Investment vs. Speculation: Understanding the Key Differences

The financial world is filled with opportunities, but navigating it requires a clear understanding of the different approaches to wealth building. Two terms often used interchangeably, but which carry significantly different meanings and risk profiles, are investment and speculation. This article aims to dissect these concepts, providing a comprehensive overview of their characteristics, strategies, and the crucial distinctions that every market participant should be aware of. Understanding the difference between investment and speculation is crucial for making informed decisions and managing risk effectively.

Defining Investment

Investment, in its purest form, involves allocating capital to assets with the expectation of generating future income or appreciation. This typically involves a thorough analysis of the underlying asset, considering factors such as financial performance, management quality, and market trends. The goal of investment is long-term growth and stability, prioritizing preservation of capital alongside reasonable returns. Key characteristics of investment include:

- Long-term horizon: Investments are typically held for several years, allowing the asset to mature and generate returns over time.

- Fundamental analysis: Investors conduct in-depth research to assess the intrinsic value of an asset.

- Risk aversion: While all investments carry some level of risk, investors generally prioritize lower-risk options with stable returns.

- Income generation: Many investments, such as bonds and dividend-paying stocks, provide a regular stream of income.

Examples of common investment vehicles include stocks of established companies, bonds, real estate, and mutual funds. These assets are typically chosen based on their proven track record and potential for sustainable growth.

Defining Speculation

Speculation, on the other hand, involves taking on significant risk in the hope of making a quick profit from short-term price fluctuations. Speculators are less concerned with the intrinsic value of an asset and more focused on predicting market trends and exploiting short-term opportunities. Key characteristics of speculation include:

- Short-term horizon: Speculative positions are typically held for a few days, weeks, or months at most.

- Technical analysis: Speculators often rely on charting patterns and technical indicators to identify trading opportunities.

- High risk tolerance: Speculation involves a significant risk of loss, as prices can move rapidly and unpredictably.

- Leverage: Speculators often use leverage (borrowed funds) to amplify their potential gains (and losses).

Examples of speculative activities include day trading, options trading, and investing in highly volatile assets such as cryptocurrencies or penny stocks. These activities are characterized by their high risk and potential for rapid gains or losses.

