Mastering Forex: The Ultimate Currency Trade Calculator Guide

Navigating the complexities of the foreign exchange (forex) market requires precision, strategic planning, and the right tools. Among these tools, the currency trade calculator stands out as an indispensable asset for both novice and experienced traders. This comprehensive guide delves into the intricacies of using a currency trade calculator effectively, ensuring you make informed decisions and optimize your trading strategies.

Understanding the Basics of Forex Trading

Before diving into the specifics of a currency trade calculator, it’s crucial to grasp the fundamentals of forex trading. Forex, or foreign exchange, is the global marketplace where currencies are traded. It’s the largest and most liquid financial market in the world, operating 24 hours a day, five days a week.

Currency pairs are the foundation of forex trading. A currency pair consists of two currencies, with one currency being quoted against the other. For example, EUR/USD represents the Euro against the US Dollar. The first currency (EUR) is the base currency, and the second currency (USD) is the quote currency. The exchange rate indicates how much of the quote currency is needed to purchase one unit of the base currency.

Key Concepts in Forex Trading

- Leverage: Leverage allows traders to control a larger position with a smaller amount of capital. While it can amplify profits, it also magnifies losses.

- Pips (Points in Percentage): Pips are the smallest unit of price movement in forex trading. Most currency pairs are quoted to four decimal places, and a pip represents a change of 0.0001.

- Spread: The spread is the difference between the bid price (the price at which a broker is willing to buy a currency) and the ask price (the price at which a broker is willing to sell a currency). It represents the broker’s commission.

- Margin: Margin is the amount of money required in your trading account to open and maintain a position.

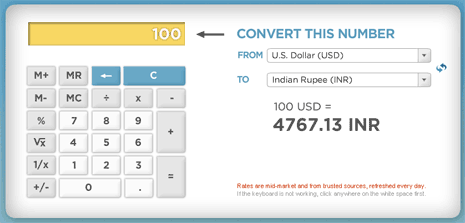

What is a Currency Trade Calculator?

A currency trade calculator is a tool designed to help forex traders determine various aspects of a potential trade, such as position size, risk exposure, and potential profit or loss. It takes into account factors like account balance, risk tolerance, currency pair volatility, and leverage to provide accurate calculations.

Essentially, a currency trade calculator automates the complex calculations involved in forex trading, saving traders time and minimizing the risk of errors. By inputting specific parameters, traders can quickly assess the potential outcomes of a trade before committing their capital.

Benefits of Using a Currency Trade Calculator

The advantages of incorporating a currency trade calculator into your trading routine are numerous:

- Risk Management: A currency trade calculator helps traders determine the appropriate position size based on their risk tolerance. By calculating the potential loss for a given trade, traders can ensure they’re not risking more than they can afford to lose.

- Position Sizing: Determining the optimal position size is crucial for maximizing profits while minimizing risk. A currency trade calculator takes into account your account balance, risk percentage, and stop-loss level to calculate the ideal position size.

- Profit and Loss Calculation: A currency trade calculator can estimate the potential profit or loss of a trade based on your entry and exit points. This allows you to assess the risk-reward ratio and make informed decisions.

- Time Saving: Manually calculating position size, risk exposure, and potential profit or loss can be time-consuming. A currency trade calculator automates these calculations, freeing up your time to focus on other aspects of your trading strategy.

- Accuracy: Human error is a common pitfall in forex trading. A currency trade calculator eliminates the risk of calculation errors, ensuring you have accurate information to base your decisions on.

Key Components of a Currency Trade Calculator

Most currency trade calculators include several key input fields:

- Account Currency: The currency in which your trading account is denominated (e.g., USD, EUR, GBP).

- Account Balance: The total amount of money in your trading account.

- Currency Pair: The currency pair you are trading (e.g., EUR/USD, GBP/JPY).

- Entry Price: The price at which you plan to enter the trade.

- Stop-Loss Price: The price at which you will exit the trade to limit your losses.

- Take-Profit Price: The price at which you will exit the trade to secure your profits.

- Leverage: The leverage ratio offered by your broker (e.g., 1:100, 1:500).

- Risk Percentage: The percentage of your account balance you are willing to risk on a single trade.

Based on these inputs, the currency trade calculator will provide outputs such as:

- Position Size (Lots): The number of lots you should trade based on your risk parameters.

- Risk Amount: The amount of money you are risking on the trade.

- Potential Profit: The potential profit you could make if the trade reaches your take-profit price.

- Potential Loss: The potential loss you could incur if the trade hits your stop-loss price.

- Risk-Reward Ratio: The ratio of potential profit to potential loss.

- Pip Value: The monetary value of each pip movement for the given position size.

How to Use a Currency Trade Calculator Effectively

To maximize the benefits of a currency trade calculator, follow these steps:

- Choose a Reliable Calculator: Select a reputable currency trade calculator from a trusted source. Many brokers and financial websites offer free currency trade calculators. Ensure the calculator is accurate and up-to-date.

- Input Accurate Data: The accuracy of the calculator’s output depends on the accuracy of your input. Double-check all the data you enter, including account balance, currency pair, entry price, stop-loss price, take-profit price, leverage, and risk percentage.

- Understand the Outputs: Familiarize yourself with the various outputs provided by the calculator. Pay close attention to the position size, risk amount, potential profit, potential loss, and risk-reward ratio.

- Adjust Your Parameters: Experiment with different parameters to see how they affect the potential outcomes of a trade. For example, try adjusting your stop-loss price or risk percentage to see how it impacts your position size and risk exposure.

