Mastering Trading 212: Essential Tips for Success

Trading 212 has emerged as a popular platform for both novice and experienced traders alike. Its user-friendly interface and commission-free trading have attracted a significant following. However, success in trading requires more than just a convenient platform. This article delves into essential Trading 212 tips designed to enhance your trading strategy and improve your overall performance. We will explore various aspects, from understanding the platform’s features to implementing robust risk management techniques. The goal is to provide actionable advice that can be immediately applied to your Trading 212 experience, helping you navigate the complexities of the market with greater confidence and potentially increase your profitability. Whether you are just starting or seeking to refine your approach, these Trading 212 tips will serve as a valuable guide.

Understanding the Trading 212 Platform

Before diving into trading strategies, it’s crucial to thoroughly understand the Trading 212 platform itself. This includes familiarizing yourself with its various features, tools, and account types. Take time to explore the platform’s interface, paying attention to the charting tools, order types, and news feeds. Understanding these elements is fundamental to making informed trading decisions. One of the first Trading 212 tips is to use the demo account extensively.

Utilizing the Demo Account

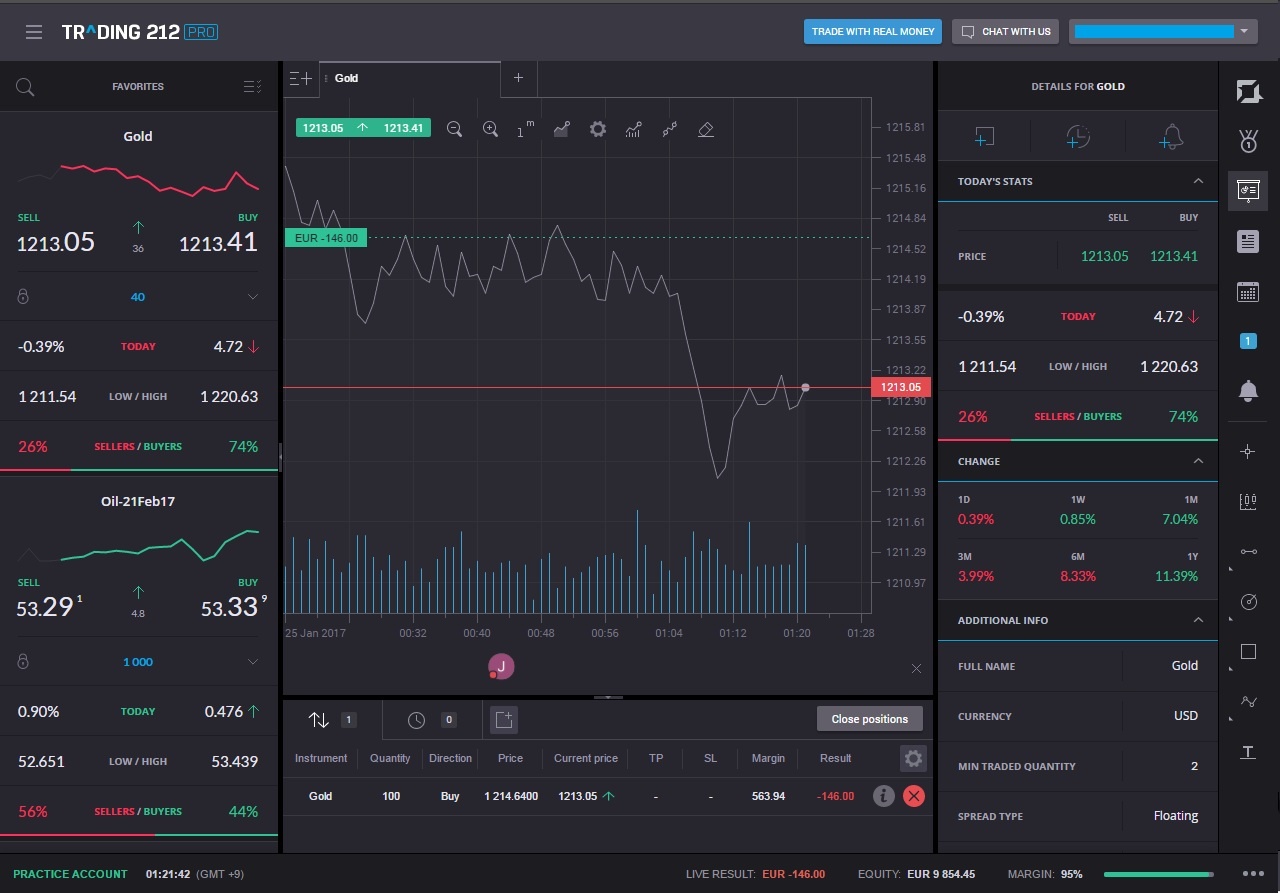

Trading 212 offers a demo account that allows you to practice trading with virtual funds. This is an invaluable resource for beginners and experienced traders alike. Use the demo account to experiment with different trading strategies, test your risk tolerance, and familiarize yourself with the platform’s functionality without risking real money. Consider this a safe space to make mistakes and learn from them. It’s a crucial step in mastering the platform and developing a solid trading foundation. Practice different order types, such as market orders, limit orders, and stop-loss orders. Understand how each order type works and when to use them effectively. This will help you execute your trades with precision and control.

Exploring Account Types

Trading 212 offers different account types, each with its own features and benefits. Understand the differences between these accounts and choose the one that best suits your trading style and financial goals. Factors to consider include leverage options, available instruments, and regulatory protections. Different accounts might offer different levels of leverage, which can significantly impact your potential profits and losses. Ensure you understand the risks associated with leverage before using it. [See also: Understanding Leverage in Forex Trading]

Developing a Solid Trading Strategy

