Investment vs. Speculation: Understanding the Key Differences

The world of finance can be complex, and it’s easy to confuse different strategies. Two terms that are often used interchangeably, but carry significantly different meanings and risk profiles, are investment and speculation. While both involve deploying capital with the hope of future gains, the underlying philosophies, time horizons, and risk tolerances are vastly different. Understanding the nuances between investment vs speculation is crucial for making informed financial decisions and achieving your long-term financial goals. This article will delve into the core distinctions between these two approaches, providing a clear framework for identifying and categorizing your own financial activities.

Defining Investment

Investment, at its core, is about deploying capital into assets with the expectation of generating income or appreciation over a reasonable period. Investors typically conduct thorough research and analysis, focusing on the intrinsic value of the asset. This might involve examining financial statements, assessing management quality, and understanding the competitive landscape. The goal is to identify fundamentally sound assets that are likely to generate consistent returns over time. Think of buying shares in a well-established company with a proven track record of profitability and dividend payments. Or purchasing a rental property with the expectation of consistent rental income and long-term appreciation. These are examples of classic investment strategies.

Key characteristics of investment include:

- Long-term horizon: Investors typically hold assets for several years, or even decades.

- Focus on intrinsic value: Investment decisions are based on a thorough assessment of the asset’s underlying value.

- Lower risk tolerance: Investors generally prioritize capital preservation and consistent returns over high-risk, high-reward opportunities.

- Income generation: Many investments are designed to generate regular income, such as dividends, interest, or rental payments.

Examples of Investment

- Stocks: Investing in the stock market involves purchasing shares of publicly traded companies.

- Bonds: Bonds are debt securities issued by governments or corporations.

- Real Estate: Investing in real estate can involve purchasing residential or commercial properties.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of assets.

- Index Funds and ETFs: These passively managed funds track a specific market index, offering broad market exposure at a low cost.

Defining Speculation

Speculation, on the other hand, involves taking on significant risk in the hope of generating substantial profits from short-term price fluctuations. Speculators are less concerned with the intrinsic value of an asset and more focused on market sentiment, technical indicators, and short-term trends. They often use leverage to amplify their potential gains (and losses). Day trading, buying penny stocks, and investing in highly volatile cryptocurrencies are often considered speculative activities. The goal is to capitalize on short-term market inefficiencies, even if the underlying asset lacks long-term fundamental value.

Key characteristics of speculation include:

- Short-term horizon: Speculators typically hold assets for a few days, weeks, or months at most.

- Focus on price movements: Speculative decisions are based on anticipated price changes, regardless of the asset’s intrinsic value.

- High risk tolerance: Speculators are willing to accept significant losses in pursuit of potentially high gains.

- Leverage: Speculators often use borrowed money to increase their potential returns (and losses).

Examples of Speculation

- Day Trading: Buying and selling securities within the same day.

- Penny Stocks: Investing in stocks of very small companies with low share prices and high volatility.

- Options Trading: Buying and selling options contracts, which give the holder the right (but not the obligation) to buy or sell an asset at a specific price.

- Futures Trading: Buying and selling futures contracts, which obligate the holder to buy or sell an asset at a specific price and date in the future.

- Certain Cryptocurrencies: Investing in newly launched or highly volatile cryptocurrencies.

