Mastering Currency Trading: How a Currency Trading Calculator Can Optimize Your Forex Strategy

In the fast-paced world of foreign exchange (forex) trading, precision and informed decision-making are paramount. A simple miscalculation can lead to significant financial losses. That’s where a currency trading calculator becomes an indispensable tool for both novice and experienced traders. This article will delve into the intricacies of using a currency trading calculator, its benefits, and how it can help optimize your forex trading strategy.

Understanding the Basics of Forex Trading

Before diving into the specifics of a currency trading calculator, it’s crucial to grasp the fundamental concepts of forex trading. Forex trading involves buying and selling currencies in the foreign exchange market. Currencies are always traded in pairs, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). The value of one currency is relative to the other.

The goal of forex trading is to profit from the fluctuations in exchange rates. Traders analyze various factors, including economic indicators, political events, and market sentiment, to predict these fluctuations. A successful forex trader needs a combination of knowledge, discipline, and the right tools. This is where a currency trading calculator proves its worth.

What is a Currency Trading Calculator?

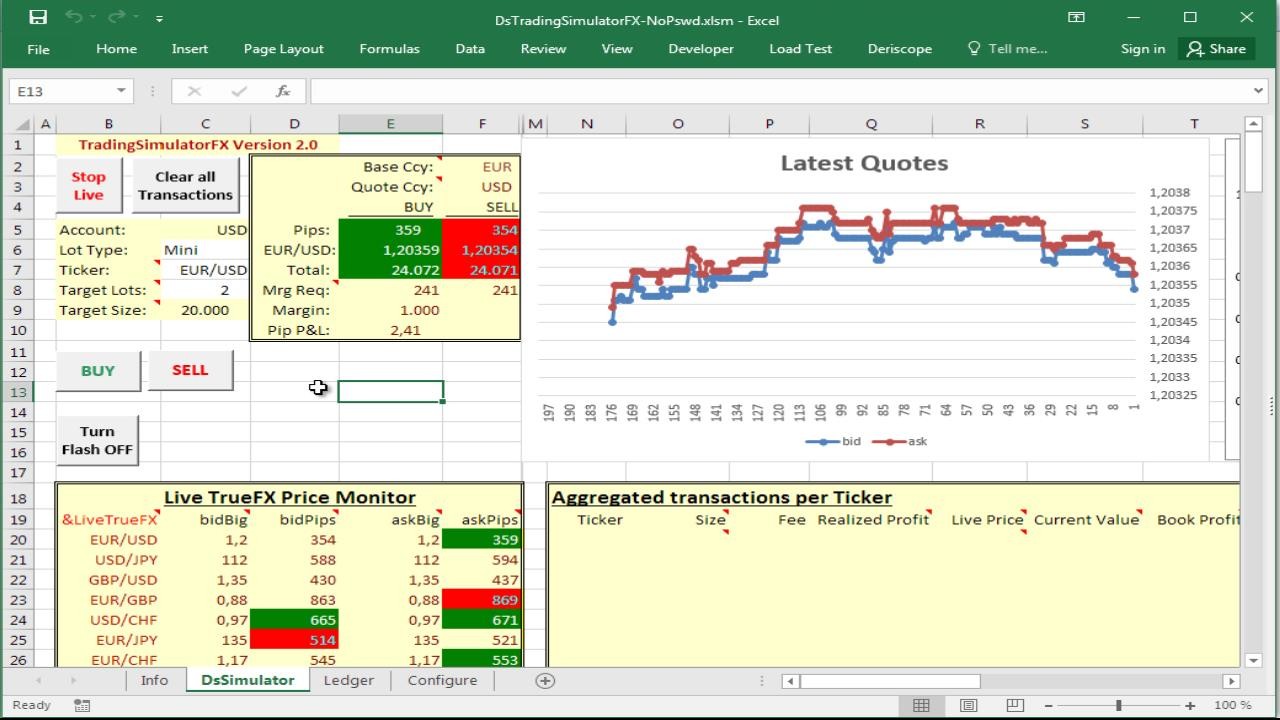

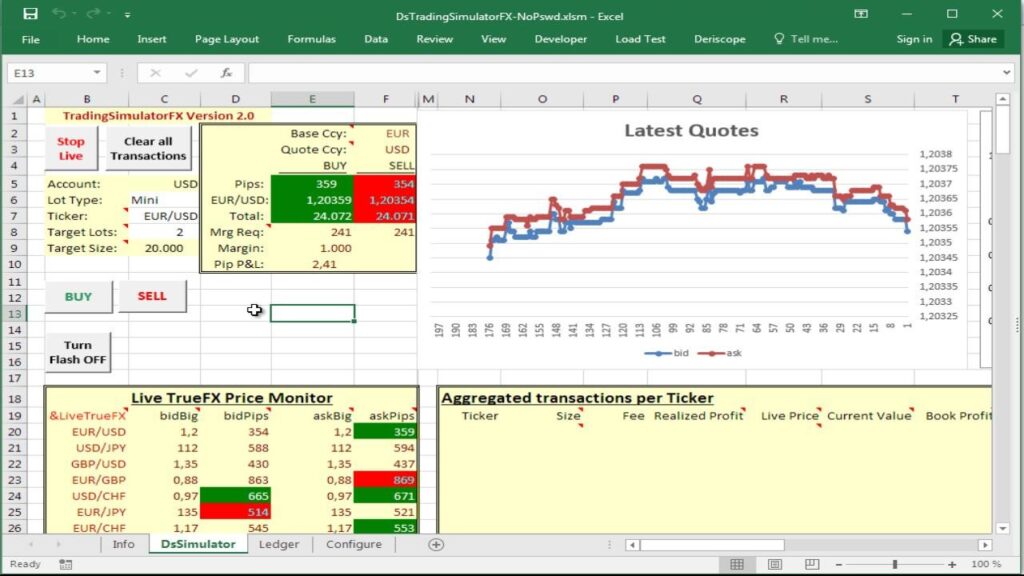

A currency trading calculator is a software tool or online application designed to assist forex traders in making informed decisions. It performs various calculations related to currency trading, such as:

- Pip Value Calculation: Determining the monetary value of a pip (percentage in point), which is the smallest unit of price change in a currency pair.

- Margin Calculation: Calculating the amount of money required in a trading account to open and maintain a position.

- Profit/Loss Calculation: Estimating the potential profit or loss from a trade based on entry and exit prices.

- Position Size Calculation: Determining the optimal position size to manage risk effectively.

- Swap Calculation: Calculating the interest earned or paid for holding a position overnight.

