Mark to Market: Understanding Fair Value Accounting

In the dynamic world of finance, understanding how assets are valued is critical. One such method is mark to market (MTM), also known as fair value accounting. It’s a method of measuring the fair value of accounts that can fluctuate over time, such as assets and liabilities. The goal is to provide a realistic and up-to-date assessment of a company’s financial position. This article will delve into the intricacies of mark to market accounting, exploring its benefits, criticisms, and practical applications.

What is Mark to Market?

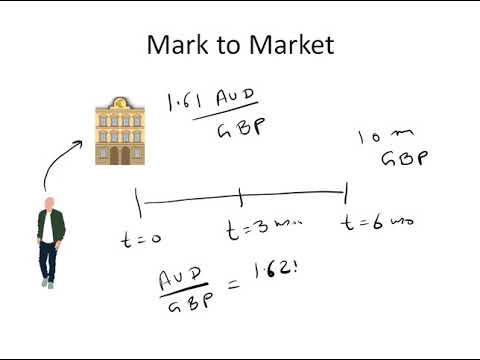

Mark to market is an accounting practice where the value of an asset or liability is recorded at its current market price, rather than its historical cost or book value. This means that the value is adjusted to reflect the prevailing market conditions. Think of it as taking a snapshot of an asset’s worth at a specific point in time. This contrasts with historical cost accounting, where assets are recorded at their original purchase price, regardless of subsequent market fluctuations. The mark to market accounting method is particularly relevant for financial instruments like derivatives, securities, and commodities, whose values can change rapidly.

How Mark to Market Works

The mark to market process involves several steps:

- Identifying Assets and Liabilities: First, identify the assets and liabilities that are subject to mark to market accounting. These typically include financial instruments traded in active markets.

- Determining Fair Value: Next, determine the fair value of these assets and liabilities. This is usually based on current market prices, such as those available on exchanges or through other reliable sources. If market prices are not readily available, valuation models may be used.

- Adjusting the Balance Sheet: The balance sheet is then adjusted to reflect the current fair value. This may result in gains or losses, which are typically recognized in the income statement.

- Periodic Updates: The mark to market process is repeated periodically, often daily or monthly, to ensure that the balance sheet accurately reflects the current market conditions.

Benefits of Mark to Market Accounting

Mark to market accounting offers several advantages:

- Transparency: It provides a more transparent view of a company’s financial position by reflecting current market values. This can help investors and other stakeholders make more informed decisions.

- Risk Management: By regularly updating asset values, mark to market accounting helps companies identify and manage risks more effectively. It allows them to see how changes in market conditions are affecting their financial performance.

- Accurate Valuation: It offers a more accurate valuation of assets and liabilities than historical cost accounting, especially in volatile markets.

- Early Warning System: The mark to market process can act as an early warning system, alerting companies to potential problems before they become too severe.

Criticisms of Mark to Market Accounting

Despite its benefits, mark to market accounting has also faced criticism:

- Volatility: It can lead to significant fluctuations in reported earnings, especially during periods of market volatility. This can make it difficult for investors to assess a company’s long-term performance.

- Procyclicality: Some argue that mark to market accounting can be procyclical, exacerbating booms and busts. During a downturn, declining asset values can force companies to sell assets, further depressing prices.

- Subjectivity: Determining fair value can be subjective, especially for assets that are not actively traded. This can lead to manipulation or inaccurate valuations.

- Complexity: The mark to market process can be complex and require specialized expertise, particularly for complex financial instruments.

Mark to Market vs. Historical Cost Accounting

The key difference between mark to market and historical cost accounting lies in how assets and liabilities are valued. Historical cost accounting records assets at their original purchase price, while mark to market adjusts the value to reflect current market conditions. This makes mark to market more relevant for assets that are actively traded and subject to price fluctuations.

Here’s a table summarizing the key differences:

| Feature | Mark to Market | Historical Cost Accounting |

|---|---|---|

| Valuation | Current market price | Original purchase price |

| Relevance | Actively traded assets | Assets held for long periods |

| Volatility | High | Low |

| Transparency | High | Lower |

Examples of Mark to Market Accounting

Here are a few examples of how mark to market accounting is used in practice:

- Derivatives: Financial institutions use mark to market accounting to value derivatives, such as futures and options. This helps them manage the risks associated with these instruments.

- Securities: Investment firms use mark to market to value their securities holdings, providing investors with an up-to-date view of their portfolio’s performance.

- Commodities: Companies that trade in commodities, such as oil or gold, use mark to market accounting to value their inventory.

Mark to Market in the 2008 Financial Crisis

Mark to market accounting came under intense scrutiny during the 2008 financial crisis. Some critics argued that it exacerbated the crisis by forcing banks to write down the value of their assets, leading to a loss of confidence and a credit crunch. Others defended mark to market, arguing that it provided a realistic assessment of the banks’ financial condition and helped to identify institutions that were at risk of failure.

The debate over mark to market accounting continues to this day, with some advocating for its reform or repeal. However, it remains an important tool for financial reporting and risk management.

The Future of Mark to Market

The future of mark to market accounting is likely to involve ongoing debate and refinement. As financial markets become more complex and volatile, the need for accurate and transparent valuation methods will only increase. Regulators and accounting standard setters will continue to grapple with the challenges of mark to market, seeking to balance its benefits with its potential drawbacks. [See also: Historical Cost Accounting vs. Fair Value Accounting]

Technological advancements, such as artificial intelligence and machine learning, may also play a role in the future of mark to market. These technologies could be used to improve the accuracy and efficiency of valuation models, reducing the subjectivity and complexity of the mark to market process.

Conclusion

Mark to market accounting is a complex and controversial topic, but it remains an essential tool for financial reporting and risk management. While it has its drawbacks, it provides a more transparent and accurate view of a company’s financial position than historical cost accounting. By understanding the principles and applications of mark to market, investors and other stakeholders can make more informed decisions about the risks and opportunities facing companies in today’s dynamic financial markets. The concept of mark to market is critical for anyone involved in finance and investing.

Ultimately, the goal of mark to market accounting is to provide a realistic and up-to-date assessment of a company’s financial health. While it may not be perfect, it is a valuable tool for promoting transparency and accountability in the financial system. Understanding mark to market principles is essential for navigating the complexities of modern finance. This fair value accounting method, though debated, remains a cornerstone of financial transparency. The ongoing discussion surrounding mark to market highlights its importance in maintaining market stability. By consistently applying the mark to market principle, businesses can ensure their financial statements accurately reflect current market realities. The use of mark to market also helps in identifying potential risks early on, allowing for proactive risk management. The impact of mark to market on a company’s financial statements can be significant, especially in volatile markets. In conclusion, mark to market accounting is a vital, albeit complex, aspect of modern finance.