Mastering Forex: How a Leverage Calculator Can Maximize Your Trading Potential

In the fast-paced world of Forex trading, understanding and managing leverage is crucial for both seasoned traders and newcomers alike. A leverage calculator forex tool is an indispensable asset, helping traders to accurately assess the potential impact of their trading positions. Leverage, in essence, is the ability to control a large amount of money with a smaller amount of capital. While it can amplify profits, it also significantly magnifies potential losses. This article explores the intricacies of Forex leverage, the importance of using a leverage calculator forex, and strategies for responsible leverage management.

Understanding Forex Leverage

Leverage in Forex trading is essentially a loan provided by your broker, allowing you to control a larger position size than your actual account balance would normally permit. It’s expressed as a ratio, such as 50:1, 100:1, or even 500:1. For example, a leverage of 100:1 means that for every $1 of your own capital, you can control $100 worth of currency.

The allure of leverage lies in its potential to increase profits exponentially. However, it’s a double-edged sword. If the market moves against your position, your losses can be magnified to the same extent, potentially exceeding your initial investment. Therefore, understanding how to use a leverage calculator forex becomes paramount in mitigating risks.

The Risks and Rewards of Leverage

- Potential for High Profits: Leverage allows traders to capitalize on even small price movements, turning them into substantial gains.

- Magnified Losses: Conversely, losses are also amplified, potentially leading to rapid depletion of your trading account.

- Margin Calls: If your losses erode your account balance to a certain level (the margin requirement), your broker may issue a margin call, requiring you to deposit more funds to maintain your position. Failure to do so can result in the automatic liquidation of your positions.

The Role of a Leverage Calculator Forex

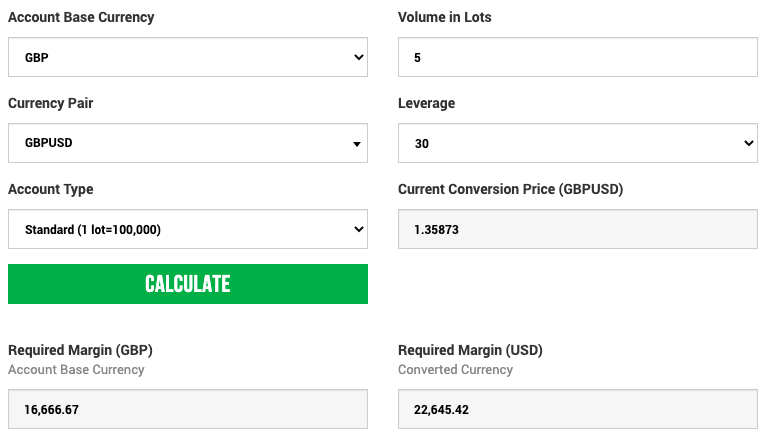

A leverage calculator forex is a simple yet powerful tool that helps traders determine the appropriate position size based on their account balance, risk tolerance, and the leverage offered by their broker. It allows you to calculate the margin required for a particular trade, the potential profit or loss, and the impact of leverage on your overall risk exposure.

How to Use a Leverage Calculator

Most leverage calculator forex tools require you to input the following information:

- Account Balance: The total amount of money in your trading account.

- Leverage Ratio: The leverage offered by your broker (e.g., 50:1, 100:1).

- Currency Pair: The currency pair you intend to trade (e.g., EUR/USD, GBP/JPY).

- Trade Size (Lots): The number of lots you plan to trade. A standard lot is 100,000 units of the base currency.

- Entry Price: The price at which you enter the trade.

- Stop-Loss Level: The price level at which you will automatically exit the trade to limit your losses.

Based on these inputs, the leverage calculator forex will provide you with the following information:

- Required Margin: The amount of money required to open the trade.

- Potential Profit/Loss: The estimated profit or loss based on your stop-loss level.

- Risk Percentage: The percentage of your account balance that you are risking on the trade.

