IonQ Stock: Is It a Buy, Hold, or Sell?

Quantum computing is rapidly evolving from theoretical possibility to tangible reality, and IonQ (NYSE: IONQ) stands at the forefront of this technological revolution. As a publicly traded pure-play quantum computing company, IonQ has captured the attention of investors seeking exposure to this potentially transformative field. However, the question remains: is IonQ stock a buy, a hold, or a sell? This article delves into the company’s financials, technology, market position, and future prospects to provide a comprehensive analysis to help inform your investment decision.

Understanding IonQ and Quantum Computing

IonQ’s approach to quantum computing centers on trapped-ion technology, which many experts believe offers superior stability and scalability compared to other quantum computing methods like superconducting qubits. Their quantum computers are accessible through cloud platforms like Amazon Braket and Microsoft Azure Quantum, making them available to a wider range of users, including researchers, developers, and enterprises.

Quantum computing promises to solve complex problems beyond the capabilities of classical computers, with potential applications spanning drug discovery, materials science, financial modeling, and artificial intelligence. However, it’s crucial to recognize that the technology is still in its early stages, and widespread commercial adoption is years away.

Financial Performance and Valuation

Analyzing IonQ’s financial performance is vital to determining if IonQ stock a buy. As a young, high-growth company, IonQ’s financials are characterized by rapid revenue growth coupled with significant net losses. In recent quarters, IonQ has demonstrated impressive revenue growth, driven by increased customer demand for access to its quantum computing systems. However, the company is also investing heavily in research and development (R&D) and infrastructure, leading to substantial operating expenses.

One key metric to watch is bookings. Bookings represent the total value of contracts signed with customers. Strong bookings growth indicates increasing demand and future revenue potential. Investors should also monitor the company’s cash burn rate, which measures how quickly it’s spending its cash reserves. A high cash burn rate could necessitate future capital raises, potentially diluting existing shareholders.

Valuing IonQ is challenging due to its early stage and the nascent nature of the quantum computing market. Traditional valuation metrics like price-to-earnings (P/E) ratio are not applicable, as the company is not yet profitable. Instead, investors often rely on metrics like price-to-sales (P/S) ratio or enterprise value-to-revenue (EV/Revenue) ratio. However, these metrics should be interpreted with caution, as they don’t account for future profitability or potential risks. The current valuation is high, reflecting the market’s optimism about the long-term potential of quantum computing and IonQ’s leading position within the industry. Whether IonQ stock a buy at these levels depends on your risk tolerance and investment horizon.

Market Position and Competitive Landscape

IonQ is considered one of the leaders in the quantum computing space, alongside companies like IBM, Google, and Rigetti Computing. While IBM and Google are developing their own quantum computing hardware and software, IonQ focuses exclusively on quantum computing as its core business. This specialization allows it to dedicate all its resources to advancing its technology and expanding its market share.

The competitive landscape in quantum computing is rapidly evolving, with new players entering the market and existing players making significant advancements. IonQ’s trapped-ion technology offers certain advantages over other approaches, but it’s important to recognize that the field is still in its early stages, and the ultimate winner is far from certain. The success of IonQ stock a buy hinges on its ability to maintain its technological lead and capture a significant share of the growing quantum computing market.

Growth Opportunities and Future Prospects

The long-term growth prospects for IonQ are substantial. As quantum computing technology matures and becomes more accessible, demand is expected to increase across various industries. IonQ is well-positioned to capitalize on this growth, with partnerships with leading cloud providers and a growing ecosystem of developers and users. [See also: Quantum Computing Stocks to Watch]

One key growth driver is the increasing availability of quantum computing resources through the cloud. This allows organizations to experiment with quantum computing without investing in expensive hardware. IonQ’s partnerships with Amazon and Microsoft provide it with access to a vast customer base and a powerful distribution channel.

Another growth opportunity lies in expanding the range of applications for quantum computing. While the technology is currently used primarily for research and development, it has the potential to revolutionize industries like drug discovery, materials science, and financial modeling. As quantum computers become more powerful and algorithms become more sophisticated, the range of applications will continue to expand. Is IonQ stock a buy based on these growth projections? It’s a consideration.

Risks and Challenges

Investing in IonQ stock involves significant risks and challenges. The quantum computing market is still in its early stages, and the technology is not yet commercially viable on a large scale. There is no guarantee that quantum computing will live up to its potential, and IonQ could face competition from other companies or alternative technologies.

One major risk is the technological uncertainty surrounding quantum computing. There is no consensus on which quantum computing technology will ultimately prevail, and IonQ’s trapped-ion approach could be surpassed by other methods. The company also faces challenges in scaling its technology and improving the performance of its quantum computers.

