Mastering Leverage: A Comprehensive Guide and Leverage Calc Explained

Leverage is a powerful tool in finance, capable of amplifying both gains and losses. Understanding how to use it effectively, and calculating its potential impact, is crucial for any investor or business owner. This guide will provide a comprehensive overview of leverage, explore various types of leverage, and delve into how a leverage calc can help you make informed decisions.

What is Leverage?

At its core, leverage refers to using borrowed capital to increase the potential return of an investment. It’s like using a small force to move a much larger object with the help of a lever. In finance, the ‘lever’ is borrowed money, and the ‘object’ is the investment. By using leverage, you can control a larger asset with a smaller amount of your own capital. However, it’s vital to remember that this increased potential return also comes with increased risk. The leverage calc helps to quantify and understand this risk.

Types of Leverage

Leverage comes in many forms, each with its own characteristics and applications:

- Financial Leverage: This involves using debt to finance assets. Companies often use financial leverage to fund expansion, acquisitions, or large projects.

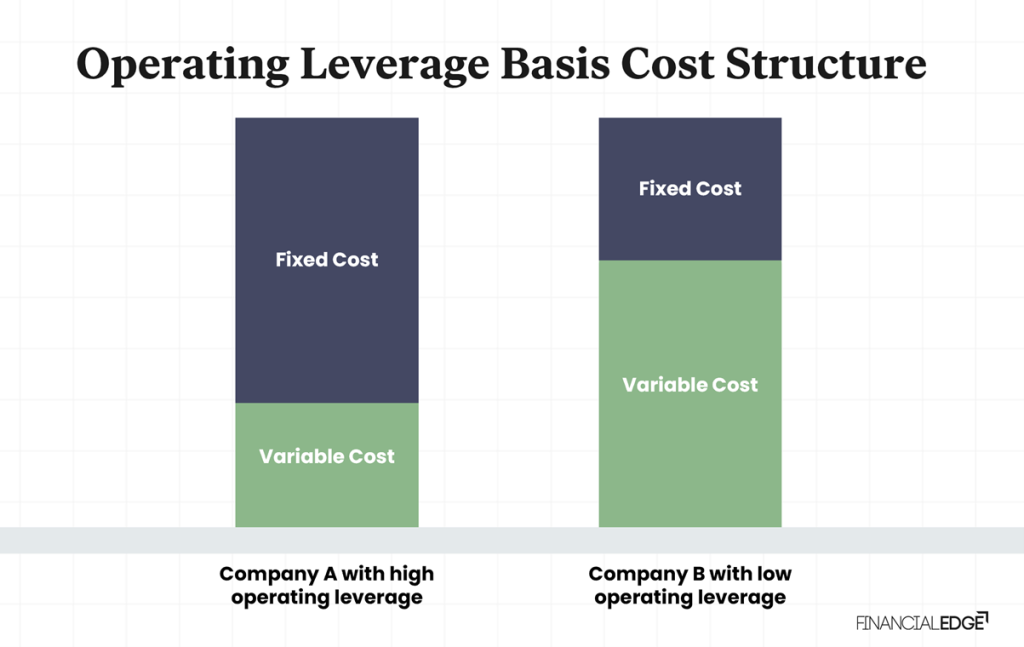

- Operating Leverage: This refers to the proportion of fixed costs in a company’s cost structure. High operating leverage means a larger portion of costs are fixed, leading to greater profitability during periods of high sales, but also greater losses during downturns.

- Trading Leverage: Commonly used in forex, futures, and options trading, this allows traders to control a larger position with a smaller margin deposit.

- Real Estate Leverage: This involves using a mortgage to purchase a property. The mortgage allows you to own a property worth much more than your initial down payment.

The Importance of a Leverage Calc

A leverage calc is an essential tool for anyone considering using leverage. It helps you quantify the potential impact of leverage on your investment or business. By inputting various parameters, such as the amount of debt, the interest rate, and the expected return on investment, you can estimate the potential profit or loss associated with using leverage. This allows you to assess the risk-reward ratio and make informed decisions.

Benefits of Using a Leverage Calc

- Risk Assessment: A leverage calc allows you to assess the potential downsides of using leverage. By understanding the potential losses, you can make more informed decisions and avoid overleveraging.

- Profit Projections: It helps you project the potential profits that can be generated through leverage. This can be useful in evaluating the viability of an investment or business strategy.

- Scenario Planning: You can use a leverage calc to analyze different scenarios and see how changes in key variables, such as interest rates or market conditions, can impact your results.

- Decision Making: Ultimately, a leverage calc provides you with the information you need to make sound financial decisions.

Understanding the Formula Behind a Leverage Calc

While many online leverage calc tools are available, understanding the underlying formula is crucial for interpreting the results. The basic formula for calculating leverage is:

Leverage Ratio = Total Assets / Equity

This ratio indicates how much of a company’s assets are financed by debt. A higher ratio indicates a higher degree of leverage. However, this is just one aspect. A more comprehensive leverage calc will also consider factors like interest rates, expected returns, and repayment schedules.

