Marginal Analysis: A Comprehensive Guide for Business Decision-Making

In the dynamic world of business, making informed decisions is paramount to success. One powerful tool that aids businesses in this process is marginal analysis. This article delves into the intricacies of marginal analysis, exploring its principles, applications, and benefits. We’ll examine how it helps businesses optimize production, pricing, and investment strategies, ultimately leading to improved profitability and efficiency. Understanding marginal analysis is crucial for any business professional seeking to make data-driven decisions and gain a competitive edge.

Understanding Marginal Analysis

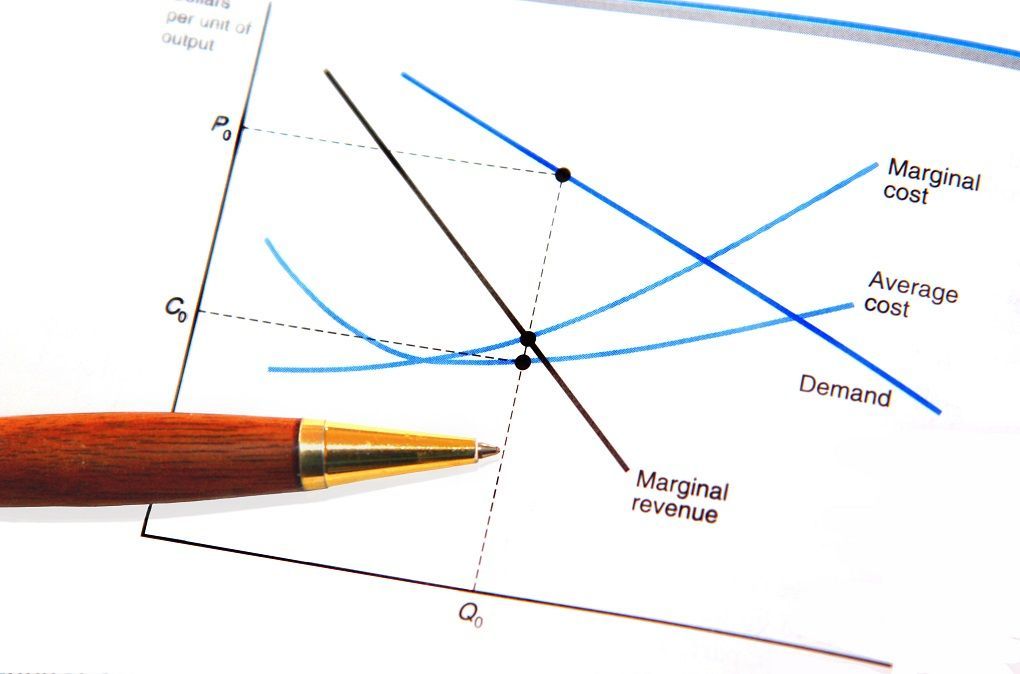

Marginal analysis is an examination of the additional benefits of an activity compared to the additional costs incurred by that same activity. In essence, it focuses on the incremental impact of decisions. The core principle is to determine whether the benefit of undertaking an action justifies the cost. If the marginal benefit exceeds the marginal cost, the action is deemed worthwhile. Conversely, if the marginal cost outweighs the marginal benefit, the action should be avoided.

This approach contrasts with average cost analysis, which considers the total cost divided by the total output. Marginal analysis hones in on the change resulting from a single additional unit of production or activity. It’s a critical tool for evaluating the profitability and efficiency of various business decisions. For instance, a company might use marginal analysis to decide whether to increase production, launch a new product, or invest in additional marketing efforts.

Key Components of Marginal Analysis

- Marginal Cost: The additional cost incurred by producing one more unit of a good or service. This includes variable costs like raw materials and labor, but not fixed costs, as these remain constant regardless of production volume.

- Marginal Revenue: The additional revenue generated by selling one more unit of a good or service. This is typically the selling price of the unit.

- Marginal Benefit: A broader concept than marginal revenue, encompassing all the additional advantages derived from an activity, whether tangible (e.g., increased sales) or intangible (e.g., improved brand reputation).

- Marginal Product: The additional output generated by adding one more unit of input (e.g., labor or capital).

Applying Marginal Analysis in Business

Marginal analysis finds application across various aspects of business management. Here are some key areas where it proves invaluable:

Production Decisions

One of the most common applications of marginal analysis is in determining the optimal level of production. A company can use marginal analysis to identify the point at which the marginal cost of producing an additional unit equals the marginal revenue generated from selling that unit. This is the point of maximum profitability.

For example, a bakery might analyze the marginal cost of producing an additional loaf of bread, considering the cost of ingredients, labor, and energy. They would then compare this to the marginal revenue, which is the price they can sell the loaf for. If the marginal revenue consistently exceeds the marginal cost, the bakery can increase production to boost profits. However, if the marginal cost starts to exceed the marginal revenue, it indicates that the bakery is producing too much and should reduce output.

