Investing in the Vanguard S&P 500 ETF: A Comprehensive Guide

The Vanguard S&P 500 ETF (VOO) is a popular and efficient way for investors to gain broad exposure to the U.S. stock market. Tracking the Standard & Poor’s 500 index, VOO offers diversification across 500 of the largest publicly traded companies in the United States. This exchange-traded fund (ETF) is known for its low expense ratio and its ability to closely replicate the performance of its benchmark index. For many, the Vanguard S&P 500 is the cornerstone of their investment portfolio. This comprehensive guide will delve into the specifics of the Vanguard S&P 500 ETF, covering its benefits, risks, performance, and how it fits into a well-rounded investment strategy. We will explore why the Vanguard S&P 500 ETF is a favorite among both beginner and experienced investors.

Understanding the S&P 500 Index

Before diving into the specifics of the Vanguard S&P 500 ETF, it’s crucial to understand the underlying index it tracks: the S&P 500. This index represents the market capitalization-weighted performance of 500 of the largest publicly traded companies in the U.S. It is widely regarded as a benchmark for the overall health and performance of the U.S. stock market. The S&P 500 is not simply a list of the 500 largest companies; rather, it is a selection chosen by a committee at S&P Dow Jones Indices. The committee considers factors such as market capitalization, liquidity, and sector representation to ensure the index accurately reflects the U.S. economy.

The index is rebalanced periodically to reflect changes in the market. Companies can be added or removed based on their market capitalization and other criteria. This dynamic nature ensures that the index remains relevant and representative over time. Investing in an S&P 500 index fund, like the Vanguard S&P 500 ETF, essentially means you are investing in a diversified portfolio of the largest and most influential companies in the U.S. economy.

Key Features of the Vanguard S&P 500 ETF (VOO)

The Vanguard S&P 500 ETF (VOO) offers several key features that make it an attractive investment option:

- Low Expense Ratio: VOO boasts a very low expense ratio, typically around 0.03%. This means that for every $10,000 invested, you’ll pay only $3 in annual fees. This low cost is a significant advantage, especially over the long term, as it minimizes the impact of fees on your investment returns.

- Diversification: By tracking the S&P 500, VOO provides instant diversification across 500 different companies spanning various sectors of the U.S. economy. This diversification helps to reduce risk compared to investing in individual stocks.

- Liquidity: As an ETF, VOO is highly liquid, meaning you can easily buy and sell shares on the stock market during trading hours. This liquidity provides flexibility and allows you to quickly adjust your investment portfolio as needed.

- Transparency: The holdings of VOO are publicly available, so you always know what companies you are invested in. This transparency allows you to make informed decisions about your investment.

- Tax Efficiency: ETFs are generally more tax-efficient than mutual funds. VOO is structured to minimize capital gains distributions, which can help to reduce your tax burden.

