Investment vs. Speculation: Understanding the Key Differences

The financial world is rife with opportunities, but navigating it requires a clear understanding of the different approaches to growing wealth. Two terms often used interchangeably, yet fundamentally distinct, are investment and speculation. While both involve deploying capital with the hope of future gains, their underlying philosophies, risk profiles, and time horizons differ significantly. This article aims to dissect these differences, providing clarity for individuals seeking to make informed financial decisions. Understanding the nuances between investment vs speculation is crucial for building a resilient and successful financial strategy.

Defining Investment

Investment, at its core, is the act of allocating capital to assets with the expectation of generating income or appreciation over a longer period. Investors typically conduct thorough research and analysis to identify assets with intrinsic value and strong fundamentals. This involves evaluating factors such as financial statements, management quality, industry trends, and macroeconomic conditions. The goal is to own assets that will generate consistent returns, such as dividends, interest, or rental income, and appreciate in value over time. Common investment vehicles include stocks, bonds, real estate, and mutual funds. A key aspect of investment is a focus on the long-term.

Key Characteristics of Investment

- Long-term horizon: Investments are typically held for several years, if not decades, allowing time for the underlying assets to grow and generate returns.

- Fundamental analysis: Investors rely on in-depth research and analysis to assess the intrinsic value of assets.

- Income generation: Many investments, such as bonds and dividend-paying stocks, generate regular income streams.

- Risk management: While all investments involve some degree of risk, investors prioritize risk management through diversification and careful asset allocation.

- Value-driven: The focus is on identifying undervalued assets with the potential for long-term appreciation.

Defining Speculation

Speculation, on the other hand, involves taking on significant risk in the hope of achieving substantial short-term gains. Speculators often focus on assets with high volatility and limited fundamental value, relying on market sentiment, technical analysis, and rumors to make trading decisions. The goal is to profit from short-term price fluctuations, rather than long-term growth. Common speculative vehicles include options, futures, penny stocks, and cryptocurrencies (in certain contexts). Speculation is inherently riskier than investment.

Key Characteristics of Speculation

- Short-term horizon: Speculative positions are typically held for days, weeks, or months, with the goal of capitalizing on short-term price movements.

- Technical analysis: Speculators often rely on charting patterns and technical indicators to predict future price movements.

- Leverage: Speculators frequently use leverage to amplify their potential gains (and losses).

- High risk: Speculative ventures carry a high degree of risk, with the potential for significant losses.

- Sentiment-driven: Market sentiment and herd behavior play a significant role in speculative trading.