By automating these calculations, a currency trading calculator saves traders time and reduces the risk of human error. It allows traders to focus on analyzing market conditions and developing trading strategies, rather than getting bogged down in complex mathematical formulas. Using a reliable currency trading calculator is crucial for effective risk management.

Benefits of Using a Currency Trading Calculator

The benefits of using a currency trading calculator are numerous and can significantly impact a trader’s success. Here are some key advantages:

Increased Accuracy

Manual calculations in forex trading can be prone to errors, especially when dealing with multiple currency pairs and complex trading scenarios. A currency trading calculator eliminates the risk of human error by providing accurate and consistent results. This accuracy is vital for making informed decisions and avoiding costly mistakes.

Time Efficiency

Calculating pip values, margin requirements, and potential profits/losses manually can be time-consuming. A currency trading calculator automates these calculations, allowing traders to quickly assess trading opportunities and execute trades more efficiently. This time-saving aspect is particularly beneficial in the fast-paced forex market, where prices can change rapidly.

Improved Risk Management

Effective risk management is crucial for long-term success in forex trading. A currency trading calculator helps traders manage risk by providing tools to calculate position sizes, stop-loss levels, and potential losses. By understanding the risks associated with each trade, traders can make more informed decisions and protect their capital. Using a currency trading calculator is a cornerstone of responsible trading.

Enhanced Trading Strategy

A currency trading calculator can help traders refine their trading strategies by providing insights into the potential profitability of different trading scenarios. By experimenting with different entry and exit prices, position sizes, and risk levels, traders can optimize their strategies and improve their overall trading performance. A currency trading calculator allows for better backtesting and scenario analysis.