For calculating the impact of leverage on returns, the following formula is helpful:

Return on Equity (ROE) = Net Income / Equity

Leverage can impact ROE by increasing both net income (if investments are profitable) and risk (if investments are not profitable). A leverage calc will often provide estimations of ROE under different leverage scenarios.

Examples of Leverage in Action

Real Estate Investment

Imagine you want to purchase a property worth $500,000. You have $100,000 for a down payment and take out a mortgage for the remaining $400,000. This is an example of using leverage. If the property value increases by 10% to $550,000, your equity increases by $50,000, representing a 50% return on your initial investment ($50,000 profit / $100,000 down payment). Without leverage, a 10% return would have only yielded a 10% return on the full $500,000, or $50,000, but that would have required you to have the full $500,000. However, if the property value decreases by 10%, you lose $50,000, representing a 50% loss on your initial investment. A leverage calc would help you estimate these potential gains and losses.

Company Expansion

A company wants to expand its operations and needs $1 million. It has $200,000 in equity and borrows the remaining $800,000. This is another example of leverage. If the expansion generates a profit of $300,000, the company’s return on equity is 150% ($300,000 profit / $200,000 equity). A leverage calc would help the company assess the feasibility of this expansion and the potential impact on its financial performance. [See also: Business Expansion Strategies]

Risks Associated with Leverage

While leverage can amplify returns, it also amplifies losses. The higher the leverage, the greater the potential for both profit and loss. It’s crucial to understand the risks involved before using leverage.

- Increased Debt Burden: Leverage increases your debt obligations, which can strain your cash flow and make it difficult to meet your financial obligations.

- Higher Interest Costs: Borrowing money comes with interest costs, which can eat into your profits.

- Risk of Foreclosure or Bankruptcy: If your investments perform poorly, you may not be able to repay your debts, leading to foreclosure or bankruptcy.

- Market Volatility: Leverage can magnify the impact of market volatility, leading to larger losses during downturns.

How to Use a Leverage Calc Effectively

To use a leverage calc effectively, follow these steps:

- Gather Accurate Data: Collect accurate data on your assets, liabilities, income, and expenses.

- Input the Data Correctly: Enter the data into the leverage calc carefully, ensuring that you are using the correct units and formats.

- Analyze the Results: Carefully analyze the results of the leverage calc, paying attention to the potential gains and losses.

- Consider Different Scenarios: Use the leverage calc to analyze different scenarios and see how changes in key variables can impact your results.

- Make Informed Decisions: Use the information provided by the leverage calc to make sound financial decisions.

Choosing the Right Leverage Calc

Many online leverage calc tools are available. When choosing a leverage calc, consider the following factors:

- Accuracy: Choose a leverage calc that uses accurate formulas and provides reliable results.

- Ease of Use: Choose a leverage calc that is easy to use and understand.

- Customization: Choose a leverage calc that allows you to customize the parameters to fit your specific needs.

- Features: Choose a leverage calc that offers the features you need, such as scenario planning and risk assessment.

Examples of Leverage Calc Tools

Several online calculators can help you understand leverage. Some examples include:

- Online financial calculators focusing on debt-to-equity ratios.

- Real estate investment calculators with leverage components.

- Specialized calculators for margin trading and forex.

Remember to compare results from different calculators and understand their underlying assumptions.

Leverage in Different Industries

The use of leverage varies across different industries. For example, the real estate industry often relies heavily on leverage in the form of mortgages. In contrast, the technology industry may use less financial leverage but may have high operating leverage due to high fixed costs. Understanding how leverage is used in your specific industry is crucial for making informed decisions. [See also: Industry Analysis]

Conclusion

Leverage is a powerful tool that can amplify both gains and losses. A leverage calc is an essential tool for understanding and managing the risks associated with leverage. By using a leverage calc effectively, you can make informed decisions and increase your chances of success. However, it is important to remember that leverage is not a magic bullet. It is a tool that should be used with caution and only after careful consideration of the risks involved. Mastering the art of leverage requires a thorough understanding of its principles, its applications, and its limitations. Always consult with a financial advisor before making any major financial decisions involving leverage. Using a leverage calc is a great starting point, but professional advice is invaluable for ensuring you’re making the right choices for your specific situation. This comprehensive guide, coupled with the judicious use of a leverage calc, will empower you to navigate the complexities of leverage with confidence and achieve your financial goals. Remember that understanding leverage calc results is just as important as using the tool itself. Don’t underestimate the power of a well-understood leverage calc in your financial planning. Finally, always double-check the numbers you input into any leverage calc to ensure accuracy, as even small errors can lead to significantly different results. The leverage calc is your friend, so use it wisely and often!