Liquidity Sweep: Understanding Market Manipulation and its Implications

In the complex world of financial markets, understanding the various strategies employed by sophisticated traders and institutions is crucial for both novice and experienced investors. One such strategy, often shrouded in mystery and controversy, is the liquidity sweep. A liquidity sweep refers to a technique where large market participants execute significant orders to trigger stop-loss orders and capture available liquidity at specific price levels. This article aims to demystify the concept of a liquidity sweep, explore its mechanics, discuss its implications, and provide insights into how investors can protect themselves from its potential adverse effects. The goal is to provide a clear, concise, and objective overview of this complex market phenomenon.

What is a Liquidity Sweep?

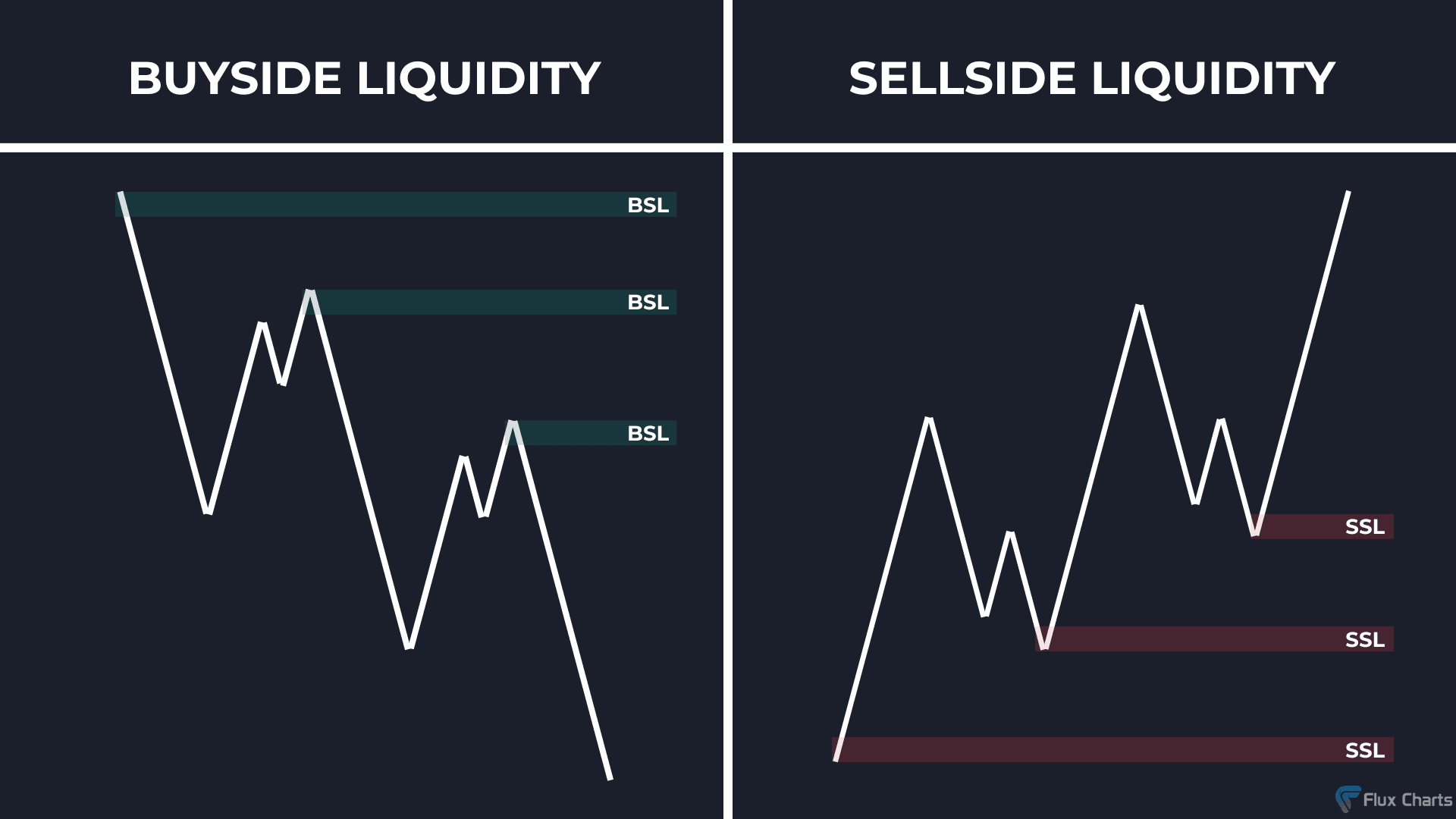

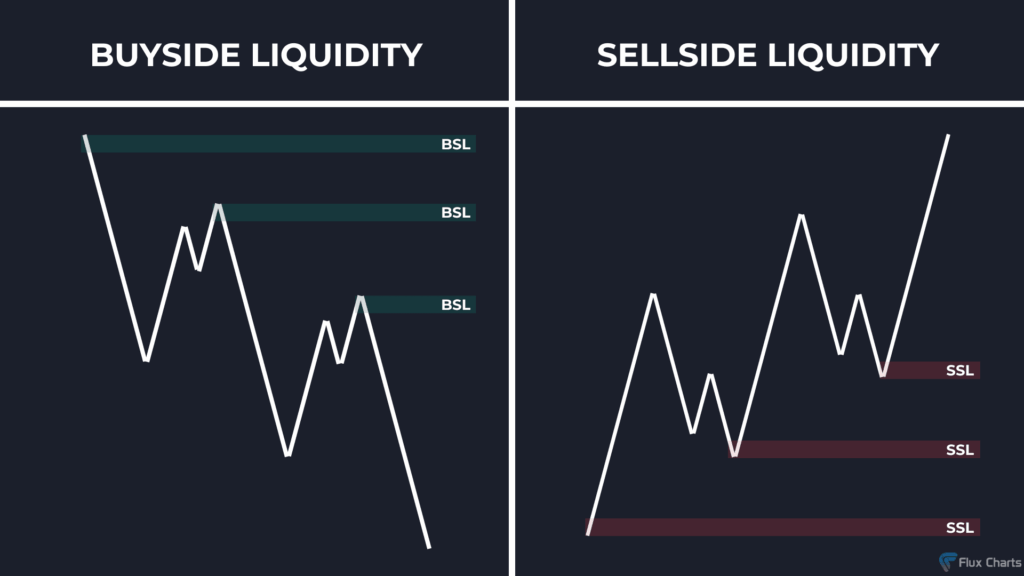

A liquidity sweep is a trading strategy employed by large entities – often institutional investors, hedge funds, or even market makers – to capitalize on areas of concentrated stop-loss orders or significant buy/sell interest. Stop-loss orders are designed to automatically sell an asset when it reaches a certain price, limiting potential losses. These orders are often clustered around key support and resistance levels or at commonly perceived psychological price points. A liquidity sweep occurs when a large order is placed to push the price to these levels, triggering a cascade of stop-loss orders. This sudden surge in selling (or buying) pressure can then be exploited by the entity initiating the liquidity sweep, who can buy (or sell) the asset at a favorable price after the initial panic subsides.

Essentially, a liquidity sweep is a form of market manipulation, albeit often difficult to prove. It preys on the vulnerability of smaller traders and investors who rely on stop-loss orders to manage risk. The entity conducting the liquidity sweep exploits the pre-existing market structure to their advantage.

How Does a Liquidity Sweep Work?

The process of a liquidity sweep typically involves several key steps:

- Identification of Liquidity Pools: The first step involves identifying areas where significant liquidity is concentrated. This often means pinpointing clusters of stop-loss orders or areas of high trading volume around specific price levels. Market makers and sophisticated traders use various tools and techniques, including order book analysis and volume profile analysis, to identify these areas.