Pricing Strategies

Marginal analysis also plays a critical role in setting prices. By understanding the relationship between production costs, demand, and pricing, businesses can determine the optimal price point that maximizes profits. This involves evaluating how changes in price affect the quantity demanded and the resulting impact on revenue.

Consider a software company that’s launching a new product. They can use marginal analysis to assess the potential impact of different pricing strategies. If they lower the price, they might attract more customers, but each sale will generate less revenue. Conversely, if they raise the price, they might sell fewer units, but each sale will generate more revenue. Marginal analysis helps them find the price point that strikes the right balance between volume and profitability. [See also: Price Elasticity of Demand]

Investment Decisions

When considering potential investments, marginal analysis helps businesses evaluate the potential returns against the associated costs. This involves assessing the marginal benefit (e.g., increased revenue, cost savings) and the marginal cost (e.g., initial investment, operating expenses) of each investment opportunity.

Imagine a manufacturing company considering whether to invest in new machinery. The marginal benefit would be the increased production capacity and reduced labor costs resulting from the new machinery. The marginal cost would be the purchase price of the machinery, installation costs, and any additional maintenance expenses. By comparing these marginal benefits and costs, the company can determine whether the investment is financially viable.

Marketing Campaigns

Marginal analysis is also useful in evaluating the effectiveness of marketing campaigns. Businesses can track the additional revenue generated by each marketing dollar spent and compare it to the cost of the campaign. This helps them optimize their marketing budget and allocate resources to the most effective channels.

For example, an e-commerce company might use marginal analysis to assess the return on investment (ROI) of its online advertising campaigns. They can track the number of sales generated by each ad campaign and compare it to the cost of running the campaign. If the marginal revenue generated by a particular campaign exceeds the marginal cost, it’s a worthwhile investment. However, if the marginal cost exceeds the marginal revenue, the company should consider reallocating its resources to more effective marketing strategies.

Benefits of Using Marginal Analysis

Employing marginal analysis offers several key benefits for businesses:

- Improved Decision-Making: Provides a structured and data-driven approach to evaluating options, leading to more informed and effective decisions.

- Increased Profitability: Helps businesses optimize production, pricing, and investment strategies to maximize profits.

- Enhanced Efficiency: Identifies areas where resources are being used inefficiently, allowing businesses to improve their operations and reduce costs.

- Better Resource Allocation: Enables businesses to allocate resources to the most profitable activities, maximizing the return on investment.

- Competitive Advantage: By making smarter decisions, businesses can gain a competitive edge in the marketplace.

Limitations of Marginal Analysis

While marginal analysis is a powerful tool, it’s important to recognize its limitations:

- Difficulty in Quantifying Intangible Benefits: Some benefits, such as improved brand reputation or employee morale, are difficult to quantify in monetary terms. This can make it challenging to accurately assess the true marginal benefit of an action.

- Assumptions of Linearity: Marginal analysis often assumes a linear relationship between inputs and outputs. However, in reality, this relationship may be non-linear, especially at extreme levels of production.

- Short-Term Focus: Marginal analysis typically focuses on short-term costs and benefits. It may not adequately consider the long-term implications of decisions.

- Data Accuracy: The accuracy of marginal analysis depends on the quality of the data used. Inaccurate or incomplete data can lead to misleading results.

- External Factors: Marginal analysis often fails to account for external factors, such as changes in market conditions or competitor actions, which can significantly impact the outcome of decisions.

Examples of Marginal Analysis in Action

Let’s consider a few real-world examples of how marginal analysis can be applied:

Airline Pricing

Airlines use marginal analysis to determine the optimal price for each seat on a flight. They consider the marginal cost of filling an empty seat, which is relatively low (e.g., the cost of the extra fuel needed to carry the passenger). They then compare this to the potential revenue from selling the seat. If the marginal revenue exceeds the marginal cost, they will lower the price to fill the seat, even if it’s only by a small amount.

Restaurant Menu Pricing

Restaurants use marginal analysis to price their menu items. They consider the marginal cost of preparing each dish, including the cost of ingredients and labor. They then compare this to the potential revenue from selling the dish. They may adjust the price of certain items to encourage customers to order more profitable dishes.

Retail Inventory Management

Retailers use marginal analysis to determine the optimal level of inventory to hold. They consider the marginal cost of holding additional inventory, including storage costs and the risk of spoilage or obsolescence. They then compare this to the potential revenue from selling the inventory. They may adjust their inventory levels based on demand forecasts and seasonal trends.

Conclusion

Marginal analysis is a valuable tool for businesses seeking to make informed decisions and optimize their operations. By focusing on the incremental impact of decisions, businesses can identify opportunities to increase profitability, enhance efficiency, and gain a competitive advantage. While it has limitations, understanding and applying the principles of marginal analysis can significantly improve business performance. From production and pricing to investment and marketing, marginal analysis provides a framework for making data-driven decisions that drive success. Businesses that embrace this analytical approach are better positioned to thrive in today’s competitive marketplace.