Maximize Your Forex Profits: Using a Forex Profit Calculator with Leverage Effectively

In the fast-paced world of Forex trading, precision and informed decision-making are paramount. One crucial tool that can significantly aid traders in assessing potential gains and losses is a forex profit calculator with leverage. This article delves into how to effectively utilize such a calculator to enhance your trading strategy and manage risk appropriately.

Understanding Forex Profit Calculation

Before diving into the specifics of using a calculator, it’s essential to understand the fundamental principles of Forex profit calculation. The profit or loss in a Forex trade is primarily determined by the difference between the entry and exit prices, the size of the trade (lot size), and the exchange rate. However, leverage adds a layer of complexity, amplifying both potential profits and losses.

The basic formula for calculating profit/loss is:

Profit/Loss = (Exit Price – Entry Price) x Trade Size x Exchange Rate

However, this doesn’t account for the impact of leverage, which is where a forex profit calculator with leverage becomes invaluable.

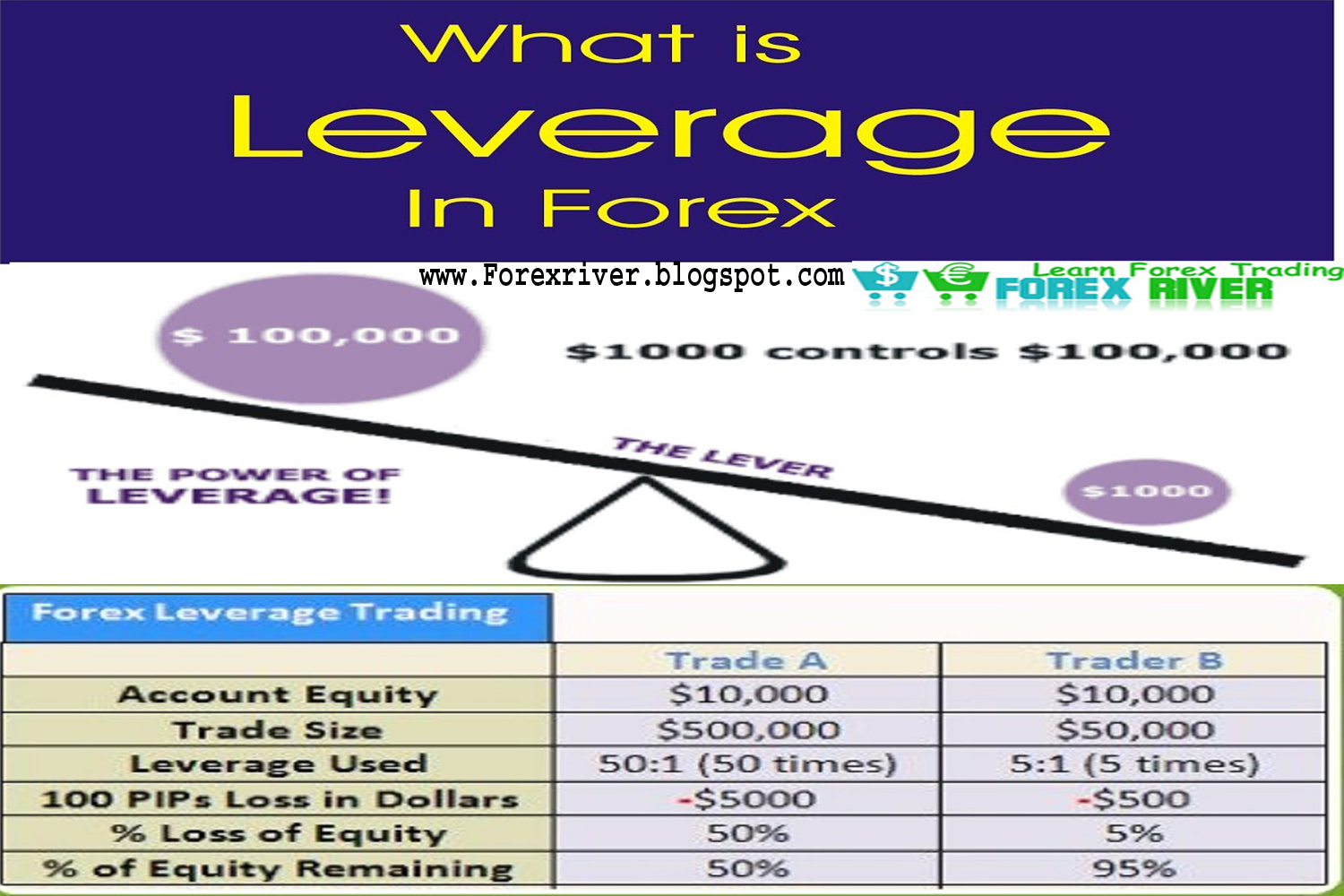

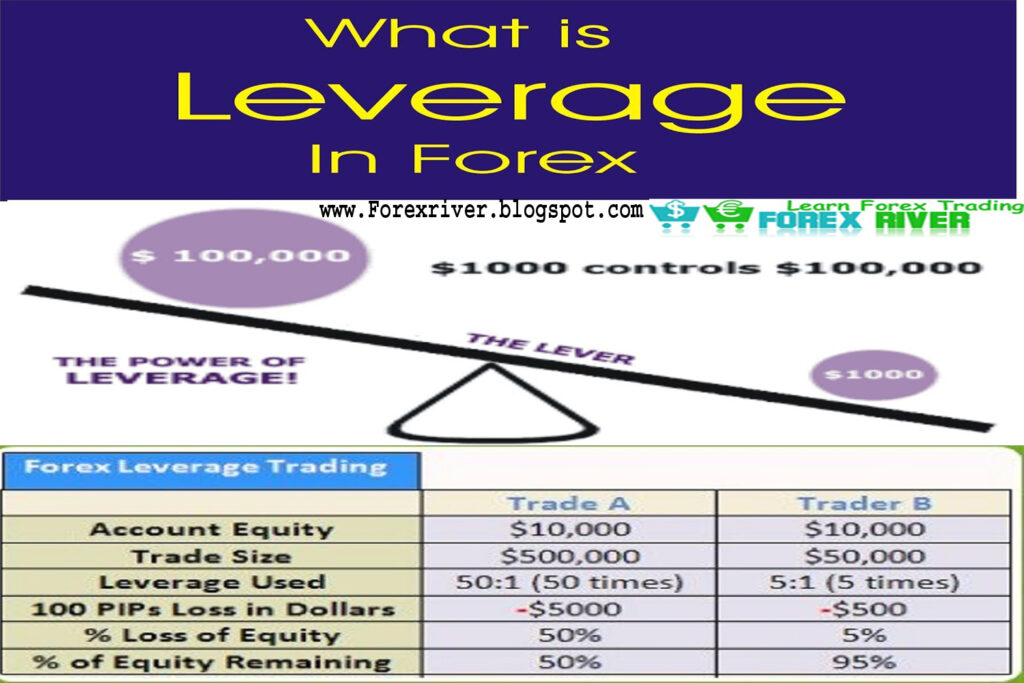

The Role of Leverage in Forex Trading

Leverage allows traders to control a larger position with a smaller amount of capital. For example, with a leverage of 1:100, a trader can control $100,000 worth of currency with just $1,000 of their own capital. While this can significantly increase potential profits, it also magnifies potential losses. Therefore, understanding and managing leverage is crucial for successful Forex trading.

How a Forex Profit Calculator with Leverage Works

A forex profit calculator with leverage simplifies the complex calculations involved in Forex trading. These calculators typically require the following inputs:

- Currency Pair: The specific currency pair being traded (e.g., EUR/USD, GBP/JPY).

- Trade Size (Lot Size): The volume of the trade, usually measured in lots (standard, mini, or micro).

- Entry Price: The price at which the trade was opened.

