Maximize Your EURUSD Trades: The Ultimate EURUSD Profit Calculator Guide

Trading the EURUSD currency pair can be a lucrative venture, but understanding the potential profits and losses is crucial for success. A EURUSD profit calculator is an indispensable tool for traders of all levels, from beginners to seasoned professionals. This guide provides a comprehensive overview of how to effectively use a EURUSD profit calculator to enhance your trading strategy and risk management.

Understanding the EURUSD Pair

The EURUSD pair represents the exchange rate between the Euro (EUR) and the US Dollar (USD). It indicates how many US dollars are needed to buy one Euro. As the most traded currency pair in the world, EURUSD offers high liquidity and tight spreads, making it attractive for day traders, swing traders, and long-term investors. Understanding the factors influencing EURUSD, such as economic indicators, political events, and central bank policies, is essential for making informed trading decisions.

What is a EURUSD Profit Calculator?

A EURUSD profit calculator is a tool designed to estimate the potential profit or loss of a EURUSD trade. It takes into account several key parameters, including:

- Trade Size (Lot Size): The amount of EURUSD you are trading. Standard lots, mini lots, and micro lots each represent different contract sizes.

- Entry Price: The price at which you enter the trade.

- Exit Price: The price at which you close the trade.

- Account Currency: The currency your trading account is denominated in.

- Leverage: The ratio of borrowed capital to your own capital, which amplifies both potential profits and losses.

By inputting these values into the EURUSD profit calculator, you can quickly determine the potential outcome of your trade before risking any capital. This allows for better risk management and strategic planning.

How to Use a EURUSD Profit Calculator

Using a EURUSD profit calculator is straightforward. Here’s a step-by-step guide:

- Find a Reliable Calculator: Many online resources offer free EURUSD profit calculators. Ensure the calculator is accurate and provides all the necessary input fields.

- Enter Trade Size: Specify the lot size you plan to trade. For example, 1 standard lot equals 100,000 EUR.

- Input Entry Price: Enter the price at which you intend to open your EURUSD trade.

- Enter Exit Price: Input the price at which you plan to close your trade. This can be based on your target profit or stop-loss level.

- Specify Account Currency: Select the currency your trading account uses (e.g., USD, EUR, GBP).

- Enter Leverage (Optional): If you are using leverage, enter the leverage ratio (e.g., 1:100, 1:500). Be aware that leverage can significantly increase both potential profits and losses.

- Calculate: Click the calculate button to see the potential profit or loss of your trade.

Benefits of Using a EURUSD Profit Calculator

Employing a EURUSD profit calculator offers several significant advantages for traders:

- Risk Management: It helps you assess the potential risk involved in a trade before execution, allowing you to set appropriate stop-loss levels and manage your capital effectively.

- Profit Target Setting: By calculating potential profits, you can set realistic profit targets and develop a well-defined trading strategy.

- Informed Decision-Making: The calculator provides crucial information that enables you to make more informed trading decisions based on potential outcomes.

- Leverage Awareness: It demonstrates the impact of leverage on your potential profits and losses, helping you use leverage responsibly.

- Time-Saving: Manually calculating potential profits and losses can be time-consuming and prone to errors. A calculator automates this process, saving you valuable time.

Key Factors Affecting EURUSD Profitability

Several factors can influence the profitability of your EURUSD trades:

- Economic Indicators: Economic data releases, such as GDP growth, inflation rates, and employment figures, can significantly impact the EURUSD exchange rate.

- Central Bank Policies: Monetary policy decisions by the European Central Bank (ECB) and the Federal Reserve (Fed) can affect the value of the Euro and the US Dollar.

- Political Events: Political instability, elections, and geopolitical tensions can create volatility in the EURUSD market.

- Market Sentiment: Overall market sentiment and investor confidence can influence the direction of the EURUSD pair.

- Trading Costs: Spreads, commissions, and swap fees can impact your overall profitability.

Advanced Strategies with a EURUSD Profit Calculator

Beyond basic profit and loss calculations, a EURUSD profit calculator can be used for more advanced trading strategies:

Position Sizing

Use the calculator to determine the optimal position size based on your risk tolerance and account balance. This ensures you don’t risk too much capital on a single trade.

Stop-Loss and Take-Profit Levels

Calculate the potential profit and loss at different stop-loss and take-profit levels to identify the most favorable risk-reward ratio.

Backtesting Strategies

Input historical data into the calculator to backtest different trading strategies and assess their potential profitability.

Hedging

If you are hedging your EURUSD positions, use the calculator to determine the appropriate hedge size and potential cost.

Choosing the Right EURUSD Profit Calculator

When selecting a EURUSD profit calculator, consider the following factors:

- Accuracy: Ensure the calculator provides accurate results based on real-time exchange rates.

- User-Friendliness: Choose a calculator with a simple and intuitive interface.

- Customization: Look for a calculator that allows you to customize input parameters, such as leverage and account currency.