Accessibility and Convenience

Most currency trading calculators are available online or as mobile apps, making them easily accessible to traders around the world. This accessibility allows traders to perform calculations and analyze trading opportunities from anywhere with an internet connection. The convenience of having a currency trading calculator at your fingertips can be a significant advantage in the dynamic forex market. Many brokers offer integrated currency trading calculator tools within their platforms for added convenience.

Key Features to Look for in a Currency Trading Calculator

When choosing a currency trading calculator, it’s important to consider the features that will best suit your trading needs. Here are some key features to look for:

- Comprehensive Calculations: The calculator should be able to perform a wide range of calculations, including pip value, margin, profit/loss, position size, and swap calculations.

- Real-Time Data: The calculator should use real-time exchange rates to ensure the accuracy of its calculations.

- Customizable Settings: The calculator should allow you to customize settings such as account currency, leverage, and risk tolerance.

- User-Friendly Interface: The calculator should be easy to use and navigate, even for novice traders.

- Mobile Compatibility: The calculator should be accessible on mobile devices, allowing you to perform calculations on the go.

How to Use a Currency Trading Calculator Effectively

Using a currency trading calculator effectively requires a systematic approach. Here are some tips to help you get the most out of this valuable tool:

- Understand the Inputs: Before using a currency trading calculator, make sure you understand the meaning of each input field. Common inputs include currency pair, account currency, leverage, entry price, exit price, and position size.

- Double-Check Your Inputs: Always double-check your inputs to ensure accuracy. Even a small error can lead to significant discrepancies in the results.

- Experiment with Different Scenarios: Use the calculator to experiment with different trading scenarios and assess the potential risks and rewards of each.

- Integrate with Your Trading Strategy: Incorporate the results of the calculator into your overall trading strategy. Use the information to make informed decisions about position sizes, stop-loss levels, and take-profit targets.

- Regularly Update Your Settings: As your trading account grows and your risk tolerance changes, be sure to update your calculator settings accordingly.

Common Mistakes to Avoid When Using a Currency Trading Calculator

While a currency trading calculator can be a powerful tool, it’s important to avoid common mistakes that can lead to inaccurate results and poor trading decisions. Here are some pitfalls to watch out for:

- Using Incorrect Exchange Rates: Always ensure that the calculator is using real-time exchange rates. Stale or inaccurate data can lead to significant errors in your calculations.

- Entering Incorrect Leverage: Leverage can have a significant impact on margin requirements and potential profits/losses. Make sure you enter the correct leverage ratio for your trading account.

- Ignoring Trading Fees: Some currency trading calculators do not factor in trading fees, such as commissions and spreads. Be sure to account for these fees when calculating potential profits and losses.

- Over-Reliance on the Calculator: A currency trading calculator is a tool to assist you in making informed decisions, but it should not be the sole basis for your trading strategy. Always consider other factors, such as market analysis and risk management principles.

The Future of Currency Trading Calculators

As technology continues to evolve, currency trading calculators are becoming more sophisticated and integrated with other trading tools. Future calculators may incorporate artificial intelligence (AI) and machine learning (ML) to provide even more accurate and personalized insights. They may also integrate with trading platforms and provide real-time alerts and recommendations. The ongoing development of these tools will continue to empower traders and improve their chances of success in the forex market. The integration of a currency trading calculator into automated trading systems is also becoming more prevalent.

Conclusion

In conclusion, a currency trading calculator is an essential tool for any forex trader who wants to make informed decisions, manage risk effectively, and optimize their trading strategy. By automating complex calculations and providing accurate results, a currency trading calculator saves traders time and reduces the risk of human error. Whether you are a novice or experienced trader, incorporating a currency trading calculator into your trading toolkit can significantly improve your overall trading performance. Embrace this technology to enhance your precision and make calculated moves in the dynamic world of forex. A well-utilized currency trading calculator is your ally in navigating the complexities of currency trading.

[See also: Understanding Forex Leverage] [See also: Risk Management in Forex Trading]