Mastering Trading Leverage: A Comprehensive Guide and Calculator

Trading leverage can be a powerful tool in the hands of a savvy investor, amplifying potential profits. However, it’s crucial to understand how it works and how to manage the associated risks. This guide will provide a comprehensive overview of trading leverage, explain how to use a trading leverage calculator effectively, and outline strategies for responsible risk management.

In essence, trading leverage allows you to control a larger position in the market than your actual capital would normally allow. Think of it as borrowing money from your broker to increase your potential returns. While this can lead to significant gains, it also magnifies potential losses. Therefore, understanding the intricacies of trading leverage and utilizing tools like a trading leverage calculator is paramount.

Understanding Trading Leverage

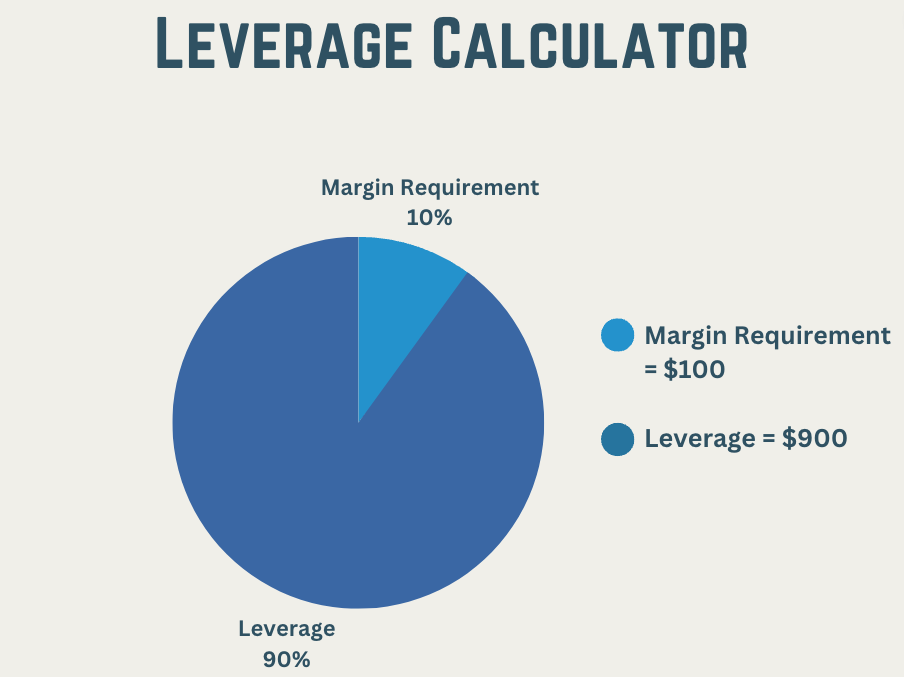

Trading leverage is typically expressed as a ratio, such as 1:10, 1:50, or even 1:500. This ratio indicates how much your broker is willing to lend you for every dollar you have in your account. For example, with a trading leverage of 1:100, you can control a $10,000 position with just $100 in your account. This can be incredibly appealing, especially for traders with limited capital.

How Leverage Works

Let’s say you have $1,000 in your trading account and your broker offers trading leverage of 1:50. This means you can control a position worth $50,000 (50 x $1,000). If the asset you’re trading increases in value by 2%, your profit would be $1,000 (2% of $50,000). That’s a 100% return on your initial investment of $1,000! However, if the asset decreases in value by 2%, you would lose $1,000, wiping out your entire investment. This demonstrates the double-edged sword of trading leverage.

The Importance of a Trading Leverage Calculator

A trading leverage calculator is an essential tool for any trader using leverage. It helps you determine the appropriate position size based on your account balance, risk tolerance, and the leverage ratio offered by your broker. By inputting these parameters, the calculator can estimate the potential profit or loss for a given trade, allowing you to make more informed decisions.

Using a Trading Leverage Calculator: A Step-by-Step Guide

Using a trading leverage calculator is typically straightforward. Here’s a step-by-step guide:

- Find a Reputable Calculator: Many online platforms offer free trading leverage calculators. Choose one from a reputable source to ensure accuracy.

- Enter Your Account Balance: Input the total amount of money you have in your trading account.

- Specify the Leverage Ratio: Enter the leverage ratio offered by your broker (e.g., 1:10, 1:50, 1:100).

- Define Your Risk Tolerance: Determine the percentage of your account you’re willing to risk on a single trade. A common rule of thumb is to risk no more than 1-2% of your account balance.

