Mastering the Markets: Utilizing the MACD and RSI Indicator for Enhanced Trading Strategies

In the dynamic world of financial markets, traders and investors constantly seek reliable tools and strategies to make informed decisions. Two widely used indicators, the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI), offer valuable insights into price momentum and potential trend reversals. This article delves into the intricacies of the MACD RSI indicator, exploring how they function individually and, more importantly, how their combined use can significantly enhance trading strategies.

Understanding the MACD Indicator

The Moving Average Convergence Divergence (MACD) is a momentum indicator that shows the relationship between two moving averages of a security’s price. Created by Gerald Appel in the late 1970s, the MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. This calculation forms the MACD line. A nine-period EMA of the MACD line, known as the signal line, is then plotted on top of the MACD line, functioning as a trigger for buy and sell signals.

Components of the MACD

- MACD Line: The difference between the 12-period EMA and the 26-period EMA.

- Signal Line: A 9-period EMA of the MACD line.

- Histogram: Represents the difference between the MACD line and the signal line. It visually displays the momentum of the price movement.

Interpreting MACD Signals

The MACD generates various signals that traders use to identify potential buying and selling opportunities:

- Crossovers: A bullish signal occurs when the MACD line crosses above the signal line, suggesting upward momentum. Conversely, a bearish signal occurs when the MACD line crosses below the signal line, indicating downward momentum.

- Divergence: Bullish divergence happens when the price makes lower lows, but the MACD makes higher lows, suggesting a potential reversal to the upside. Bearish divergence occurs when the price makes higher highs, but the MACD makes lower highs, signaling a possible reversal to the downside.

- Histogram Analysis: The histogram provides a visual representation of the strength of the trend. An increasing histogram suggests strengthening momentum, while a decreasing histogram indicates weakening momentum.

Understanding the RSI Indicator

The Relative Strength Index (RSI), developed by J. Welles Wilder Jr., is a momentum oscillator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. The RSI is displayed as an oscillator (a line graph) that can range between 0 and 100. Traditionally, an RSI reading above 70 is considered overbought, indicating that the asset may be overvalued and prone to a price decline. An RSI reading below 30 is considered oversold, suggesting that the asset may be undervalued and poised for a price increase.

Calculation of RSI

The RSI is calculated using the following formula:

RSI = 100 – [100 / (1 + (Average Gain / Average Loss))]

Where:

- Average Gain is the average of the gains over a specified period (typically 14 periods).

- Average Loss is the average of the losses over the same period.

Interpreting RSI Signals

The RSI provides several signals that traders use to assess market conditions:

- Overbought and Oversold Levels: As mentioned earlier, readings above 70 indicate overbought conditions, while readings below 30 indicate oversold conditions.

- Divergence: Similar to the MACD, divergence in the RSI can signal potential trend reversals. Bullish divergence occurs when the price makes lower lows, but the RSI makes higher lows. Bearish divergence occurs when the price makes higher highs, but the RSI makes lower highs.

- Centerline Crossovers: The 50 level is considered the centerline. A move above 50 suggests bullish momentum, while a move below 50 indicates bearish momentum.

- Failure Swings: A failure swing is a pattern where the RSI fails to reach a previous high (in an uptrend) or low (in a downtrend), suggesting a potential trend reversal.

Combining the MACD and RSI Indicator for Enhanced Trading Strategies

While both the MACD and RSI are valuable indicators on their own, their combined use can provide a more comprehensive and reliable view of market conditions. By using these indicators together, traders can filter out false signals and increase the probability of successful trades.

Confirmation of Signals

One of the primary benefits of using the MACD and RSI together is the confirmation of signals. For example, if the MACD generates a bullish crossover, traders can look to the RSI to confirm that the asset is not already in overbought territory. If the RSI is below 70, it supports the bullish signal from the MACD. Conversely, if the RSI is above 70, it may suggest that the asset is overbought, and the bullish signal from the MACD should be approached with caution.

Similarly, if the RSI indicates oversold conditions (below 30), traders can look to the MACD for confirmation. A bullish crossover in the MACD would further strengthen the case for a potential price increase.

Filtering False Signals

Both the MACD and RSI can generate false signals, especially in volatile market conditions. By using them together, traders can filter out these false signals and improve the accuracy of their trading decisions. For instance, a bearish divergence in the MACD may be less reliable if the RSI is not confirming the divergence. If the RSI is showing bullish divergence or is in neutral territory, the bearish signal from the MACD may be a false alarm.

Identifying High-Probability Trading Setups

The combination of the MACD RSI indicator can help traders identify high-probability trading setups. A high-probability setup typically involves multiple confirmations from both indicators. For example, a setup could include:

- The MACD generates a bullish crossover.

- The RSI is below 50 and rising, indicating increasing momentum.

- The price is breaking above a key resistance level.

This confluence of signals suggests a strong likelihood of a sustained upward move. Conversely, a bearish setup could include:

- The MACD generates a bearish crossover.

- The RSI is above 50 and falling, indicating decreasing momentum.

- The price is breaking below a key support level.

This combination of signals suggests a high probability of a continued downward trend.