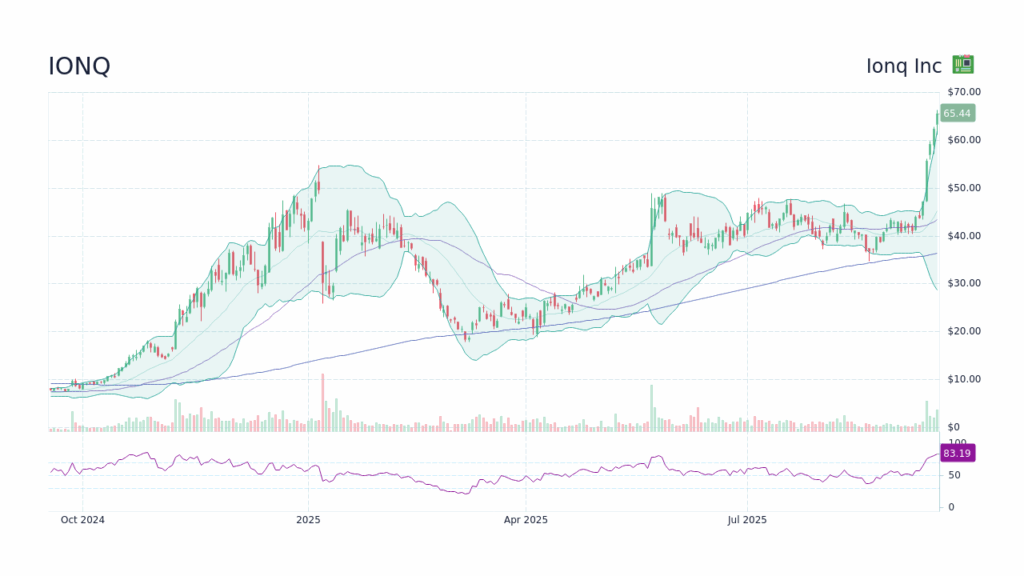

Another risk is the high valuation of IonQ stock. The stock is currently trading at a premium to its peers, reflecting the market’s optimism about the company’s future prospects. However, if IonQ fails to meet expectations, the stock could experience a significant correction. Investors should be prepared for volatility and consider the potential for downside risk. Determining if IonQ stock a buy needs careful assessment of these risks.

Analyst Ratings and Price Targets

Analyst ratings on IonQ stock are mixed, with some analysts rating it as a buy and others rating it as a hold or sell. The consensus price target for the stock varies widely, reflecting the uncertainty surrounding the company’s future prospects. Investors should carefully consider analyst ratings and price targets, but they should also conduct their own research and form their own opinions.

Analyst ratings are based on a variety of factors, including the company’s financial performance, market position, and growth prospects. However, analyst ratings are not always accurate, and they should not be the sole basis for investment decisions. Investors should also consider their own risk tolerance and investment horizon when making investment decisions.

Is IonQ Stock a Buy, Hold, or Sell?

The decision to buy, hold, or sell IonQ stock depends on your individual investment goals and risk tolerance. If you are a long-term investor with a high risk tolerance and believe in the potential of quantum computing, IonQ could be a worthwhile investment. However, if you are a risk-averse investor or have a short-term investment horizon, you may want to avoid the stock.

IonQ stock a buy for those who are optimistic about the future of quantum computing and believe that IonQ is well-positioned to capitalize on this growth. The company has a strong technology, a growing customer base, and partnerships with leading cloud providers. However, investors should be aware of the risks and challenges associated with investing in a young, high-growth company.

If you already own IonQ stock, you may want to hold it if you believe in the company’s long-term potential and are willing to ride out the volatility. However, if you are concerned about the risks and challenges, you may want to consider selling a portion of your holdings. [See also: Quantum Computing ETFs]

Ultimately, the decision to buy, hold, or sell IonQ stock is a personal one. Investors should carefully consider their own investment goals and risk tolerance before making a decision. Is IonQ stock a buy for you? Weigh the potential rewards against the inherent risks.

Conclusion

IonQ represents a compelling yet risky investment opportunity in the burgeoning field of quantum computing. While the company demonstrates significant potential for growth and innovation, its high valuation, nascent market, and technological uncertainties warrant careful consideration. Determining whether IonQ stock a buy requires a thorough understanding of the company’s financials, technology, market position, and risk factors. As with any investment, due diligence is paramount.

The future of quantum computing is uncertain, but IonQ is undoubtedly a key player to watch. Investors should closely monitor the company’s progress, as well as the broader developments in the quantum computing industry, to make informed investment decisions. The question of whether IonQ stock a buy remains open, and the answer will likely evolve as the technology matures and the market develops. Continual assessment is key to making the right decision.

The phrase IonQ stock a buy has been referenced throughout this article to provide a comprehensive analysis and answer the central question for potential investors.