Mastering the Micro Lot: A Comprehensive Guide to Forex Trading with Small Capital

The world of Forex trading, once perceived as the exclusive domain of institutional investors and high-net-worth individuals, has become increasingly accessible to retail traders. One of the key factors contributing to this democratization is the introduction of the micro lot. This guide provides a comprehensive overview of micro lot trading, its benefits, risks, and strategies for success. Whether you are a beginner with limited capital or an experienced trader looking to refine your risk management, understanding the nuances of trading with micro lots is essential.

What is a Micro Lot in Forex Trading?

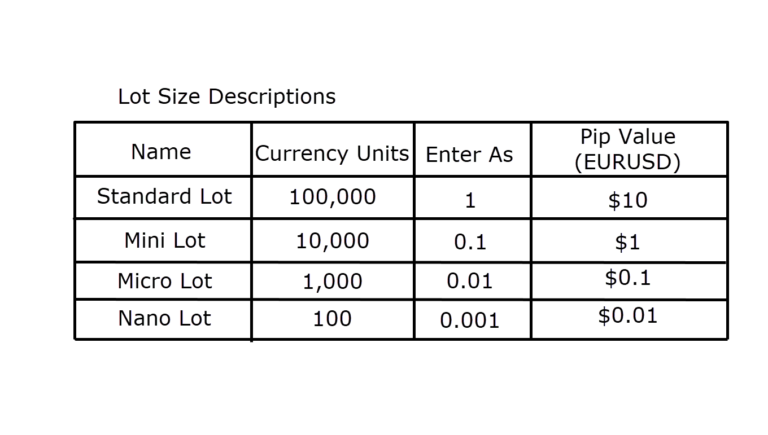

In Forex trading, a lot is a standardized unit of measurement representing the quantity of currency being traded. A standard lot is 100,000 units of the base currency. A mini lot is 10,000 units, and a micro lot represents 1,000 units of the base currency. For example, if you are trading EUR/USD with a micro lot, you are controlling 1,000 Euros.

The advent of the micro lot has lowered the barrier to entry for new traders. It allows individuals with smaller trading accounts to participate in the Forex market without risking a significant portion of their capital. This is a crucial aspect of responsible trading and risk management.

Benefits of Trading with Micro Lots

Reduced Risk Exposure

The primary advantage of trading with micro lots is the significantly reduced risk exposure. Because you are trading smaller amounts, each pip movement has a smaller impact on your account balance. This allows you to experiment with different strategies and learn the market dynamics without the fear of substantial losses. It’s a great way to learn Forex trading strategies. [See also: Forex Trading Strategies for Beginners]

Ideal for Beginners

For novice traders, micro lots provide an excellent opportunity to gain experience and build confidence. The lower risk allows beginners to make mistakes and learn from them without jeopardizing their entire trading account. It’s like learning to drive in a safe environment before hitting the open road.

Greater Flexibility

Micro lots offer greater flexibility in position sizing. Traders can fine-tune their position size to match their risk tolerance and trading strategy. This level of control is particularly valuable when testing new strategies or trading volatile currency pairs. You can carefully manage your account balance.

Accessibility

Trading micro lots makes the Forex market accessible to individuals who might otherwise be excluded due to capital constraints. It levels the playing field and allows more people to participate in the global currency market. The ability to trade with small amounts opens doors for many aspiring traders.

Risks Associated with Micro Lot Trading

Limited Profit Potential

While the reduced risk is a major advantage, it also comes with a trade-off: limited profit potential. Because you are trading smaller amounts, the potential gains are also smaller. However, for beginners and those focused on learning, the reduced risk often outweighs the limited profit potential.

Over-Leveraging

The accessibility of micro lots can sometimes lead to over-leveraging. Traders might be tempted to use high leverage to amplify their potential profits, but this can also magnify their losses. It is crucial to use leverage responsibly and understand the risks involved. [See also: Understanding Leverage in Forex Trading]

Psychological Impact

Some traders may find it challenging to stay disciplined when trading with micro lots. The small profits might lead to impatience and impulsive decisions. It is important to maintain a consistent and disciplined approach, regardless of the position size.