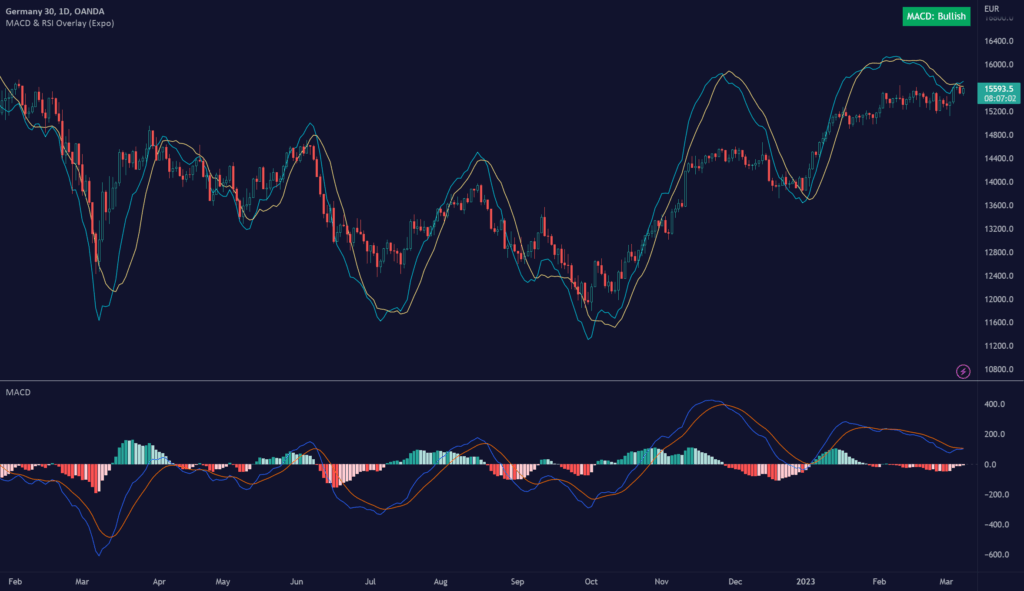

Practical Examples of Using the MACD and RSI Together

To illustrate the practical application of the MACD RSI indicator, consider the following examples:

Example 1: Identifying a Bullish Reversal

Suppose a stock has been in a downtrend for several weeks. The price is making lower lows, and the MACD is consistently below the signal line. However, the RSI starts to show bullish divergence, making higher lows while the price continues to make lower lows. This bullish divergence in the RSI suggests that the downtrend may be losing momentum. If the MACD then generates a bullish crossover, confirming the signal from the RSI, it could be a high-probability buying opportunity. Traders might enter a long position, placing a stop-loss order below a recent swing low to manage risk.

Example 2: Avoiding a False Breakout

Imagine a stock is trading in a range, and the price breaks above a key resistance level. The MACD generates a bullish crossover, seemingly confirming the breakout. However, the RSI is already in overbought territory (above 70). This suggests that the breakout may be unsustainable and could be a false signal. Traders might avoid entering a long position and wait for the RSI to cool down before considering a trade. Alternatively, they might look for a shorting opportunity if the price fails to hold above the resistance level.

Limitations of Using the MACD and RSI

While the MACD and RSI can be powerful tools, it’s essential to recognize their limitations. No indicator is foolproof, and they should not be used in isolation. Factors to consider include:

- Lagging Indicators: Both the MACD and RSI are lagging indicators, meaning they react to past price movements. This can sometimes lead to delayed signals.

- Whipsaws: In choppy or sideways markets, the MACD and RSI can generate numerous false signals, leading to whipsaws (rapid and contradictory signals).

- Divergence Failures: Divergence signals are not always reliable. Sometimes, the price may continue in the same direction despite the divergence.

- Market Context: The effectiveness of the MACD and RSI can vary depending on the market context. They may work better in trending markets than in range-bound markets.

Best Practices for Using the MACD and RSI

To maximize the effectiveness of the MACD and RSI, consider the following best practices:

- Use in Conjunction with Other Indicators: Combine the MACD and RSI with other technical indicators, such as moving averages, Fibonacci levels, and volume analysis, to get a more complete picture of market conditions.

- Consider Multiple Timeframes: Analyze the MACD and RSI on multiple timeframes (e.g., daily, weekly, monthly) to identify potential trends and support/resistance levels.

- Adjust Parameters: Experiment with different parameter settings for the MACD and RSI to find what works best for your trading style and the specific assets you are trading.

- Manage Risk: Always use stop-loss orders and proper position sizing to manage risk. No trading strategy is guaranteed to be profitable, so it’s crucial to protect your capital.

- Stay Informed: Keep up-to-date with market news and economic events that could impact your trading decisions.

Conclusion

The MACD RSI indicator are valuable tools for traders looking to enhance their understanding of market momentum and potential trend reversals. By combining these indicators, traders can confirm signals, filter out false signals, and identify high-probability trading setups. However, it’s essential to recognize the limitations of these indicators and use them in conjunction with other technical analysis tools and risk management strategies. With careful analysis and disciplined execution, the MACD RSI indicator can be a powerful addition to any trader’s toolkit. Further research into other indicators and strategies can be found [See also: Understanding Moving Averages] and [See also: Fibonacci Trading Strategies]. Mastering these tools requires practice and a deep understanding of market dynamics, but the potential rewards are significant for those who dedicate themselves to learning and refining their trading skills.