Liquidity Sweep: Understanding Market Dynamics and Strategic Implications

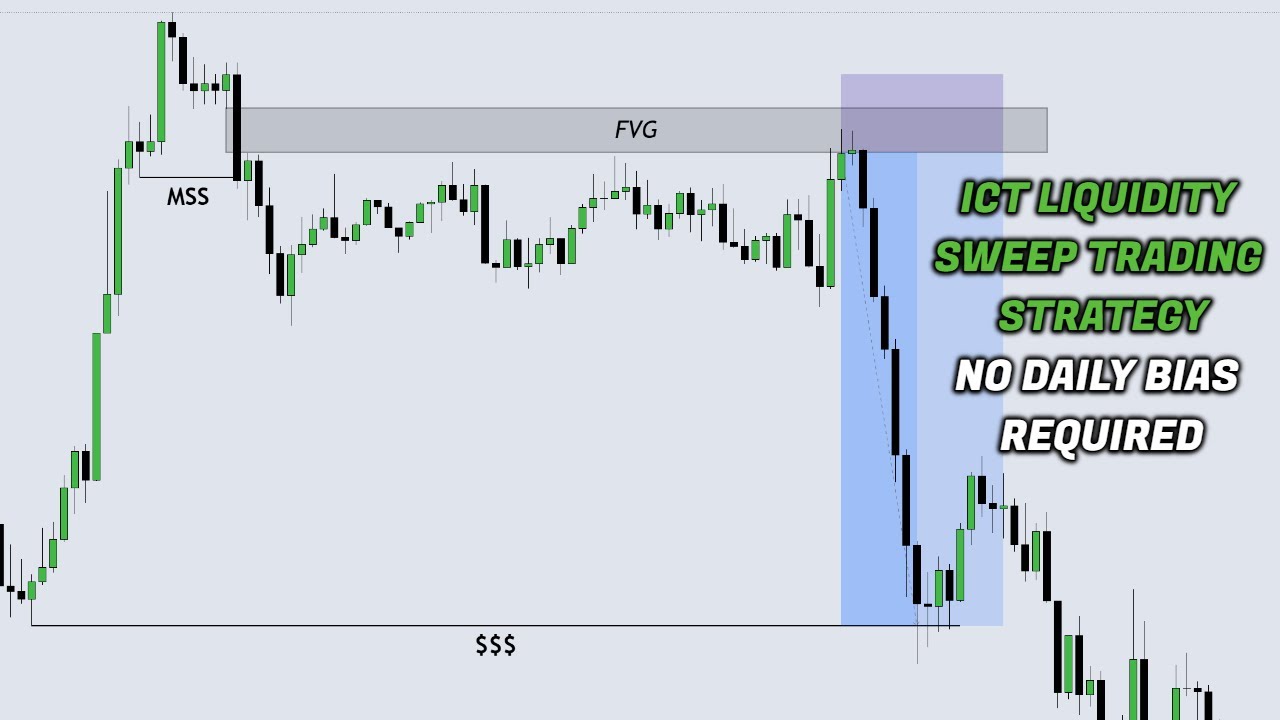

In the dynamic world of finance, understanding market movements is crucial for investors, traders, and financial analysts alike. One such market movement that often goes unnoticed but holds significant implications is the liquidity sweep. A liquidity sweep refers to a rapid and significant removal of available liquidity from a specific market or asset. This phenomenon can lead to increased volatility, price fluctuations, and altered trading strategies. This article aims to provide an in-depth understanding of what a liquidity sweep is, its causes, its effects, and how market participants can navigate such events effectively.

What is a Liquidity Sweep?

A liquidity sweep is essentially a sudden depletion of available funds or assets in a market. It occurs when a large volume of buy or sell orders are executed quickly, consuming all available liquidity at specific price levels. The result is a sharp price movement as the market seeks new equilibrium. This can happen in any market, from stocks and bonds to foreign exchange (forex) and cryptocurrencies.

The term liquidity sweep is often associated with algorithmic trading and high-frequency trading (HFT), where automated systems are designed to identify and exploit areas of low liquidity. These algorithms can trigger rapid order executions, exacerbating the impact of a liquidity sweep.

Causes of Liquidity Sweeps

Several factors can contribute to a liquidity sweep. Understanding these causes is essential for anticipating and mitigating potential risks:

- Algorithmic Trading: As mentioned earlier, algorithmic trading systems can identify and exploit areas of low liquidity. These systems are programmed to execute large orders rapidly, which can quickly deplete available liquidity and trigger a sweep.

- News Events: Unexpected news events, such as economic data releases, geopolitical tensions, or company-specific announcements, can trigger a surge in buying or selling activity. If the market is thinly traded, this can lead to a liquidity sweep.

- Stop-Loss Orders: A cluster of stop-loss orders placed at similar price levels can trigger a cascade effect. When the price reaches the stop-loss level, these orders are automatically executed, further driving down the price and potentially leading to a liquidity sweep.

- Margin Calls: A margin call occurs when a trader’s account balance falls below the required margin level. The broker may then liquidate the trader’s positions to cover the margin deficit, which can contribute to a liquidity sweep, particularly if many traders are facing margin calls simultaneously.

- Market Manipulation: In some cases, a liquidity sweep can be the result of market manipulation. This involves intentionally creating a false sense of demand or supply to trigger price movements and profit from the resulting volatility.