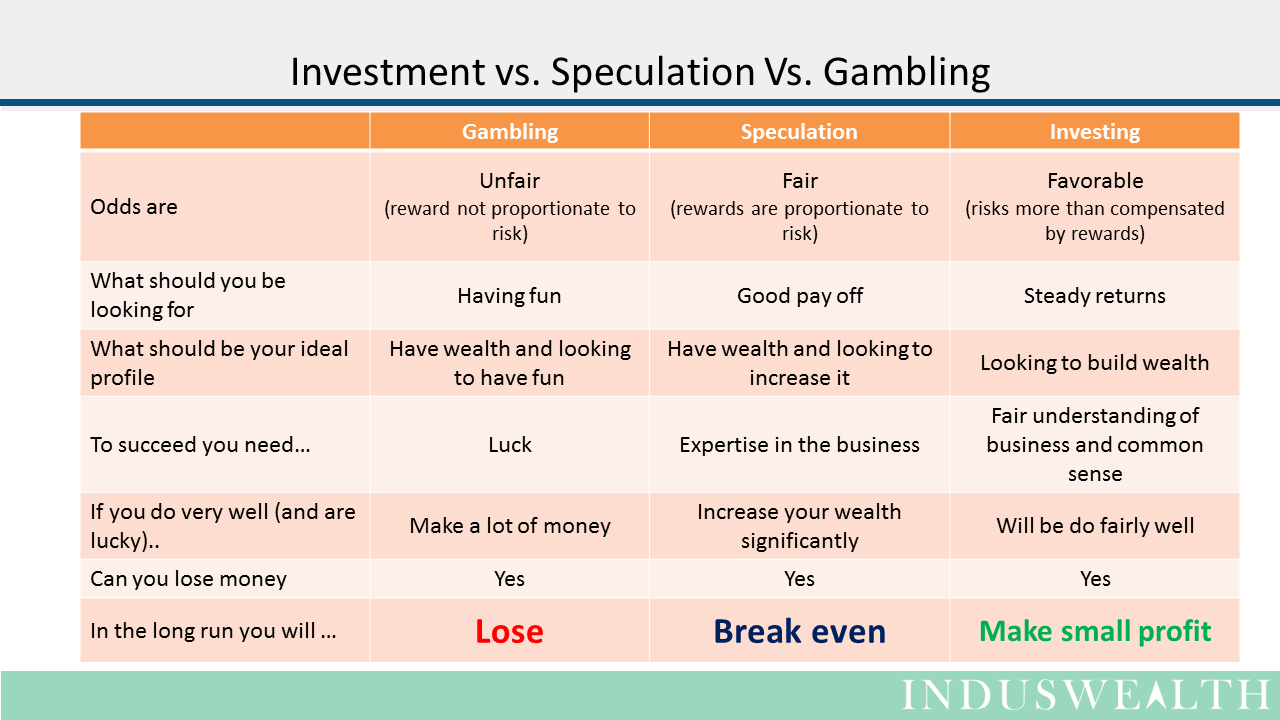

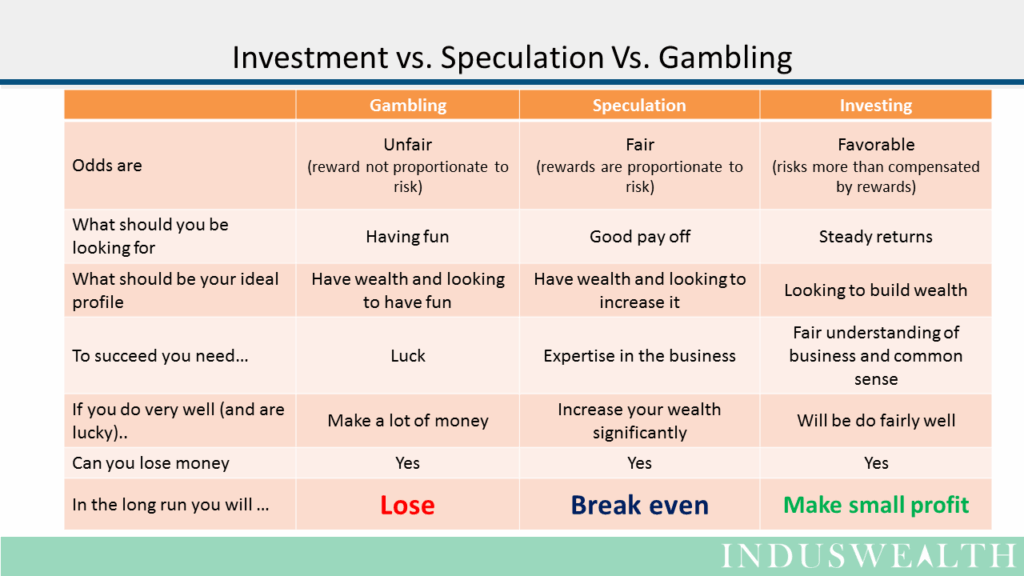

Investment vs. Speculation: A Detailed Comparison

To further illustrate the differences between investment and speculation, consider the following comparison across various key aspects:

Time Horizon

As mentioned earlier, time horizon is a critical differentiator. Investment is a long-term game, requiring patience and discipline. Investors are willing to wait years for their assets to appreciate in value. Speculation, conversely, is a short-term pursuit, driven by the desire for quick profits. Speculators are constantly monitoring market movements and are ready to buy or sell at a moment’s notice.

