Mastering Forex: The Essential Currency Trading Calculator Guide

In the fast-paced world of foreign exchange, or Forex, precision and informed decision-making are paramount. Whether you’re a seasoned trader or just starting to dip your toes into the Forex market, understanding the tools at your disposal is crucial. One such indispensable tool is the currency trading calculator. This guide provides a comprehensive overview of how to effectively use a currency trading calculator, its benefits, and how it can significantly improve your trading strategy. In essence, a currency trading calculator is your first line of defense against miscalculations in the high-stakes arena of Forex.

Understanding the Basics of Currency Trading

Before diving into the specifics of a currency trading calculator, it’s important to grasp the fundamentals of Forex trading. Forex involves buying and selling currencies in pairs, with the goal of profiting from fluctuations in their exchange rates. These fluctuations are influenced by a myriad of factors, including economic indicators, geopolitical events, and market sentiment. Understanding these factors is crucial for making informed trading decisions.

Currency pairs are always quoted in relation to each other. For example, EUR/USD represents the Euro against the US Dollar. The first currency listed is the base currency, and the second is the quote currency. The exchange rate indicates how much of the quote currency is needed to purchase one unit of the base currency.

What is a Currency Trading Calculator?

A currency trading calculator is a digital tool designed to assist traders in various aspects of Forex trading. It simplifies complex calculations, allowing traders to quickly and accurately determine crucial factors such as pip value, margin requirements, potential profits, and risk-reward ratios. Using a currency trading calculator minimizes the chances of human error, which can be costly in Forex trading.

These calculators come in various forms, from simple online tools to more sophisticated software integrated into trading platforms. The core function remains the same: to provide traders with precise data to inform their trading decisions.

Key Functions of a Currency Trading Calculator

Pip Value Calculation

A pip, or “percentage in point,” is the smallest unit of price movement in Forex. Knowing the pip value is essential for calculating potential profits and losses. The currency trading calculator automates this process, taking into account the currency pair, trade size, and exchange rate. This is a critical step in risk management, as it allows traders to understand the monetary impact of each pip movement.

Margin Calculation

Margin is the amount of money required in your trading account to open and maintain a position. Forex brokers typically offer leveraged trading, allowing traders to control larger positions with relatively small amounts of capital. The currency trading calculator helps determine the margin needed for a specific trade, based on the leverage offered by the broker and the size of the position. Understanding margin requirements is vital for avoiding margin calls, which can lead to the forced liquidation of positions.

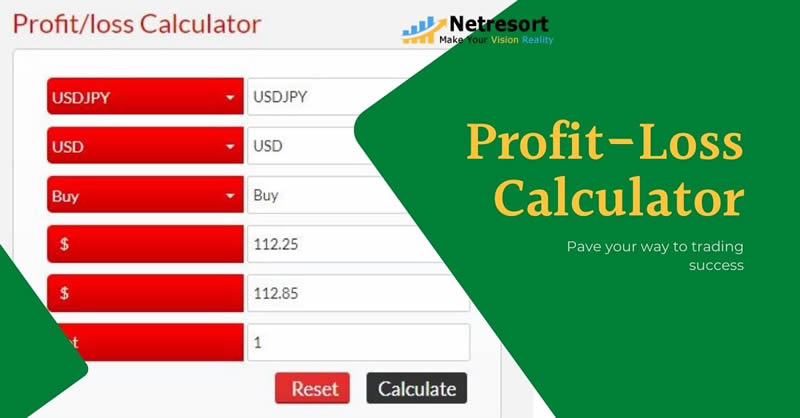

Profit and Loss Calculation

One of the most straightforward uses of a currency trading calculator is to estimate potential profits and losses. By inputting the entry price, exit price, and trade size, the calculator provides an immediate estimate of the potential outcome. This is invaluable for assessing the viability of a trade and setting realistic profit targets and stop-loss levels.

Risk-Reward Ratio Calculation

The risk-reward ratio is a crucial metric for evaluating the potential profitability of a trade relative to its risk. The currency trading calculator can quickly calculate this ratio, helping traders make informed decisions about whether a trade is worth pursuing. A favorable risk-reward ratio (e.g., 1:2 or higher) indicates that the potential profit outweighs the potential loss.

Benefits of Using a Currency Trading Calculator

- Accuracy: Minimizes the risk of human error in complex calculations.