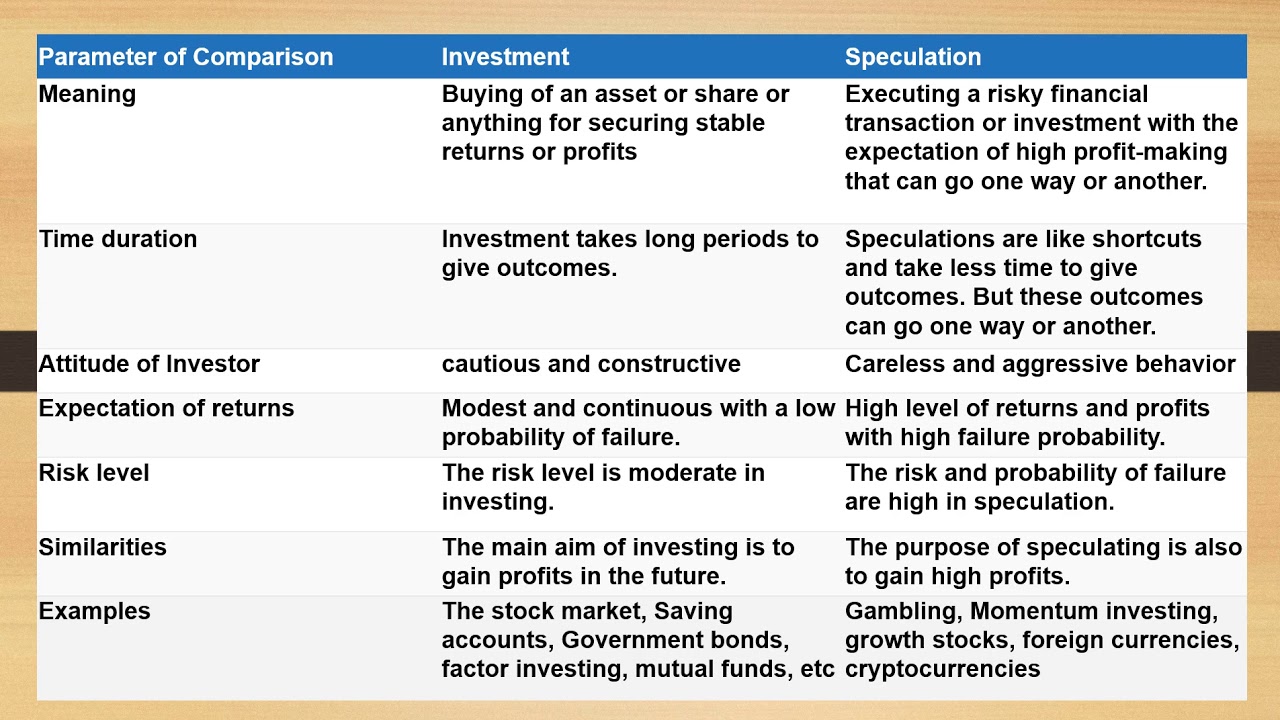

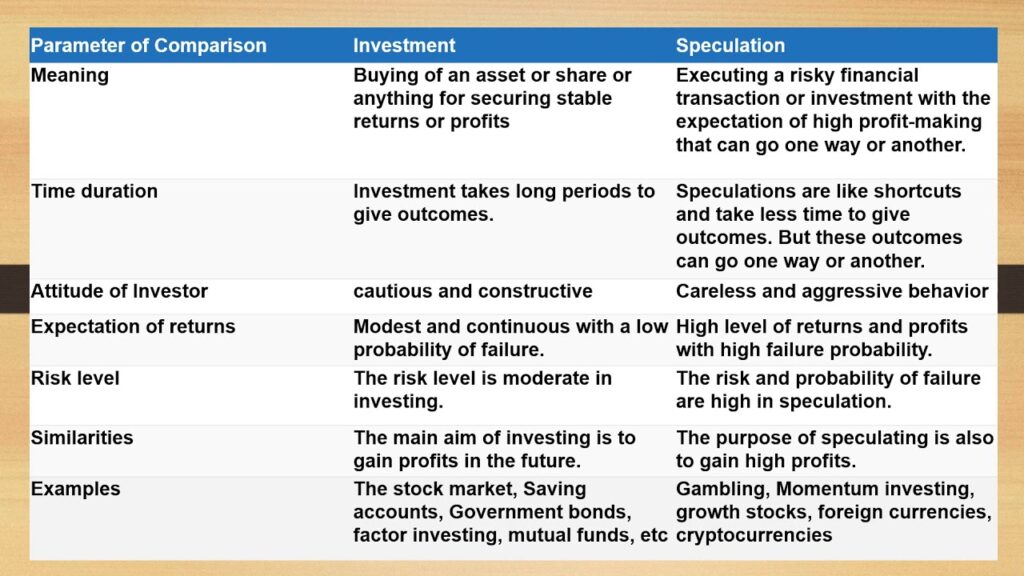

Key Differences Between Investment and Speculation

The core distinction between investment and speculation lies in the time horizon, risk tolerance, and analytical approach. Investors focus on long-term growth and preservation of capital, while speculators seek short-term profits through high-risk strategies. Here’s a table summarizing the key differences:

| Feature | Investment | Speculation |

|---|---|---|

| Time Horizon | Long-term | Short-term |

| Risk Tolerance | Low to Moderate | High |

| Analytical Approach | Fundamental Analysis | Technical Analysis |

| Goal | Long-term growth and income | Short-term profit |

| Capital Allocation | Conservative | Aggressive |

Another crucial difference is the level of due diligence involved. Investors conduct thorough research to understand the underlying value of an asset, while speculators often rely on market sentiment and short-term trends. This difference in approach can significantly impact the outcome of their financial endeavors. Understanding that investment focuses on building wealth slowly, while speculation seeks quick gains, is paramount.

The Role of Risk in Investment and Speculation

Risk is an inherent part of both investment and speculation, but the level of risk varies significantly. Investors typically seek to minimize risk by diversifying their portfolios and investing in established assets with a proven track record. They understand that returns may be lower, but the probability of significant losses is also reduced. [See also: Diversification Strategies for Long-Term Growth]

Speculators, on the other hand, are willing to take on substantial risk in pursuit of higher returns. They may invest in volatile assets, use leverage to amplify their gains, and engage in short-term trading strategies. While the potential for profit is higher, the risk of significant losses is also much greater. Successful speculation requires a deep understanding of market dynamics, disciplined risk management, and the ability to react quickly to changing conditions.

