Mastering Forex Leverage: A Comprehensive Guide & Leverage Calculator

Forex trading, with its potential for high returns, attracts traders of all levels. However, it’s crucial to understand the powerful tool that drives both profits and losses: forex leverage. This article provides a comprehensive guide to forex leverage, explaining its mechanics, risks, and benefits, while also introducing a forex leverage calculator to aid in risk management.

What is Forex Leverage?

Forex leverage is essentially a loan provided by your broker, allowing you to control a larger position size than your initial capital would otherwise permit. It’s expressed as a ratio, such as 50:1, 100:1, or even 500:1. For example, a forex leverage of 100:1 means you can control $100,000 worth of currency with just $1,000 of your own capital.

This amplified buying power can significantly increase your potential profits. However, it also magnifies your potential losses. Understanding this duality is paramount to successful and responsible forex trading.

How Forex Leverage Works

Let’s illustrate with an example. Suppose you want to trade EUR/USD and believe the Euro will strengthen against the US Dollar. Without forex leverage, you might only be able to buy a small amount of EUR/USD with your available capital. However, with forex leverage of 100:1, you can control a much larger position.

If you deposit $1,000 and use forex leverage of 100:1, you can control a $100,000 position. If the EUR/USD exchange rate moves favorably by 1%, your profit would be $1,000 (1% of $100,000). Without forex leverage, your profit would have been significantly smaller.

Conversely, if the EUR/USD exchange rate moves unfavorably by 1%, your loss would also be $1,000, wiping out your entire initial deposit. This highlights the importance of risk management when using forex leverage.

Benefits of Forex Leverage

- Increased Profit Potential: As demonstrated, forex leverage can amplify potential profits.

- Lower Capital Requirements: It allows traders with limited capital to participate in the forex market.

- Diversification: By using forex leverage, traders can spread their capital across multiple trades, potentially diversifying their risk.

Risks of Forex Leverage

- Magnified Losses: This is the most significant risk. Losses can quickly accumulate and exceed your initial deposit.

- Margin Calls: If your losses erode your account equity below a certain level (the margin requirement), your broker may issue a margin call, requiring you to deposit additional funds to maintain your position. Failure to do so can result in your positions being automatically closed at a loss.

- Emotional Trading: The potential for large and rapid profits (or losses) can lead to emotional decision-making, which can be detrimental to your trading strategy.

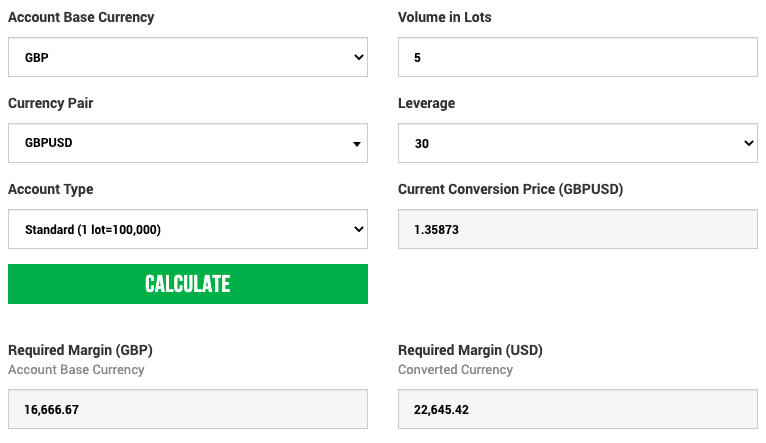

Introducing the Forex Leverage Calculator

A forex leverage calculator is a valuable tool that helps traders assess the potential impact of forex leverage on their trading positions. It allows you to calculate the margin required for a trade, the potential profit or loss based on different scenarios, and the risk exposure associated with your chosen forex leverage level.

How to Use a Forex Leverage Calculator

Most forex leverage calculators require the following inputs:

- Account Balance: Your total trading account balance.

- Leverage Ratio: The forex leverage ratio offered by your broker (e.g., 50:1, 100:1, 200:1).

- Trade Size (Lot Size): The size of the position you intend to trade (e.g., 0.1 lot, 1 lot, 5 lots).

- Currency Pair: The currency pair you are trading (e.g., EUR/USD, GBP/USD).

- Entry Price: The price at which you enter the trade.

- Stop-Loss Level: The price level at which you will automatically exit the trade to limit potential losses.

By inputting these values, the forex leverage calculator will provide you with critical information, including:

- Margin Required: The amount of capital required to open and maintain the position.

- Pip Value: The monetary value of each pip (percentage in point) movement in the currency pair.

- Potential Profit/Loss: The estimated profit or loss based on your stop-loss level and potential price movements.

- Risk/Reward Ratio: A measure of the potential profit relative to the potential loss.

Choosing the Right Forex Leverage Level

Selecting the appropriate forex leverage level is a personal decision that depends on your risk tolerance, trading strategy, and capital available. There is no one-size-fits-all answer.

Here are some factors to consider:

- Risk Tolerance: If you are risk-averse, a lower forex leverage ratio is generally recommended. Higher forex leverage ratios are more suitable for experienced traders with a higher risk appetite.

- Trading Strategy: Different trading strategies may require different forex leverage levels. For example, scalpers may use higher forex leverage to capitalize on small price movements, while long-term traders may prefer lower forex leverage to reduce their risk exposure.

- Capital Available: The amount of capital you have available will influence your forex leverage choices. Traders with limited capital may be tempted to use higher forex leverage to increase their trading power, but this can also increase their risk of ruin.

As a general guideline, beginners should start with lower forex leverage ratios (e.g., 10:1 or 20:1) and gradually increase their forex leverage as they gain experience and develop a solid understanding of risk management.

Risk Management Strategies with Forex Leverage

Effective risk management is crucial when using forex leverage. Here are some essential strategies:

- Use Stop-Loss Orders: Always use stop-loss orders to limit your potential losses on each trade. Determine your stop-loss level based on your risk tolerance and the volatility of the currency pair.

- Manage Your Position Size: Avoid risking more than a small percentage of your capital on any single trade (e.g., 1-2%). Use a forex leverage calculator to determine the appropriate position size based on your risk tolerance and stop-loss level.

- Monitor Your Account Equity: Regularly monitor your account equity to ensure you have sufficient margin to maintain your positions. Be prepared to close positions or deposit additional funds if your account equity falls below the required margin level.

- Avoid Emotional Trading: Stick to your trading plan and avoid making impulsive decisions based on fear or greed.

- Stay Informed: Keep up-to-date with market news and economic events that could impact your trades.

Forex Leverage Regulations

Forex leverage regulations vary by jurisdiction. Regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK and the Commodity Futures Trading Commission (CFTC) in the US, impose limits on the maximum forex leverage that brokers can offer to retail clients. These regulations are designed to protect traders from excessive risk.

Before trading with forex leverage, it’s important to understand the regulations in your jurisdiction and choose a reputable broker that complies with those regulations.

Conclusion

Forex leverage is a powerful tool that can amplify both profits and losses. By understanding its mechanics, risks, and benefits, and by using a forex leverage calculator to manage your risk exposure, you can increase your chances of success in the forex market. Remember to choose a forex leverage level that is appropriate for your risk tolerance and trading strategy, and always prioritize risk management.

[See also: Forex Trading Strategies for Beginners] [See also: Understanding Margin Calls in Forex] [See also: Best Forex Brokers for Beginners]