A well-defined trading strategy is essential for success in any market. This strategy should outline your trading goals, risk tolerance, and the specific instruments you plan to trade. Without a clear plan, you’re essentially gambling, and the odds are stacked against you. Developing a strategy is one of the most important Trading 212 tips. A good strategy helps to stay disciplined and avoid impulsive decisions based on emotion.

Setting Realistic Goals

Before you start trading, set realistic and achievable goals. Avoid aiming for unrealistic returns in a short period, as this can lead to reckless trading behavior. Focus on consistent, incremental gains rather than trying to get rich quick. Define what success looks like to you and create a roadmap to achieve it. Consider factors such as your available capital, risk tolerance, and time commitment. Setting realistic goals will help you stay motivated and focused on the long term. It also helps to manage your expectations and avoid disappointment. A key Trading 212 tip is to regularly review and adjust your goals as needed.

Understanding Risk Tolerance

Risk tolerance is a crucial factor in determining your trading strategy. Assess your comfort level with potential losses and only invest what you can afford to lose. Avoid risking capital that you need for essential expenses or financial obligations. Understanding your risk tolerance will help you choose appropriate trading instruments and position sizes. If you are risk-averse, consider focusing on lower-volatility assets and using smaller position sizes. If you are more risk-tolerant, you may be comfortable with higher-volatility assets and larger position sizes. However, always remember that higher risk comes with the potential for higher losses. One of the most overlooked Trading 212 tips is to protect your capital at all costs.

Choosing Trading Instruments

Trading 212 offers a wide range of trading instruments, including stocks, forex, commodities, and indices. Choose instruments that you understand well and that align with your trading strategy. Research the fundamentals of each instrument and understand the factors that can influence its price. Avoid trading instruments that you don’t understand, as this can lead to costly mistakes. Consider focusing on a few specific instruments and becoming an expert in those areas. This will allow you to develop a deeper understanding of their price movements and identify potential trading opportunities. [See also: A Beginner’s Guide to Forex Trading]

Implementing Effective Risk Management

Risk management is arguably the most important aspect of successful trading. Without proper risk management, even the best trading strategies can fail. Implement robust risk management techniques to protect your capital and minimize potential losses. This includes setting stop-loss orders, managing position sizes, and diversifying your portfolio. Ignoring risk management is a common mistake, so one of the most important Trading 212 tips is to take risk management seriously.

