of your investment returns.

- Interest Rate Risk: Changes in interest rates can impact the value of stocks and the S&P 500.

Alternatives to Investing in the S&P 500

While the S&P 500 is a popular investment option, there are alternatives to consider:

- Total Stock Market Index Funds: These funds track a broader range of stocks than the S&P 500, including small-cap and mid-cap companies.

- International Stock Funds: These funds invest in companies outside the United States, providing diversification across different economies.

- Bond Funds: Bond funds invest in fixed-income securities, offering a more conservative investment option.

- Real Estate Investment Trusts (REITs): REITs invest in real estate properties, providing exposure to the real estate market.

[See also: Understanding Expense Ratios in Index Funds]

[See also: How to Choose the Right Vanguard Fund for Your Portfolio]

Conclusion

Investing in the S&P 500 through Vanguard offers a simple, low-cost, and diversified way to participate in the U.S. stock market. By understanding the index, Vanguard’s investment options, and the potential risks and rewards, you can make informed decisions about whether investing in the S&P 500 Vanguard is right for you. Remember to consider your individual circumstances, investment goals, and risk tolerance before making any investment decisions. Always consult with a qualified financial advisor for personalized advice. The S&P 500 through Vanguard remains a cornerstone investment for many, offering exposure to some of the largest and most influential companies in the United States. With careful planning and a long-term perspective, investing in the S&P 500 can be a valuable component of a well-diversified investment portfolio.