Benefits of Using a Leverage Calculator

Employing a leverage calculator forex offers several key advantages:

- Risk Management: It helps you to assess the potential risk associated with each trade and avoid over-leveraging your account.

- Position Sizing: It allows you to determine the appropriate position size based on your risk tolerance and account balance.

- Margin Awareness: It provides you with a clear understanding of the margin requirements for each trade, helping you to avoid margin calls.

- Emotional Control: By understanding the potential risks and rewards, you can trade with more confidence and avoid making impulsive decisions driven by fear or greed.

Strategies for Responsible Leverage Management

While a leverage calculator forex is a valuable tool, it’s just one component of responsible leverage management. Here are some additional strategies to consider:

Determine Your Risk Tolerance

Before you start trading, it’s crucial to determine your risk tolerance. How much are you willing to lose on a single trade? A general rule of thumb is to risk no more than 1-2% of your account balance on any single trade. Use the leverage calculator forex to ensure your trades align with this risk tolerance.

Use Stop-Loss Orders

Stop-loss orders are essential for limiting your potential losses. A stop-loss order is an instruction to your broker to automatically close your position if the price reaches a certain level. This prevents your losses from spiraling out of control. The leverage calculator forex can help you determine appropriate stop-loss levels based on your risk tolerance and market volatility.

Understand Margin Calls

Be aware of your broker’s margin call policy. Understand at what point your account will be subject to a margin call and how much time you have to deposit additional funds. Regularly monitor your account balance and margin levels to avoid unexpected margin calls. Using a leverage calculator forex regularly helps you to understand the relationship between your leverage, position size and margin.

Avoid Over-Leveraging

It’s tempting to use high leverage to maximize potential profits, but this is a risky strategy. Over-leveraging your account can lead to rapid losses and margin calls. Stick to a conservative leverage ratio that you are comfortable with and that aligns with your risk tolerance. A leverage calculator forex is invaluable in ensuring you don’t over-leverage.

Practice with a Demo Account

Before trading with real money, practice using leverage and a leverage calculator forex on a demo account. This allows you to experiment with different leverage ratios and trading strategies without risking any capital. This hands-on experience will give you a better understanding of how leverage works and how to manage your risk effectively.

Choosing the Right Leverage Ratio

The ideal leverage ratio depends on several factors, including your trading experience, risk tolerance, and trading strategy. Beginners should start with lower leverage ratios, such as 10:1 or 20:1, to minimize their risk exposure. More experienced traders may be comfortable with higher leverage ratios, but it’s important to use caution and always manage your risk effectively. Remember to use a leverage calculator forex to see the real impact of your choices.

Consider these points when selecting a leverage ratio:

- Volatility of the Currency Pair: More volatile currency pairs require lower leverage ratios.

- Trading Style: Day traders may use higher leverage ratios than swing traders.

- Account Size: Smaller accounts may benefit from higher leverage, but the risk is also greater.

The Future of Forex Leverage

Regulatory scrutiny of Forex leverage is increasing globally. Many regulatory bodies are imposing stricter limits on leverage ratios to protect retail traders from excessive risk. This trend is likely to continue in the future, so it’s important to stay informed about the latest regulations in your jurisdiction. Regardless of regulatory changes, using a leverage calculator forex will remain a key tool for responsible trading.

Conclusion

Leverage can be a powerful tool for Forex traders, but it’s essential to understand the risks involved and manage your leverage responsibly. A leverage calculator forex is an indispensable tool for assessing risk, determining position size, and avoiding margin calls. By using a leverage calculator forex in conjunction with sound risk management strategies, you can increase your chances of success in the Forex market and protect your capital. Remember, responsible leverage management is the key to long-term profitability in Forex trading. Don’t underestimate the power of a simple leverage calculator forex – it could be the difference between success and failure.

[See also: Forex Risk Management Strategies]

[See also: Understanding Margin in Forex Trading]