Risk Profile

The risk profile of investment is generally lower than that of speculation. Investors carefully assess the risks associated with each asset and diversify their portfolios to mitigate potential losses. Speculators, on the other hand, are willing to take on significant risks in the hope of achieving high returns. This can lead to substantial losses if their bets go wrong. Understanding your risk tolerance is essential before engaging in any form of investment or speculation.

Due Diligence

Investment requires thorough due diligence and fundamental analysis. Investors spend time researching companies, industries, and macroeconomic trends to make informed decisions. Speculation often relies on limited information and gut feelings. Speculators may follow market rumors or technical indicators without fully understanding the underlying fundamentals. This lack of due diligence increases the risk of losses.

Return Expectations

Investment typically involves moderate return expectations. Investors are content with consistent, steady growth over time. Speculation, on the other hand, is driven by the pursuit of high returns. Speculators are looking for quick profits and are willing to take on significant risks to achieve them. These high return expectations are often unrealistic and can lead to disappointment.

Examples

Consider a scenario where an individual purchases shares of a well-established company with a history of consistent earnings and dividend payouts. This would be considered an investment. The investor is betting on the company’s long-term growth and profitability. Now, consider another scenario where an individual purchases options contracts on a volatile stock, hoping to profit from a short-term price swing. This would be considered speculation. The speculator is betting on a specific market movement and is willing to risk losing their entire investment.

The Role of Emotion

Emotions can play a significant role in both investment and speculation. However, their impact is often more pronounced in speculative trading. Fear and greed can drive speculators to make irrational decisions, leading to impulsive buying and selling. Investors, on the other hand, are typically more disciplined and rational, relying on their research and analysis to guide their decisions. Maintaining emotional control is crucial for successful investment and avoiding costly mistakes in speculation.

Is Speculation Always Bad?

While speculation is often associated with high risk and potential losses, it is not necessarily always bad. Speculators can play a valuable role in the market by providing liquidity and price discovery. They are willing to take on risks that other investors may avoid, helping to ensure that there are always buyers and sellers available. However, it is important to approach speculation with caution and a clear understanding of the risks involved. [See also: Risk Management Strategies for Investors]

Bridging the Gap: Combining Investment and Speculation

It’s important to note that the line between investment and speculation can sometimes be blurred. Some strategies may incorporate elements of both. For example, a value investor might identify a fundamentally sound company experiencing temporary market volatility and purchase its stock with the intention of holding it for the long term. While the initial purchase might be influenced by short-term market conditions, the overall strategy remains rooted in long-term investment principles. Similarly, some day traders might employ sophisticated risk management techniques and rigorous analysis to inform their short-term trading decisions. However, it’s crucial to maintain a clear understanding of the underlying rationale and risk profile of each approach. [See also: Value Investing Principles]

Making Informed Decisions

Ultimately, the choice between investment and speculation depends on your individual financial goals, risk tolerance, and time horizon. If you are seeking long-term growth and stability, investment is likely the more appropriate approach. If you are comfortable with high risk and have the potential to lose a significant portion of your capital, speculation may be an option. However, it is crucial to conduct thorough research, understand the risks involved, and manage your emotions. Before making any financial decisions, it is always advisable to consult with a qualified financial advisor. Remember, understanding the difference between investment vs speculation is the cornerstone of sound financial planning. [See also: How to Choose a Financial Advisor]

Conclusion

Investment and speculation represent two distinct approaches to growing wealth. While both involve deploying capital with the expectation of future gains, their underlying philosophies, risk profiles, and time horizons differ significantly. Investors prioritize long-term growth, fundamental analysis, and risk management, while speculators focus on short-term price fluctuations, technical analysis, and high returns. Understanding the nuances between investment vs speculation is crucial for making informed financial decisions and building a resilient portfolio. Whether you choose to invest, speculate, or both, it is essential to do your research, manage your risks, and stay disciplined.