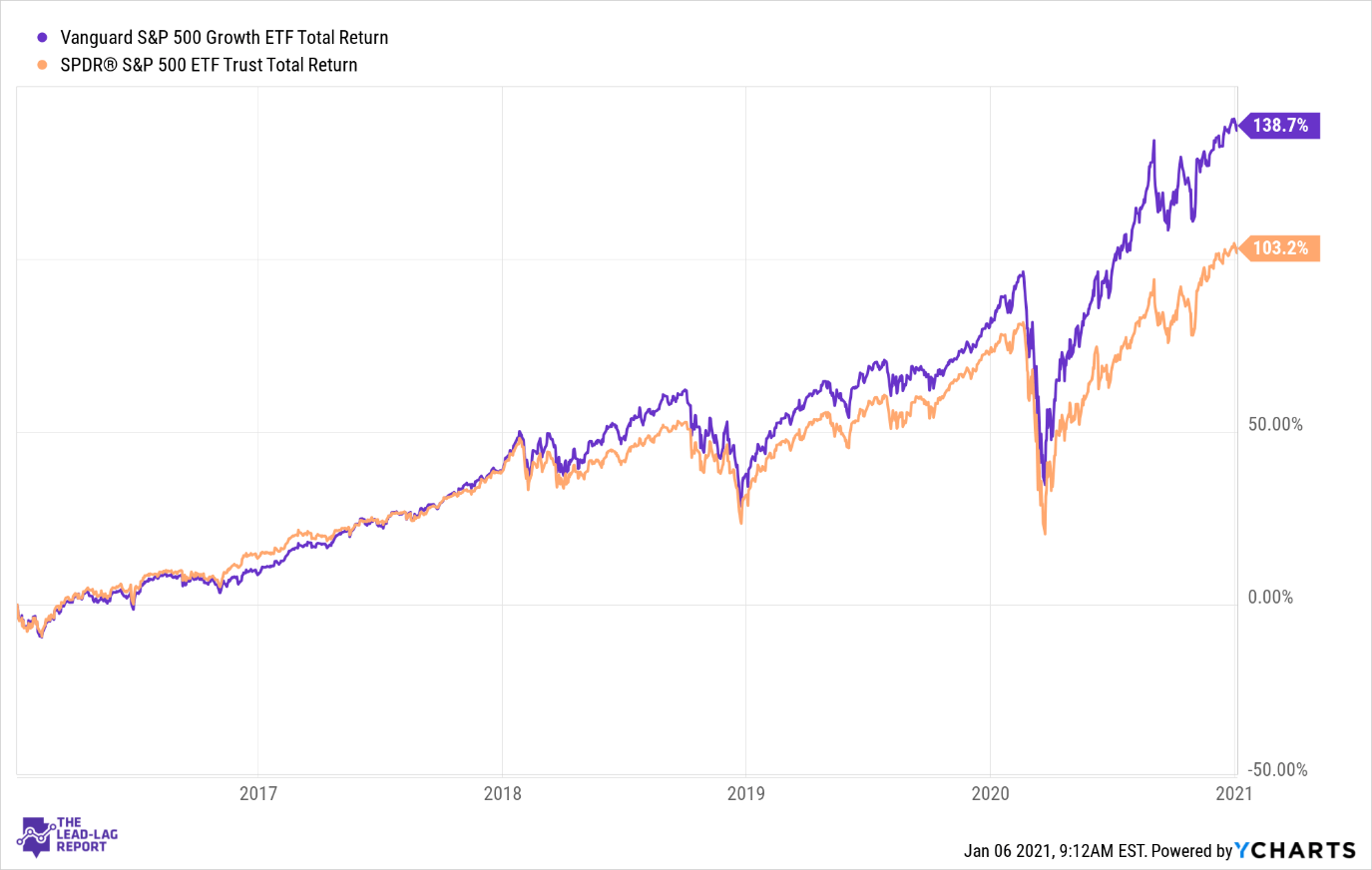

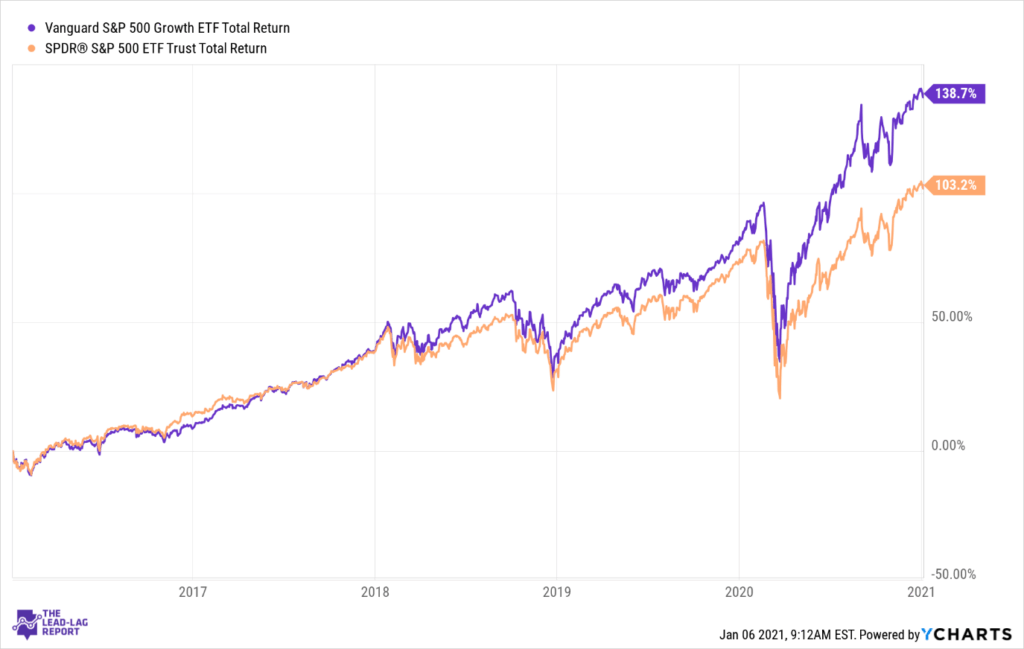

Performance of the Vanguard S&P 500 ETF

The historical performance of the Vanguard S&P 500 ETF has been strong, closely mirroring the returns of the S&P 500 index. Past performance is not indicative of future results, but it provides a general idea of what to expect from this investment. Over the long term, the S&P 500 has historically delivered average annual returns of around 10%. However, it’s important to remember that the stock market experiences fluctuations, and there will be periods of both gains and losses. Investors should be prepared for market volatility and have a long-term investment horizon.

To analyze the performance of the Vanguard S&P 500 ETF, consider factors such as its annual returns, expense ratio, and tracking error (the difference between the ETF’s performance and the performance of the S&P 500 index). A lower tracking error indicates that the ETF is effectively replicating the performance of its benchmark index. You can find detailed performance data on Vanguard’s website or through financial data providers.