- Efficiency: Saves time by automating calculations, allowing traders to focus on analysis and strategy.

- Risk Management: Provides essential data for managing risk, such as pip value and margin requirements.

- Informed Decision-Making: Helps traders make better decisions by providing clear and concise information about potential profits and losses.

- Accessibility: Available online and as part of trading platforms, making it easily accessible to traders of all levels.

How to Use a Currency Trading Calculator Effectively

To maximize the benefits of a currency trading calculator, it’s essential to understand how to use it correctly. Here are some tips:

- Input Accurate Data: Ensure that all data entered into the calculator, such as currency pair, trade size, entry price, and exit price, is accurate. Even small errors can lead to significant miscalculations.

- Understand the Parameters: Familiarize yourself with the different parameters and settings of the calculator. Understand what each input represents and how it affects the results.

- Use Multiple Calculators: Compare results from different currency trading calculators to ensure consistency and accuracy. This can help identify any potential errors or discrepancies.

- Integrate with Trading Strategy: Use the calculator as an integral part of your trading strategy. Don’t rely solely on the calculator, but use it in conjunction with technical and fundamental analysis.

- Regularly Update: Ensure that the currency trading calculator you are using is up-to-date with the latest exchange rates and market conditions.

Choosing the Right Currency Trading Calculator

With numerous currency trading calculator options available, selecting the right one can be challenging. Here are some factors to consider:

- Ease of Use: Choose a calculator that is user-friendly and intuitive to navigate.

- Features: Look for a calculator that offers the features you need, such as pip value calculation, margin calculation, and profit/loss estimation.

- Accuracy: Ensure that the calculator provides accurate and reliable results.

- Integration: Consider whether the calculator can be integrated with your trading platform.

- Reviews and Reputation: Check reviews and ratings to gauge the calculator’s reputation and reliability.

Advanced Applications of Currency Trading Calculators

Beyond the basic functions, currency trading calculators can be used for more advanced applications. For example, traders can use them to optimize their position sizing, fine-tune their risk management strategies, and backtest their trading ideas. By simulating different scenarios with varying trade sizes and risk levels, traders can gain valuable insights into the potential outcomes of their strategies.

Furthermore, currency trading calculators can be integrated with automated trading systems, allowing for real-time adjustments to position sizes and risk parameters based on market conditions. This can be particularly useful for algorithmic traders who rely on precise calculations and rapid execution.

Common Mistakes to Avoid When Using Currency Trading Calculators

While currency trading calculators are invaluable tools, they are not foolproof. Traders can still make mistakes if they are not careful. Here are some common mistakes to avoid:

- Incorrect Data Entry: Always double-check the data you enter into the calculator. Even small errors can lead to significant miscalculations.

- Ignoring Market Volatility: Be aware that market conditions can change rapidly, affecting exchange rates and pip values. Update your calculations regularly to account for these changes.

- Over-Reliance: Don’t rely solely on the calculator. Use it in conjunction with other tools and analysis techniques.

- Neglecting Fees and Commissions: Remember to factor in any fees and commissions charged by your broker when calculating potential profits and losses.

- Failing to Understand Leverage: Be aware of the risks associated with leverage. Use the calculator to understand the potential impact of leverage on your margin requirements and potential losses.

The Future of Currency Trading Calculators

As technology continues to evolve, currency trading calculators are likely to become even more sophisticated and integrated into trading platforms. We can expect to see more advanced features, such as real-time risk analysis, automated position sizing, and personalized trading recommendations. Artificial intelligence and machine learning could also play a role in enhancing the accuracy and predictive capabilities of these tools.

Moreover, the increasing popularity of mobile trading will likely lead to the development of more user-friendly and feature-rich mobile currency trading calculators. This will allow traders to access essential information and make informed decisions on the go.

Conclusion

In conclusion, a currency trading calculator is an essential tool for any Forex trader. It simplifies complex calculations, minimizes the risk of error, and provides valuable insights into potential profits and losses. By understanding how to use a currency trading calculator effectively, traders can improve their risk management, make more informed decisions, and ultimately increase their chances of success in the Forex market. Embrace this tool and integrate it into your trading strategy to gain a competitive edge. Remember, precision and accuracy are key in the world of Forex, and a currency trading calculator is your ally in achieving both. [See also: Risk Management in Forex Trading] and [See also: Advanced Forex Trading Strategies]