- Calculate Your Position Size: The trading leverage calculator will then calculate the maximum position size you can take based on your input parameters.

For example, if you have a $5,000 account, a leverage ratio of 1:20, and a risk tolerance of 1%, the calculator would determine that you should risk no more than $50 (1% of $5,000) per trade. This would then translate into a maximum position size that the calculator will provide based on the specific asset you intend to trade and its price.

Benefits of Using a Trading Leverage Calculator

- Risk Management: The primary benefit is improved risk management. By understanding the potential impact of trading leverage on your account, you can make more informed decisions and avoid excessive losses.

- Position Sizing: A trading leverage calculator helps you determine the optimal position size for each trade, ensuring that you’re not over-leveraging your account.

- Emotional Control: By using a systematic approach to position sizing, you can reduce emotional decision-making and stick to your trading plan.

- Improved Profitability: While trading leverage can increase risk, it can also increase potential profits. By using a trading leverage calculator, you can optimize your leverage to maximize your returns while managing your risk.

Risks Associated with Trading Leverage

While trading leverage offers potential benefits, it’s crucial to be aware of the associated risks:

- Magnified Losses: As mentioned earlier, trading leverage magnifies both profits and losses. A small adverse price movement can result in significant losses, potentially wiping out your entire account.

- Margin Calls: If your losses exceed the margin requirements set by your broker, you may receive a margin call. This means you’ll need to deposit additional funds into your account to cover the losses. If you fail to meet the margin call, your broker may close your position, resulting in further losses.

- Increased Volatility: Leveraged trading can amplify the impact of market volatility, making it more difficult to predict price movements and manage risk.

- Overtrading: The allure of high potential profits can lead to overtrading, which can result in increased transaction costs and poor decision-making.

Strategies for Responsible Leverage Trading

To mitigate the risks associated with trading leverage, consider the following strategies:

- Start Small: Begin with a low leverage ratio and gradually increase it as you gain experience and confidence.

- Use Stop-Loss Orders: Always use stop-loss orders to limit your potential losses on each trade. A stop-loss order automatically closes your position when the price reaches a predetermined level.

- Manage Your Risk: Never risk more than a small percentage of your account balance on a single trade. A common rule of thumb is to risk no more than 1-2%.

- Understand the Market: Thoroughly research the assets you’re trading and understand the factors that can influence their price movements.

- Stay Disciplined: Stick to your trading plan and avoid making impulsive decisions based on emotions.

- Use a Trading Leverage Calculator: As emphasized throughout this guide, consistently use a trading leverage calculator to determine appropriate position sizes.

- Monitor Your Positions: Regularly monitor your open positions and be prepared to adjust your strategy if necessary.

Choosing the Right Leverage Ratio

The optimal trading leverage ratio depends on several factors, including your risk tolerance, trading experience, and the asset you’re trading. Beginners should generally start with a lower leverage ratio, such as 1:10 or 1:20, and gradually increase it as they become more comfortable with the risks involved. More experienced traders may be able to handle higher leverage ratios, but it’s still crucial to manage risk responsibly.

Consider the volatility of the asset you’re trading. Highly volatile assets may require lower leverage ratios to avoid excessive losses. Also, be aware of the margin requirements set by your broker, as these can vary depending on the asset and the leverage ratio.

Beyond the Calculator: Additional Risk Management Tools

While a trading leverage calculator is a valuable tool, it’s just one component of a comprehensive risk management strategy. Consider using other tools, such as:

- Position Size Calculators: These calculators help you determine the appropriate position size based on your account balance, risk tolerance, and the volatility of the asset you’re trading.

- Volatility Calculators: These calculators help you assess the volatility of an asset, allowing you to adjust your leverage and position size accordingly.

- Economic Calendars: Economic calendars provide information on upcoming economic events that could impact the markets. By staying informed about these events, you can anticipate potential price movements and adjust your trading strategy.

Conclusion

Trading leverage can be a powerful tool for increasing potential profits, but it’s essential to understand the associated risks and use it responsibly. A trading leverage calculator is an invaluable tool for managing risk and determining appropriate position sizes. By following the strategies outlined in this guide and continuously educating yourself about the markets, you can increase your chances of success in the world of leveraged trading. Remember to always prioritize risk management and never risk more than you can afford to lose. The effective use of a trading leverage calculator, coupled with disciplined risk management, is key to navigating the complexities of leveraged trading.

[See also: Understanding Margin Calls in Forex Trading]

[See also: The Psychology of Trading: Overcoming Emotional Biases]

[See also: Risk Management Strategies for Day Traders]