Strategies for Trading with Micro Lots

Start with a Demo Account

Before trading with real money, it is highly recommended to practice with a demo account. This allows you to familiarize yourself with the trading platform, test different strategies, and get a feel for the market dynamics without risking any capital. Most brokers offer demo accounts with virtual funds.

Develop a Trading Plan

A well-defined trading plan is essential for success in Forex trading. Your plan should include your trading goals, risk tolerance, trading strategy, and money management rules. Stick to your plan and avoid making impulsive decisions based on emotions.

Use Stop-Loss Orders

Stop-loss orders are crucial for managing risk. A stop-loss order is an instruction to your broker to automatically close your position if the price reaches a certain level. This helps to limit your potential losses and protect your capital. Always use stop-loss orders when trading with micro lots.

Manage Your Leverage

Leverage can amplify both your profits and your losses. Use leverage responsibly and understand the risks involved. A general rule of thumb is to never risk more than 1-2% of your trading capital on any single trade. With micro lots, you can more easily control your risk exposure.

Focus on Education

The Forex market is constantly evolving, so it is important to stay informed and continue learning. Read books, attend webinars, and follow reputable financial news sources. The more you know, the better equipped you will be to make informed trading decisions. There are many resources available to help you improve your trading skills.

Start Small and Scale Up

Begin with a small trading account and gradually increase your position sizes as you gain experience and confidence. This approach allows you to learn the ropes without risking a significant amount of capital. As you become more comfortable with micro lot trading, you can consider increasing your position sizes or transitioning to mini lots or standard lots.

Risk-Reward Ratio

Always consider the risk-reward ratio of your trades. Aim for trades where the potential profit is at least twice the potential loss. This will help you to maintain profitability in the long run, even if you have some losing trades. A good risk-reward ratio is a key component of successful trading.

Monitor Your Trades

Keep a close eye on your open positions and be prepared to adjust your strategy if necessary. The market can be unpredictable, and it is important to be flexible and adapt to changing conditions. Regularly review your trades and analyze your performance to identify areas for improvement. This diligent monitoring is key to success.

Choosing a Broker for Micro Lot Trading

Selecting the right broker is crucial for a successful trading experience. Look for a broker that offers micro lot trading, competitive spreads, reliable trading platforms, and excellent customer support. Also, ensure that the broker is regulated by a reputable financial authority. Regulation provides a level of security and protection for your funds. [See also: How to Choose a Forex Broker]

Regulation

Ensure the broker is regulated by a reputable financial authority such as the Financial Conduct Authority (FCA) in the UK, the Securities and Exchange Commission (SEC) in the US, or the Australian Securities and Investments Commission (ASIC) in Australia. Trading with a regulated broker provides a level of security and protection for your funds.

Trading Platform

The trading platform is your gateway to the Forex market. Choose a broker that offers a user-friendly and reliable trading platform, such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5). These platforms offer a wide range of features, including charting tools, technical indicators, and automated trading capabilities.

Spreads and Commissions

Spreads and commissions are the costs associated with trading. Look for a broker that offers competitive spreads and low commissions. These costs can eat into your profits, so it is important to minimize them as much as possible. Some brokers offer fixed spreads, while others offer variable spreads.

Customer Support

Excellent customer support is essential, especially for beginners. Choose a broker that offers responsive and helpful customer support via phone, email, or live chat. You never know when you might need assistance, so it is important to have access to reliable support.

The Future of Micro Lot Trading

Micro lot trading is likely to continue to grow in popularity as more and more people enter the Forex market. The accessibility and low risk associated with micro lots make them an attractive option for beginners and those with limited capital. As technology continues to advance, we can expect to see even more innovative trading platforms and tools that cater to micro lot traders.

In conclusion, micro lot trading offers a valuable entry point into the world of Forex trading. By understanding the benefits, risks, and strategies involved, you can increase your chances of success and achieve your trading goals. Remember to trade responsibly, manage your risk, and never stop learning.