IonQ Stock Outlook 2025: Is Quantum Computing Ready for Takeoff?

As we approach 2025, investors are keenly observing the trajectory of IonQ (NYSE: IONQ), a frontrunner in the burgeoning quantum computing industry. The IonQ stock outlook 2025 hinges on several key factors, including technological advancements, market adoption rates, and the company’s ability to navigate the competitive landscape. This analysis delves into these critical aspects to provide a comprehensive perspective on IonQ’s potential performance in the coming years.

Understanding IonQ and its Quantum Computing Approach

IonQ distinguishes itself through its trapped ion technology, a method considered by many to be among the most promising approaches to building scalable and reliable quantum computers. Unlike superconducting qubit systems, trapped ion qubits exhibit inherent stability and high fidelity, reducing error rates and enabling more complex quantum computations. This technological advantage could be a significant driver for IonQ stock.

Key Technological Milestones

IonQ has consistently achieved significant milestones. These include increasing the number of qubits, enhancing qubit coherence times, and developing more sophisticated quantum algorithms. In the quantum computing realm, increased qubit counts and extended coherence times are crucial for solving more complex problems. These advancements directly impact the practicality and usefulness of IonQ’s quantum computers, driving interest in IonQ stock.

Market Dynamics and Adoption Rates

The quantum computing market is still in its nascent stages, but forecasts predict substantial growth in the coming years. Industries such as pharmaceuticals, finance, materials science, and artificial intelligence are beginning to explore the potential of quantum computing to solve problems currently intractable for classical computers. The speed at which these industries adopt quantum solutions will significantly influence the IonQ stock outlook 2025.

Potential Applications and Industry Use Cases

Quantum computing offers transformative capabilities across various sectors. In drug discovery, it can accelerate the identification of new drug candidates by simulating molecular interactions with unprecedented accuracy. In finance, it can optimize investment portfolios and detect fraudulent activities. In materials science, it can design novel materials with specific properties. Successful demonstration of these applications will likely boost investor confidence in IonQ.

Financial Performance and Growth Strategy

A critical aspect of the IonQ stock outlook 2025 is the company’s financial performance and growth strategy. As a relatively young company in a capital-intensive industry, IonQ’s ability to manage its finances effectively and execute its growth plans is paramount. This includes securing funding, managing operating expenses, and generating revenue.