Using Stop-Loss Orders

Stop-loss orders are essential for limiting potential losses. A stop-loss order automatically closes your position when the price reaches a predetermined level. This prevents you from losing more than you are willing to risk on a particular trade. Set stop-loss orders at levels that are consistent with your risk tolerance and trading strategy. Avoid setting stop-loss orders too close to the current price, as this can result in premature exits due to normal market fluctuations. Consider using trailing stop-loss orders, which automatically adjust the stop-loss level as the price moves in your favor. A smart Trading 212 tip is to always use stop-loss orders, even if you are confident in your trade.

Managing Position Sizes

Position size refers to the amount of capital you allocate to each trade. Managing position sizes is crucial for controlling your overall risk exposure. Avoid risking a large percentage of your capital on any single trade. A general rule of thumb is to risk no more than 1-2% of your capital on each trade. This will help you protect your capital and prevent a single losing trade from wiping out your account. Calculate your position size based on your risk tolerance, the stop-loss level, and the volatility of the instrument. A key Trading 212 tip is to start with smaller position sizes and gradually increase them as you gain experience and confidence.

Diversifying Your Portfolio

Diversification involves spreading your investments across different asset classes and instruments. This helps to reduce your overall risk exposure by mitigating the impact of any single investment performing poorly. Consider diversifying your portfolio by investing in stocks, forex, commodities, and indices. Also, diversify within each asset class by investing in different companies or currencies. Diversification is not a guarantee against losses, but it can help to reduce the volatility of your portfolio and improve your long-term returns. A smart Trading 212 tip is to regularly review and rebalance your portfolio to maintain your desired level of diversification.

Staying Informed and Disciplined

The financial markets are constantly evolving, so it’s essential to stay informed about the latest news and trends. Follow reputable financial news sources, attend webinars, and read books and articles on trading. Continuous learning is crucial for adapting to changing market conditions and improving your trading skills. Furthermore, discipline is key to executing your trading strategy consistently and avoiding impulsive decisions. Stick to your plan, even when faced with short-term losses or market volatility. A combination of knowledge and discipline is a powerful recipe for success in trading. This is one of the most important Trading 212 tips for long-term profitability.

Following Market News

Stay up-to-date on the latest market news and economic events that could impact your trading positions. Pay attention to economic indicators, such as GDP growth, inflation rates, and unemployment figures. Also, follow news related to specific companies or industries that you are trading. Market news can provide valuable insights into potential trading opportunities and help you make informed decisions. Use Trading 212’s news feed and other reputable sources to stay informed. Remember that news can be both a source of opportunity and risk, so it’s important to analyze the information carefully before making any trading decisions. A practical Trading 212 tip is to set up news alerts for the instruments you are trading.

Maintaining a Trading Journal

Keep a detailed trading journal to track your trades, analyze your performance, and identify areas for improvement. Record the reasons for each trade, the entry and exit prices, the stop-loss level, and the profit or loss. Regularly review your trading journal to identify patterns and trends in your trading behavior. This will help you understand your strengths and weaknesses and refine your trading strategy accordingly. A trading journal is an invaluable tool for self-improvement and can significantly enhance your trading performance. A valuable Trading 212 tip is to be honest and detailed in your trading journal.

Controlling Emotions

Emotions can be a trader’s worst enemy. Fear and greed can lead to impulsive decisions and costly mistakes. Learn to control your emotions and avoid letting them influence your trading decisions. Stick to your trading strategy and avoid chasing profits or panicking during market downturns. Emotional discipline is crucial for maintaining a clear and rational mindset. Practice mindfulness and meditation to help manage your emotions and stay focused on your goals. Remember that trading is a marathon, not a sprint, and emotional stability is essential for long-term success. A final Trading 212 tip is to take breaks when you feel overwhelmed or emotional.

Conclusion

Mastering Trading 212 requires a combination of knowledge, strategy, risk management, and discipline. By understanding the platform, developing a solid trading strategy, implementing effective risk management techniques, and staying informed and disciplined, you can significantly improve your chances of success. Remember that trading involves risk, and there are no guarantees of profit. However, by following these Trading 212 tips, you can increase your confidence and navigate the complexities of the market with greater skill and potentially improve your financial outcomes. Trading 212 provides the tools; it’s up to you to use them wisely. Good luck, and happy trading!