- Exit Price: The price at which the trade was closed.

- Leverage: The leverage ratio applied to the trade (e.g., 1:50, 1:100, 1:200).

- Account Currency: The currency in which your trading account is denominated.

Once these inputs are provided, the calculator will automatically compute the potential profit or loss, taking into account the leverage applied. This allows traders to quickly assess the potential outcome of a trade before entering it.

Benefits of Using a Forex Profit Calculator with Leverage

Using a forex profit calculator with leverage offers several key benefits for Forex traders:

- Risk Management: By calculating potential losses, traders can make informed decisions about position sizing and stop-loss levels, mitigating risk.

- Profit Potential Assessment: Traders can quickly determine the potential profit of a trade, allowing them to identify opportunities with favorable risk-reward ratios.

- Strategy Optimization: By experimenting with different leverage levels and trade sizes, traders can optimize their strategies for maximum profitability.

- Time Savings: Manual calculations can be time-consuming and prone to errors. A calculator automates the process, saving time and ensuring accuracy.

- Improved Decision-Making: Armed with accurate profit and loss projections, traders can make more informed and rational trading decisions.

Choosing the Right Forex Profit Calculator with Leverage

With numerous forex profit calculator with leverage tools available online, it’s essential to choose one that meets your specific needs. Consider the following factors when selecting a calculator:

- Accuracy: Ensure the calculator provides accurate results by verifying its calculations against manual computations.

- User-Friendliness: Choose a calculator with a clear and intuitive interface that is easy to use.

- Customization: Look for a calculator that allows you to input all relevant parameters, such as currency pair, trade size, entry and exit prices, leverage, and account currency.

- Additional Features: Some calculators offer additional features, such as pip value calculation, margin calculation, and risk percentage calculation.