- Use in Conjunction with Other Tools: A currency trade calculator is a valuable tool, but it should not be used in isolation. Combine it with other forms of analysis, such as technical analysis and fundamental analysis, to make well-rounded trading decisions.

- Practice with a Demo Account: Before using a currency trade calculator with real money, practice using it with a demo account. This will allow you to familiarize yourself with the tool and refine your trading strategy without risking your capital.

Example Scenario: Using a Currency Trade Calculator

Let’s illustrate how a currency trade calculator can be used in a practical scenario. Suppose you have a trading account with a balance of $10,000, and you want to trade the EUR/USD currency pair. You are willing to risk 2% of your account balance on a single trade. Your broker offers a leverage of 1:100.

You analyze the market and decide to enter a long position (buy) on EUR/USD at a price of 1.1000. You set a stop-loss price at 1.0950 and a take-profit price at 1.1050.

Using a currency trade calculator, you input the following data:

- Account Currency: USD

- Account Balance: $10,000

- Currency Pair: EUR/USD

- Entry Price: 1.1000

- Stop-Loss Price: 1.0950

- Take-Profit Price: 1.1050

- Leverage: 1:100

- Risk Percentage: 2%

The currency trade calculator provides the following outputs:

- Position Size: 0.4 lots

- Risk Amount: $200

- Potential Profit: $200

- Potential Loss: $200

- Risk-Reward Ratio: 1:1

- Pip Value: $4 per pip

Based on these calculations, you can see that trading 0.4 lots of EUR/USD will risk $200, which is 2% of your account balance. The potential profit is also $200, resulting in a risk-reward ratio of 1:1. Each pip movement will be worth $4.

With this information, you can make an informed decision about whether to proceed with the trade. If you are comfortable with the risk-reward ratio and the potential loss, you can execute the trade. If not, you can adjust your parameters, such as your stop-loss price or risk percentage, to find a more suitable trade setup.

Common Mistakes to Avoid When Using a Currency Trade Calculator

While a currency trade calculator is a powerful tool, it’s important to avoid common mistakes that can lead to inaccurate results and poor trading decisions:

- Incorrect Data Entry: Always double-check the data you enter into the calculator. Even a small error can significantly impact the results.

- Ignoring Slippage and Commission: Some calculators do not account for slippage (the difference between the expected price and the actual price at which a trade is executed) or commission. Be sure to factor these costs into your calculations.

- Over-Reliance on the Calculator: A currency trade calculator is a tool, not a trading strategy. Do not rely solely on the calculator to make your trading decisions. Use it in conjunction with other forms of analysis and your own judgment.

- Not Adjusting for Volatility: Currency pairs can experience periods of high volatility. Be sure to adjust your parameters, such as your stop-loss price and risk percentage, to account for increased volatility.

- Ignoring the Risk-Reward Ratio: Always pay attention to the risk-reward ratio. A good risk-reward ratio is generally considered to be 1:2 or higher, meaning that you are risking one unit of capital to potentially earn two or more units of capital.

Advanced Features of Currency Trade Calculators

Some advanced currency trade calculators offer additional features that can further enhance your trading strategy:

- Correlation Analysis: These calculators can analyze the correlation between different currency pairs, helping you avoid trading pairs that are highly correlated and could potentially result in double losses.

- Margin Calculation: These calculators can calculate the margin required to open and maintain a position, helping you ensure you have sufficient funds in your trading account.

- Pip Value Calculation: These calculators can calculate the monetary value of each pip movement for a given position size, helping you understand the potential profit or loss for each pip.

- Volatility Analysis: These calculators can analyze the volatility of different currency pairs, helping you identify pairs that are more or less volatile and adjust your trading strategy accordingly.

Choosing the Right Currency Trade Calculator

Selecting the appropriate currency trade calculator is pivotal for precise forex trading. Here are key considerations:

- Accuracy: Prioritize calculators known for their accuracy. Test them with known data to ensure reliable outputs.

- User-Friendliness: Opt for a calculator with an intuitive interface. Ease of use reduces errors and saves time.

- Features: Depending on your needs, look for advanced features like correlation analysis or volatility assessment.

- Reputation: Choose calculators from reputable sources. Broker-provided calculators are generally trustworthy.

- Accessibility: Consider whether you prefer a web-based calculator or a downloadable app.

The Future of Currency Trade Calculators

As technology advances, currency trade calculators are becoming increasingly sophisticated. Future calculators may incorporate artificial intelligence (AI) and machine learning (ML) to provide more accurate and personalized calculations. They may also integrate with trading platforms to automate the process of position sizing and risk management.

Moreover, the increasing popularity of mobile trading is driving the development of mobile-friendly currency trade calculators. These calculators allow traders to perform calculations on the go, making it easier to manage their trades from anywhere in the world.

Conclusion

In conclusion, a currency trade calculator is an essential tool for any forex trader looking to manage risk, optimize position size, and make informed trading decisions. By understanding the key components of a currency trade calculator, knowing how to use it effectively, and avoiding common mistakes, you can significantly improve your trading performance and increase your chances of success in the forex market. Remember to always use a currency trade calculator in conjunction with other forms of analysis and your own judgment, and to practice with a demo account before risking real money. A well-utilized currency trade calculator can be the difference between a successful trade and a costly mistake. The use of a reliable currency trade calculator is paramount for effective forex trading. Understanding its features and proper usage ensures better risk management and informed decision-making. So, empower yourself with a currency trade calculator and elevate your trading journey.

[See also: Forex Trading Strategies for Beginners]

[See also: Understanding Forex Leverage and Margin]