Effects of Liquidity Sweeps

The effects of a liquidity sweep can be significant and far-reaching:

- Increased Volatility: The most immediate effect of a liquidity sweep is increased volatility. The sudden price movements can create uncertainty and fear in the market, leading to further price swings.

- Price Gaps: A liquidity sweep can create price gaps on trading charts. These gaps occur when the price jumps from one level to another without any trading occurring in between. Price gaps can be difficult to trade and can lead to unexpected losses.

- Whipsaws: A liquidity sweep can lead to whipsaw price action, where the price rapidly moves in one direction and then quickly reverses. This can be particularly challenging for traders who are trying to identify trends.

- Increased Transaction Costs: During a liquidity sweep, bid-ask spreads can widen significantly. This increases the cost of trading, making it more difficult to enter and exit positions profitably.

- Loss of Confidence: A severe liquidity sweep can erode investor confidence in the market. This can lead to a decline in trading volume and a reluctance to participate in the market.

Identifying Liquidity Sweeps

Recognizing a liquidity sweep as it unfolds can be challenging, but there are several indicators to watch out for:

- Sudden Price Spikes or Drops: A sharp and unexpected price movement is often the first sign of a liquidity sweep.

- Increased Trading Volume: A surge in trading volume can indicate that a large number of orders are being executed, potentially leading to a liquidity sweep.

- Widening Bid-Ask Spreads: As liquidity dries up, bid-ask spreads tend to widen. This makes it more expensive to trade and can be a warning sign of a liquidity sweep.

- Price Gaps on Charts: The appearance of price gaps on trading charts can be an indication that a liquidity sweep has occurred.

- News Events: Keep an eye on news events that could trigger a surge in buying or selling activity.

Strategies for Navigating Liquidity Sweeps

While liquidity sweeps can be disruptive, there are strategies that market participants can use to navigate them effectively:

- Use Limit Orders: Limit orders allow you to specify the price at which you are willing to buy or sell an asset. This can help you avoid getting caught in a liquidity sweep, as your order will only be executed if the price reaches your specified level.

- Avoid Market Orders: Market orders are executed immediately at the best available price. During a liquidity sweep, this can result in your order being filled at a significantly worse price than you expected.

- Manage Your Risk: Use stop-loss orders to limit your potential losses. Be sure to place your stop-loss orders at a level that is appropriate for your risk tolerance.

- Reduce Position Size: Consider reducing your position size during periods of high volatility. This will help you limit your potential losses if a liquidity sweep occurs.

- Stay Informed: Keep up-to-date on market news and events that could trigger a liquidity sweep. This will help you anticipate potential risks and adjust your trading strategy accordingly.

- Diversify Your Portfolio: Diversification can help to mitigate the impact of a liquidity sweep in one particular asset or market.

- Consider Using Automated Trading Tools: Some automated trading tools can help you to identify and avoid liquidity sweeps. These tools can monitor market conditions and automatically adjust your trading strategy to minimize risk.

Liquidity Sweep in Cryptocurrency Markets

Cryptocurrency markets are particularly susceptible to liquidity sweeps due to their relatively low liquidity compared to traditional financial markets. The 24/7 nature of crypto trading and the presence of numerous smaller exchanges can exacerbate the problem. [See also: Cryptocurrency Trading Strategies] Small cap cryptocurrencies are especially vulnerable. A large sell order for a less liquid altcoin, for instance, can easily trigger a liquidity sweep, leading to significant price declines. Traders in the crypto space should be extra cautious and employ risk management strategies diligently.

Examples of Liquidity Sweeps

While pinpointing specific instances of liquidity sweeps with absolute certainty can be difficult (as the exact order book data is often proprietary), here are some scenarios that often align with the characteristics of a liquidity sweep:

- Flash Crashes: Flash crashes, characterized by sudden and dramatic price drops followed by a quick recovery, often involve liquidity sweeps. These events can be triggered by algorithmic trading or large sell orders in thinly traded markets.

- Sudden News-Driven Price Swings: When unexpected news breaks, such as a surprise interest rate hike or a negative earnings report, the market can react violently. If liquidity is low, a liquidity sweep can occur, amplifying the price movement.

- Volatility Around Economic Data Releases: Economic data releases, such as GDP figures or inflation reports, are often preceded by increased volatility. Traders should be aware of the potential for liquidity sweeps during these periods.

The Role of Market Makers

Market makers play a crucial role in providing liquidity to the market. They quote bid and ask prices for assets, facilitating trading and reducing the likelihood of liquidity sweeps. However, even market makers can struggle to maintain liquidity during periods of extreme volatility. [See also: Understanding Market Makers] Regulatory oversight and responsible market making practices are essential for ensuring market stability and preventing excessive liquidity sweeps.

Conclusion

A liquidity sweep is a phenomenon that can have a significant impact on market dynamics. By understanding the causes and effects of liquidity sweeps, market participants can develop strategies to navigate these events effectively. Staying informed, managing risk, and using appropriate trading tools are essential for protecting your capital and achieving your investment goals. While a liquidity sweep can present challenges, it also offers opportunities for savvy traders who are prepared to capitalize on the resulting volatility. Recognizing a liquidity sweep in real-time requires experience and vigilance, but the potential rewards can be substantial. Remember to always prioritize risk management and trade responsibly.