Benefits of Investing in the Vanguard S&P 500 ETF

Investing in the Vanguard S&P 500 ETF offers numerous benefits:

- Broad Market Exposure: Gain exposure to a wide range of leading U.S. companies, providing diversification and reducing individual stock risk.

- Low Cost: The low expense ratio minimizes investment costs, allowing you to keep more of your returns.

- Simplicity: Investing in VOO is simple and straightforward, making it an ideal choice for both beginner and experienced investors.

- Long-Term Growth Potential: The S&P 500 has historically delivered strong long-term returns, offering the potential for significant wealth accumulation.

- Easy Accessibility: VOO is easily accessible through most brokerage accounts, making it convenient to buy and sell shares.

Risks Associated with Investing in the Vanguard S&P 500 ETF

While the Vanguard S&P 500 ETF offers many benefits, it’s also important to be aware of the potential risks:

- Market Risk: The value of VOO can fluctuate with the overall stock market. Economic downturns, political events, and other factors can negatively impact the performance of the S&P 500 and, consequently, the value of your investment.

- Concentration Risk: While VOO provides diversification across 500 companies, the index is market capitalization-weighted, meaning that larger companies have a greater influence on the ETF’s performance. This can lead to concentration risk, where a few large companies disproportionately impact the overall return.

- Inflation Risk: Inflation can erode the purchasing power of your investment returns. If the rate of inflation exceeds the rate of return on VOO, your real returns will be negative.

- Interest Rate Risk: Rising interest rates can negatively impact the stock market, as higher rates can make bonds more attractive to investors and increase borrowing costs for companies.

How to Invest in the Vanguard S&P 500 ETF

Investing in the Vanguard S&P 500 ETF is a straightforward process:

- Open a Brokerage Account: Choose a reputable brokerage firm that offers access to ETFs. Popular options include Vanguard, Fidelity, Charles Schwab, and online brokers like Robinhood and Webull.

- Fund Your Account: Deposit funds into your brokerage account via electronic transfer, check, or wire transfer.

- Search for VOO: Use the ticker symbol “VOO” to find the Vanguard S&P 500 ETF in your brokerage platform.

- Place Your Order: Specify the number of shares you want to purchase and place your order. You can choose between a market order (to buy shares at the current market price) or a limit order (to buy shares at a specific price).

- Monitor Your Investment: Regularly monitor the performance of your VOO investment and rebalance your portfolio as needed to maintain your desired asset allocation.

Incorporating the Vanguard S&P 500 ETF into Your Portfolio

The Vanguard S&P 500 ETF can be a valuable component of a well-diversified investment portfolio. It is often used as a core holding to provide broad market exposure to U.S. equities. Consider the following when incorporating VOO into your portfolio:

- Asset Allocation: Determine your desired asset allocation based on your risk tolerance, investment goals, and time horizon. Allocate a portion of your portfolio to VOO based on your overall investment strategy.

- Diversification: While VOO provides diversification within the U.S. stock market, it’s important to diversify across different asset classes, such as bonds, international stocks, and real estate.

- Rebalancing: Periodically rebalance your portfolio to maintain your desired asset allocation. This involves selling assets that have outperformed and buying assets that have underperformed to bring your portfolio back into balance.

- Long-Term Perspective: Investing in VOO is a long-term strategy. Avoid making impulsive decisions based on short-term market fluctuations. Stay focused on your long-term investment goals and maintain a disciplined approach.

Alternatives to the Vanguard S&P 500 ETF

While the Vanguard S&P 500 ETF is a popular choice, there are other options to consider:

- Other S&P 500 ETFs: Several other ETF providers offer S&P 500 index funds, such as the iShares Core S&P 500 ETF (IVV) and the SPDR S&P 500 ETF Trust (SPY). These ETFs are similar to VOO in terms of their investment objective and holdings, but they may have slightly different expense ratios or trading volumes.

- Total Stock Market ETFs: Total stock market ETFs, such as the Vanguard Total Stock Market ETF (VTI), provide even broader diversification by including small-cap and mid-cap stocks in addition to large-cap stocks.

- Mutual Funds: S&P 500 index mutual funds are another option for investing in the S&P 500. However, ETFs generally offer lower expense ratios and greater tax efficiency compared to mutual funds.

Conclusion

The Vanguard S&P 500 ETF (VOO) is a compelling investment option for those seeking broad exposure to the U.S. stock market at a low cost. Its diversification, liquidity, and tax efficiency make it a popular choice for both beginner and experienced investors. By understanding the key features, benefits, and risks of VOO, you can make informed decisions about whether it fits into your investment strategy. Remember to consider your risk tolerance, investment goals, and time horizon when incorporating VOO into your portfolio. With a long-term perspective and a disciplined approach, the Vanguard S&P 500 ETF can be a valuable tool for building wealth over time. [See also: Diversifying Your Investment Portfolio] [See also: Understanding ETF Expense Ratios] [See also: Long-Term Investment Strategies]