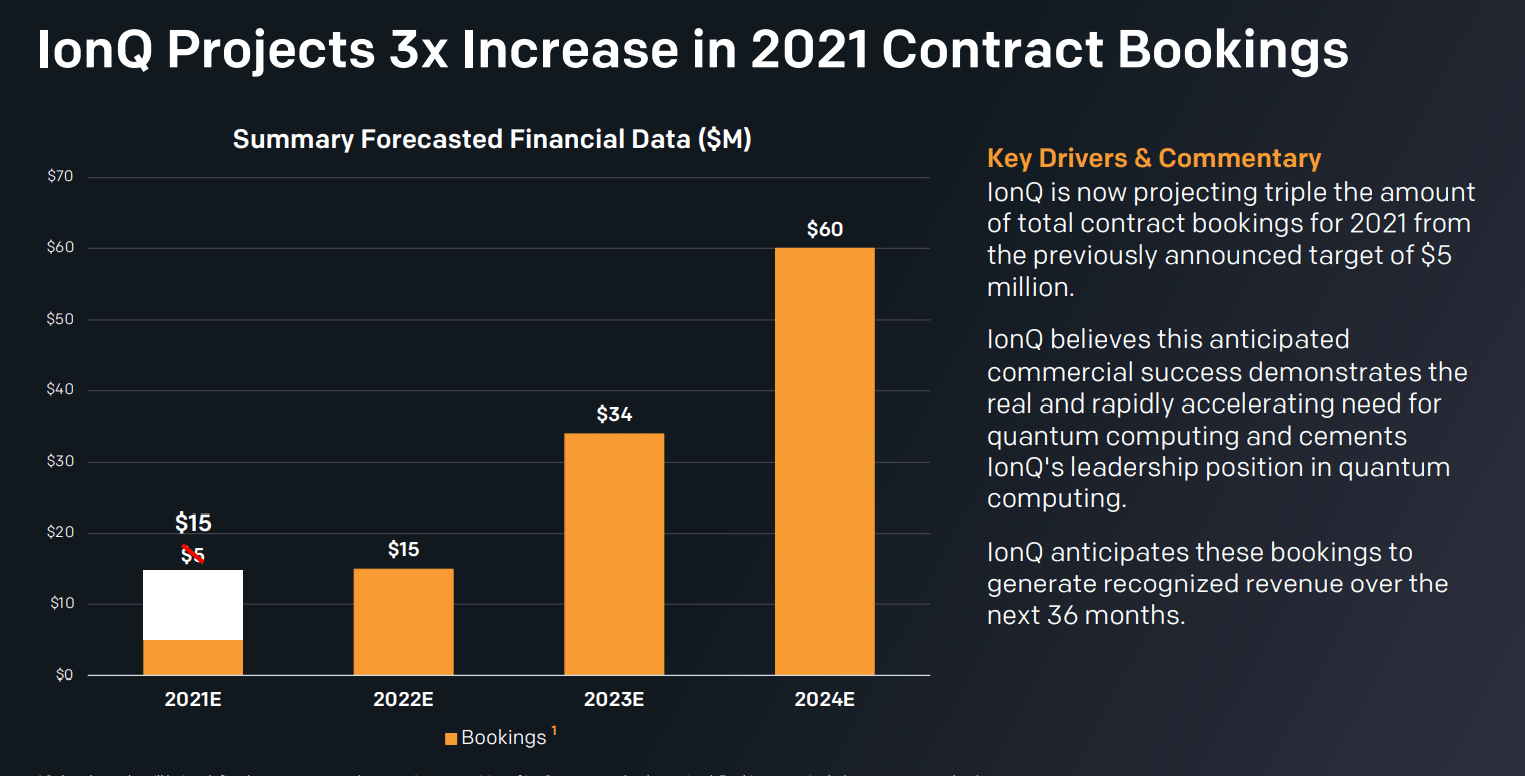

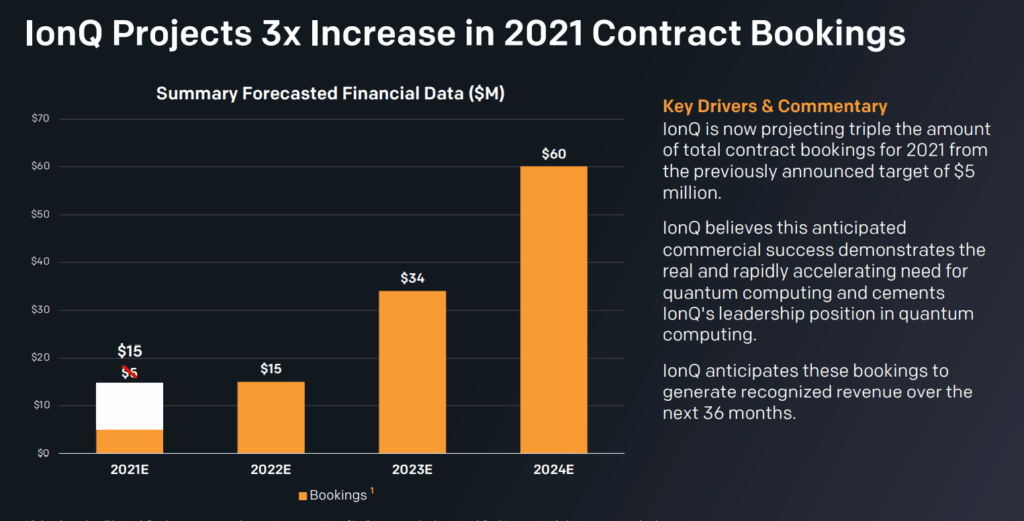

Revenue Generation and Customer Acquisition

IonQ generates revenue through a combination of providing access to its quantum computers via cloud platforms and through direct sales of quantum computing systems. Expanding its customer base and securing long-term contracts with major corporations and research institutions are essential for sustainable revenue growth. Investors will be closely monitoring IonQ’s ability to attract and retain customers, which will directly impact the IonQ stock.