- Order Placement: Once a liquidity pool is identified, the entity initiating the liquidity sweep places a large order designed to push the price towards the identified level. This order is typically placed strategically to maximize its impact and trigger the desired cascade of stop-loss orders.

- Triggering Stop-Loss Orders: As the price approaches the stop-loss levels, a wave of automated sell orders is triggered. This sudden increase in selling pressure drives the price down further, exacerbating the initial move.

- Capturing Liquidity: The entity that initiated the liquidity sweep then steps in to buy the asset at the lower price, effectively capturing the liquidity created by the triggered stop-loss orders. They can then profit from the subsequent price rebound or use the acquired assets for other trading strategies.

For example, imagine a stock trading at $50 with a significant number of stop-loss orders placed at $49.50. A large institutional investor might place a sell order large enough to push the price below $49.50, triggering those stop-loss orders. As the price drops, the investor buys back the shares at the artificially lower price, profiting from the difference. This is a classic example of a liquidity sweep.

Identifying a Liquidity Sweep

Detecting a liquidity sweep in real-time can be challenging, but there are several telltale signs that traders can look for:

- Sudden Price Spikes or Drops: A rapid and unexpected price movement, especially near key support or resistance levels, can be an indicator of a liquidity sweep.

- High Trading Volume: A significant increase in trading volume accompanying the price spike or drop can further suggest that a liquidity sweep is in progress.

- Reversal Patterns: After the initial price movement, a quick and sharp reversal can be a sign that the price was artificially manipulated to trigger stop-loss orders.

- Order Book Analysis: Examining the order book can reveal large orders being placed just below support or above resistance levels, potentially indicating an attempt to trigger a liquidity sweep.

Implications of Liquidity Sweeps

Liquidity sweeps have several significant implications for the financial markets and individual investors:

- Market Volatility: Liquidity sweeps can contribute to increased market volatility, as they can trigger rapid and unpredictable price movements.