Examples of Investment vs. Speculation

Consider the following examples to illustrate the difference between investment and speculation:

- Investing: Buying shares of a well-established company like Apple (AAPL) with the intention of holding them for several years, collecting dividends, and benefiting from the company’s long-term growth. This involves analyzing Apple’s financial statements, understanding its competitive position, and assessing its future prospects.

- Speculation: Day trading penny stocks based on rumors or short-term price movements. This involves little to no fundamental analysis and relies heavily on technical indicators and market sentiment. The goal is to profit from short-term price swings, with little regard for the company’s underlying value.

- Investing: Purchasing a rental property with the intention of generating rental income and benefiting from long-term appreciation. This involves analyzing the local real estate market, assessing the property’s condition, and managing tenants.

- Speculation: Buying and quickly flipping real estate based on market hype and perceived short-term gains. This involves little to no long-term planning and relies heavily on market timing and the ability to quickly sell the property at a profit.

The Importance of Understanding Your Risk Tolerance

One of the most critical factors in determining whether to invest or speculate is understanding your own risk tolerance. Risk tolerance refers to your ability and willingness to withstand potential losses. If you are risk-averse, you should focus on low-risk investments with stable returns. If you are comfortable with higher risk, you may consider allocating a portion of your portfolio to speculative ventures. [See also: Assessing Your Risk Tolerance for Investment]

It’s important to be honest with yourself about your risk tolerance and to avoid taking on more risk than you can handle. Many investors have lost significant amounts of money by engaging in speculative activities without fully understanding the risks involved. A well-diversified portfolio that aligns with your risk tolerance is essential for long-term financial success. Always remember that both investment and speculation require knowledge; however, speculation demands more active involvement and a higher risk appetite.

Building a Balanced Portfolio

For most individuals, a balanced portfolio that combines elements of both investment and speculation is the ideal approach. This involves allocating a portion of your capital to long-term investments with stable returns, while also setting aside a smaller portion for speculative ventures with higher potential gains. The key is to carefully manage your risk and to avoid putting all your eggs in one basket. This strategy allows you to pursue growth opportunities while maintaining a solid foundation of stable assets. [See also: Building a Diversified Investment Portfolio]

A financial advisor can help you assess your risk tolerance, set financial goals, and create a customized portfolio that aligns with your individual needs and circumstances. Remember that both investment and speculation carry their own set of rewards and pitfalls. Understanding them is the first step towards financial success.

The Psychology of Investment and Speculation

The emotional aspect of investment and speculation is often overlooked, but it can play a significant role in decision-making. Fear and greed can drive investors to make irrational choices, leading to poor outcomes. It’s important to remain disciplined and to avoid letting emotions dictate your investment strategy. Speculators, in particular, are susceptible to emotional biases, as the pressure to make quick profits can lead to impulsive decisions. [See also: Overcoming Emotional Biases in Investing]

Successful investors and speculators are able to maintain a rational and objective perspective, even in the face of market volatility. They understand the importance of sticking to their strategy and avoiding the temptation to chase short-term gains. By managing their emotions and focusing on long-term goals, they can increase their chances of success. Remember, investment and speculation are both influenced by human psychology; understanding this is key to making sound financial decisions.

Conclusion

Investment and speculation are two distinct approaches to wealth building, each with its own set of characteristics, strategies, and risk profiles. While investment focuses on long-term growth and preservation of capital, speculation seeks short-term profits through high-risk ventures. Understanding the key differences between these two concepts is crucial for making informed financial decisions and managing risk effectively. By carefully assessing your risk tolerance, setting realistic goals, and building a balanced portfolio, you can increase your chances of achieving long-term financial success. Whether you choose to invest or speculate (or both), knowledge, discipline, and a clear understanding of your own risk appetite are essential for navigating the financial markets successfully. Careful consideration of the differences between investment and speculation will lead to more informed and potentially rewarding financial decisions.