- Mobile Compatibility: If you trade on the go, consider a calculator that is accessible on mobile devices.

Step-by-Step Guide to Using a Forex Profit Calculator with Leverage

Here’s a step-by-step guide on how to use a forex profit calculator with leverage effectively:

- Select a Reputable Calculator: Choose a reliable forex profit calculator with leverage from a reputable source.

- Enter the Currency Pair: Select the currency pair you are trading (e.g., EUR/USD).

- Input the Trade Size: Enter the size of your trade in lots (e.g., 1 standard lot, 0.1 mini lot, 0.01 micro lot).

- Specify Entry and Exit Prices: Enter the price at which you opened the trade (entry price) and the price at which you closed or plan to close the trade (exit price).

- Enter the Leverage Ratio: Input the leverage ratio applied to your account (e.g., 1:50, 1:100).

- Specify Account Currency: Select the currency in which your trading account is denominated (e.g., USD, EUR, GBP).

- Calculate the Profit/Loss: Click the calculate button to determine the potential profit or loss of the trade.

- Analyze the Results: Review the calculated profit or loss and assess whether the potential reward justifies the risk.

- Adjust Parameters: Experiment with different leverage levels, trade sizes, and stop-loss levels to optimize your trading strategy.

Example Scenario: Calculating Profit with Leverage

Let’s consider an example to illustrate how a forex profit calculator with leverage works.

Suppose you are trading EUR/USD with a leverage of 1:100. You enter a long position (buy) at 1.1000 with a trade size of 1 standard lot (100,000 units). You close the position at 1.1050.

Using a forex profit calculator with leverage, you would input the following:

- Currency Pair: EUR/USD

- Trade Size: 1 standard lot

- Entry Price: 1.1000

- Exit Price: 1.1050

- Leverage: 1:100

- Account Currency: USD

The calculator would then compute the profit as follows:

Profit = (1.1050 – 1.1000) x 100,000 = $500

This calculation demonstrates how leverage can amplify profits. Without leverage, the profit would have been significantly smaller.

Common Mistakes to Avoid When Using a Forex Profit Calculator with Leverage

While a forex profit calculator with leverage is a valuable tool, it’s important to avoid common mistakes that can lead to inaccurate results or poor trading decisions:

- Incorrect Input Data: Ensure you enter all parameters accurately, including currency pair, trade size, entry and exit prices, leverage, and account currency.

- Ignoring Trading Fees: Remember to factor in trading fees, such as spreads and commissions, which can impact your overall profitability.

- Over-Leveraging: Avoid using excessive leverage, as it can significantly increase your risk of losses.

- Relying Solely on the Calculator: Use the calculator as a tool to inform your decisions, but don’t rely on it exclusively. Consider other factors, such as market analysis and risk management principles.

- Neglecting Stop-Loss Orders: Always use stop-loss orders to limit potential losses, regardless of the calculator’s projections.

Advanced Features and Considerations

Some advanced forex profit calculator with leverage tools offer additional features that can further enhance your trading strategy. These may include:

- Pip Value Calculation: Calculates the value of each pip in the currency pair, which is essential for determining position sizing and risk management.

- Margin Calculation: Calculates the amount of margin required to open and maintain a trade with a specific leverage level.

- Risk Percentage Calculation: Calculates the percentage of your account balance that you are risking on a particular trade.

- Profit Target Calculation: Calculates the exit price needed to achieve a specific profit target.

- Stop-Loss Calculation: Calculates the stop-loss level needed to limit losses to a specific percentage of your account balance.

Furthermore, it’s crucial to consider the following factors when using a forex profit calculator with leverage:

- Market Volatility: High market volatility can significantly impact the accuracy of the calculator’s projections.

- Slippage: Slippage, which is the difference between the expected price and the actual execution price, can affect your actual profit or loss.

- News Events: Major news events can cause sudden and significant price movements, which can impact your trading outcomes.

Conclusion

A forex profit calculator with leverage is an indispensable tool for Forex traders. By accurately calculating potential profits and losses, it empowers traders to make informed decisions, manage risk effectively, and optimize their trading strategies. However, it’s crucial to use the calculator responsibly, avoid common mistakes, and consider other factors that can impact trading outcomes. Understanding how leverage affects your potential profits and losses is crucial. By integrating a reliable forex profit calculator with leverage into your trading toolkit, you can significantly enhance your chances of success in the dynamic world of Forex trading. Remember to always practice sound risk management and continuous learning to stay ahead in the game. Using a forex profit calculator with leverage responsibly is key to maximizing potential gains while minimizing risks. Always double-check your inputs and understand the implications of leverage on your trading account. The effective use of a forex profit calculator with leverage, combined with a solid trading plan, can contribute to a more profitable and sustainable Forex trading journey.

[See also: Understanding Forex Leverage and Margin]

[See also: Forex Risk Management Strategies]