Investment in Research and Development

Quantum computing is a rapidly evolving field, and continuous investment in research and development (R&D) is crucial for maintaining a competitive edge. IonQ must continue to innovate and improve its quantum computing technology to stay ahead of the competition. The company’s R&D spending and its ability to translate research into tangible products and services will be a key determinant of the IonQ stock outlook 2025.

Competitive Landscape

The quantum computing industry is becoming increasingly competitive, with major players like IBM, Google, and Microsoft investing heavily in their own quantum computing programs. IonQ must differentiate itself through technological superiority, strategic partnerships, and effective marketing to capture market share. Understanding the competitive landscape is vital for assessing the IonQ stock outlook 2025.

Differentiation and Strategic Partnerships

IonQ’s trapped ion technology offers distinct advantages, but the company must continue to innovate to maintain its lead. Strategic partnerships with leading companies and research institutions can provide access to valuable resources, expertise, and market channels. These partnerships can accelerate the development and deployment of IonQ’s quantum solutions, bolstering investor confidence in IonQ.

Potential Risks and Challenges

Investing in quantum computing companies like IonQ involves inherent risks and challenges. The technology is still in its early stages, and there is no guarantee that quantum computers will achieve their full potential. Technical challenges, regulatory hurdles, and market volatility could all impact the IonQ stock outlook 2025.

Technological Uncertainty and Scalability

Scaling quantum computers to the level required to solve complex problems remains a significant challenge. Maintaining qubit stability and coherence as the number of qubits increases is technically demanding. Any setbacks in IonQ’s technological development could negatively impact its stock price. The ability to overcome these challenges is vital for the long-term success of IonQ.

Regulatory and Ethical Considerations

As quantum computing becomes more powerful, regulatory and ethical considerations will become increasingly important. Governments may impose regulations on the use of quantum computers for national security reasons, and ethical guidelines may be needed to ensure responsible development and deployment of the technology. Navigating these regulatory and ethical considerations will be crucial for IonQ’s long-term success. This may impact the overall IonQ stock outlook.

Expert Opinions and Analyst Ratings

Analyzing expert opinions and analyst ratings can provide valuable insights into the IonQ stock outlook 2025. Financial analysts regularly assess IonQ’s performance and prospects, providing recommendations to investors. These ratings can reflect a range of factors, including the company’s financial health, technological advancements, and market opportunities.

Monitoring Analyst Forecasts and Recommendations

Staying informed about analyst forecasts and recommendations can help investors make informed decisions about IonQ stock. However, it’s important to remember that analyst ratings are not always accurate, and investors should conduct their own due diligence before making any investment decisions. Understanding the reasoning behind analyst recommendations can provide valuable context for evaluating IonQ stock.

Conclusion: Is IonQ a Promising Investment for 2025?

The IonQ stock outlook 2025 is a complex and multifaceted question. While the company faces challenges, its technological advantages, strong growth potential, and strategic partnerships make it a promising investment in the quantum computing space. However, investors should carefully consider the risks and challenges before investing in IonQ stock.

Ultimately, the success of IonQ depends on its ability to execute its growth strategy, overcome technological hurdles, and capitalize on the growing demand for quantum computing solutions. As we approach 2025, the IonQ stock outlook remains cautiously optimistic, but diligent monitoring and informed decision-making are essential for investors.

[See also: Quantum Computing Stocks to Watch]

[See also: Investing in Quantum Technology]

[See also: The Future of Quantum Computing]