- Losses for Retail Investors: Retail investors who rely on stop-loss orders are particularly vulnerable to liquidity sweeps, as their orders can be triggered unnecessarily, resulting in losses.

- Erosion of Trust: The perception that markets are being manipulated can erode trust in the financial system, discouraging participation and potentially leading to market instability.

- Regulatory Challenges: Proving and prosecuting liquidity sweeps can be difficult, as it requires demonstrating intent and proving that the market manipulation caused harm to other investors.

How to Protect Yourself from Liquidity Sweeps

While it’s impossible to completely eliminate the risk of being affected by a liquidity sweep, there are several strategies that investors can employ to mitigate their exposure:

- Avoid Tight Stop-Loss Orders: Placing stop-loss orders too close to the current market price makes them more vulnerable to being triggered by a liquidity sweep. Consider using wider stop-loss orders that allow for more price fluctuation.

- Use Stop-Limit Orders: A stop-limit order combines a stop price with a limit price. Once the stop price is reached, a limit order is placed, ensuring that the order is only filled at or better than the limit price. This can help prevent orders from being filled at unfavorable prices during a liquidity sweep.

- Monitor Market Activity: Pay close attention to market activity, including volume and price movements, especially around key support and resistance levels. Be wary of sudden and unexpected price spikes or drops.

- Diversify Your Portfolio: Diversifying your portfolio across different asset classes can help reduce the impact of liquidity sweeps on your overall investment performance.

- Educate Yourself: Understanding market dynamics and the strategies employed by sophisticated traders can help you make more informed investment decisions and protect yourself from potential manipulation.

- Consider Guaranteed Stop-Loss Orders: Some brokers offer guaranteed stop-loss orders, which guarantee that your order will be filled at the specified stop price, even if the market gaps below that level. However, these orders typically come with a higher commission or fee.

The Legality of Liquidity Sweeps

The legality of liquidity sweeps is a grey area. While outright manipulation is illegal, proving intent and demonstrating that a liquidity sweep caused harm to other investors is challenging. Regulators like the Securities and Exchange Commission (SEC) in the United States and the Financial Conduct Authority (FCA) in the United Kingdom actively monitor market activity and investigate potential cases of manipulation. However, the burden of proof is high, and successful prosecutions are relatively rare. [See also: SEC Market Manipulation Cases]

The difficulty in regulating liquidity sweeps stems from the fact that they often involve legitimate trading strategies combined with aggressive order execution. It’s difficult to distinguish between a genuine attempt to profit from market opportunities and a deliberate effort to manipulate the price for personal gain.

Real-World Examples of Potential Liquidity Sweeps

While it’s often impossible to definitively prove a liquidity sweep occurred, there have been numerous instances where market activity suggested the possibility of such manipulation. These events often involve sudden and unexplained price movements followed by a quick reversal. Analyzing these events can provide valuable insights into how liquidity sweeps might be executed and how investors can protect themselves. [See also: Historical Market Crashes and Manipulation]

For example, consider a situation where a stock experiences a sharp decline in price during a period of low trading volume, followed by a rapid recovery. This pattern could indicate that a liquidity sweep was used to trigger stop-loss orders and accumulate shares at a lower price. Similarly, a sudden spike in price followed by a quick sell-off could suggest that stop-loss orders were triggered on the short side, allowing the manipulator to profit from the subsequent decline.

The Future of Liquidity Sweeps

As financial markets become increasingly sophisticated and automated, the potential for liquidity sweeps to occur will likely increase. The rise of algorithmic trading and high-frequency trading (HFT) has made it easier for large entities to execute complex trading strategies and exploit market inefficiencies. [See also: The Impact of Algorithmic Trading on Market Stability]

Regulators will need to adapt to these changing market dynamics and develop more effective tools and techniques for detecting and preventing market manipulation. This may involve enhanced surveillance capabilities, stricter regulations on algorithmic trading, and increased cooperation between regulatory agencies across different jurisdictions.

Conclusion

A liquidity sweep is a sophisticated trading strategy that can have significant implications for the financial markets and individual investors. By understanding the mechanics of a liquidity sweep, recognizing its telltale signs, and implementing appropriate risk management strategies, investors can protect themselves from its potential adverse effects. While regulators face challenges in detecting and prosecuting liquidity sweeps, ongoing efforts to enhance market surveillance and tighten regulations are crucial for maintaining market integrity and protecting investor confidence. Staying informed and vigilant is the best defense against market manipulation in an increasingly complex and interconnected financial world. The ability to recognize and react to a potential liquidity sweep can be a crucial skill for any serious investor looking to navigate the complexities of modern financial markets. Understanding the nuances of market manipulation, like the liquidity sweep, is essential for making informed decisions and protecting your investments.