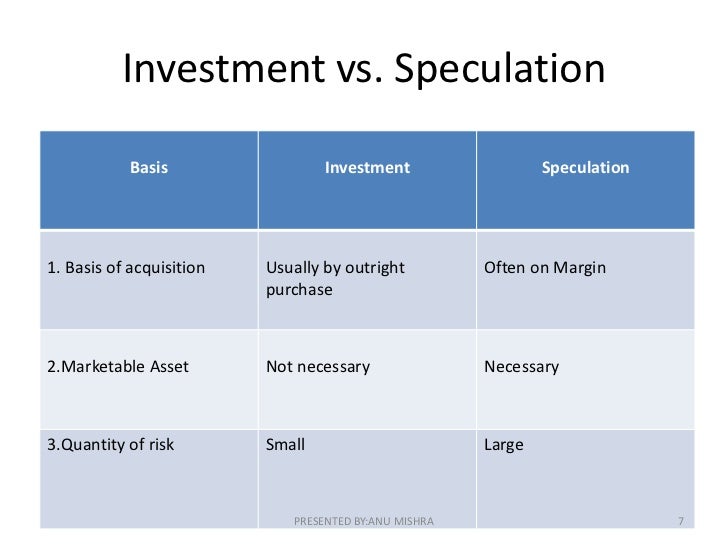

Key Differences: Investment vs. Speculation

To further clarify the distinction between investment vs speculation, let’s examine the key differences in more detail:

- Time Horizon: Investments are typically held for the long term (years or decades), while speculation is short-term (days, weeks, or months).

- Risk Tolerance: Investors have a lower risk tolerance than speculators.

- Due Diligence: Investors conduct thorough research and analysis before making investment decisions, while speculators often rely on market sentiment or technical indicators.

- Leverage: Speculators frequently use leverage to amplify their potential returns (and losses), while investors generally avoid excessive leverage.

- Focus: Investors focus on the intrinsic value of an asset, while speculators focus on price movements.

The Role of Risk

Risk is a fundamental element in both investment and speculation. However, the way risk is approached and managed differs significantly. Investors seek to mitigate risk through diversification, thorough research, and a long-term perspective. They understand that market fluctuations are inevitable but believe that fundamentally sound assets will appreciate over time. Speculators, on the other hand, embrace risk as a necessary component of potentially high returns. They are willing to accept significant losses in pursuit of quick profits.

It’s important to note that all investments carry some degree of risk. Even seemingly safe investments, such as government bonds, are subject to inflation risk and interest rate risk. However, the level of risk associated with speculation is generally much higher than that associated with investment.

The Gray Areas

While the distinction between investment vs speculation is generally clear, there are some gray areas. For example, an investor might purchase a stock with the expectation of holding it for the long term, but also be aware of short-term market trends that could affect its price. Similarly, a speculator might conduct some basic research on an asset before making a trade, even if their primary focus is on price movements. The key is to understand your own risk tolerance, investment goals, and time horizon, and to make decisions that align with those factors.

The Importance of Due Diligence

Regardless of whether you are engaging in investment or speculation, due diligence is essential. For investors, this means conducting thorough research on the assets you are considering, understanding the risks involved, and developing a long-term investment strategy. For speculators, this means understanding market trends, using risk management tools, and being prepared to accept losses. Never invest or speculate in anything you don’t understand. [See also: Understanding Risk Tolerance]

Aligning with Your Financial Goals

Ultimately, the decision of whether to engage in investment vs speculation should be based on your individual financial goals, risk tolerance, and time horizon. If you are seeking long-term growth and capital preservation, investment is likely the more appropriate approach. If you are comfortable with high risk and have a short-term focus, speculation might be an option. However, it’s crucial to understand the potential downsides and to manage your risk accordingly.

Seeking Professional Advice

If you are unsure whether a particular financial activity constitutes investment or speculation, or if you need help developing an investment strategy, it’s always a good idea to seek professional advice from a qualified financial advisor. A financial advisor can help you assess your risk tolerance, set realistic goals, and develop a plan that is tailored to your specific needs. They can also help you avoid common investment mistakes and make informed decisions about your financial future. [See also: Choosing a Financial Advisor]

Conclusion: Informed Decision-Making

Understanding the difference between investment and speculation is paramount for navigating the complexities of the financial world. While both involve deploying capital with the hope of future gains, their underlying philosophies, time horizons, and risk profiles are vastly different. By carefully considering your own goals, risk tolerance, and time horizon, and by conducting thorough due diligence, you can make informed financial decisions that align with your long-term objectives. Remember, knowledge is power, and a clear understanding of investment vs speculation will empower you to make sound financial choices.