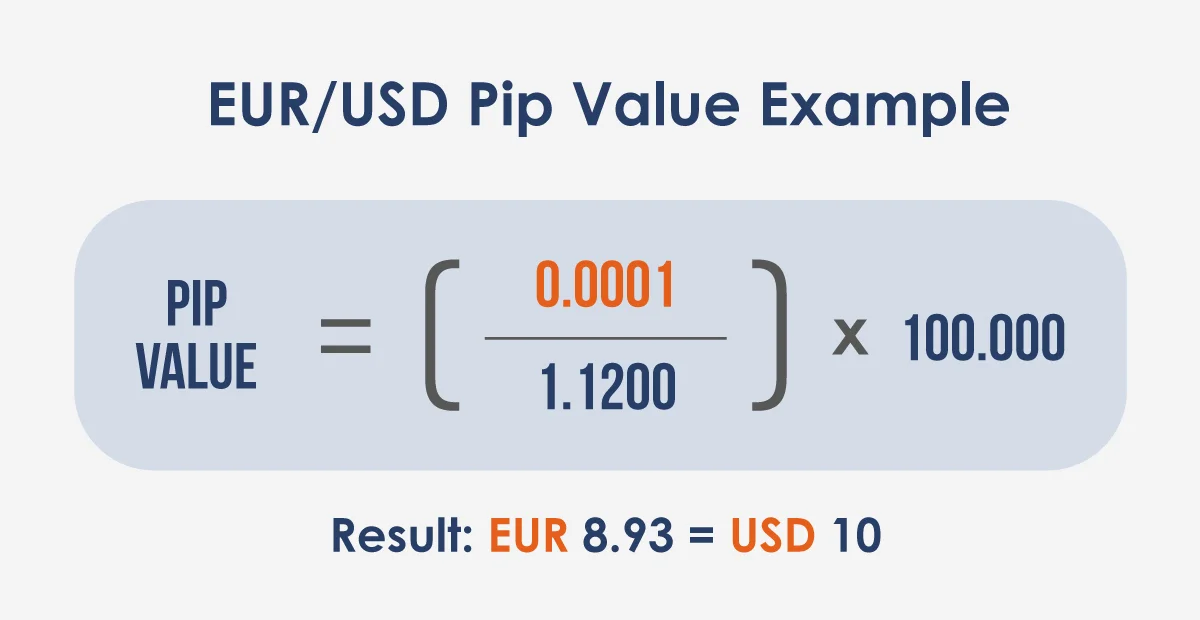

- Features: Some calculators offer additional features, such as pip value calculation and margin requirements.

- Mobile Compatibility: If you trade on the go, opt for a calculator that is mobile-friendly.

Common Mistakes to Avoid

While a EURUSD profit calculator is a valuable tool, it’s essential to avoid common mistakes:

- Inaccurate Data Input: Double-check all input values to ensure accuracy. Even small errors can lead to significant discrepancies in the results.

- Ignoring Trading Costs: Remember to factor in spreads, commissions, and swap fees when calculating potential profits and losses.

- Overreliance on Leverage: While leverage can amplify profits, it can also magnify losses. Use leverage responsibly and understand the risks involved.

- Neglecting Market Volatility: The EURUSD market can be highly volatile, so be prepared for unexpected price movements.

- Failing to Adapt: Continuously monitor market conditions and adjust your trading strategy as needed.

Real-World Example

Let’s say you want to trade 1 standard lot of EURUSD. You enter the trade at 1.1000 and plan to exit at 1.1050. Your account currency is USD, and you are using a leverage of 1:100. Using a EURUSD profit calculator, you can quickly determine that your potential profit is $500. This allows you to assess whether the potential reward justifies the risk involved in the trade.

Integrating the Calculator into Your Trading Plan

The EURUSD profit calculator should be an integral part of your overall trading plan. Here’s how to integrate it effectively:

- Pre-Trade Analysis: Use the calculator to analyze potential trades before execution.

- Risk Assessment: Determine the potential risk involved in each trade and set appropriate stop-loss levels.

- Profit Target Setting: Set realistic profit targets based on the calculator’s results.

- Position Sizing: Adjust your position size based on your risk tolerance and account balance.

- Performance Tracking: Track your trading performance and use the calculator to analyze past trades.

Future Trends in EURUSD Trading

As technology evolves, EURUSD profit calculators are likely to become even more sophisticated, with features such as:

- AI-Powered Analysis: Integration of artificial intelligence to provide more accurate predictions and trading recommendations.

- Real-Time Data Integration: Seamless integration with real-time market data feeds.

- Automated Trading: Integration with automated trading platforms to execute trades based on calculator results.

- Personalized Recommendations: Customized recommendations based on individual trading preferences and risk profiles.

Conclusion

A EURUSD profit calculator is an essential tool for any trader looking to profit from the EURUSD currency pair. By understanding how to use the calculator effectively, you can enhance your risk management, set realistic profit targets, and make more informed trading decisions. Whether you are a beginner or an experienced trader, integrating a EURUSD profit calculator into your trading plan can significantly improve your overall profitability. Remember to choose a reliable calculator, avoid common mistakes, and continuously adapt your trading strategy to changing market conditions. With the right tools and knowledge, you can navigate the EURUSD market with confidence and achieve your financial goals. Using a EURUSD profit calculator responsibly is key to long-term success. Always consider market volatility, economic indicators, and your own risk tolerance before making any trading decisions. The EURUSD profit calculator is a powerful aid in your trading arsenal.

[See also: Understanding Forex Leverage]

[See also: Risk Management in Forex Trading]

[See also: The Impact of Economic News on Forex]